Resume

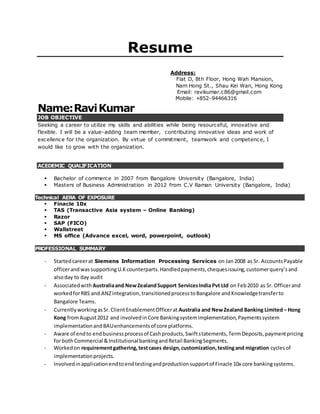

- 1. Resume Address: Flat D, 8th Floor, Hong Wah Mansion, Nam Hong St., Shau Kei Wan, Hong Kong Email: ravikumar.c86@gmail.com Mobile: +852-94466316 Name:RaviKumar JOB OBJECTIVE Seeking a career to utilize my skills and abilities while being resourceful, innovative and flexible. I will be a value-adding team member, contributing innovative ideas and work of excellence for the organization. By virtue of commitment, teamwork and competence, I would like to grow with the organization. ACEDEMIC QUALIFICATION Bachelor of commerce in 2007 from Bangalore University (Bangalore, India) Masters of Business Administration in 2012 from C.V Raman University (Bangalore, India) Technical AERA OF EXPOSURE Finacle 10x TAS (Transactive Asia system – Online Banking) Razor SAP (FICO) Wallstreet MS office (Advance excel, word, powerpoint, outlook) PROFESSIONAL SUMMARY - Startedcareerat Siemens Information Processing Services on Jan2008 as Sr. AccountsPayable officerandwassupportingU.Kcounterparts.Handledpayments,chequesissuing,customerquery’sand alsoday to day audit - Associatedwith Australiaand NewZealandSupport ServicesIndiaPvt Ltd on Feb2010 as Sr. Officerand workedforRBS and ANZintegration,transitionedprocesstoBangalore andKnowledgetransferto Bangalore Teams. - CurrentlyworkingasSr.ClientEnablementOfficerat Australia and NewZealand Banking Limited – Hong Kong fromAugust2012 and involvedinCore Bankingsystemimplementation,Paymentssystem implementationandBAUenhancementsof core platforms. - Aware of endto endbusinessprocessof Cashproducts,Swiftstatements,TermDeposits,paymentpricing for bothCommercial &Institutional bankingandRetail BankingSegments. - Workedon requirementgathering,testcases design,customization,testingand migration cyclesof implementationprojects. - Involvedinapplicationendtoendtestingandproductionsupportof Finacle 10x core bankingsystems.

- 2. Brief Summary of ANZ – HONG KONG, Work Experience : From August 2012 till today Project: Core Banking System Implementation System: Finacle 10 X Roles and Responsibilities: Lead Business Analyst (Lead a team of 2) Segments: Institutional, commercial and Retail banking. Modules: Customer Information File (CIF): - Identifying the system gaps and massaging data for migration. - Assigning New CIF numbers and group code numbers - Preparation of test cases for CIF creation, modification and suspension. - Group code creation, linkage and de-linkage to CIF. - Sub group code linkage and de-linkage to Main group code. - Prepared detailed document of CIF functionality. - Implemented customized menu for Minimum account balance fee waiver. - Designed new field for Customer Risk Rating at CIF level for compliance, RM’s and HKICL reporting purpose. - Migrated Registered, Mailing, Residential and Payment address at CIF level. - Customization for Entity type, Business Registration number, Incorporation date, Incorporation place and customer ID, as mandatory fields at CIF level based on the requirement from HKICL. - Testing statements: paper statements and email statements - Functionality of combined and individual statements as per business/customer requirement - Enhancement of currency’s preference at CIF level to ensure for account opening in Onscore. - Updating Lending operation client risk rating and annual review date to fac ilitate Risk team for monitoring. - Customize option for bulk Relationship manager code change which replicates at all types of accounts (CASA, TD, and Term Loan accounts). - Designing Verification baskets for different operations team to restrict the access on customer types (like Insto and Retails segment types) - Audit trail report availability for better control - Data linkage and update to downstream system through EOD batch job - Reports storage in shared drives for BCP purpose and access restrictions for specified users - Current and Savings account and TD accounts: - Identifying the system gaps and massaging data for migration. - Assigning new account numbers - Migrating statement frequency’s for each account level. - Swift bic code configurations and enabling swift message types like MT940,942, 950, 900 and 910 at account level - Linkage and De-linkage of accounts to downstream system - Designing of Freeze types (Total Freeze, Debit Freeze and Credit Freeze) along with freeze reasons. - Account lien maintenance with reason for lien and expiry date. - Auto update of standard current and savings account interest rate during the account opening as default. - Designing the tiered interest rates for CASA accounts

- 3. - Parameter level setup for dormant account fee charge and Business premium account fee charge (customized for ANZ). - Multiple swift message and paper statement customized menu option. Direct Debit Authorization: - Migration of data from finacle 7 to finacle 10 for DDA’s - Sending out advises for both inward and outward DDA through HKICL regarding account number change for autopay clearing. - Creation of new bank codes and branch codes for DDA setups. - Designing the autopay letter advices for client and generating letter by batch job with ANZ letter header. - Assigning the shared drive path for letter printing vendor to extract and mailing out the advices to client - Providing the HKICL requirement for autopay file generation and transaction code specification, updating the file in data integrator for HKICL submission before clearing house cut off. - After batch job system posting the GL accounting entries for payments team and for loans team. Standing Instruction: - Migration of data from finacle 7 to finacle 10 for SI’s - Creation of new bank codes and branch codes for SI setups. - Designing the autopay letter advices for client and generating letter by batch job with ANZ letter header. - Assigning the shared drive path for letter printing vendor to extract and mailing out the advices to client - Providing the HKICL requirement for autopay file generation and transaction code specification, updating the file in data integrator for HKICL submission before clearing house cut off. - After batch job system posting the GL accounting entries for payments team and for loans team. - Standing instruction setup, modification, execution fee charge designing and crediting the fees to Internal revenue account - Option for user to choose the type of standing instruction payment like payroll, salary or monthly transfer etc. - International payment type standing instruction to feed the data to downstream system for swift message sending out - Creating repair queue to handle the rejected SI’s due to invalid BIC codes for TT payment Rate uploads – FX, commercial fixed deposits, mortgage and Lombard loans rate upload - New tool implemented WINSCP for feeding the rates from text file to finacle - Report generation for knowing the status of rate upload whether its successful or failure - Designed new menu option for verification for audit control prospective

- 4. Hub management: (Bangalore and Manila) - Assisting day to day queries and providing training as SME - Preparation of work instruction and Screen instruction for documentation purpose and future references. - Validating system issues raised by Hubs before escalating to second level team. - Handing and tracking the system defects - Making sure the defect fixed and not impacting the production environment prior its tested in UAT environment - Check if the issue has fixed post to patches applied in production. - Working on the system customization which benefits bank on cost reduction side and time reduction in processing with quality improvement. - Discussing error and escalation on weekly call to ensure all the FTE’s are aware of it. - Brief Summary of ANZ – Bangalore, Work Experience: From Feb 2010 till August 2012 BAU: Job Description: Handling Customers on-boarding, account maintenance, account closure of commercial and retail customers in systems Responsible of reviewing account opening document and understanding the product customer has availed. Perform KYC check for TAS/Online banking customers Perform KYC check for additional account opening for Cash product Obtaining the required document for MT101 setup/debit authorization to setup Perform Quality check on KYC’ed Financial Institutional customers Maintaining payments service fee (TT,RTGS,MT942,MT942…..) for each customer Creation, maintenance and closure of Standing Instruction and DDA for retail customers. Handling system issues/breakdown for standing instruction and provide SACR and non-SACR report to HKICL through excel macro file. Maintain Electronic banking fee charges and MT940 monthly fee charges in TAS system Provide training to Bangalore and Manila hubs as and when required Assigning the work to the team members and Meeting SLA for the request on daily basics. Have extensive knowledge on cash products like cheques, TT and RTGS pricing setups, ACH, Autopay, DDA, Standing Instruction, special/preferential Interest rate setup. Handling Vostro account opening Supporting on rate upload issues (FX, Insto and commercial, retail loan) to MNL hub and also act as BCP. Assisting on data extraction for Transaction banking team on interest rates review periodically. Assist or advice Transaction banking team which they can offer pricing to the client that can accommodate in Finacle system Raise request for system enhancement which enables hub (BLR and MNL) to reduce effort on manual processing and increase efficiency.

- 5. Update Work instruction and Screen Instruction document for Hub reference and practice. Working on KYC QC outsourcing document which comprises Risk, compliance and regulatory. WORK EXPERIENCE IN SIEMENS BANGALORE, From Jan 2008 till Feb 2010 Worked as Senior accounts payable officer in Siemens for UK siemens project. Handling UK invoice processing in SAP. Handling special request for payment from the business & uploading the statements into SAP. Handling day- to-day audits. Handling the queries from customers through emails. Skill Sets: Knowledge of SAP, planning targets, monitoring numbers and achieving the targets on a daily, weekly & monthly basis in adherence to the pre-set standards. Day today accounting & finalization of accounts, Handled purchases & Sales. Handled Payments & receipts. ACHIVEMENTS Customer appreciation award for the Process improvement suggestion Award - October 2009 (Siemens) Best performer process improvement suggestion for the year Award – March 2010 (Siemens) Operations Productivity and Customer Obsession Award – June 2014 (ANZ HK) Hong Kong Operations and Technology Team Award – July 2015 (ANZ HK) PERSONAL PROFILE Father's Name : CHINNAPPA Date of Birth : October 05, 1986 Marital Status : Married Sex : Male Nationality : Indian Passport : H7344472 DECLEARATION

- 6. I hereby declare that all information mentioned above is true to the best of my knowledge. Date ……………. Ravi Kumar