The Swedish Economy No.3 - May 29, 2012

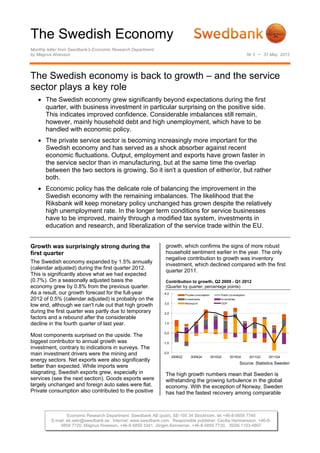

- 1. The Swedish Economy Monthly letter from Swedbank’s Economic Research Department by Magnus Alvesson Nr 3 • 31 May 2012 The Swedish economy is back to growth – and the service sector plays a key role The Swedish economy grew significantly beyond expectations during the first quarter, with business investment in particular surprising on the positive side. This indicates improved confidence. Considerable imbalances still remain, however, mainly household debt and high unemployment, which have to be handled with economic policy. The private service sector is becoming increasingly more important for the Swedish economy and has served as a shock absorber against recent economic fluctuations. Output, employment and exports have grown faster in the service sector than in manufacturing, but at the same time the overlap between the two sectors is growing. So it isn't a question of either/or, but rather both. Economic policy has the delicate role of balancing the improvement in the Swedish economy with the remaining imbalances. The likelihood that the Riksbank will keep monetary policy unchanged has grown despite the relatively high unemployment rate. In the longer term conditions for service businesses have to be improved, mainly through a modified tax system, investments in education and research, and liberalization of the service trade within the EU. Growth was surprisingly strong during the growth, which confirms the signs of more robust first quarter household sentiment earlier in the year. The only negative contribution to growth was inventory The Swedish economy expanded by 1.5% annually investment, which declined compared with the first (calendar adjusted) during the first quarter 2012. quarter 2011. This is significantly above what we had expected (0.7%). On a seasonally adjusted basis the Contribution to growth, Q2 2009 - Q1 2012 economy grew by 0.8% from the previous quarter. (Quarter by quarter, percentage points) As a result, our growth forecast for the full-year 4,0 Private consumption Public consumption 2012 of 0.5% (calendar adjusted) is probably on the Investments Inventories 3,0 Net export GDP low end, although we can't rule out that high growth during the first quarter was partly due to temporary 2,0 factors and a rebound after the considerable decline in the fourth quarter of last year. 1,0 0,0 Most components surprised on the upside. The biggest contributor to annual growth was -1,0 investment, contrary to indications in surveys. The main investment drivers were the mining and -2,0 2009Q2 2009Q4 2010Q2 2010Q4 2011Q2 2011Q4 energy sectors. Net exports were also significantly Source: Statistics Sweden better than expected. While imports were stagnating, Swedish exports grew, especially in The high growth numbers mean that Sweden is services (see the next section). Goods exports were withstanding the growing turbulence in the global largely unchanged and foreign auto sales were flat. economy. With the exception of Norway, Sweden Private consumption also contributed to the positive has had the fastest recovery among comparable Economic Research Department, Swedbank AB (publ), SE-105 34 Stockholm, tel +46-8-5859 7740 E-mail: ek.sekr@swedbank.se Internet: www.swedbank.com Responsible publisher: Cecilia Hermansson, +46-8- 5859 7720, Magnus Alvesson, +46-8-5859 3341, Jörgen Kennemar, +46-8-5859 7730, ISSN 1103-4897

- 2. The Swedish Economy Monthly letter from Swedbank’s Economic Research Department, continued No. 3 • 31 May 2012 economies since the financial crisis in 2008 and the savings ratio declined in the wake of the rising 2009. One probable reason is that Norway and consumption. Household debt is leveling off, but Germany, which have also managed the crisis remains a significant risk to the Swedish economy relatively well, are among Sweden's most important going forward. export markets. To the extent the global market continues to weaken, especially if Europe's debt Household disposable income and borrowing, 2006 - 2012 (Annual change, %) crisis worsens, it will also affect the Swedish 14 economy. Furthermore, the strong first quarter Disp. Inc. (real) partly reflects a recovery from the major slowdown 12 Borrowing (nom.) in the last quarter of 2011. 10 8 GDP level: Sweden and comparable countries, 2007 - 2012 6 (Real index 2007=100) 105 NOR 4 103 SWE 2 GER USA 0 101 -2 FRA 99 2005Q1 2006Q1 2007Q1 2008Q1 2009Q1 2010Q1 2011Q1 2012Q1 NETH FIN 97 Source: Statistics Sweden UK 95 DEN In summary, there was a surprisingly sharp rebound 93 of the Swedish economy surprisingly in early 2012, 91 which was a sign of strength given the growing concerns plaguing the European economy. There 89 Q4-07 Q2-08 Q4-08 Q2-09 Q4-09 Q2-10 Q4-10 Q2-11 Q4-11 are still significant weaknesses in Sweden, Source: Ecowin however, especially the stubbornly high unemployment and high level of household debt, The expansive GDP during the first quarter which should be taken into consideration in future coincides with a slightly more positive labor market. assessments of the economy and dealt with Here as well we had expected a weakening, yet through economic policy. employment and unemployment levels have both been a positive surprise. Unemployment has risen, The service sector is an important but only marginally, and employment has continued economic shock absorber to grow. The number of hours worked increased by 1% in total and by 1.3% in the private sector during Although the service sector has been growing for the first quarter. Given a growing GDP, labor some time as a share of Swedish GDP, as it has in productivity was unchanged compared with the first other developed economies, its importance as an quarter 2011. economic shock absorber became more apparent during the fiscal crisis in 2008-2009 and late last Labor market development, 2006 - 2012 year, when the economy again slowed. Since the (Annual change, %, unless otherwise indicated) beginning of the 1990s the private service sector 9 has expanded in real terms by about 2/3, while 7 manufacturing is about 1/3 bigger. Its contribution to 5 productivity has also been strong – 50% higher in fact than for industry since the mid-1990’s.1 At the 3 same time, however, the service content in 1 industrial production has increased as well in recent -1 Employment years, which means that the service sector’s Unemployment rate (sa, % of development is dependent in many respects on a -3 labour f orce) Hours worked healthy manufacturing industry, and vice versa.2 -5 Mar-06 Nov-06 Jul-07 Mar-08 Nov-08 Jul-09 Mar-10 Nov-10 Jul-11 Mar-12 The economic slowdown late last year was partly Source: Statistics Sweden offset by continued growth in service production. The service sector further expanded in the first Improving household finances have also supported the Swedish economy. Real disposable incomes 1 continue to rise, mainly due to rising wages. At the ”The Size of Service Sector”, Swedish Agency for same time household borrowing decreased. Growth Policy Analysis, WP 2010:14 2 “Servicification of Swedish manufacturing,” 2010 03, Savings fell during the first quarter, however, and National Board of Trade. 2 (4)

- 3. The Swedish Economy Monthly letter from Swedbank’s Economic Research Department, continued No. 3 • 31 May 2012 quarter of this year, by slightly over 2% at an annual Employment per sector, 2006 - 2012 (Q1 2006 = 100) rate, while the industrial production index fell by more than 4%. It should be noted, however, that 120 industrial production as measured in the national Manuf acturing 115 accounts has reported significantly higher growth, Services (excl. public sector) 110 especially in 2010. According to Statistics Sweden, this is partly because some services are included in 105 these figures. 100 Production indices for the service sector and manufacturing 95 industry, January 2007 – March 2012 90 (Annual change, %) 20 85 Service production 15 80 Industrial production 2006Q1 2007Q1 2008Q1 2009Q1 2010Q1 2011Q1 2012Q1 10 Source: Statistics Sweden 5 0 Despite the growing spinoff of service companies -5 from the manufacturing industry, the service content -10 in manufacturers’ exports has grown in magnitude. -15 From early 2005 till the first quarter 2012 service exports expanded by slightly over 50%, compared -20 with nearly 30% for goods exports. This is partly -25 because manufacturers are exporting more Jan-07 Jul-07 Jan-08 Jul-08 Jan-09 Jul-09 Jan-10 Jul-10 Jan-11 Jul-11 Jan-12 services, which are an important part of their Source: Statistics Sweden integrated product range, and partly because The latest data indicate, however, that the service service businesses are increasing their exports. sector is also slowing. The purchasing managers Exports of goods and services, Q1 2005 – Q1 2012 index for services was 48.6 in April, compared with (Q4 2004 = 100 and SEK billion) an average of 53.7 during the first three months of 200 400 the year. In other words, the service sector is no 180 Goods (SEK billion) Services (SEK billion) Goods (index) Service (index) 350 longer expanding. Order bookings for the service 160 sector, with an index measure of 47.3, also point to 300 140 slowing demand for services. 250 120 The service sector is also playing an increasingly 100 200 important role for the labor market. Since the mid- 80 150 2000’s employment in the private service 60 100 businesses has grown by nearly 10% at the same 40 time that it has declined correspondingly in 20 50 manufacturing. This is partly because many 0 0 manufacturers are hiring independent service 2005Q1 2006Q1 2007Q1 2008Q1 2009Q1 2010Q1 2011Q1 2012Q1 contractors for tasks they previously did in-house. Source: Statistics Sweden Deregulation of the public sector has also contributed to a growing private service sector. Policy agenda in the short and long term Better than expected economic growth during the first quarter reduces the need for economic policy stimulus, and monetary policy is likely to remain unchanged in the short term. There are still significant risks, however, mainly related to the global economy, though also domestically in the form of relatively high unemployment and high household debt. A rapid worsening of the debt crisis in Europe would again raise the issue of whether the Swedish economy needs more stimulus, at the same time that risks have to be balanced in the housing and credit markets. 3 (4)

- 4. The Swedish Economy Monthly letter from Swedbank’s Economic Research Department, continued No. 3 • 31 May 2012 Service production’s importance to the Swedish research to increase value-added in the service economy will grow. Economic reform policies sector and pave the way for wage growth. As should therefore focus on fully taking advantage of foreign trade data have indicated, the export trend this trend. An important area of reform is tax policy, is also positive for services, and Sweden would where labor-intensive production is currently at a thus greatly benefit from further liberalization of the disadvantage from relatively high taxes. Moreover, service trade within the EU. additional investment is needed in education and Magnus Alvesson Swedbank Economic Research Department Swedbank’s monthly The Swedish Economy newsletter is published as a service to SE-105 34 Stockholm, Sweden our customers. We believe that we have used reliable sources and methods in the Phone +46-8-5859 7740 preparation of the analyses reported in this publication. However, we cannot guarantee ek.sekr@swedbank.se the accuracy or completeness of the report and cannot be held responsible for any www.swedbank.se error or omission in the underlying material or its use. Readers are encouraged to base Legally responsible publisher any (investment) decisions on other material as well. Neither Swedbank nor its Cecilia Hermansson, +46-8-5859 7720 employees may be held responsible for losses or damages, direct or indirect, owing to Magnus Alvesson, +46-8-5859 3341 any errors or omissions in Swedbank’s monthly The Swedish Economy newsletter. Jörgen Kennemar, +46-8-5859 7730 4 (4)