6 November Daily Market Report

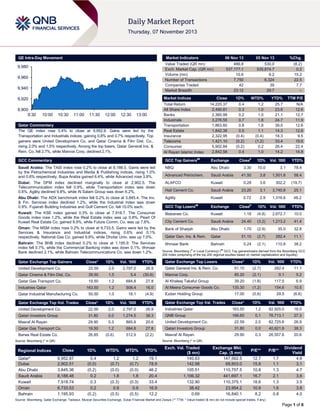

- 1. QE Intra-Day Movement Market Indicators 9,980 9,960 9,940 05 Nov 13 %Chg. 486.8 537,177.1 10.6 7,750 42 23:12 530.0 535,874.7 9.2 6,324 39 29:7 (8.2) 0.2 15.2 22.5 7.7 – Market Indices 9,920 9,900 9:30 06 Nov 13 Value Traded (QR mn) Exch. Market Cap. (QR mn) Volume (mn) Number of Transactions Companies Traded Market Breadth 10:00 10:30 11:00 11:30 12:00 12:30 13:00 Qatar Commentary The QE index rose 0.4% to close at 9,952.9. Gains were led by the Transportation and Industrials indices, gaining 0.8% and 0.7% respectively. Top gainers were United Development Co. and Qatar Cinema & Film Dist. Co., rising 2.0% and 1.5% respectively. Among the top losers, Qatar General Ins. & Rein. Co. fell 2.7%, while Mannai Corp. declined 2.1%. Close Total Return All Share Index Banks Industrials Transportation Real Estate Insurance Telecoms Consumer Al Rayan Islamic Index 1D% WTD% YTD% TTM P/E 14,220.37 2,490.81 2,360.99 3,276.55 1,863.60 1,842.38 2,322.95 1,421.10 5,902.84 2,842.58 0.4 0.3 0.2 0.7 0.8 0.5 (0.4) (0.2) (0.2) 0.4 1.2 1.0 1.0 1.8 1.8 1.1 (0.4) (1.2) 0.2 1.0 25.7 23.6 21.1 24.7 39.0 14.3 18.3 33.4 26.4 14.2 N/A 12.6 12.7 11.9 12.6 12.6 9.5 19.6 22.4 14.8 GCC Commentary GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 Saudi Arabia: The TASI index rose 0.2% to close at 8,188.5. Gains were led by the Petrochemical Industries and Media & Publishing indices, rising 1.0% and 0.6% respectively. Bupa Arabia gained 6.4%, while Advanced rose 3.8%. NBQ Abu Dhabi 3.30 10.0 3.1 78.4 Advanced Petrochem. Saudi Arabia 41.50 3.8 1,501.6 58.4 Dubai: The DFM index declined marginally to close at 2,902.5. The Telecommunication index fell 0.9%, while Transportation index was down 0.6%. Agility declined 9.8%, while Al Salam Group was down 6.2%. ALAFCO Kuwait Hail Cement Co. Saudi Arabia Abu Dhabi: The ADX benchmark index fell 0.2% to close at 3,845.4. The Inv. & Fin. Services index declined 1.2%, while the Industrial index was down 0.9%. Fujairah Building Industries and Gulf Cement Co. fell 10.0% each. Agility GCC Top Losers Exchange Kuwait: The KSE index gained 0.3% to close at 7,918.7. The Consumer Goods index rose 1.2%, while the Real Estate index was up 0.8%. Pearl Of Kuwait Real Estate Co. gained 8.9%, while Future Comm. Co. was up 7.8%. Mabanee Co. Kuwait City Cement Co. Saudi Arabia Oman: The MSM index rose 0.2% to close at 6,733.5. Gains were led by the Services & Insurance and Industrial indices, rising 0.6% and 0.1% respectively. National Gas Co. gained 9.9%, while Dhofar Univ. was up 7.0%. Bank of Sharjah Abu Dhabi Qatar Gen. Ins. & Rein. Qatar Ithmaar Bank Bahrain Bahrain: The BHB index declined 0.2% to close at 1,195.9. The Services index fell 0.7%, while the Commercial Banking index was down 0.1%. Ithmaar Bank declined 2.1%, while Bahrain Telecommunications Co. was down 1.2%. United Development Co. Qatar Cinema & Film Dist. Co. Close* 1D% Vol. ‘000 YTD% 22.59 Qatar Exchange Top Gainers 2.0 2,797.0 26.9 39.50 1.5 5.4 (30.6) 302.2 (19.7) 3.1 3,740.6 25.1 0.72 2.9 1,316.6 48.2 # Close 1D% Vol. ‘000 YTD% 1.18 (4.8) 2,672.7 10.0 24.40 (3.2) 1,213.2 41.4 1.70 (2.9) 35.0 32.8 51.10 (2.7) 282.4 11.1 0.24 (2.1) 110.8 38.2 Close* 1D% Vol. ‘000 YTD% Qatar General Ins. & Rein. Co. 51.10 (2.7) 282.4 11.1 Mannai Corp. 85.20 (2.1) 0.1 5.2 Qatar Exchange Top Losers 19.50 1.2 684.8 27.8 Al Khaleej Takaful Group 1.2 508.4 16.0 Al Meera Consumer Goods Co. Qatar Industrial Manufacturing Co. 50.50 1.0 18.1 (4.9) Ezdan Holding Group Qatar Exchange Top Vol. Trades Industries Qatar 3.6 Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) 163.50 Qatar Gas Transport Co. 0.28 23.20 Kuwait ## YTD% 39.20 (1.8) 117.5 6.9 135.30 (1.2) 154.6 10.5 17.00 (0.6) 29.5 (6.6) Close* 1D% Vol. ‘000 YTD% Qatar Exchange Top Val. Trades Close* 1D% Val. ‘000 YTD% United Development Co. 22.59 2.0 2,797.0 26.9 Industries Qatar 163.50 1.2 82,925.0 16.0 Qatari Investors Group 31.80 0.0 1,274.5 38.3 QNB Group 166.60 0.1 76,713.1 27.3 Masraf Al Rayan 29.90 0.3 885.9 20.6 United Development Co. 22.59 2.0 62,725.6 26.9 Qatar Gas Transport Co. 19.50 1.2 684.8 27.8 Qatari Investors Group 31.80 0.0 40,621.9 38.3 Barwa Real Estate Co. 26.85 (0.6) 512.9 (2.2) Masraf Al Rayan 29.90 0.3 26,557.6 20.6 Source: Bloomberg (* in QR) Source: Bloomberg (* in QR) Regional Indices Qatar* Dubai Abu Dhabi Saudi Arabia Kuwait Oman Bahrain Close 1D% WTD% MTD% YTD% 9,952.87 2,902.51 3,845.36 8,188.46 7,918.74 6,733.53 1,195.93 0.4 (0.0) (0.2) 0.2 0.3 0.2 (0.2) 1.2 (0.7) (0.0) 1.8 (0.3) 0.9 (0.5) 1.2 (0.7) (0.0) 1.8 (0.3) 0.9 (0.5) 19.1 78.9 46.2 20.4 33.4 16.9 12.2 Exch. Val. Traded ($ mn) 140.63 142.98 105.51 1,106.32 132.90 38.42 0.69 Exchange Mkt. Cap. ($ mn) 147,562.5 69,803.0 110,757.5 441,697.1 110,375.1 23,954.2 16,840.1 P/E** P/B** 12.7 15.8 10.8 16.7 18.6 10.9 8.2 1.7 1.1 1.3 2.1 1.3 1.6 0.8 Dividend Yield 4.6 3.1 4.7 3.6 3.5 3.8 4.0 Source: Bloomberg, Qatar Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) Page 1 of 6

- 2. Qatar Market Commentary The QE index rose 0.4% to close at 9,952.9. The Transportation and Industrials indices led the gains. The index rose on the back of buying support from non-Qatari shareholders despite selling pressure from Qatari shareholders. Overall Activity Sell %* Net (QR) Qatari 60.52% 77.23% (81,373,879.47) Non-Qatari United Development Co. and Qatar Cinema & Film Dist. Co. were the top gainers, rising 2.0% and 1.5% respectively. Among the top losers, Qatar General Ins. & Rein. Co. fell 2.7%, while Mannai Corp. declined 2.1%. Buy %* 39.49% 22.76% 81,373,879.47 Source: Qatar Exchange (* as a % of traded value) Volume of shares traded on Wednesday rose by 15.2% to 10.6mn from 9.2mn on Tuesday. Further, as compared to the 30day moving average of 6.2mn, volume for the day was 72.1% higher. United Development Co. and Qatari Investors Group were the most active stocks, contributing 26.4% and 12.0% to the total volume respectively. Ratings, Earnings and Global Economic Data Ratings Updates Company Agency Market Dubai Holding Commercial Operations Group (DHCOG) Moody's Dubai Dubai Dubai Holding Commercial Operations MTN Limited Moody's Type* Old Rating New Rating Rating Change Outlook Outlook Change CFR/ PDR B2/B2-PD B1/B1-PD Positive – Provisional rating/ multi-currency debt instruments issued under medium-term note (MTN) program (P)B2/B2 (P)B1/B1 Positive – Source: News reports (* LT – Long Term, ST – Short Term, FSR- Financial Strength Rating, FCR – Foreign Credit Rating, LCR – Local Currency Rating, IDR – Issuer Default Rating, SR – Support Rating, LC – Local Currency, CFR- Corporate Family Rating, PDR- Probability Of Default Rating) Earnings Releases Company Revenue (mn) 3Q2013 % Change YoY AED 12.6 29.1% – AED 826.8 9.1% 74.5 Market Arabian Scandinavian Insurance Co. (ASCANA) Aramex Drake & Scull International (DSI) Union Cement Co. (UCC) Ras Al Khaimah National Insurance Co. (RAKNIC) National Takaful Co. (Watania Takaful) Abu Dhabi National Energy Co. (ADNEC) Al Wathba National Insurance Co. (AWNIC) Al Ahlia Insurance Co. (AAI)* Currency Dubai Dubai Operating Profit (mn) 3Q2013 % Change YoY Net Profit (mn) 3Q2013 % Change YoY – 7.8 131.8% 14.3% 59.9 12.7% Dubai AED 995.0 59.8% 42.7 NA 23.8 505.7% Abu Dhabi AED 74.2 -41.9% – – -1.9 NA Abu Dhabi AED 33.6 27.0% – – 6.0 111.5% Abu Dhabi AED 10.3 274.2% – – 0.0 0.0% Abu Dhabi AED 7,396 -11.2% – – 146.0 NA Abu Dhabi AED 61.6 10.1% – – 74.4 187.9% Bahrain BHD 3.6 5.6% – – 2.6 769.8% Source: Company data, DFM, ADX, MSM (* Nine months ended on September 30, 2013) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 11/06 US MBA MBA Mortgage Applications 1-November 11/06 US Conference Board Leading Index September -7.00% – 6.40% 0.70% 0.60% 11/06 EU Markit PMI Services 0.70% October 51.6 50.9 11/06 EU Markit 52.2 PMI Composite October 51.9 51.5 11/06 EU 52.2 Eurostat Retail Sales MoM September -0.60% -0.40% 0.50% 11/06 11/06 EU Eurostat Retail Sales YoY September 0.30% 0.60% -0.20% France Markit PMI Services October 50.9 50.2 51.0 11/06 Germany Markit PMI Services October 52.9 52.3 53.7 11/06 Germany Bundesbank Factory Orders MoM September 3.30% 0.50% -0.30% 11/06 UK Lloyds TSB Halifax House Prices MoM October 0.70% 0.90% 0.40% 11/06 UK Lloyds TSB Halifax House Price 3Mths/Year October 6.90% 7.00% 6.20% 11/06 UK ONS Industrial Production MoM September 0.90% 0.60% -1.10% 11/06 UK ONS Industrial Production YoY September 2.20% 1.80% -1.50% Page 2 of 6

- 3. 11/06 UK ONS Manufacturing Production MoM September 1.20% 1.10% -1.20% 11/06 UK ONS Manufacturing Production YoY September 0.80% 0.80% -0.20% 11/06 Italy Markit PMI Services October 50.5 51.2 52.7 Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) News Qatar QCB issues QR4bn T-bills – The Qatar Central Bank (QCB) has issued three treasury bills worth QR4bn on November 5, 2013. Total bids stood at QR7.73bn for all three maturities. Yield on 91-day T-bills stood at 1.28% rising from 0.97% for 93-days, while yield for 182-day T-bills fell to 1.30% from 1.36% and for 273-day notes yield declined to 1.40% from 1.57%. (QCB) Centrica signs $7bn LNG deal with Qatar – UK-based Centrica entered into a deal worth $7bn with Qatar to import LNG over four & half years, as the UK’s domestic production dwindles. Under this contract, Centrica will purchase 3mn tons of LNG per year from Qatar, which is equivalent to approximately 13% of Britain's annual residential gas demand. This deal is an extension of a three-year LNG supply agreement that was signed in 2011, which expires in June 2014. (Reuters) GDI, Oxy Qatar sign QR865mn rig deal for 5 years – Gulf Drilling International (GDI) has signed a QR865mn five-year contract with Occidental Petroleum of Qatar (Oxy Qatar) to bring a newly acquired rig into service. This will mark the third rig that GDI has under contract for Oxy Qatar, having already successfully deployed the Al Rayyan and Al Wajba jack-up rigs to support Oxy Qatar’s extensive development program. The cumulative value of the three GDI rigs stands at QR1.3bn. (GulfTimes.com) 7 new malls to be built for Al Meera – Al Meera Consumer Goods Company has signed a blanket agreement with Al-Aliaa Trading & Contracting Company (Al-Aliaa) and Al-Muftah Trading & Contracting Company (Al-Muftah) to build seven new malls. According to the agreement, Al-Muftah will build three new stores for Al Meera at Rawdat Ekdeem, Al Azizia, and Zakhira, while Al-Aliaa will handle the construction of the other four malls at Al Wajba, Muaither, Al Wakrah, and Al Thumama. (Gulf-Times.com) Ashghal to open Lejbailat intersection – The Public Works Authority (Ashghal) announced that the conversion of the Lejbailat roundabout into a signal-controlled intersection will be completed and the intersection will be opened to traffic on November 10. With this, Lejbailat has been added to the list of roundabouts that have been converted into signalized intersections. The conversion is part of Ashghal’s comprehensive development plan for the Corniche Street and its surrounding areas. (Gulf-Times.com) QP, Dubai Carbon Centre sign MoU – Qatar Petroleum (QP) and the Dubai Carbon Centre of Excellence (DCCE) have signed a MoU to enter into a strategic partnership for developing mutually beneficial sustainable development projects. (Peninsula Qatar) QNB Group receives two awards from Global Investor – QNB Group has secured two prestigious recognitions at the Global Investor/ISF Middle East Summit & Awards 2013 ceremony. QNB won the “Best Asset Manager Award”, while QNB Financial Services, a group subsidiary specializing in brokerage services, won the “Best Broker Award”. (QNB Group Press Release) International Global economic growth hits 32-month high in October – According to a JPMorgan-Markit survey, the global economic growth accelerated in October to a 32-month high, bolstered by a steady improvement in new business. JPMorgan's Global AllIndustry Output Index, produced along with Markit, rose to 55.5 in October from 53.6 in September, which is the highest reading since February 2011. David Hensley, a director at JPMorgan said the global economy has begun the year’s final quarter on a positive footing. He said the all-industry output accelerated October, indicating that global GDP is on track to post a decent outcome in 4Q2013. (Reuters) US Treasury to sell $10-15bn in floating notes – The US Treasury Department will sell its first floating-rate notes worth around $10-15bn on January 29, 2014, and said a period of political wrangling over the budget has delayed its plans to reduce coupon auctions. The floating-rate notes will have a twoyear maturity and will be the Treasury’s first new security in 17 years. The Treasury said note and bond sales will total $70bn next week, less than the $72bn auctioned last quarter and the lowest since February 2009. (Reuters) UK economy grew 0.7% in three months until October – According to the National Institute of Economic & Social Research (NIESR), Britain's economy grew at an estimated 0.7% during the three months until the end of October 2013, driven largely by private sector services companies. This GDP growth represents a slight slowdown from the 0.8% growth recorded in the three months until September, and is markedly lower than the 1.3% growth implied by recent purchasing managers' surveys. NIESR's forecast has put 2013 GDP growth at 1.4% and 2014 growth at 2.0%, which are slightly less than those expected by economists polled by Reuters last month. (Reuters) Regional IATA: Mid-east airlines set to earn $2.1bn profit in 2014 – The International Air Transport Association’s (IATA) Director General Tony Tyler said Middle East airlines are expected to earn a profit of $2.1bn in 2014. He said the global airline industry is expected to deliver a total profit of around $16.4bn next year. He said the passenger traffic share of Middle East airlines has grown from 7% of the global total to 8.4% over the past 28 months, and cargo services have grown from 9.7% to 12%. (Gulf-Times.com) QFC: Asian reinsurance market confident despite waning outlook – According to the Qatar Financial Center (QFC), Asia’s reinsurance markets are still bustling with confidence, although the outlook on pricing and profitability for the next 12 months is slightly waning. QFC said Asia’s strong economic growth is regarded as the market’s key attraction with reinsurance exposure and premium growth expected to outpace the regional GDP growth. (Gulf-Times.com) RSH signs SR91mn oilfield drilling camp deal with Nabors – The Red Sea Housing Services Company (RSH) has received purchase orders worth SR91mn from Nabors Drilling International for the manufacture, delivery and installation of nine new oilfield drilling camps in the Eastern province of Saudi Arabia. This agreement also consists of refurbishment and Page 3 of 6

- 4. associated works for two additional camps, which brings the total number of camps to 11 camps. These camps will be delivered over seven months and the financial impact of this project will be reflected from 4Q2013 onward. These projects will be financed through RSH’s existing cash flows. (Tadawul) HMC, AGH appoint banks to assist with IPO – Saudi-based Dr. Sulaiman Al Habib Medical Center (HMC) has appointed Banque Saudi Fransi to assist with its upcoming IPO. Meanwhile, Almana General Hospitals (AGH) has appointed GIB Capital to help with the IPO process. (Reuters) SABIC appoints banks for euro-denominated bond issue – Saudi Basic Industries Corporation (SABIC) has appointed Credit Agricole, ING, JP Morgan Chase, Mitsubishi and Standard Chartered to arrange roadshows of a possible eurodenominated bond issue. The bond to be sold through its subsidiary SABIC Capital could follow a series of investor meetings in London, Frankfurt, Amsterdam and Paris during November 8 to 12, 2013. (Reuters) ADC reconciles with Emar Arabian Shield – Al Ahsa Development Company (ADC) has signed a reconciliation agreement with Emaar Arabian Shield. ADC had earlier filed a lawsuit against Emaar Arabian Shield for the delay in transferring the ownership of land plots located on Sheikh Jaber Road, Riyadh. According to the latest agreement, Emaar Arabian Shield has pledged to transfer the ownership within 30 days. (Tadawul) Ajman Bank reports AED13.7mn net profit in Ajman Bank has reported a net profit of AED13.7mn The bank’s assets stood at AED6.7bn at the end of 30, 2013. Customer deposits rose 14% YTD to (Bloomberg) 3Q2013 – in 3Q2013. September AED4.9bn. Dubai's GDP accelerates to 4.9% in 1H2013 – According to the latest government data, Dubai's GDP has accelerated to 4.9% YoY in 1H2013, due to strong expansion in trade and tourism. The Emirate’s real estate market rose 79% YTD helped by an influx of foreign money. The data showed that the hotel & restaurants sector grew 13.7% in 1H2013. The number of hotel guests rose 11.1% to 5.6mn, while the number of available rooms stood at 58,950 in 1H2013. The wholesale & retail trade sector, which accounts for nearly one-third of Dubai’s GDP, has expanded 4.1% YoY, while the manufacturing sector increased 13.3% due to strong exports. The real estate & business services sector (13% of GDP) grew 3.3% YoY, while the financial sector rose 2.7%. (GulfBase.com) GEMS signs school lease deal with PineBridge Investments – Dubai-based Global Education Management Systems (GEMS) has entered into a sale-leaseback agreement with US-based PineBridge Investments to lease a school campus for a term of 20 years. (Reuters) Air Arabia to fly to Hofuf from November 18 – Air Arabia will begin flights to Hofuf from Sharjah starting from November 18, 2013. This is the airline’s 10th destination in Saudi Arabia and 87th global destination. (GulfBase.com) Flydubai obtains $228mn loan to finance 6 jets – Flydubai has obtained $228mn loan from regional and international banks to finance the purchase of six new Boeing jets. The loan is structured as a finance lease with quarterly loan repayments over 10-12 years. Five banks including NordLB, Crédit Agricole and Gulf International Bank arranged the financing. (Reuters) Kauai to open first store in Dubai – South Africa-based Kauai is set to open its first store in Dubai in December 2013. The company is planning to open several more stores over the next three years. (Bloomberg) ADIA reports 10.1% rise in passenger traffic in September – According to a report released by Abu Dhabi Airports Company (ADAC), over 1.3mn passengers have travelled through Abu Dhabi International Airport (ADIA) in September 2013, indicating 10.1% rise YoY. The airport has also registered a 12.1% YoY growth in passenger traffic during January-September 2013. The report showed that the aircraft movement had reached 11,379 flights in September 2013, reflecting an increase of 13.1% YoY, while cargo traffic rose 27.6% to 61,913 tons. In September, ADIA’s top five destinations for outbound passengers were Bangkok, London, Doha, Manila, and Sydney. (GulfBase.com) EMAL ahead of schedule to expand capacity to 1.3mn tpy – Emirates Aluminium Company’s (EMAL) CEO Saeed al Mazrooei said the company is three months ahead of schedule to expand its production capacity to 1.3mn tons per year (tpy). EMAL expects this expansion to be completed in mid-2014. Emal's $4bn project to boost its capacity from about 800,000 tpy was expected to be completed by 2014-end. (Reuters) Arabtec bags AED1.8bn contract to build tower in Dubai – Arabtec Holding’s subsidiary, Arabtec Construction has won AED1.8bn contract for the construction of a mixed-use 369.1 meters high tower in Dubai. The tall tower’s construction is scheduled to begin in mid-November 2013 and will take 42 months to complete. (DFM) FGB completely acquires Dubai First – First Gulf Bank (FGB) has successfully completed the acquisition of Dubai First. (GulfBase.com) ALAFCO awaits approval from Kuwait’s CMA to list shares in London – The Aviation Lease & Finance Company (ALAFCO) is awaiting approval from Kuwait’s Capital Market Authority (CMA) to list 30% of its shares as global depository notes in London. The company has appointed Deutsche Bank to manage this sale on the London Stock Exchange’s secondary market and plans to be ready by 2Q2014. ALAFCO plans to use this capital to grow its operations, increase aircraft fleet and seek more deals. (Bloomberg) KKR, Kuwait Petroleum team up for RWE unit bid – US private equity firm KKR has teamed up with the international arm of Kuwait Petroleum Corp. to jointly bid for German utility RWE's oil & gas unit, DEA. Kuwait Foreign Petroleum Exploration Company (KUFPEC) is joining hands with KKR to bid for DEA, which is potentially worth €5bn. (Reuters) Oman’s largest power project could cost $2.4bn – Oman Power & Water Procurement Company’s (OPWP) Client and Contracts & Interface Manager Hilal al Abdali said that the country’s biggest independent power project could cost as much as $2.4bn. With a power generation capacity of 3,000MW, this plant will be able to serve much of northern Oman and is proposed to be implemented by 2017-2018. (Bloomberg) UPC’s BoD resolves to reduce company’s initial capital by 5% – The United Power Company’s (UPC) Board of Directors has resolved to reduce the company’s initial capital of OMR34.9mn by 5%. After this reduction and the previous capital reductions, the company’s current capital of OMR8.72mn will be reduced to OMR7mn. This capital reduction will be applicable to shareholders who are registered in the company’s shareholders register at the end of trading day of December 1, 2013. Meanwhile, the board has also appointed Guillaume Baudet as the new Company Secretary. (MSM) Page 4 of 6

- 5. NGC’s BoD recommends rights issue; appoints OAB to manage the issue – The National Gas Company’s (NGC) BoD has recommended increasing the company’s issued and paid-up share capital through a rights issue of 3:2, which will be 20mn new shares for 377 baisas per share that aggregates to OMR7.54mn. This will increase NGC’s issued and paid-up share capital by OMR2mn. The BoD has also appointed Oman Arab Bank (OAB) as the financial advisor and issue manager for this rights issue. (MSM) ABC Islamic Bank reports $3.2mn net profit in 3Q2013 – ABC Islamic Bank has reported a net profit of $3.2mn in 3Q2013, reflecting an increase of 15% QoQ (+13% YoY). The bank’s total assets stood at $1.08bn at the end of September 30, 2013 as compared to $1.067bn at 2012-end. (GulfBase.com) CBRE: Bahrain’s rental rates remain static in 3Q2013 – According to a report by global property advisor CBRE, the office and residential rental rates in Bahrain have remained static in 3Q2013. The residential sales rates have continued to climb in master-planned communities where units have been completed. The report also showed that five new luxury hotels are scheduled to open in Bahrain by 1Q2014, which will add to the existing 14 hotels operating in the Kingdom. (Bloomberg) Page 5 of 6

- 6. Rebased Performance Daily Index Performance 150.0 0.8% 140.0 143.0 130.0 128.5 120.0 0.4% 0.4% 0.2% 0.3% 0.2% 117.2 110.0 0.0% 100.0 (0.0%) S&P Pan Arab S&P GCC Source: Bloomberg Asset/Currency Performance 1D% WTD% YTD% Global Indices Performance 1,317.93 0.5 0.1 (21.3) DJ Industrial 21.82 0.5 (0.3) (28.1) 105.24 (0.1) (0.6) (5.3) 3.45 2.8 (0.1) 0.8 119.00 1.9 2.4 33.0 142.00 1.4 0.4 (17.9) Euro 1.35 0.3 0.2 2.4 Yen 98.66 0.2 (0.0) 13.7 Nikkei GBP 1.61 0.2 1.0 (1.1) CHF 1.10 0.1 0.0 0.3 AUD 0.95 0.2 0.9 (8.3) USD Index 80.48 (0.3) (0.3) RUB 32.41 (0.4) 0.0 BRL 0.44 (0.1) (1.2) (10.3) Silver/Ounce Crude Oil (Brent)/Barrel (FM Future) Natural Gas (Henry Hub)/MMBtu North American Spot LPG Propane Price North American Spot LPG Normal Butane Price Dubai Source: Bloomberg Close ($) Gold/Ounce Oman Jul-13 Kuwait May-12 Dec-12 (0.2%) Abu Dhabi QE Index Oct-11 Qatar Jan-10 Aug-10 Mar-11 Saudi Arabia (0.4%) 80.0 Bahrain (0.2%) 90.0 Close 1D% WTD% YTD% 15,746.88 0.8 0.8 20.2 S&P 500 1,770.49 0.4 0.5 24.1 NASDAQ 100 3,931.95 (0.2) 0.3 30.2 323.26 0.4 0.5 15.6 DAX 9,040.87 0.4 0.4 18.8 FTSE 100 6,741.69 (0.1) 0.1 14.3 STOXX 600 4,286.93 0.8 0.3 17.7 14,337.31 0.8 1.0 37.9 MSCI EM 1,016.19 (0.0) (1.1) (3.7) SHANGHAI SE Composite 2,139.61 (0.8) (0.5) (5.7) HANG SENG 23,036.94 (0.0) (0.9) 1.7 0.9 BSE SENSEX 20,894.94 (0.4) (1.4) 7.6 6.2 Bovespa 53,384.60 (0.8) (1.2) (12.4) 1,458.93 (0.1) (1.1) (4.5) Source: Bloomberg CAC 40 RTS Source: Bloomberg Contacts Saugata Sarkar Ahmed M. Shehada Keith Whitney Sahbi Kasraoui Head of Research Head of Trading Head of Sales Manager - HNWI Tel: (+974) 4476 6534 Tel: (+974) 4476 6535 Tel: (+974) 4476 6533 Tel: (+974) 4476 6544 saugata.sarkar@qnbfs.com.qa ahmed.shehada@qnbfs.com.qa keith.whitney@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa QNB Financial Services SPC Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar DISCLAIMER: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange; QNB is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. While this publication has been prepared with the utmost degree of care by our analysts, QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6