3 November Daily technical trader

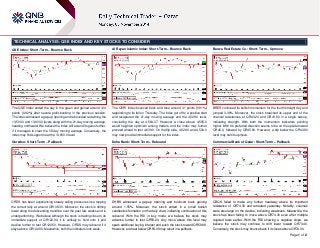

- 1. Page 1 of 2 TECHNICAL ANALYSIS: QSE INDEX AND KEY STOCKS TO CONSIDER QSE Index: Short-Term – Bounce Back The QSE Index ended the day in the green and gained around 124 points (0.92%) after severe profit-booking in the previous session. The index witnessed a gap-up opening and rebounded reclaiming the 13,500.0 and 13,600.0 levels along with the 21-day moving average, heading northward. We believe the index will extend its gains further, if it manages to clear the 55-day moving average. Conversely, the index may find support near the 13,600.0 level. Ooredoo: Short-Term – Pullback ORDS has been experiencing steady selling pressure since topping the current rally at around QR138.30. Moreover, the stock is drifting lower along the descending trendline over the past few weeks and is underperforming. We believe although the stock is trading close to its immediate support of QR122.90, it is unlikely to hold onto it and decline further to test QR120.50. However, ORDS may rebound if it stays above QR122.90. Meanwhile, both the indicators look weak. Al Rayan Islamic Index: Short-Term – Bounce Back The QERI Index bounced back and rose around 41 points (0.91%) responding to its fall on Thursday. The index got off to a positive start and recaptured the 21-day moving average and the 4,529.0 level, concluding the day at 4,564.37. However a close above 4,585.0 would heighten optimism among traders, and the index may further proceed ahead to test 4,639.0. On the flip side, 4,529.0 and 4,500.0 may now provide immediate support for the index. Doha Bank: Short-Term – Rebound DHBK witnessed a gap-up opening and bounced back gaining around 1.55%. Moreover, the stock ended in a small bullish candlestick formation on the daily chart, indicating continuation of this rebound. With the RSI in buy mode, we believe the stock may advance further to test QR59.20. Any move above this level may spark additional buying interest and push the stock toward QR59.98. However, a retreat below QR58.08 may result in a pullback. Barwa Real Estate Co.: Short-Term – Upmove BRES continued its bullish momentum for the fourth straight day and jumped 3.38%. Moreover, the stock breached its upper end of the channel resistances of QR43.20 and QR43.80 in a single swoop, indicating strength. With both the momentum indicators pointing higher, BRES’s preferred direction seems to be on the upside toward QR45.0, followed by QR45.60. However, a dip below the QR43.80 level may halt its upmove. Commercial Bank of Qatar: Short-Term – Pullback CBQK failed to make any further headway above its important resistance of QR74.30 and retreated yesterday. Notably, volumes were also large on the decline, indicating weakness. Meanwhile, the stock has been failing to move above QR74.30 even after multiple rejected tests earlier. With the RSI showing a negative slope, we believe the stock may continue to drift lower toward QR73.40. Conversely, the stock may bounce back if it closes above QR74.30.

- 2. Contacts Saugata Sarkar Abdullah Amin, CFA Shahan Keushgerian Sahbi Kasraoui Ahmed Al-Khoudary QNB Financial Services SPC Head of Research Senior Research Analyst Senior Research Analyst Manager - HNWI Head of Sales Trading – Institutional Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6534 Tel: (+974) 4476 6569 Tel: (+974) 4476 6509 Tel: (+974) 4476 6544 Tel: (+974) 4476 6548 PO Box 24025 saugata.sarkar@qnbfs.com.qa abdullah.amin@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa ahmed.alkhoudary@qnbfs.com.qa Doha, Qatar DISCLAIMER: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Stock Exchange; QNB is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. While this publication has been prepared with the utmost degree of care by our analysts, QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 2 of 2 *These stocks are today’s suggested ideas Overall Methodology: The charts and descriptions on Page 1 provide an indicative view of the future direction of the equities mentioned. The table on page 2 has been provided to denote historical movements in certain stocks. The historical trend analysis uses 21- and 55- day SMAs for indicating short-term and long-term trends, respectively. Based on these SMAs, the historical direction of the trend is denoted as UP, DOWN or FLAT. Selection of Key Stocks of the Day: Key stocks’ selection is based on our analysis of 19 members of the QSE Index (excludes QNBK QD). Analysis includes identifying trends (short-term as well as long-term), patterns and support/resistance levels. Trend Direction: The methods used to determine trend direction are subjective in nature. We use 21-day SMA and 55-day SMA, absolute price movements, price movements relative to SMAs and accurately drawn trend lines and chart patterns to determine the short- and long-term trends. Investment Horizon: The definition of short term and long term depends upon investors’ preferences and their investment objectives. As a rule of thumb, the time horizon for traders/short-term trend is 1-3 weeks while it is 1-3 months for investors/long-term trend. Combining Technical and Fundamental Analysis: Investors can combine technical analysis (TA) with fundamental analysis (FA) to maximize their investment returns. While the “True Value” of stocks could be estimated by FA, the entry and exit timings could be fine tuned using technical analysis to benefit from short-term movements in stock prices. Trading Tactics: The trend direction should be analyzed based on the time-horizon of your investments. In general, investors attempt selling close to resistance levels during a downtrend and attempt buying close to support levels during uptrend. Definitions: 1> Simple Moving Average (SMA): A SMA is the average of the closing price of a security for a given period. 2> RSI (Relative Strength Index): A technical momentum indicator that ranges from 0 to 100 and compares the stock’s recent price movements by evaluating recent gains and losses. Stocks with RSI above 70 could be considered overbought and below 30 could be considered oversold. If the RSI falls below 70, it is a bearish signal. On the other hand, if the RSI rises above 30 it is considered bullish. We use a RSI of 14 days. 3> MACD (Moving Average Convergence Divergence): MACD denotes the relationship between two moving averages, which is used to spot changes in strength, direction, momentum and duration of a stock price trend. The MACD is calculated by subtracting the 26-day exponential moving average (EMA) from the 12-day EMA. A nine-day EMA of the MACD, called the signal line, is also plotted on top of the MACD, functioning as a trigger for buy/sell signals. The MACD line above the signal line provides a positive signal and vice versa. Name (Ticker) Last Close Trend Support Resistance Short Term Long Term First Second First Second Qatar Stock Exchange Index (QSE Index) 13,623.33 UP DOWN 13,584.34 13,500.00 13,700.00 13,753.36 Al Rayan Islamic Index (QERI Index) 4,564.37 UP DOWN 4,528.58 4,500.00 4,584.50 4,638.81 Banks and Financial Services Banks and Masraf Al Rayan (MARK QD) 51.30 DOWN DOWN 50.40 49.75 51.80 52.80 Commercial Bank of Qatar (CBQK QD)* 73.70 UP UP 73.40 72.50 74.30 75.00 Doha Bank (DHBK QD)* 58.90 UP DOWN 58.00 57.20 59.20 60.50 Qatar Islamic Bank (QIBK QD) 112.00 DOWN DOWN 111.00 110.00 113.00 115.00 Qatar International Islamic Bank (QIIK QD) 87.60 UP DOWN 87.30 86.10 88.00 89.00 Qatar Insurance (QATI QD) 98.20 FLAT FLAT 98.00 97.00 99.00 100.00 Consumer Goods and Services Consumer Goods Medicare Group (MCGS QD) 126.50 FLAT DOWN 124.75 121.50 126.50 128.80 Industrials Industrials Industries Qatar (IQCD QD) 190.00 UP UP 190.00 188.50 191.50 193.50 Qatar Electricity & Water Co. (QEWS QD) 185.00 DOWN DOWN 184.00 182.00 186.00 188.00 Gulf International Services (GISS QD) 119.80 UP FLAT 119.50 118.10 121.00 122.50 Qatari Investors Group (QIGD QD) 49.50 DOWN DOWN 48.90 47.70 49.75 51.00 Real Estate Real Estate Barwa Real Estate Co. (BRES QD)* 44.40 UP UP 43.80 43.20 45.00 45.60 United Development Co. (UDCD QD) 26.60 DOWN DOWN 26.45 26.10 26.70 27.00 Ezdan Holding Group (ERES QD) 19.90 UP UP 19.50 19.36 20.04 20.35 Mazaya Qatar Real Estate Development (MRDS QD) 24.17 UP UP 23.89 23.35 24.25 25.00 Telecom Telecom Ooredoo (ORDS QD)* 123.00 DOWN DOWN 122.90 120.50 123.70 124.90 Vodafone Qatar (VFQS QD) 21.20 UP UP 21.10 20.79 21.40 21.97 Transportation Transportation Nakilat (QGTS QD) 24.10 UP DOWN 23.90 23.40 24.12 24.45 Milaha (QNNS QD) 97.90 UP UP 97.20 96.50 98.30 100.10