QE Index Rises 1.3% Led by Banking & Real Estate Gains

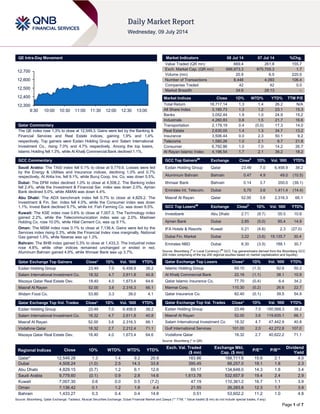

- 1. Page 1 of 7 QE Intra-Day Movement Qatar Commentary The QE index rose 1.3% to close at 12,549.3. Gains were led by the Banking & Financial Services and Real Estate indices, gaining 1.9% and 1.4% respectively. Top gainers were Ezdan Holding Group and Salam International Investment Co., rising 7.0% and 4.7% respectively. Among the top losers, Islamic Holding fell 1.3%, while Al Khalij Commercial Bank declined 1.1%. GCC Commentary Saudi Arabia: The TASI index fell 0.1% to close at 9,779.6. Losses were led by the Energy & Utilities and Insurance indices, declining 1.0% and 0.7% respectively. Al Ahlia Ins. fell 9.1%, while Buruj Coop. Ins. Co. was down 5.5%. Dubai: The DFM index declined 1.0% to close at 4,508.2. The Banking index fell 2.4%, while the Investment & Financial Ser. index was down 2.0%. Ajman Bank declined 5.0%, while AMAN was down 4.4%. Abu Dhabi: The ADX benchmark index fell 0.7% to close at 4,829.2. The Investment & Fin. Ser. index fell 4.0%, while the Consumer index was down 1.1%. Invest Bank declined 9.7%, while Int. Fish Farming Co. was down 9.5%. Kuwait: The KSE index rose 0.6% to close at 7,007.3. The Technology index gained 2.2%, while the Telecommunication index was up 2.0%. Mashaer Holding Co. rose 10.0%, while Hilal Cement Co. was up 9.1%. Oman: The MSM index rose 0.1% to close at 7,136.4. Gains were led by the Services index rising 0.3%, while the Financial Index rose marginally. National Gas gained 1.5%, while Nawras was up 1.3%. Bahrain: The BHB index gained 0.3% to close at 1,433.3. The Industrial index rose 4.8%, while other indices remained unchanged or ended in red. Aluminum Bahrain gained 4.9%, while Ithmaar Bank was up 3.7%. Qatar Exchange Top Gainers Close* 1D% Vol. ‘000 YTD% Ezdan Holding Group 23.49 7.0 6,458.9 38.2 Salam International Investment Co. 18.32 4.7 2,611.8 40.8 Mazaya Qatar Real Estate Dev. 18.40 4.0 1,673.4 64.6 Masraf Al Rayan 52.00 3.6 2,316.3 66.1 Widam Food Co. 53.80 3.3 39.0 4.1 Qatar Exchange Top Vol. Trades Close* 1D% Vol. ‘000 YTD% Ezdan Holding Group 23.49 7.0 6,458.9 38.2 Salam International Investment Co. 18.32 4.7 2,611.8 40.8 Masraf Al Rayan 52.00 3.6 2,316.3 66.1 Vodafone Qatar 18.32 2.7 2,212.4 71.1 Mazaya Qatar Real Estate Dev. 18.40 4.0 1,673.4 64.6 Market Indicators 08 Jul 14 07 Jul 14 %Chg. Value Traded (QR mn) 669.4 261.8 155.7 Exch. Market Cap. (QR mn) 686,973.3 675,705.3 1.7 Volume (mn) 20.9 6.5 220.5 Number of Transactions 8,448 4,093 106.4 Companies Traded 42 42 0.0 Market Breadth 34:6 28:13 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 18,717.14 1.3 1.4 26.2 N/A All Share Index 3,185.73 1.3 1.2 23.1 15.3 Banks 3,052.44 1.9 1.0 24.9 15.2 Industrials 4,260.83 0.8 1.5 21.7 16.6 Transportation 2,179.19 0.4 (0.0) 17.3 14.0 Real Estate 2,630.05 1.4 1.3 34.7 13.2 Insurance 3,506.44 0.0 2.3 50.1 9.2 Telecoms 1,580.26 1.0 2.1 8.7 21.8 Consumer 6,792.86 1.0 1.0 14.2 26.7 Al Rayan Islamic Index 4,196.54 1.7 2.1 38.2 18.2 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Ezdan Holding Group Qatar 23.49 7.0 6,458.9 38.2 Aluminium Bahrain Bahrain 0.47 4.9 49.0 (10.5) Ithmaar Bank Bahrain 0.14 3.7 200.0 (39.1) Emirates Int. Telecom. Dubai 5.70 3.6 1,411.4 (14.4) Masraf Al Rayan Qatar 52.00 3.6 2,316.3 66.1 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Investbank Abu Dhabi 2.71 (9.7) 55.5 10.8 Ajman Bank Dubai 2.85 (5.0) 85.4 14.9 IFA Hotels & Resorts Kuwait 0.21 (4.6) 2.3 (27.0) Dubai Fin. Market Dubai 3.22 (3.6) 19,135.7 30.4 Emirates NBD Dubai 8.30 (3.5) 188.1 30.7 Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) Qatar Exchange Top Losers Close* 1D% Vol. ‘000 YTD% Islamic Holding Group 69.10 (1.3) 92.6 50.2 Al Khalij Commercial Bank 22.16 (1.1) 38.1 10.9 Qatar Islamic Insurance Co. 77.70 (0.4) 6.4 34.2 Mannai Corp. 110.30 (0.2) 26.6 22.7 Qatar Insurance Co. 82.40 (0.1) 39.5 54.9 Qatar Exchange Top Val. Trades Close* 1D% Val. ‘000 YTD% Ezdan Holding Group 23.49 7.0 150,568.3 38.2 Masraf Al Rayan 52.00 3.6 119,935.1 66.1 Salam International Investment Co 18.32 4.7 47,442.9 40.8 Gulf International Services 101.00 2.0 42,272.8 107.0 Vodafone Qatar 18.32 2.7 40,622.2 71.1 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 12,549.28 1.3 1.4 9.2 20.9 183.86 188,711.6 15.6 2.1 4.0 Dubai 4,508.24 (1.0) 2.5 14.3 33.8 395.45 88,257.0 18.1 1.8 2.3 Abu Dhabi 4,829.15 (0.7) 1.2 6.1 12.6 69.17 134,648.0 14.3 1.8 3.4 Saudi Arabia 9,779.60 (0.1) 0.9 2.8 14.6 1,613.78 532,657.9 19.4 2.4 2.9 Kuwait 7,007.30 0.6 0.0 0.5 (7.2) 47.19 110,361.2 16.7 1.1 3.9 Oman 7,136.42 0.1 1.2 1.8 4.4 21.55 26,283.8 12.3 1.7 3.9 Bahrain 1,433.27 0.3 0.4 0.4 14.8 0.51 53,602.2 11.2 1.0 4.8 Source: Bloomberg, Qatar Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 12,300 12,400 12,500 12,600 12,700 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 7 Qatar Market Commentary The QE index rose 1.3% to close at 12,549.3. The Banking & Financial Services and Real Estate indices led the gains. The index rose on the back of buying support from non-Qatari shareholders despite selling pressure from Qatari shareholders. Ezdan Holding Group and Salam International Investment Co. were the top gainers, rising 7.0% and 4.7% respectively. Among the top losers, Islamic Holding Group fell 1.3%, while Al Khalij Commercial Bank declined 1.1%. Volume of shares traded on Tuesday surged by 220.5% to 20.9mn from 6.5mn on Monday. Further, as compared to the 30- day moving average of 20.5mn, volume for the day was 1.8% higher. Ezdan Holding Group and Salam International Investment Co. were the most active stocks, contributing 30.9% and 12.5% to the total volume respectively. Source: Qatar Exchange (* as a % of traded value) Ratings, Earnings and Global Economic Data Ratings Updates Company Agency Market Type* Old Rating New Rating Rating Change Outlook Outlook Change Jebel Ali Free Zone (JAFZ) Fitch UAE LT IDR/SSR B+/B+/RR4 BB-/BB-/RR4 Stable – Source: News reports (* LT – Long Term, ST – Short Term, FSR- Financial Strength Rating, FCR – Foreign Credit Rating, LCR – Local Currency Rating, IDR – Issuer Default Rating, SR – Support Rating, LC – Local Currency, SSR – Senior Secured Rating) Earnings Releases Company Market Currency Revenue (mn)2Q2014 % Change YoY Operating Profit (mn) 2Q2014 % Change YoY Net Profit (mn) 2Q2014 % Change YoY Yamama Cement Company Saudi Arabia SR – – 183.0 -28.5% 207.0 -22.8% The National Co. for Glass Industries (ZOUJAJ) Saudi Arabia SR – – 3.1 -62.7% 14.1 7.6% Etihad Airways* UAE USD 3,200.0 28.0% – – – – National Aluminium Products* Oman OMR 8.6 -18.9% – – 0.3 -54.8% Al Anwar Ceramic Tiles* Oman OMR 14.5 0.9% – – 4.3 1.4% Oman Chlorine* Oman OMR 3.9 -11.7% – – 1.4 -16.8% Source: Company data, DFM, ADX, MSM (* 1H2014 results) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 07/08 US NFIB NFIB Small Business Optimism June 95.0 97.0 96.6 07/08 France Banque De France Bank of France Bus. Sentiment June 97.0 96.0 97.0 07/08 France Ministry of the Economy Budget Balance YTD May -64.3B – -64.2B 07/08 France Ministry of the Economy Trade Balance May -4866M -4250M -4101M 07/08 Germany Destatis Trade Balance May 17.8B 16.2B 17.2B 07/08 Germany Destatis Current Account Balance May 13.2B 14.5B 16.9B 07/08 Germany Deutsche Bundesbank Exports SA MoM May -1.10% -0.40% 2.60% 07/08 Germany Deutsche Bundesbank Imports SA MoM May -3.40% 0.50% 0.20% 07/08 UK ONS Industrial Production MoM May -0.70% 0.30% 0.30% 07/08 UK ONS Industrial Production YoY May 2.30% 3.20% 2.90% 07/08 UK ONS Manufacturing Production MoM May -1.30% 0.40% 0.30% 07/08 UK ONS Manufacturing Production YoY May 3.70% 5.60% 4.30% 07/08 UK NIESR NIESR GDP Estimate June 0.90% – 0.70% 07/08 Japan Bank of Japan Bank Lending Incl Trusts YoY June 2.30% 2.20% 2.20% 07/08 Japan Bank of Japan Bank Lending Ex-Trusts YoY June 2.50% – 2.40% 07/08 Japan ESRI Eco Watchers Survey Current June 47.7 48.9 45.1 07/08 Japan ESRI Eco Watchers Survey Outlook June 53.3 54.5 53.8 07/08 Japan Tokyo Shoko Research Bankruptcies YoY June -3.56% – -20.19% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Overall Activity Buy %* Sell %* Net (QR) Qatari 68.18% 71.11% (19,599,529.33) Non-Qatari 31.82% 28.89% 19,599,529.33

- 3. Page 3 of 7 News Qatar QNBK delivers strong 1H2014 results, net profit surges 7% YoY – The QNB Group (QNBK) reported a net profit of QR5.1bn in 1H2014, reflecting an increase of 7.0% as compared to 1H2013. This was driven by operating income, including the share of results of associates, which increased to QR7.6bn, up by 5.0% as compared to 1H2013. Net interest income increased by 6.0% to reach QR6.0bn, with net fee & commission income and net gain from foreign exchange reaching QR1.0bn and QR0.4bn, respectively, reflecting success in diversifying sources of income. The Group’s prudent cost control policy and strong revenue generating capabilities allowed it to maintain its efficiency ratio at 21.5% in 1H2014, marginally up from 20.5% in 1H2013. Earnings per share stood at QR7.2 in 1H2014 as compared to QR6.8 in 1H2013. Total assets increased 7.9% YoY to QR466bn in 1H2014 –yet again scaling the highest ever level achieved by the Group. This was led by a strong 10.1% YoY growth in loans & advances that reached QR326bn in 1H2014. On the other hand, customer funding rose 5.8% YoY to QR345bn in 1H2014. As a result, the Group’s loan-to-deposit ratio increased to 95% in 1H2014 as compared to 91% in 1H2013. The Group continued to maintain strong asset quality as reflected by its NPL ratio that stood at 1.6% in 1H2014 (1.5% in 1H2013), one of the lowest among the banks in the Middle East and Africa. The low NPL ratio reflects high quality of QNBK’s loan book coupled with effective credit risk management. The Group’s conservative policy in regard to provisioning continued with the coverage ratio reaching 123% in June 2014. QNBK’s total shareholders' equity increased to QR54bn in 1H2014, up by 10.4% from June 2013. The Group’s Capital Adequacy Ratio, on a Basel III basis, stood at 15.9% as at 30 June 2014, higher than the minimum regulatory requirements of the Qatar Central Bank (minimum limit without capital conservation buffer is 10% and including capital conservation buffer is 12.5%). (QNB Press Release) Woqod to start mobile fuel station in Al Shamal soon – Responding to reports of fuel shortage due to its fuel station undergoing maintenance in Al Shamal, Woqod (QFLS) has assured its clients that the scarcity situation is of temporary nature and should not exceed a few days. The company had felt an urgent need to close the fuel station for maintenance for public safety as well as for better conservation of the local environment from any potential contamination or pollution hazards. The company is expected to open a mobile station, which includes all essential services needed by clients, in the next few days. Woqod said that tankers shall be made available immediately for Premium petrol (Super), while umbrellas will be installed to offer sun protection to drivers. The company is studying the actual need for the availability of tankers in the area, and if there is a need for an extended availability for more than 12 hours, it will not hesitate in providing so. Further, Woqod assured that there is no danger associated with these supply measures (through tankers) because tankers have the required equipment to provide safety, security and deal with gas emissions. (Qatar Peninsula) Ministry signs agreements with Ezdan, Waseef – The permanent committee for the investment fund for government markets at the Ministry of Economy and Commerce has signed two agreements with Ezdan Holding (ERES) and Waseef to run various facilities at Al Furjan Markets. The Committee Chairman Yahya bin Saeed al-Nuaimi pointed out that these agreements are aimed at making both Ezdan and Waseef representatives of the committee in signing contracts with tenants, collecting monthly rents, and providing direct communication with those who run shops at Al-Furjan Markets. Besides, they will be authorized to grant approval for any proposed architectural modifications or alterations in the shops. He said that “ready shops” would be handed over to tenants next week. (Gulf- Times.com) Emir endorses Cabinet decision on Mesaieed power – The Emir HH Sheikh Tamim bin Hamad Al Thani ratified the Cabinet Decision No. 32 of 2014, exempting Mesaieed Power Company Ltd from income tax. It stipulates that the company is exempted from income tax for another year starting January 1, 2013. (Peninsula Qatar) QP, ExxonMobil file seek FERC permission for Texas LNG plant – Golden Pass LNG developers ExxonMobil and Qatar Petroleum (QP) have sought permission from the US Federal Energy Regulatory Commission (FERC) to construct and operate their planned 15.6mn tons per annum (mtpa) plant in Sabine Pass, Texas, US. (Bloomberg) Kahramaa: 14% of tap water wasted through leakage – Kahramaa has said some 14% of water meant for consumption in the country is wasted through leakage and utility distributor. The corporation said if buildings are properly insulated, especially if the windows are sealed, 40% electricity can be saved (with efficient use of air-conditioners). Kahramaa said that it had carried out studies to find out the reasons for water & power waste and come up with solutions to help stop waste. (Peninsula Qatar) QATI postpones results disclosure to July 14 – Qatar Insurance Company (QATI) has postponed the announcement of its reviewed financial reports for the period ending June 30, 2014, from July 13, 2014 to July 14, 2014. (QE) QGMD to announce results on July 24 – Qatari German for Medical Devices Company (QGMD) will disclose its financial reports for the period ending June 30, 2014, on July 24, 2014. (QE) AHCS to announce results on July 24 – Aamal Company (AHCS) will disclose its financial reports for the period ending June 30, 2014, on July 24, 2014. (QE) NLCS to announce results on July 24 – Alijarah Holding Company (NLCS) will disclose its financial reports for the period ending June 30, 2014, on July 24, 2014. (QE) Real estate transactions worth QR914.7mn between June 29 and July 3 – The real estate sales contracts registered at the Ministry of Justice between June 29 and July 03 were worth QR914.7mn. The list of properties that were traded by sale includes open plots of land, two floors villas, annexes, houses, towers, residential buildings & complexes and shops which are located in the municipalities of Umm Salal, Al Khor, Al Dhakira, Doha, Al Rayyan, Al Shamal, Al Daayen and Al Wakra. (Bloomberg) International Job openings in US increased to an almost seven-year high in May – Job openings rose in May to the highest level in almost seven years, a sign that the US labor market will help boost economic growth in the second half of 2014. A Labor Department report showed the number of positions waiting to be filled climbed by 171,000 to 4.64mn, the most since June 2007. The number of unemployed job seekers per opening fell to the lowest level in six years. Recent data are among the labor measures monitored by Federal Reserve Chair Janet Yellen and add to evidence the job market is strengthening. Payrolls grew more than forecast in June, and the jobless rate fell to an almost

- 4. Page 4 of 7 six-year low, the figures showed last week. The median forecast in a Bloomberg survey of economists projected 4.35 million openings in May. (Bloomberg) Fitch raises New Zealand’s Outlook to positive; currency gains – New Zealand’s credit Outlook was raised to positive from stable by Fitch Ratings, which cited the nation’s improving fiscal situation and supportive economy. The currency climbed to an almost three-year high. Fitch affirmed its long-term foreign currency rating at AA, two grades below the top score. The New Zealand dollar touched 88.06 US cents following the announcement, the highest since August 2011. The South Pacific nation’s building boom is helping sustain an economic expansion that has prompted the central bank to raise its benchmark lending rate three times this year and signal that more may be on the way. Prime Minister John Key has projected that the budget will return to surplus in the current financial year for the first time in seven years. Data showed GDP increased 1% in the first three months of 2014 from the fourth quarter. Finance Minister Bill English said the government’s operating surplus will be NZ$372mn in the year through June 2015, up from a previously forecasted NZ$86mn. (Bloomberg) UK sees surprise slump in May factory output – British factory output suffered an unexpected slump in May, echoing a similar decline in German industrial production, according to official data on Tuesday that raises questions about the pace of the country's recovery. The Office for National Statistics (ONS) said the factory output dropped by 1.3% in May, its biggest fall since January 2013 and in sharp contrast to economists' forecasts for a solid 0.4% increase. The decline comes after the sector recorded its strongest growth in nearly four years in the three months to April, and goes against the grain of robust private-sector surveys and a run of more positive surprises from British data. The Bank of England had forecasted in May that Britain's red-hot economic growth would start to slow in the second half of 2014, though more recently Governor Mark Carney said he had seen little sign that this was about to happen. Sterling weakened and government bond prices extended gains on the news, on bets that this could slightly reduce the chance of a first Bank of England rate rise this year. But economists said it was too early to draw big conclusions. (Reuters) German exports and imports fall more than expected in May – German exports and imports dropped much more than expected in May, data showed on Tuesday, coming on the heels of other soft indicators that have signaled Europe's largest economy is losing momentum. Exports – the traditional backbone of Germany's economy – struggled last year and fell in three of the first five months this year, weighing on overall growth and making the economy reliant on imports. However, they slumped in May. The figures from the Federal Statistics Office showed seasonally-adjusted exports fell by 1.1% on the month, while imports dropped 3.4%, the steepest monthly fall since November 2012. The trade surplus widened to a seasonally adjusted €18.8bn from a revised €17.2bn in April and compared with a Reuters consensus forecast for €16.4bn. (Reuters) China's Yuan global ambition hits payment roadblock – China's quest to turn its Yuan into a full-fledged global currency has hit a roadblock as the planned roll-out of a worldwide payments superhighway looks certain to get delayed because of policy snags and technology challenges. The China International Payments System (CIPS) that would replace a patchwork of networks and allow hassle-free Yuan payments was meant to debut later this year, but bankers say it is unlikely to be ready before 2016. The slippage might be good news for China's big clearing banks such as Bank of China and offshore centers such as London or Singapore, which now handle most international Yuan transactions and stand to lose their privileged position. However, in the long run, an efficient global network for Yuan trades will be essential for fulfilling Beijing's wish to boost the currency's use. A spate of agreements on Yuan clearing with financial centers in Europe and Asia signed over the past month or so highlighted the importance of such a system for those ambitions. Yet the government debate over how much users should be allowed to move in a single day without punching too big of a hole in China's capital controls and technological problems have stymied the system's development, bankers say. (Reuters) Regional AGC Europe forms JV with Saudi-based Obeikan Glass – European branch of AGC Glass, AGC Europe has signed a letter of intent (LOI) to form a joint venture (JV) with Saudi Arabian glass company, Obeikan Glass. The JV will build a solar glass coating manufacturing plant at Yanbu, Saudi Arabia, which is expected to be opened by the start of 2016. The plant will be on the same site as Obeikan’s float glass plant. Obiekan Glass is owned by the Saudi Arabian industrial entities, Obeikan Investment Group and Saudi Advanced Industries Company. (GulfBase.com) GIB launches trial phase of retail banking services – Gulf International Bank (GIB) has initiated its trial phase for retail banking services to Saudi customers under the Meem brand name. The bank will provide services to the retail banking sector using a bold and innovative approach focused on technology and will provide a suite of non-traditional products that are considered a new addition to the Saudi banking sector, which is set to propel the bank into a new era. Meem is a registered trademark and an independent brand, offering a gamut of innovative Shari’ah-compliant non-traditional banking services approved by the Saudi Arabian Monetary Agency (SAMA) and targets a technophile customer base. (GulfBase.com) Saudi pharma market to reach $5.9bn by 2020 – According to an industry report, the Saudi pharmaceutical market is the largest among the GCC members and is one of the largest markets in the Middle East, valued at approximately $4bn in 2013 and is projected to reach $5.9bn in 2020 at a CAGR of 5.8%. A high rate of chronic diseases, improving regulatory guidelines and new product launches will provide the necessary impetus for the growth of the pharmaceutical market. Increasing access to medicines, increasing affordability and rising general awareness of common diseases are the other factors that will drive the pharmaceutical market. The price of pharmaceuticals was less expensive as compared to other GCC member countries. These low prices enhance the affordability of pharmaceuticals, boosting the pharmaceutical market. (GulfBase.com) Bank Albilad reports SR204.3mn net profit in 2Q2014 – Bank Albilad reported a net profit of SR204.3mn in 2Q2014 as compared to SR175.9mn in 2Q2013, reflecting an increase of 16.15% YoY. The bank’s net profit for 1H2014 stood at SR378mn as compared to SR318.4mn for 1H2013, surging 18.72%. EPS as of June 30, 2014 amounted to SR0.94 as against SR0.8 a year earlier. The bank’s total assets stood at SR40.98bn at the end of June 2014 as against SR33.35bn a year ago. Loans & advances stood at SR26.76bn, while customer deposits stood at SR33.35bn. (Tadawul) Alinma Bank’s net profit surges to SR308mn in 2Q2014 – Alinma Bank reported a net profit of SR308mn in 2Q2014 as

- 5. Page 5 of 7 compared to SR241mn in 2Q2013, up by 27.8%. The bank recorded a net profit of SR600mn for 1H2014 as compared to SR463mn for 1H2013, reflecting an increase of 29.6%. EPS as of June 30, 2014 amounted to SR0.4 as against SR0.31 a year earlier. The bank’s total assets stood at SR70.6bn at the end of June 2014 as against SR57.9bn a year ago. Both loans & advances and customer deposits stood at SR49bn approximately. (Tadawul) ANB reports net profit of SR785.4mn in 2Q2014 – Arab National Bank (ANB) reported a net profit of SR785.4mn in 2Q2014 as compared to SR718mn in 2Q2013, reflecting an increase of 9.4%. The bank’s net profit for 1H2014 reached SR1.5bn from SR1.4bn, registering an increase of 7.3%. EPS as of June 30, 2014 amounted to SR1.5 as against SR1.4 a year earlier. The bank’s total assets stood at SR142.7bn at the end of June 2014 as against SR136bn a year ago. Loans & advances stood at SR91.7bn, while customer deposits stood at SR109.2bn. (Tadawul) Tadawul announces beginning of first subscription period for Al-Ahlia – The Saudi Stock Exchange (Tadawul) announced the beginning of the first subscription period and tradable rights trading for Al-Ahlia Insurance Company, which starts from July 8, 2014 and ends on July 17, 2014. (Tadawul) Mitsubishi buys 38.4% stake in UAE water firm Metito – Japan's Mitsubishi Corp and Mitsubishi Heavy Industries have acquired a 38.4% stake in UAE-based water and wastewater project developer Metito Holdings for an undisclosed sum. In addition, the Japan Bank for International Co-operation will provide up to $92mn in funds to Metito to help finance its expansion plans. Japanese firms' global network and expertise will help Metito develop its operations. The new funding secured under the deal will be used to expand some of the firm's existing schemes, as well as for new schemes in China and African markets it is targeting, including Ghana and Rwanda. Metito said the Japanese transaction provides Abu Dhabi-based private equity firm Gulf Capital with a partial exit from its 2006 investment, reducing its holding in Metito to 23.8% from 56%. World Bank unit International Finance Corp (IFC) cut its 6% stake in Metito, originally bought in 2007, to 3% under the Mitsubishi deal. (GulfBase.com) India, UAE talk strategic oil storage lease – According to sources, India is in talks to lease part of its planned strategic storage to UAE’ state oil company ADNOC, as New Delhi moves to protect its economy against crude price shocks and supply disruptions. India imports about 80% of its oil needs and is building emergency storage capacity to hedge against energy security risks. India had initially planned to fill the oil storage without overseas participation, but it is now drawn to deals similar to those that the Abu Dhabi National Oil Company (ADNOC) struck earlier with Japan and South Korea. Such a deal would take into account India’s growing role as a regional refining hub. The South Asian nation imports around 16mn tons of crude a month — more than it consumes — and exports about a third of that as refined products. (Peninsula Qatar) Sharjah plans its maiden sukuk – According to sources, the emirate of Sharjah is planning its first foray into international bond markets with a debut sukuk deal. The sovereign is rumoured to have appointed banks to manage the transaction and could launch the deal as early as September2014. While Sharjah itself has not issued a bond in international markets before, state-owned Sharjah Islamic Bank has two sukuk outstanding: a $400mn, 4.715% 2016 bond and a $500mn, 2.95% 2018 note. Sharjah would become the fourth emirate from the United Arab Emirates to issue bonds. (Peninsula Qatar) Dubai Holding needs $6.8bn to build world’s largest mall – Dubai Holding’s CEO Ahmad Bin Byat said that the investment vehicle of the emirate's ruler, will need $6.8bn to build an entertainment district that will include the world's largest shopping mall. HH Sheikh Mohammed bin Rashid al-Maktoum, Vice-President and Prime Minister of the UAE and Ruler of Dubai, announced plans to build the "Mall of the World", encompassing an 8mn square foot mall connected to a theme park, 100 hotels and serviced apartment buildings with 20,000 rooms. The plans, and other new building projects, have led some analysts to warn that Dubai risks overbuilding again as it did a decade ago, culminating in its 2009 debt crisis. (Gulf- Times.com) Al Habtoor Chief plans to buy prime London hotels – Al Habtoor Group’s Chairman, Khalaf Al Habtoor, is leading a consortium of Middle Eastern businessmen to buy landmark hotels such as Grosvenor House, Claridges and the Berkeley, in London. Habtoor has earmarked more than £1bn to build the new pan-European leisure empire. According to a report, the Grosvenor House on Park Lane, as well as the Maybourne Group – which includes Claridges, the Connaught and the Berkeley might be under consideration. (GulfBase.com) AI Madina initiates settlement with Boubyan Bank – AI Madina for Finance and Investment Company has sold a piece of land in Abu Dhabi, in order to begin the implementation of the first phase of the settlement with Boubyan Bank. Accordingly the bank is bearing the remaining liability related to land amounting to KD1.2mn, which will result in the reduction of company's liability by this amount. The transaction is related to the settlement agreement signed between AI Madina and Boubyan Bank. (DFM) SCA approves reduction of Gulf Navigation’s capital – Securities and Commodities Authority (SCA) has approved the capital reduction of Gulf Navigation Holding from 1,655mn to 551.67mn. The company in cooperation with Dubai Financial Market (DFM) has made all necessary arrangements to amend the percentage of shares, regarding reducing the capital of the company from July 8, 2014. (DFM) DGCX plans spot silver after gold – Dubai Gold & Commodities Exchange (DGCX) will consider starting a silver contract for immediate delivery after spot gold is introduced in the third quarter. DGCX has also hired Sanjeev Vohra from the Singapore Mercantile Exchange as head of soft commodities to study adding agriculture products starting in 1Q2015. DGCX now has commodities futures on gold, silver and copper, WTI oil, Brent crude and polypropylene. It also has trading in the euro, sterling, Australian dollar, Canadian dollar, Swiss franc and Japanese yen against the U.S. dollar and the S&P BSE Sensex Futures in equities. The exchange also plans to start options on the Indian rupee futures on July 18, 2014. (Bloomberg) Moody’s: Emaar to benefit from property and tourism boom – According to Moody’s Investors Services, Dubai-based Emaar Properties is set to benefit from the current economic boom in Dubai, especially the surge in tourism and real estate sectors. A new report from the rating agency noted that the economic growth in the emirate of Dubai will continue to support Emaar’s domestic property development, hospitality and retail businesses. While the company put new projects in Dubai on hold for a handful of quarters owing to lackluster demand, it has been unveiling and profitably selling projects at regular intervals since last year on the back of the recent resurgence in the country’s property market. (GulfBase.com)

- 6. Page 6 of 7 CBI signs agreement with RERA for re-activating escrow account services – Commercial Bank International (CBI) announced the re-activation of its escrow (trust) account services by signing a new agreement with the Real Estate Regulatory Agency (RERA). Pursuant to this agreement, CBI now offers escrow account services to real estate developers, who are preparing to launch new construction projects for off- plan sale in Dubai. (GulfBase.com) Etihad reports 28% rise in 1H2014 revenues; signs codeshare agreement with Brazil’s Gol – Etihad Airways reported a 28% jump in its 1H2014 revenues, from $2.5bn to $3.2bn, helped by the growth in passenger and cargo volumes. The airline carried 6.7mn passengers in 1H2014, up 22%, while cargo volumes grew 25% to 268,713 tones. Meanwhile, the company entered into a codeshare agreement with Brazil’s Gol Linhas Aereas Inteligentes. Etihad will place its EY codeshare on 52 Gol-operated flights across Brazil and 14 destinations in South America. Etihad flies daily passenger services to Sao Paulo in Brazil. This agreement enables Etihad to extend its reach into South America. (Bloomberg) Al Jaber signs MoU with Etihad Rail – Al Jaber Crushers & Quarries, a subsidiary of Al Jaber Group, has signed a MoU with national railway developer and operator, Etihad Rail. Under the terms of the MoU, Al Jaber will use the Etihad rail network for its logistics operations. The MoU allows Al Jaber to transport its products in a cost and time-effective manner. (Bloomberg) OICT enhances Terminal C capabilities at Sohar Port – Oman International Container Terminal (OICT) has successfully completed the task of moving its massive quayside cranes together with other container handling equipment from its old terminal at Sohar Port to its state-of-the-art Terminal C. Four post-Panamax cranes, each weighing a mammoth 1,050 tons and eight rubber-tyred gantry cranes (RTGC) were relocated from the old Terminal B to OICT’s new high-tech terminal, which became operational in May 2014. Upon the deployment and re- commissioning of the cranes, Terminal C now has seven quay cranes and 14 RTGCs. OICT is set to take delivery of six additional RTGCs, 18 additional yard tractors, and more than 30 trailers. (GulfBase.com) ODB signs loan guarantee agreements with five banks – Oman Development Bank (ODB) has signed loan guarantee agreements with five banks operating in the Sultanate, in line with its efforts to make bank facilitations available for the entrepreneurs and the small & medium enterprises (SMEs). The participating banks are Bank Muscat, Bank Dhofar, Bank Sohar, Al Ahly Bank and Bank Nizwa. The agreements give the commercial banks the right to obtain a government guarantee through ODB for a maximum amount of OMR250,000 they provide to loan applicants. The agreements encourage commercial banks to have a bigger share in supporting SMEs with high levels of risk and the Omani entrepreneurs, who have no sufficient guarantees to apply for loans. (GulfBase.com) Haya Water awards wastewater network project contracts in Oman – Haya Water has signed contracts worth OMR38mn for the third and fourth packages of waste water network project in the Wilayat of Al Amerat, Oman. The scope of the contracts includes laying of networks of wastewater &water treatment in the northern and eastern parts of the Wilayat. The consolidated Contractors have been awarded with a OMR16.2mn project for the northern Wilayat, which will be completed by October 2017. This project includes laying of 6.2 kilometer (km) of wastewater pipes, 70km of side pipelines, installation of 13.35km of treated water lines and 230.4km of fibre-optic channels, in addition to 23.2km of house-connecting lines, while Gulf Petrochemical Services and Trading Company is awarded with a OMR21.4mn eastern area project, which is expected to be completed by January 2018. The scope of the eastern area project includes laying of 8.9km of wastewater pipes, 86.5km of side pipelines, installation of 9.9km of treated water lines and 230.3km of fibre- optic channels, and 32.45km of house-connecting lines. (Bloomberg) GPIC achieves key production target – Gulf Petrochemical Industries Company (GPIC) has said that it saw an increase of 2% in ammonia production amounting to 227,000 tons, reflecting an increase of 3.5% in methanol production to 225,000 tons and an increase of 7% in the production of urea to 360,000 tons. GPIC reported total exports of 557,000 tons of ammonia, urea and methanol for 1H2014. (GulfBase.com)

- 7. Contacts Saugata Sarkar Abdullah Amin, CFA Shahan Keushgerian Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6569 Tel: (+974) 4476 6509 saugata.sarkar@qnbfs.com.qa abdullah.amin@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa Sahbi Kasraoui Ahmed Al-Khoudary QNB Financial Services SPC Manager – HNWI Head of Sales Trading – Institutional Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6544 Tel: (+974) 4476 6548 PO Box 24025 sahbi.alkasraoui@qnbfs.com.qa ahmed.alkhoudary@qnbfs.com.qa Doha, Qatar DISCLAIMER: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange; QNB is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. While this publication has been prepared with the utmost degree of care by our analysts, QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 7 of 7 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg 80.0 90.0 100.0 110.0 120.0 130.0 140.0 150.0 160.0 170.0 180.0 190.0 200.0 210.0 Jul-10 Jul-11 Jul-12 Jul-13 Jul-14 QE Index S&P Pan Arab S&P GCC (0.1%) 1.3% 0.6% 0.3% 0.1% (0.7%) (1.0%) (1.6%) (0.8%) 0.0% 0.8% 1.6% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D% WTD% YTD% Gold/Ounce 1,319.28 (0.1) (0.1) 9.4 DJ Industrial 16,906.62 (0.7) (0.9) 2.0 Silver/Ounce 21.04 (0.0) (0.6) 8.1 S&P 500 1,963.71 (0.7) (1.1) 6.2 Crude Oil (Brent)/Barrel (FM Future) 108.94 (1.2) (1.5) (1.7) NASDAQ 100 4,391.46 (1.3) (2.1) 5.1 Natural Gas (Henry Hub)/MMBtu 4.16 (2.3) (3.2) (4.3) STOXX 600 339.99 (1.4) (2.3) 3.6 LPG Propane (Arab Gulf)/Ton 103.25 (0.6) (0.6) (18.4) DAX 9,772.67 (1.3) (2.4) 2.3 LPG Butane (Arab Gulf)/Ton 123.50 (0.2) (0.4) (9.0) FTSE 100 6,738.45 (1.2) (1.9) (0.2) Euro 1.36 0.1 0.1 (1.0) CAC 40 4,342.53 (1.4) (2.8) 1.1 Yen 101.57 (0.3) (0.5) (3.6) Nikkei 15,314.41 (0.4) (0.8) (6.0) GBP 1.71 0.0 (0.2) 3.5 MSCI EM 1,064.73 0.0 0.2 6.2 CHF 1.12 0.1 0.1 (0.0) SHANGHAI SE Composite 2,064.02 0.2 0.2 (2.5) AUD 0.94 0.3 0.4 5.4 HANG SENG 23,541.38 0.0 (0.0) 1.0 USD Index 80.18 (0.0) (0.1) 0.2 BSE SENSEX 25,582.11 (2.0) (1.5) 20.8 RUB 34.26 (0.5) (0.6) 4.2 Bovespa 53,634.69 (0.3) (0.8) 4.1 BRL 0.45 0.3 (0.1) 6.7 RTS 1,393.59 0.6 2.4 (3.4) 180.3 151.9 137.7