QE Intra-Day Movement Analysis

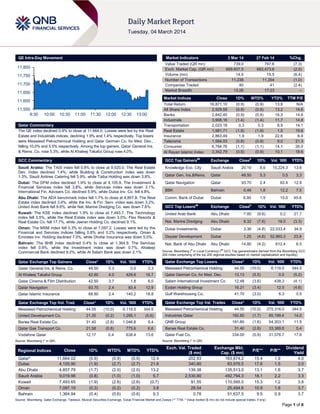

- 1. QE Intra-Day Movement Market Indicators 11,800 11,750 11,700 11,650 Market Indices 11,600 11,550 9:30 3 Mar 14 10:00 10:30 11:00 11:30 12:00 12:30 13:00 Qatar Commentary The QE index declined 0.9% to close at 11,664.0. Losses were led by the Real Estate and Industrials indices, declining 1.9% and 1.4% respectively. Top losers were Mesaieed Petrochemical Holding and Qatar German Co. for Med. Dev., falling 10.0% and 5.5% respectively. Among the top gainers, Qatar General Ins. & Reins. Co. rose 5.3%, while Al Khaleej Takaful Group rose 4.0%. 27 Feb 14 %Chg. 739.0 669,607.5 14.5 11,238 40 13:26 Value Traded (QR mn) Exch. Market Cap. (QR mn) Volume (mn) Number of Transactions Companies Traded Market Breadth 797.6 683,473.6 15.5 11,354 41 17:23 (7.3) (2.0) (6.4) (1.0) (2.4) – Close Total Return All Share Index Banks Industrials Transportation Real Estate Insurance Telecoms Consumer Al Rayan Islamic Index 1D% WTD% YTD% TTM P/E 16,871.10 2,929.59 2,842.45 3,908.16 2,023.18 1,981.71 2,863.49 1,584.03 6,784.76 3,342.79 (0.9) (0.9) (0.9) (1.4) 0.3 (1.9) 1.9 (0.8) (1.1) (0.9) (0.9) (0.9) (0.9) (1.4) 0.3 (1.9) 1.9 (0.8) (1.1) (0.9) 13.8 13.2 16.3 11.7 8.9 1.5 22.6 9.0 14.1 10.1 N/A 14.6 14.6 14.8 14.1 19.6 6.9 21.3 26.0 18.6 GCC Commentary GCC Top Gainers## Exchange Close# Saudi Arabia: The TASI index fell 0.8% to close at 9,020.0. The Real Estate Dev. Index declined 1.4%, while Building & Construction index was down 1.3%. Saudi Airlines Catering fell 3.9%, while Taiba Holding was down 3.8%. Knowledge Eco. City 1D% Saudi Arabia 20.10 8.6 15,224.3 13.6 Qatar Gen. Ins.&Reins. Qatar 49.50 5.3 0.5 3.3 Dubai: The DFM index declined 1.9% to close at 4,105.9. The Investment & Financial Services index fell 3.8%, while Services index was down 3.1%. International Fin. Advisers Co. declined 5.9%, while Dubai Inv. Co. fell 4.8%. Qatar Navigation Qatar 93.70 2.4 83.4 12.9 BBK Bahrain 0.46 1.8 12.2 7.5 Abu Dhabi: The ADX benchmark index fell 1.7% to close at 4,857.8. The Real Estate index declined 3.4%, while the Inv. & Fin. Serv. index was down 3.2%. United Arab Bank fell 9.6%, while Nat. Marine Dredging Co. was down 7.6%. Comm. Bank of Dubai Dubai 6.90 1.5 10.0 45.6 GCC Top Losers Exchange Kuwait: The KSE index declined 1.9% to close at 7,493.7. The Technology index fell 3.5%, while the Real Estate index was down 3.0%. Flex Resorts & Real Estate Co. fell 17.7%, while Jeeran Holding Co. declined 9.1%. United Arab Bank Abu Dhabi 7.85 (9.6) 0.2 21.7 Nat. Marine Dredging Abu Dhabi 8.32 (7.6) 18.0 (3.3) Oman: The MSM index fell 0.3% to close at 7,097.2. Losses were led by the Financial and Services Indices falling 0.8% and 0.2% respectively. Oman & Emirates Inv. Holding declined 7.0%, while Dhofar Insurance was down 5.5%. Dubai Investments Dubai 3.36 (4.8) 22,533.4 34.9 Deyaar Development Dubai 1.25 (4.6) 52,860.3 23.8 Nat. Bank of Abu Dhabi Abu Dhabi 14.80 (4.2) 612.4 6.5 Bahrain: The BHB index declined 0.4% to close at 1,364.9. The Services index fell 0.9%, while the Investment index was down 0.7%. Khaleeji Commercial Bank declined 9.2%, while Al Salam Bank was down 2.1%. Qatar Exchange Top Gainers Qatar General Ins. & Reins. Co. ## # Close Vol. ‘000 1D% Vol. ‘000 YTD% YTD% Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) Close* 1D% Vol. ‘000 YTD% Close* 1D% Vol. ‘000 YTD% 49.50 5.3 0.5 3.3 Mesaieed Petrochemical Holding 44.55 (10.0) 6,119.5 344.5 16.7 Qatar German Co. for Med. Dev. 13.13 (5.5) 0.0 (5.2) 429.6 Qatar Exchange Top Losers Al Khaleej Takaful Group 42.60 4.0 Qatar Cinema & Film Distribution 42.50 3.7 1.8 6.0 Salam International Investment Co 12.48 (3.6) 438.3 (4.1) Qatar Navigation 93.70 2.4 83.4 12.9 Ezdan Holding Group 16.21 (3.4) 12.5 (4.6) Qatar Islamic Insurance 68.80 2.4 140.2 18.8 Gulf Warehousing Co. 41.70 (3.0) 6.3 0.5 Close* 1D% Val. ‘000 YTD% 44.55 (10.0) 275,316.0 344.5 Industries Qatar 192.60 (1.7) 85,199.4 14.0 5.4 QNB Group 191.80 (1.6) 54,303.1 11.5 775.6 6.6 Barwa Real Estate Co. 31.40 (2.8) 33,389.8 5.4 638.4 13.6 334.00 (0.9) 31,576.7 17.6 Qatar Exchange Top Vol. Trad. Close* 1D% Vol. ‘000 YTD% Mesaieed Petrochemical Holding 44.55 (10.0) 6,119.5 344.5 United Development Co. 21.35 (0.2) 1,295.1 (5.6) Barwa Real Estate Co. 31.40 (2.8) 1,046.8 Qatar Gas Transport Co. 21.58 (0.8) Vodafone Qatar 12.17 0.4 Qatar* Dubai Abu Dhabi Saudi Arabia Kuwait Oman Bahrain Mesaieed Petrochemical Holding Qatar Fuel Co. Source: Bloomberg (* in QR) Source: Bloomberg (* in QR) Regional Indices Qatar Exchange Top Val. Trades Close 1D% WTD% MTD% YTD% 11,664.02 4,105.90 4,857.79 9,019.98 7,493.65 7,097.19 1,364.94 (0.9) (1.9) (1.7) (0.8) (1.9) (0.3) (0.4) (0.9) (2.7) (2.0) (1.0) (2.6) (0.2) (0.6) (0.9) (2.7) (2.0) (1.0) (2.6) (0.2) (0.6) 12.4 21.8 13.2 5.7 (0.7) 3.8 9.3 Exch. Val. Traded ($ mn) 202.93 340.80 139.38 2,530.80 91.55 28.54 0.78 Exchange Mkt. Cap. ($ mn) 183,874.2 83,976.5 135,513.0 492,794.3 110,595.0 25,494.6 51,637.5 P/E** P/B** 15.4 17.6 13.1 18.1 15.3 10.9 9.5 1.9 1.5 1.6 2.2 1.2 1.6 0.9 Dividend Yield 4.0 2.0 3.7 3.3 3.8 3.7 3.7 Source: Bloomberg, Qatar Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) Page 1 of 6

- 2. Qatar Market Commentary The QE index declined 0.9% to close at 11,664.0. The Real Estate and Industrials indices led the losses. The index fell on the back of selling pressure from Qatari shareholders despite buying support from non-Qatari shareholders. Overall Activity Sell %* Net (QR) Qatari 66.27% 72.77% (47,978,320.69) Non-Qatari Mesaieed Petrochemical Holding and Qatar German Co. for Med. Dev. were the top losers, falling 10.0% and 5.5% respectively. Among the top gainers, Qatar General Ins. & Reins. Co. rose 5.3%, while Al Khaleej Takaful Group rose 4.0%. Buy %* 33.72% 27.23% 47,978,320.69 Source: Qatar Exchange (* as a % of traded value) Volume of shares traded on Monday fell by 6.4% to 14.5mn from 15.5mn on Thursday. However, as compared to the 30-day moving average of 12.7mn, volume for the day was 14.2% higher. Mesaieed Petrochemical Holding Co. and United Development Co. were the most active stocks, contributing 42.3% and 9.0% to the total volume respectively. Earnings and Global Economic Data Earnings Releases Company Market Currency Revenue (mn) 4Q2013 % Change YoY Operating Profit (mn) 4Q2013 % Change YoY Net Profit (mn) 4Q2013 % Change YoY 10.1 818.2% 0.0 NA 3.0 NA KIPCO Asset Management Co. (Kamco)* Etihad Airways* Kuwait KD Abu Dhabi AED – – – – 62.0 47.6% Al Noor Hospitals* Abu Dhabi AED – – – – 61.7 2.0% Source: Company data, DFM, ADX, MSM (*FY 2013 results) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 03/03 US BEA Personal Income January 0.30% 0.20% 0.00% 03/03 US BEA Personal Spending January 0.40% 0.10% 0.10% 03/03 US BEA PCE Deflator MoM January 0.10% 0.10% 0.20% 03/03 US BEA PCE Deflator YoY January 1.20% 1.10% 1.10% 03/03 US Bloomberg Indices Markit US PMI Final February 57.1 56.7 – 03/03 US ISM ISM Manufacturing February 53.2 52.3 51.3 03/03 US ISM ISM Prices Paid February 60 57.5 60.5 03/03 US US Census Bureau Construction Spending MoM January 0.10% -0.50% 1.50% 03/03 US Bloomberg Total Vehicle Sales February 15.27M 15.40M 15.16M 03/03 EU Markit PMI Manufacturing February 53.2 53.0 53.0 03/03 France Markit PMI Manufacturing February 49.7 48.5 48.5 03/03 Germany Markit PMI Manufacturing February 54.8 54.7 54.7 03/03 UK Markit PMI Manufacturing February 56.9 56.8 56.6 03/03 UK Bank of England Mortgage Approvals January 76.9K 74.5K 72.8K 03/03 UK Bank of England Money Supply M4 MoM January 0.30% 1.40% -1.40% 03/03 UK Bank of England M4 Money Supply YoY January -0.30% 0.70% 0.10% 03/03 Italy Markit PMI Manufacturing February 52.3 52.9 53.1 03/03 Italy ISTAT GDP Annual YoY 5-July -1.90% -1.90% -2.40% 03/03 Italy ISTAT Deficit to GDP 5-July 3.00% 3.00% 3.00% 03/03 China CFLP Non-manufacturing PMI February 55 -- 53.4 03/03 China Markit HSBC/Markit Manufacturing PMI February 48.5 48.5 49.5 03/03 Japan Ministry of Finance Capital Spending YoY 4Q2013 4.00% 4.90% 1.50% 03/03 Japan Ministry of Finance Company Profits 4Q2013 0.27 – 0.24 03/03 Japan Ministry of Finance Company Sales 4Q2013 0.04 – 0.01 Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Page 2 of 6

- 3. News Qatar QCB caps bonuses for bank board members – The Qatar Central Bank (QCB) is capping bonuses for board members of commercial banks in the country. This is a part of the Emir's objective to undertake a number of steps to spread the country's wealth more widely among all Qataris. The maximum annual bonus for a bank chairman in Qatar has been set at QR2mn ($550,000), while the cap for a board member is QR1.5mn. Bonuses can only be granted if a bank makes a net profit and 5% of a bank's capital has to be distributed among investors. No bonuses can be distributed without the QCB's approval. (GulfTimes.com) QCB: FDs grow by 30%, demand deposits grow by 19% in 2013 – According to data from the Qatar Central Bank, fixed deposits (FDs) of individuals in Qatari banks registered a strong growth of 30% in 2013, while demand deposits registered a 19% growth. FDs grew to QR94.97bn at the end of 2013 from QR72.87bn at the end of 2012, whereas demand deposits rose to QR44bn from QR37bn. Total deposits of banks (excluding non-resident deposits), including all kinds of deposits from public sector institutions, private companies and individuals, grew by 23% to QR514.8bn in 2013 from QR417bn in 2012. (GulfBase.com) S&P: Qatar may not issue long-term debt in 2014 – Standard & Poor‟s (S&P) said that Qatar is not expected to issue any long-term debt in 2014 even as the Middle East & North Africa (MENA) region is slated to witness borrowings of around $56bn. In general, sovereign debt capital markets are relatively underdeveloped in the GCC and S&P said it does not expect Abu Dhabi, Kuwait, Qatar, or Saudi Arabia to issue long-term debt in 2014. S&P viewed that financing these states‟ large investment programs could result in weaker government balances, but as long as oil prices remain high, it expects them to continue to post fiscal surpluses. However, S&P expects that smaller GCC countries such as Oman and Bahrain to issue commercial debt in the market. (Gulf-Times.com) QTA, QDB offer joint tourism initiatives to woo investors – The Qatar Tourism Authority (QTA), in partnership with the Qatar Development Bank (QDB) announced various investment opportunities for private firms in the country‟s tourism sector. QDB will provide financing and non-financing support for investors in six new ventures. Investors have the opportunity to bid for them until May 2014. QDB will provide 70% of the total investment for each project, while private investors have to provide a minimum of 30%. A maximum loan amount of QR100mn is offered for a tenor of 15 years. QTA‟s Chairman Issa bin Mohamed al-Mohannadi said the partnership would help in promoting many SMEs in Qatar. (Gulf-Times.com) DHBK AGM approves cash dividend – Doha Bank's (DHBK) AGM has approved the distribution of cash dividends worth QR4.5 per share to shareholders. (QE) Doha Bank to acquire bank branches in India – Doha Bank‟s (DHBK) Group CEO R. Seetharaman said that the bank is exploring opportunities to buy branches of foreign and Indian banks operating in India. Shareholders of Doha Bank authorized its board of directors to acquire branches of foreign and Indian banks in India at the bank's ordinary general meeting. Seetharaman said instead of taking the organic route, the bank is planning to take the investment route to grow its operations in India. In the first phase of DHBK‟s expansion in India, the bank will aim at acquiring the branches of only foreign banks operating in India. In the second-phase, the bank will look at acquiring the branches of Indian banks. (Qatar Tribune) QA plans Boeing 787 service to South Africa from May 2014 – Qatar Airways (QA) is planning to increase its operations to South Africa by increasing weekly flight frequencies to Johannesburg and by deploying a new Boeing 787 Dreamliner aircraft from May 1, 2014. Three weekly flights will be added to the current daily schedule to Johannesburg, bringing the total frequency on the route to 10 services a week. This coincides with the start of additional services, where QA will also be introducing the Boeing 787 Dreamliner on all its flights to South Africa. (Gulf-Times.com) ERES opens board nomination – Ezdan Holding Group (ERES) announced that the nomination to elect one member for its board of directors is open until March 12, 2014. (QE) Alijarah to add 200 vehicles to Mowasalat fleet – Alijarah Holding (NLCS) has signed an agreement with Mowasalat Company to add 200 new vehicles to its existing taxi fleet in order to take it to 1,000 vehicles. (QE) QGRI closes candidacy for board membership – Qatar General Insurance & Reinsurance Company (QGRI) announced the closure of nomination for membership of its board of directors on March 2, 2014, which had begun on February 19, 2014. (QE) QIMD approves agenda, 20% bonus shares – The Qatar Industrial Manufacturing Company‟s (QIMD) AGM has approved the distribution of 20% free bonus shares for the year ended December 31, 2013. Meanwhile, the EGM has approved to increase the company‟s capital from QR396mn to QR475.2mn by distributing 20% free bonus shares (47,520,000) for nominal value, i.e. QR10 per share. (QE) International Reuters: US factory, spending data hint at improving economy – Factory activity in the US rebounded in February from an eight-month low, while consumer spending rose more than expected in January, suggesting the economy was regaining strength after abruptly slowing in recent months. These signs are also evident in a surprise gain in construction spending, which should bolster the Federal Reserve's resolve to keep scaling back its massive monetary stimulus. Reports from automakers also showed sales edged up from January's weather-depressed levels. The Institute for Supply Management said its index of national factory activity rose to 53.2 last month after slumping in January to 51.3, its weakest reading since May. (Reuters) IMF: 15-20% risk of extended Eurozone low inflation - The International Monetary Fund (IMF) Chief Christine Lagarde urged the Eurozone to fight persistently low inflation, warning that it presents a looming threat to the fragile economic recovery in the region. Lagarde stated that key risks still threaten the 18nation group even as it emerges from recession and inflation was running well below the European Central Bank's target rate of around 2% a year. The IMF boss said the Eurozone was hampered by unacceptably high unemployment rates, especially among the young, and by high levels of private and public debt. (ET) Wages fall in Japan weakening the battle against deflation – Japanese wage earners' total cash earnings fell in January for the first time in three months, in a sign the government may be struggling to convince companies to pay higher salaries. The 0.2% decline in total cash earnings in January followed a 0.5% annual rise in December and could temper some policymakers' optimism that Japan can convincingly escape deflation. The Bank of Japan considers wage growth crucial to meet its 2% Page 3 of 6

- 4. inflation target in roughly two years, which most economists believe is too ambitious. Prime Minister Shinzo Abe's government had publicly lobbied companies to raise wages and help boost domestic demand, but the decline in January shows firms are reluctant to heed the call. (Reuters) Obama’s 2015 budget seeks $60 billion tax credit expansion – The US President Barack Obama will strike a populist tone in his 2015 budget plan, proposing to pay for an expansion of a popular tax credit for the working poor by eliminating tax breaks claimed by wealthy Americans. The White House said the proposal to expand the popular US government poverty reduction program – the Earned Income Tax Credit – would cost $60bn, a modest amount in a budget in which the president has $1.014tn in spending to parcel out. Obama would pay for the tax credit expansion by closing tax loopholes used by wealthy investors or employees of professional service companies. The president's budget request is just two-tenths of a percent higher than his 2014 budget of $1.012tn, since both amounts were set in a congressional budget deal in January. (Reuters) Regional Qudurat Holding formed to invest in Saudi infrastructure – Abdulaziz Alsaghyir Holding Company and Abdul Mohsen Al Hokair Trading Group have entered into a partnership to form „Qudurat Development Holding Company‟ for investing in infrastructure projects and related services in Saudi Arabia. Hisham Alsaghyir has been named as the Chairman of the new company. Qudurat will primarily focus on airport management and operations, water, and renewable energy. The new holding company has earmarked SR5bn in the first three years of its operation to implement technical-related projects in the infrastructure sector. (GulfBase.com) Saudi CMA approves Othaim’s capital increase – The Saudi CMA‟s board has approved the Abdullah Al Othaim Markets Company‟s (Othaim) request to increase its capital from SR225mn to SR450mn by issuing one bonus share for each existing share. This increase will be paid by transferring a total of SR225mn from the statutory reserve account, the voluntary reserve account and the retained earnings account to the company's capital. Consequently, the company's outstanding shares will increase from 22.5mn to 45mn shares. The bonus shares eligibility is limited to those shareholders who are registered at the close of trading on the day of the extraordinary general assembly, which will be determined later. (Tadawul) Saudi CMA approves Al Khaleej Training’s capital rise – The Saudi CMA‟s board has approved the Al Khaleej Training & Education Company‟s request to increase its capital from SR300mn to SR350mn by issuing one bonus share for every six existing shares. This increase will be paid by transferring SR50mn from the retained earnings account to the company's capital. Consequently, the company's outstanding shares will increase from 30mn to 35mn shares. Eligibility of these bonus shares is limited to those shareholders who are registered at the close of trading on the day of the extraordinary general assembly, which will be determined later. (Tadawul) Al-Futtaim to take control of Kenyan motor firm – Al-Futtaim Group stated that it is about to take control of the Kenyan car retailer, CMC Holdings after 91% of CMC‟s shareholders accepted its $87.91mn offer. This means Al-Futtaim will hold 533mn shares in CMC, which distributes Ford, Suzuki, Volkswagen and other leading vehicle brands in the region. (GulfBase.com) Dubai plans floating Emirates IPO to raise capital – According to sources, Dubai authorities are said to be considering an IPO for Emirates Airline as part of its ambitious capital-raising plans. Investment Corporation of Dubai CEO Mohammed Al Shaibani said that the state-controlled companies in the Emirate could potentially float the IPO on the London Stock Exchange. He further added that several entities in Dubai can also go public, which can aid in raising capital if needed. Al Shaibani stated that Emirates, along with Dubai Airports, budget carrier flyDubai and aluminum smelter EMAL were among those entities that could be sold at some point to raise funds. (GulfBase.com) DIB declares 25% cash dividend – Dubai Islamic Bank‟s (DIB) AGM has approved the distribution of a 25% cash dividend for the year 2013. (GulfBase.com) Majid Al Futtaim plans mall with Dubai Holding – Dubaibased Majid Al Futtaim Properties (MAF) is planning to invest AED275mn over the next two years to build a mall as part of a project operated by Dubai Holding, the investment vehicle of the Emirate's ruler. MAF had bought 1mn square feet of land in Dubai's International Media Production Zone, which is run by TECOM Investments, a unit of Dubai Holding. MAF‟s Chief Executive, George Kostas, said that the investment will cover the cost of buying the land and building the first phase of the mall. The project will be completed in two or three phases and is expected to be fully ready in the next 5-10 years. (Reuters) Lamprell sells INSPEC division to Intertek for $66.2mn – Dubai-based Lamprell has sold its International Inspection Services (INSPEC) division to Intertek for $66.2mn cash to reduce its debt and focus on its core business. INSPEC carries out inspections for infrastructure-intensive industries including desalination and energy projects. Lamprell will use part of the proceeds to pay a substantial part of a secured debt facility put in place in 2013. (Reuters) ARMX’s BoD recommends 11.5% cash dividend – The board of directors of Aramex (ARMX) has recommended the distribution of 11.5% cash dividend to its shareholders for the year ended December 31, 2013. (DFM) Orient declares AED81mn cash dividend, to raise capital by AED95mn – The Orient Insurance Company‟s (Orient) AGM has approved its board recommendation to allocate 20% of share capital to distribute cash dividends worth AED81mn to the shareholders. Meanwhile, the EGM has approved the board recommendation to increase the company‟s capital from AED405mn to AED500mn by integrating part of the general reserve into the capital. (DFM) Etihad reviews business model for investment in Alitalia – Etihad Airways‟ CEO James Hogan said that the airline is currently in the final phase of due diligence on its possible investment in Italian carrier, Alitalia. Hogan assured that Etihad is currently reviewing the business model, and will only commit to Alitalia if the Italian carrier can become profitable. He added that such partnerships are part of Etihad's long-term strategy to build a global network. (Bloomberg) Rosette, GoExport sign partnership deal – Kuwait-based Rosette Group and Swiss export & import company, GoExport, have signed a partnership agreement. This enables the two companies to exchange international experience to achieve high level of fast moving consumer goods (FMCG) business services in the region. (GulfBase.com) TAQA group to buy two Indian power plants – A consortium led by Abu Dhabi National Energy Company (TAQA) has agreed to acquire two hydroelectric plants in India, making TAQA the largest private operator of such power plants in India. The consortium agreed to purchase the Baspa Stage II and Karcham Page 4 of 6

- 5. Wangtoo plants in the northern state of Himachal Pradesh, from Jaiprakash Power Ventures, a subsidiary of Jaypee Group. Under the proposed deal, Taqa will hold a 51% stake in the consortium worth $616mn and will have control of operations & management of both the facilities. The remaining equity will be held by Canadian institutional investors (39%) and IDFC Alternatives‟ India Infrastructure Fund II (10%). The consortium will also acquire the assets‟ non-recourse project debt. (GulfBase.com) Al Hilal signs OMR20mn finance deal with Muttawar Omani – Al Hilal Islamic Banking Services has signed an agreement with Muttawar Omani Company to provide project finance wroth around OMR20mn for the construction of the Lamar Bausher project. Lamar Bausher is a high-end mixed-use project with 357 residential units and self-sustaining commercial units spread over a total area of 80,350 square meters. (GulfBase.com) GICI’s BoD recommends 10.5% cash dividend – Gulf International Chemicals‟ (GICI) board of directors has recommended the distribution of 10.5% cash dividends (10.5 baizas per share) to all its shareholders for the year ended December 31, 2013. (MSM) Bank Muscat plans $1.3bn Islamic Bond Program – Bank Muscat plans to establish a $1.3bn Islamic bond program in 2014, and expects to conduct the first sukuk issue by an Omani bank in September 2014. The bank will seek its shareholder approval for the sukuk program at a meeting on March 19 and the regulatory approval thereafter. Sukuk tranches will be of varying maturities and currencies; which will be issued in international markets through both public subscriptions and private placements. (Gulf Business) GFH signs agreements with Wadhwa, Adani – Bahrain-based Gulf Finance House (GFH) has signed two development agreements for real estate development in India. The flagship investment of GFH in India is the Energy City and Mumbai IT & Telecom City (India Project) developments in New Mumbai, which is spread over an area of 1,200 acres. The first agreement has been signed with Wadhwa Group, where GFH and Wadhwa have appointed Hafeez Contractor as the master planner for the Phase 1 of the India Project, with an expected value of $4bn. The second agreement has been signed with Adani Infrastructure & Developers, for exploring development opportunities in various infrastructure and real estate projects in India. Adani will be partnering with Asiastar City Holdings to develop the Phase 2 of GFH's India Project. (Bahrain Bourse) Ithmaar posts $79.3m loss after provisions – Bahrain-based Ithmaar Bank has reported a net loss of BHD29.9mn for 2013 as against a net loss of BHD10.1mn the year before. The results include a loss of BHD25.4mn for the quarter ended December 31, 2013, as against a loss of BHD4.2mn for the same period of the previous year. Ithmaar Bank's Chairman Prince Amr Al Faisal said the positive story for last year is that total income mainly comprises increased recurring income, whereas income in 2012 included certain one-off items. The impairment provisions for last year worth BHD30.9mn, represent a 51.9% increase compared with BHD20.4mn for 2012. (Bloomberg) GIH appoints Orhan Osmansoy as unit CEO – Global Investment House (GIH) has appointed Orhan Osmansoy as the Chief Executive Officer to head the Special Situations Asset Management unit of the company. (Bahrain Bourse) Page 5 of 6

- 6. Rebased Performance Daily Index Performance 170.0 160.0 150.0 140.0 130.0 120.0 110.0 100.0 90.0 80.0 0.0% (0.4%) 139.7 127.2 (1.2%) (0.4%) (0.3%) (0.8%) (0.8%) (0.9%) (1.6%) QE Index May-13 S&P Pan Arab Dec-13 S&P GCC Source: Bloomberg Asset/Currency Performance Gold/Ounce Silver/Ounce Crude Oil (Brent)/Barrel (FM Future) Natural Gas (Henry Hub)/MMBtu North American Spot LPG Propane Price North American Spot LPG Normal Butane Price Euro Source: Bloomberg Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D% WTD% YTD% 1,350.58 1.8 1.8 12.0 DJ Industrial 16,168.03 (0.9) (0.9) (2.5) 21.43 0.9 0.9 10.1 S&P 500 1,845.73 (0.7) (0.7) (0.1) 111.20 2.0 2.0 0.4 NASDAQ 100 4,277.30 (0.7) (0.7) 2.4 6.86 46.0 46.0 57.9 330.36 (2.3) (2.3) 0.6 111.50 (0.4) (0.4) (11.9) DAX 9,358.89 (3.4) (3.4) (2.0) 122.50 0.4 0.4 (9.8) FTSE 100 6,708.35 (1.5) (1.5) (0.6) STOXX 600 1.37 (0.5) (0.5) (0.1) CAC 40 101.45 (0.3) (0.3) (3.7) Nikkei GBP 1.67 (0.5) (0.5) 0.7 MSCI EM CHF 1.13 (0.3) (0.3) 1.1 SHANGHAI SE Composite AUD 0.89 0.2 0.2 0.2 USD Index 80.08 0.5 0.5 0.1 RUB 36.58 2.0 2.0 11.3 BRL* 0.43 0.0 0.0 0.9 Yen (1.9%) Dubai Oct-12 Oman Mar-12 Bahrain Aug-11 Kuwait Jan-11 (1.7%) (1.9%) Qatar (2.4%) Abu Dhabi (2.0%) Saudi Arabia Jun-10 160.3 Source: Bloomberg (*Market closed on March 03, 2014) 4,290.87 (2.7) (2.7) (0.1) 14,652.23 (1.3) (1.3) (10.1) 950.68 (1.6) (1.6) (5.2) 2,075.24 0.9 0.9 (1.9) HANG SENG 22,500.67 (1.5) (1.5) (3.5) BSE SENSEX 20,946.65 (0.8) (0.8) (1.1) Bovespa* 47,094.40 0.0 0.0 (8.6) 1,115.06 (12.0) (12.0) (22.7) RTS Source: Bloomberg (*Market closed on March 03, 2014) Contacts Saugata Sarkar Ahmed M. Shehada Keith Whitney Sahbi Kasraoui Head of Research Head of Trading Head of Sales Manager - HNWI Tel: (+974) 4476 6534 Tel: (+974) 4476 6535 Tel: (+974) 4476 6533 Tel: (+974) 4476 6544 saugata.sarkar@qnbfs.com.qa ahmed.shehada@qnbfs.com.qa keith.whitney@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa QNB Financial Services SPC Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar DISCLAIMER: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange; QNB is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. While this publication has been prepared with the utmost degree of care by our analysts, QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6