QE Index Declines 0.1% Led by Telecoms and Banking Stocks

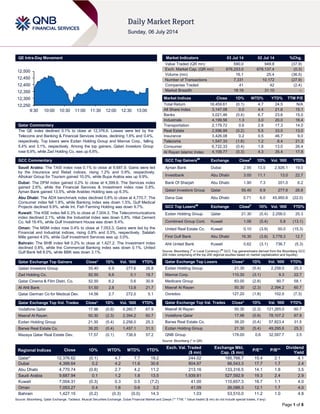

- 1. Page 1 of 8 QE Intra-Day Movement Qatar Commentary The QE index declined 0.1% to close at 12,376.6. Losses were led by the Telecoms and Banking & Financial Services indices, declining 1.6% and 0.4%, respectively. Top losers were Ezdan Holding Group and Mannai Corp., falling 5.4% and 3.1%, respectively. Among the top gainers, Qatari Investors Group rose 6.9%, while Zad Holding Co. was up 6.6%. GCC Commentary Saudi Arabia: The TASI index rose 0.1% to close at 9,687.9. Gains were led by the Insurance and Retail indices, rising 1.2% and 0.9%, respectively. Alhokair Group for Tourism gained 10.0%, while Bupa Arabia was up 9.9%. Dubai: The DFM index gained 0.2% to close at 4,399.6. The Services index gained 2.6%, while the Financial Services & Investment index rose 0.8%. Ajman Bank gained 13.5%, while Arabtec Holding was up 6.3%. Abu Dhabi: The ADX benchmark index declined 0.8% to close at 4,770.7. The Consumer index fell 1.8%, while Banking index was down 1.5%. Gulf Medical Projects declined 9.9%, while Int. Fish Farming Holding was down 9.7%. Kuwait: The KSE index fell 0.3% to close at 7,004.3. The Telecommunications index declined 2.1%, while the Industrial index was down 0.8%. Hilal Cement Co. fell 19.4%, while Gulf Investment House was down 9.4%. Oman: The MSM index rose 0.4% to close at 7,053.3. Gains were led by the Financial and Industrial indices, rising 0.8% and 0.5%, respectively. Salalah Mills gained 4.5%, while Gulf Investment Services was up 3.0%. Bahrain: The BHB index fell 0.2% to close at 1,427.2. The Investment index declined 0.8%, while the Commercial Banking index was down 0.1%. United Gulf Bank fell 8.0%, while BBK was down 3.1%. Qatar Exchange Top Gainers Close* 1D% Vol. ‘000 YTD% Qatari Investors Group 55.40 6.9 277.6 26.8 Zad Holding Co. 82.50 6.6 0.1 18.7 Qatar Cinema & Film Distri. Co. 52.50 6.2 0.6 30.9 Al Ahli Bank 51.50 2.8 13.8 21.7 Qatar German Co for Medical Dev. 14.56 2.7 272.0 5.1 Qatar Exchange Top Vol. Trades Close* 1D% Vol. ‘000 YTD% Vodafone Qatar 17.98 (0.9) 4,260.7 67.9 Masraf Al Rayan 50.30 (2.3) 2,394.2 60.7 Ezdan Holding Group 21.30 (5.4) 2,258.0 25.3 Barwa Real Estate Co. 39.20 (0.4) 1,457.1 31.5 Mazaya Qatar Real Estate Dev. 17.57 (0.1) 738.9 57.2 Market Indicators 03 Jul 14 02 Jul 14 %Chg. Value Traded (QR mn) 590.0 949.8 (37.9) Exch. Market Cap. (QR mn) 676,253.0 678,137.4 (0.3) Volume (mn) 16.1 25.4 (36.5) Number of Transactions 7,331 10,172 (27.9) Companies Traded 41 42 (2.4) Market Breadth 18:19 31:10 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 18,459.61 (0.1) 4.7 24.5 N/A All Share Index 3,147.08 0.0 4.4 21.6 15.1 Banks 3,021.46 (0.4) 6.7 23.6 15.0 Industrials 4,199.56 1.3 3.0 20.0 16.4 Transportation 2,179.72 0.6 2.8 17.3 14.0 Real Estate 2,596.99 (0.2) 5.5 33.0 13.0 Insurance 3,426.08 0.2 0.5 46.7 9.0 Telecoms 1,547.33 (1.6) 1.2 6.4 21.3 Consumer 6,722.33 (0.4) 1.8 13.0 26.4 Al Rayan Islamic Index 4,109.77 (0.3) 4.3 35.4 17.8 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Ajman Bank Dubai 2.95 13.5 2,926.1 19.0 Investbank Abu Dhabi 3.00 11.1 13.0 22.7 Bank Of Sharjah Abu Dhabi 1.90 7.3 201.0 6.2 Qatari Investors Group Qatar 55.40 6.9 277.6 26.8 Dana Gas Abu Dhabi 0.71 6.0 45,950.6 (22.0) GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Ezdan Holding Group Qatar 21.30 (5.4) 2,258.0 25.3 Combined Group Cont. Kuwait 1.06 (5.4) 5.8 (13.1) United Real Estate Co. Kuwait 0.10 (3.9) 50.0 (15.3) First Gulf Bank Abu Dhabi 16.30 (3.8) 3,778.3 12.7 Ahli United Bank Kuwait 0.62 (3.1) 736.7 (5.3) Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) Qatar Exchange Top Losers Close* 1D% Vol. ‘000 YTD% Ezdan Holding Group 21.30 (5.4) 2,258.0 25.3 Mannai Corp. 110.30 (3.1) 9.3 22.7 Medicare Group 83.00 (2.8) 90.7 58.1 Masraf Al Rayan 50.30 (2.3) 2,394.2 60.7 Ooredoo 127.20 (1.8) 102.0 (7.3) Qatar Exchange Top Val. Trades Close* 1D% Val. ‘000 YTD% Masraf Al Rayan 50.30 (2.3) 121,265.0 60.7 Vodafone Qatar 17.98 (0.9) 78,107.2 67.9 Barwa Real Estate Co. 39.20 (0.4) 57,823.4 31.5 Ezdan Holding Group 21.30 (5.4) 49,295.6 25.3 QNB Group 178.00 0.6 32,597.7 3.5 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 12,376.62 (0.1) 4.7 7.7 19.2 244.02 185,766.7 15.4 2.1 4.1 Dubai 4,399.64 0.2 4.2 11.6 30.6 804.97 86,543.3 17.7 1.7 2.4 Abu Dhabi 4,770.74 (0.8) 2.7 4.2 11.2 213.16 133,316.5 14.1 1.8 3.5 Saudi Arabia 9,687.94 0.1 1.2 1.8 13.5 1,939.81 527,592.9 19.3 2.4 2.9 Kuwait 7,004.31 (0.3) 0.3 0.5 (7.2) 41.00 110,657.3 16.7 1.1 4.0 Oman 7,053.27 0.4 1.6 0.6 3.2 41.09 26,086.3 12.1 1.7 4.0 Bahrain 1,427.15 (0.2) (0.3) (0.0) 14.3 1.03 53,510.0 11.2 1.0 4.8 Source: Bloomberg, Qatar Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 12,250 12,300 12,350 12,400 12,450 12,500 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 8 Qatar Market Commentary The QE index declined 0.1% to close at 12,376.6. The Telecoms and Banking & Financial Ser. indices led the losses. The index fell on the back of selling pressure from Qatari shareholders despite buying support from non-Qatari shareholders. Ezdan Holding Group and Mannai Corp. were the top losers, falling 5.4% and 3.1%, respectively. Among the top gainers, Qatari Investors Group rose 6.9%, while Zad Holding Co. was up 6.6%. Volume of shares traded on Thursday fell by 36.5% to 16.1mn from 25.4mn on Wednesday. Further, as compared to the 30-day moving average of 21.9mn, volume for the day was 26.3% lower. Vodafone Qatar and Masraf Al Rayan were the most active stocks, contributing 26.4% and 14.8% to the total volume respectively. Source: Qatar Exchange (* as a % of traded value) Ratings, Earnings and Global Economic Data Ratings Updates Company Agency Market Type* Old Rating New Rating Rating Change Outlook Outlook Change Qatar Insurance Company (QATI) S&P Qatar CCR/FSR A/A A/A – Stable – Source: News reports (* LT – Long Term, ST – Short Term, FSR– Financial Strength Rating, FCR – Foreign Credit Rating, LCR – Local Currency Rating, IDR – Issuer Default Rating, SR – Support Rating, LC – Local Currency, CCR– Counterparty Credit Rating) Earnings Releases Company Market Currency Revenue (mn)1Q2014 % Change YoY Operating Profit (mn) 2Q2014 % Change YoY Net Profit (mn) 2Q2014 % Change YoY Advanced Petrochemical Company (APC) Saudi SR – – 183.0 30.6% 185.0 35.4% Source: Company data, DFM, ADX, MSM Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 07/03 US US Census Bureau Trade Balance May -$44.4B -$45.0B -$47.0B 07/03 US BLS Unemployment Rate June 6.10% 6.30% 6.30% 07/03 US Bloomberg Bloomberg Consumer Comfort 29 June 36.4 – 37.1 07/03 US Markit Markit US Services PMI June 61.0 61.0 61.0 07/03 US Markit Markit US Composite PMI June 61.0 – 61.0 07/03 US ISM ISM Non-Manf. Composite June 56.0 56.3 56.3 07/03 EC Markit Markit Eurozone Services PMI June 52.8 52.8 52.8 07/03 EC Markit Markit Eurozone Composite PMI June 52.8 52.8 52.8 07/03 EC European Central Bank ECB Main Refinancing Rate 3 July 0.15% 0.15% 0.15% 07/03 EC European Central Bank ECB Marginal Lending Facility 3 July 0.40% 0.40% 0.40% 07/03 EC European Central Bank ECB Deposit Facility Rate 3 July -0.10% -0.10% -0.10% 07/04 EC Markit Markit Eurozone Retail PMI June 50.0 – 49.9 07/03 FR Markit Markit France Composite PMI June 48.1 48.0 48.1 07/03 FR Markit Markit France Services PMI June 48.2 48.2 48.2 07/04 FR Markit Markit France Retail PMI June 47.6 – 50.5 07/03 GE Markit Markit Germany Services PMI June 54.6 54.8 54.6 07/03 GE Markit Markit/BME Germany Composite PMI June 54.0 54.2 54.0 07/04 GE Markit Markit Germany Construction PMI June 45.5 – 48.1 07/04 GE Markit Markit Germany Retail PMI June 56.2 – 52.5 07/03 UK Markit Markit/CIPS UK Composite PMI June 58.0 58.6 59.0 07/03 UK Markit Markit/CIPS UK Services PMI June 57.7 58.3 58.6 07/03 IT Markit Markit/ADACI Italy Composite PMI June 54.2 – 52.7 07/03 IT Markit Markit/ADACI Italy Services PMI June 53.9 52.0 51.6 07/04 IT Markit Markit Italy Retail PMI June 43.8 – 45.2 07/03 CH CFLP Non-manufacturing PMI June 55.0 – 55.5 07/03 CH Markit HSBC China Services PMI June 53.1 – 50.7 07/03 CH Markit HSBC China Composite PMI June 52.4 – 50.2 07/03 JN Markit Markit Japan Services PMI June 49.0 – 49.3 Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Overall Activity Buy %* Sell %* Net (QR) Qatari 64.15% 66.44% (13,494,992.09) Non-Qatari 35.84% 33.56% 13,494,992.09

- 3. Page 3 of 8 News Qatar QNBK: Qatar’s growth momentum picks up further – According to a report by QNB Group (QNBK), Qatar’s economy accelerated in the first quarter of 2014, driven by strong growth in construction, financial services and trade, restaurants and hotels, according to figures released last week by the Ministry of Development Planning and Statistics (MDPS). Qatar real GDP growth accelerated to 6.2% in the year to Q1 2014 with the non- hydrocarbon sector expanding by 11.5% owing to rapid progress with the implementation of major projects. The pickup in growth came despite a 1.2% contraction in hydrocarbon real GDP as a result of falling crude oil production and flat production at LNG facilities. QNB Group expects real GDP growth to continue to pick up during 2014 as hydrocarbon production stabilizes and non-hydrocarbon growth remains high. Overall, the new GDP data are in line with our expectations for real GDP growth of around 6.8% in 2014. In 2015-16, we expect momentum to continue to gather steam owing to the ongoing implementation of major projects, with growth rising to an average of 7.7%. Strong growth in the non-hydrocarbon sector has been driven by a pickup in major infrastructure investment projects since the middle of 2013. This has led to rapid growth in construction, which expanded by 19.6% in real terms in the year to Q1 2014 and contributed 2.3% to overall growth. Rising project activity has also led to a rapid increase in the number of workers being employed in Qatar, pushing up population growth to 11.6% in the year to end-March 2014. In turn, this has helped boost growth in services sectors. Services contributed 4.2% to total real growth, with sectors such as financial services and trade, restaurants and hotels fairing particularly well. (Gulf-Times.com) Qatari hospitality sector sees bullish trend – The year 2014 has started on a positive note for Qatar’s hospitality sector. Hotels have seen a strong inflow of tourists during 1H2014, taking the occupancy level to up to 85%. 1H2014 has been very good for the sector as the occupancy rate was 70%. (Peninsula Qatar) GISS completes purchase of JDC’s 30% shareholding in GDI – Gulf International Services (GISS) announced that the purchase price payable to Japan Drilling CO., LTD. (JDC) for the acquisition of JDC’s 30% stake in Gulf Drilling International (GDI) has been confirmed by GDI’s external auditors to be $157.7mn. This purchase price is equivalent to 30% of GDI’s net book value as of April 30, 2014, being the total consideration owed JDC for its interest pursuant to the Joint Venture Agreement between the parties. In accordance with the Sale and Purchase Agreement, GIS made a down payment of $153.6 million to JDC in April for its 30% interest, leaving a balance owing of $4.1 million, which was paid to JDC on June 19th, 2014. The transaction is being financed via an eight year bilateral loan agreement that has been secured through local banks on highly competitive terms. (QE) S&P affirms ‘A’ rating for QATI with stable outlook – Rating agency Standard & Poor’s (S&P) has affirmed its ‘A’ counterparty credit and financial strength ratings for Qatar Insurance Company (QATI) and its guaranteed subsidiaries with a “stable” outlook. S&P said that QATI’s strong business risk profile reflects its strong competitive position, achieved through its dominant domestic and regional GCC operations, even as the full integration of its overseas operations poses operational and management challenges. S&P observed QATI’s financial profile to be very strong, reflecting its very strong capital and earnings, intermediate risk position, and adequate financial flexibility. Over the next two years, S&P expects QIC Group premium to develop from being predominantly sourced from the GCC region to 50% non-GCC business; and forecast its premium growth at about 70% in 2014, easing back to 20% and below in 2015 and 2016. S&P said QATI’s still rapidly developing business model and franchises in the global reinsurance as well as London insurance markets present some uncertainty. Highlighting that QATI’s retained earnings will support capital, S&P said that it expects QATI to show combined ratios lower than 95% during 2014-2016. The rating agency forecast QATI’s net earnings to be above QR660mn, representing a return on equity of more than 10% and a return on revenues of 15%. (Gulf-Times.com) N-KOM, HeLenGi Engineering to cooperate on LNG ferry ship retrofits – Nakilat-Keppel Offshore & Marine (N-KOM) has entered into a new agreement with Greece-based HeLenGi Engineering for the retrofit of Greek ferries as part of the Poseidon-Med project. Poseidon-Med is the first LNG bunkering project in the Mediterranean and Adriatic Sea led and coordinated by QEnergy Europe, which aims to promote LNG as a widely adopted fuel for shipping operations. (Bloomberg) Barwa Bank opens Representative Office in DIFC – Barwa Bank has announced the opening of its representative office in Dubai International Financial Centre (DIFC). This is the first time Barwa Bank has opened an office overseas, which is testament to its commitment for developing the Shari’ah-compliant financial market outside Qatar. (Bloomberg) DBIS to disclose results on July 16 – Dlala Brokerage & Investments Holding Company (DBIS) will disclose its financial reports on July 16, 2014 for the period ending June 30, 2014. (QE) QGRI’s BoD to meet on July 17 – Qatar General Insurance & Reinsurance Company (QGRI) announced that its board of directors (BoD) will meet on July 17, 2014 to discuss the company’s financial reports for the period ending June 30, 2014. (QE) QOIS to publish results on July 20 – Qatar Oman Investment Company (QOIS) will disclose its financial reports for the period ending June 30, 2014, on July 20, 2014. (QE) GWCS to announce results on July 20 – Gulf Warehousing Company (GWCS) will announce its financial reports for the period ending June 30, 2014, on July 20, 2014. (QE) QIIK to release results on July 21 – Qatar International Islamic Bank (QIIK) will publish its financial reports for the period ending June 30, 2014, on July 21, 2014. (QE) QFLS to disclose results on July 22 – Woqod (QFLS) will disclose its financial reports for the period ending June 30, 2014, on July 22, 2014. (QE) CBQK to publish results on July 23 – The Commercial Bank of Qatar (CBQK) will publish its financial reports for the period ending June 30, 2014, on July 23, 2014. (QE) SIIS to announce results on July 24 – Salam International Investment Company (SIIS) will announce its financial reports for the period ending June 30, 2014, on July 24, 2014. (QE) International US job growth surges, unemployment rate near six-year low – Employment growth in the US jumped in June 2014 and the jobless rate closed in on a six-year low, providing decisive evidence that the economy was growing briskly in the second half of the year. The Labor Department said non-farm payrolls increased by 288,000 jobs last month, while the unemployment rate fell to 6.1% from 6.3% in May. Data for April and May were

- 4. Page 4 of 8 revised to show a total of 29,000 more new jobs than previously reported. In addition, the ranks of the long-term unemployed shrank and the share of employed Americans reached its highest level since August 2009. Job gains were widespread across sectors and there were few signs of inflationary wage pressures. Employment has now grown by more than 200,000 jobs in each of the last five months, a stretch not seen since the technology boom in the 1990s. This indicated that the signs of a plunge in economic output in the first quarter were a weather- driven anomaly. (Reuters) ECB says measures will push inflation up, but money- printing still possible – The European Central Bank (ECB) President Mario Draghi said a raft of policy measures introduced last month will help lift inflation and support bank lending, but the ECB stands ready to create money in future if required. The ECB left interest rates steady a month after cutting them to record lows and pushing the deposit rate into negative territory for the first time – effectively charging banks for holding their money overnight to persuade them to lend to businesses. The measures unveiled in June also included extending the duration of unlimited cheap liquidity for banks until the end of 2016, and offering them a four-year loan plan. Detailing the loan plan, Draghi said banks must use the new funds to lend or else they will be made to pay back the money. He said last month's measures had further loosened the Eurozone's monetary policy stance. (Reuters) German private sector PMI falls to 54.0 in June; manufacturing orders decline on geopolitical risks – A survey showed Germany's private sector expanded at the slowest rate in eight months in June, as manufacturing lost steam, although Europe's largest economy looked set to post solid growth in the second quarter. Markit's final composite Purchasing Managers' Index (PMI), which tracks growth in the manufacturing and services sectors, fell to 54.0 in June from 55.6 in May. That was the lowest level since October 2013, coming in below a flash estimate of 54.2. The services sector PMI fell to 54.6 in June from 56.0 a month earlier and also below the 54.8 flash estimate, but Markit said the sector had grown at the fastest rate in three years in the second quarter. Meanwhile, German factory orders fell more than expected in May as geopolitical risks weighed on confidence in Europe’s largest economy. The Economy Ministry said orders fell 1.7% from April, when they rose a revised 3.4%. A median of 30 estimates in a Bloomberg News survey of economists had forecast a decline of 1.1%. While recent surveys suggest that the pace of Germany’s economic expansion is cooling and tensions between Russia and Ukraine have increased uncertainty, the nation remains the driving force for the subdued recovery in the Eurozone. (Bloomberg, Reuters) S&P affirms BNP's long-term credit rating, outlook negative – Standard & Poor's affirmed its 'A+' long-term credit rating on BNP Paribas on Thursday after the French bank pleaded guilty to two criminal charges and agreed to pay around $9bn to resolve accusations of violating US sanctions. S&P said it revised its assessment of the bank's capital to "moderate" from "adequate" and placed the rating on a negative outlook from Credit Watch negative. S&P said the negative outlook reflects that the ratings may be lowered on BNP Paribas if the implications of the sanctions on the bank's risks and business profile are more detrimental than expected. Further, S&P has also lowered junior subordinated debt rating by one notch to 'BBB+'. (Reuters) China HSBC services PMI reaches 53.1 in June; Chinese premier expects economy to fare better in 2Q2014 – A private survey showed that China's service sector activity expanded at the fastest pace in 15 months in June, reinforcing signs that the broader economy is stabilizing. The services Purchasing Managers' Index (PMI) compiled by HSBC/Markit rebounded to 53.1 in June from 50.7 in May. In a sign that the domestic economy is regaining internal strength, a sub-index measuring new businesses also jumped to 53.8 in June, the strongest expansion since January 2013. Meanwhile, Chinese Premier Li Keqiang said the country’s economic performance has improved in the second quarter over the first quarter, though the downward pressure cannot be ignored. Li Keqiang also pledged to pay more attention to the implementation of targeted measures to improve the macroeconomic policy control to guarantee that the annual economic growth target can be achieved. He also reiterated that the government will step up efforts to build more infrastructure projects, including railway and energy, in poorer regions. (Reuters) Regional Saudi 1Q2014 economic growth slows to 4.7% YoY, labor reforms weigh – Saudi Arabia's economic growth eased to an annual rate of 4.7% in the 1Q2014 as labor market measures curbed activity in some sectors, but the expansion was still stronger and more widespread than growth a year ago. Economic growth in the world's top oil exporter reached 5.0% in October-December, the fastest pace since the 3Q2012. Jadwa Investment’s head of research in Riyadh Fahad al-Turki said it is certainly the change in the labor market affecting the annual growth. On a quarterly basis, inflation-adjusted gross domestic product growth accelerated to 3.4%, the fastest clip in a year, from 2.7% in the previous quarter, the Central Statistics Office data show. Economic growth is usually at its most robust early in the year, when the weather is at its most favorable and few public holidays halt work. (Reuters) Oxy fails to sell stake in Mideast business – US-based Occidental Petroleum Corporation (Oxy) has failed to sell a stake in its Middle East business and now plans to sell some assets piece by piece. Earlier in October 2013, Oxy had planned to sell a minority stake in its MENA operations as part of a restructuring program to lift its valuation. In December 2013, Mubadala Development Company, Qatar Petroleum and Oman Oil Company, were considering a joint bid for the unit, in a deal that could be worth between $8bn and $10bn. (Reuters) SABIC proposes SR2.5 DPS for 1H2014 – Saudi Basic Industries Corporation (SABIC) has proposed the distribution of SR2.5 per share cash dividend for 1H2014. The proposed figure is higher than SR2 per share paid earlier in 1H2013. (GulfBase.com) Bank Al Jazira wins Best Real Estate Financing award – Bank Al Jazira has won the Best Real Estate Financing award at the Banker Middle East Awards, organized by CPI Financial Group. This award highlights the bank’s track record in its continuous achievements in the banking sector. (GulfBase.com) SABB HSBC PMI: Saudi’s non-oil business activity accelerates in June – According to the headline SABB HSBC Saudi Arabia Purchasing Managers’ Index (PMI), growth in Saudi’s non-oil business activity rose to a five-month high in June 2014, bolstered by strong growth in output and new orders. This reflects the economic performance of Saudi Arabian non-oil producing private sector companies through monitoring a number of variables, including output, orders, prices, stocks and employment. June data signaled the continued expansion of the Saudi Arabian non-oil private sector, with the seasonally adjusted headline PMI recording 59.2, up from 57.0 in May. This highlights a strong improvement in operating conditions and the highest since January. The pace of output growth quickened to

- 5. Page 5 of 8 a 26-month high. New business from abroad also improved, albeit at a slower pace than total new orders. The net rise in employment was solid overall, with the latest increase the fastest in the current sequence of job creation. In spite of strong demand for inputs, average delivery times continued to improve. Better vendor performance was encouraged by a competitive market that required shorter delivery times. (GulfBase.com) SAIB reports SR352.9mn net profit in 2Q2014 – The Saudi Investment Bank (SAIB) has reported a net profit of SR352.9mn for 2Q2014 as compared to SR320.4mn for 2Q2013, reflecting 4.56% rise. The bank’s net profit for 1H2014 stood at SR690.4mn as compared to SR634.7mn for 1H2013, up by 8.78%. EPS as of June 30, 2014 amounted to SR1.15 as against SR1.06 a year earlier. Bank’s total assets at the end of June 2014 stood at SR88.06bn as against SR66.66bn a year ago. Loans and advances stood at SR54.8bn, while customer deposits stood at SR67.7bn. (Tadawul) Jarir Marketing signs partnership deal with Apple – Jarir Marketing Company has entered into an agreement with US- based Apple Inc. Under the agreement, Apple will supply directly its Apple products to Jarir Bookstore and subsequently provide the after-sale services. This transaction is the first of its kind by which Apple to deal directly with any of retail business in the Kingdom. (Tadawul) SFG proposes SR0.65 DPS for 1H2014 – Samba Financial Group (SFG) has proposed the distribution of SR0.65 per share cash dividend for 1H2014. The proposed figure is marginally higher than SR0.6 per share paid in 1H2013. (Reuters) Motiva Port Arthur refinery reaches throughput milestone – Motiva Port Arthur refinery, the Saudi Aramco and Royal Dutch Shell operated joint venture, has reached its throughput milestone of processing 615,000 barrels in one day for the first time since a series of setbacks that followed its $10bn expansion. The refinery when established was predicted slowly gain efficiencies and by now would be routinely running 630,000 to 660,000 bpd, instead it often runs below its stated capacity of 600,000 bpd at a time when refiners are processing rising volumes of crude in the US energy boom. (Reuters) IMF: UAE’s economic recovery is solid – The UAE has continued to benefit from its perceived safe-haven status amid regional instability. The International Monetary Fund (IMF) said that the economic recovery has been solid, supported by the tourism and hospitality sectors, and a rebounding real estate sector. While growth in oil production moderated, public projects in Abu Dhabi and buoyant growth in Dubai’s service sectors continued to underpin growth, which reached 5.2% in 2013. IMF said that the real estate sector has been recovering quickly in some segments, especially in the Dubai residential market. The Fund observed that the macroeconomic outlook is positive. Economic growth is expected at 4.8% in 2014 and about 4.5% in coming years, supported by a number of megaprojects announced over the past 18 months and the successful bid for the World Expo 2020. (Zawya) SAIF Zone to invest AED50mn to lure aviation companies – Sharjah Airport International Freezone (SAIF Zone) is investing AED50mn into a new logistics park that will house aviation sector companies. The freezone is looking to lure aviation freight, parts and maintenance services companies with a multi- million infrastructure development. Saud Salim Al Mazrouei, the newly appointed director of SAIF Zone, said the park will be open by the end of July 2014 when tenants are expected to start moving in. The logistics park will have an initial area of 100,000 square meters spread over SAIF Zone’s 13mn square meters. The companies will be expected to provide their services to airlines and other companies operating at Sharjah International. (GulfBase.com) NMC invests $30mn for multi-specialty hospital in Dubai – New Medical Centre (NMC) has invested $30mn for the first multi-specialty hospital in Dubai Investments Park (DIP) 1 which will provide round-the-clock medical services to the over 200,000 residents around the vicinity of DIP and beyond. The hospital is located at a prime area opposite the Green Community, and will further provide comprehensive healthcare to the respective communities. The state-of-the-art hospital has 60 ward beds and 100 functional beds in all and will be served by 35 doctors and 150 para-medical staff. Services available at the hospital include regular GP consultations, surgery, pediatrics, gynecology and obstetrics, dentistry, dermatology, gastroenterology, urology, ENT and ophthalmology. The new hospital will also provide 24-hour pharmacy, ambulance and emergency services, as well as an array of laboratory and radiology facilities. (GulfBase.com) GE Oil & Gas expands in UAE with new facility – GE Oil & Gas celebrated the ground-breaking of a new facility that will further expand its presence in the UAE in Jebel Ali Free Zone (Jafza). Scheduled to open in 2015, the new facility spreads over an area of 22,700 sq meters and can accommodate over 300 employees. The new facility will offer services by GE Oil & Gas’ various business units, thus strengthening customer service standards. Housed in a customized state-of-the-art facility developed by Jafza, the new GE Oil & Gas Manufacturing & Technology Center will offer tailored training programs, and also feature a dedicated repair center that will help improve the speed of service delivered by being closer to the customers. (GulfBase.com) Aseel launches Business Finance Solution for SMEs – Aseel Islamic Finance has launched its new Business Finance Solution for small and medium-sized enterprises (SMEs) to support the government and local business community’s efforts to promote SME development across the UAE. The new product will support small businesses in managing their cash flow efficiently and give them the freedom to take advantage of new opportunities as and when they arise. (GulfBase.com) UAE-Japan trade remains robust at $51.03bn in 2013 – According to the data released by the Japan External Trade Organization (JETRO), bilateral trade between Japan and the UAE has remained robust in 2013 at $51.03bn. The value of Japan’s imports from the UAE stood at $42.5bn in 2013, which was 3.3% lower than the value in 2012, its exports to the UAE stood at $8.5bn, 5.1% lower as compared to 2012. The overall trade value between the two countries down by 3.6% in 2013 compared to $52.9bn in the previous year due to the drop in the average price of crude oils; a sharp fall in the volume of import of light oils; and a decline in Japan’s export of machinery, iron and steel etc. In the overall trade, UAE was Japan’s eighth largest trading partner in the world in 2013. By meeting nearly 23% of the total crude oil requirements of Japan, UAE remained to be Japan’s second largest supplier of crude oils after Saudi Arabia, which covered 31.83% of Japan’s total crude oil imports. Japan’s major exports to the UAE were motor vehicles, general machinery, electrical machinery, iron and steel, rubber products, textiles, plastic products, beverages and glass products. However, sluggishness in the export of machinery and iron and steel products in 2013 reduced the value of Japan’s exports to the UAE by 5.14% to $8.5bn from $8.9bn in the previous year. Automobiles remained stable and registered an increase by 3.23% to $4.64bn, compared to $4.49bn in the previous year. The coverage of vehicle exports from Japan to the UAE rose to

- 6. Page 6 of 8 54.56% of the total exports in 2013, which was 50.16% in 2012 and 42.52% in 2011. (GulfBase.com) AFZ, Kaznex Invest sign deal – Ajman Free Zone (AFZ) and Kazakh National Investment & Exports (Kaznex Invest) have signed a MoU for cooperation. This MoU paves the way for two other similar important agreements with SaryArka special Economic Zone in Karaganda Province, and Port-Aktau, another special economic zone in Mangystau Province, Kazakhstan. The agreements will also see the parties exchange relevant information on the specialized economical zones (SEZs) including attracting investment, and investment projects (actual and planned). (GulfBase.com) BoA Merrill Lynch: UAE recovery fundamentally sound – According to Bank of America Merrill Lynch, the economic fundamentals of the UAE and Dubai are strong and the recent equity sell off is not linked to any potential vulnerability in the economy. The economic recovery is helped by high oil prices, support from the external sector, accommodative monetary policy, the rebound in the real estate sector, steady yet uneven progress on government related entities (GRE) restructuring and a mild fiscal consolidation drive. After averaging 10% annual growth from 2000-10 and a slump in 2009, real GDP growth was 4.6% in 2013. Dubai’s externally driven sectors (tourism, manufacturing) led the increase. With a fading drag from construction and real estate activity, growth is likely to accelerate toward 5% in 2014/15. (GulfBase.com) HSBC PMI: UAE non-oil activity growth back to record high – The HSBC UAE Purchasing Managers' Index (PMI) rose to 58.2 points in June 2014 from 57.3 in May. It was just below a peak of 58.3 points hit in April. Business activity growth in the UAE's non-oil private sector rebounded to near a record high in June, as output rose at the fastest pace in the history of the series. UAE firms saw output growth accelerate to a record 63.3 points in June from 61 in May. New orders growth picked up to 65.5 points from a nine-month low of 64.4, while growth in new export orders jumped to a record high of 63.2 points. Employment creation across the UAE's non-oil private sector eased marginally but remained in positive territory. Output prices dropped for the third month in a row, with the index up slightly at 49.3 points in June after 49 in May. But the rate of input price inflation quickened to 55.8 points. (GulfBase.com) DSI bags AED304mn power line contract in India – Drake & Scull International (DSI) has announced the winning of AED304mn deal for the electrical transmission line of the Uttarakhand Power Sector Investment Program-Project in Uttarakhand, India. The contract for the construction of a new 400 kiloVolt (kV) Double Circuit (DC) transmission line will support DSI’s aggressive expansion plans within India. The Uttarakhand Power Sector Investment-Project will run from Srinagar to Kashipur in Kumaon to enhance the hydropower development in Uttarakhand. The scope of work for DSI includes the construction of 152-km transmission line on quadruple bundled Bersimis conductor. The company will also undertake the survey, design, fabrication and supply of 400 kV DC transmission line towers, supply of conductors and insulators, erection of towers and other related materials, and testing and commissioning of the whole transmission line. (DFM) DW makes early repayment of $300mn; LLOY drops sale of $540mn of DW’s debt – Dubai World (DW) has made a second early repayment worth around $300mn under its $25bn debt restructuring plan. The payment, made at the end of June 2014, came from the proceeds of asset sales completed by the firm and follows an initial sum of $284.5mn returned in March 2014 to creditors, which include dozens of local and international lenders. Meanwhile, DW’s creditor, Lloyds Banking Group (LLOY) has dropped a plan to sell its $540mn worth of loans to the company after offers fell short of the reserve price. DW debt is split between a $4.4bn loan due to be repaid in September 2015, and a $10.3bn loan due in September 2018. The government-owned company hired Blackstone Group LP to advise on managing its debt and to review possible asset sales. (GulfBase.com) Arabtec denies delisting rumors; Aabar mulls stake Increase in Arabtec – Arabtec Holding has denied the rumors about delisting from the Dubai Financial Market (DFM). The company announced that it is proceeding with all projects as scheduled for without cancellation or changes and with strong financial capacity. Arabtec also said that Aabar has sold a small portion of the bonus shares which it has obtained recently. However, Aabar may increase its stake in the company that helped build the tallest tower in the world. (DFM, Bloomberg) GNH raises foreign ownership to 49% – Gulf Navigation Holding has increased the foreign ownership limit from 20% to 49%, effective from July 03, 2014. (DFM) Etihad claims rescue-investor role for Europe’s ailing airlines – Etihad Airways said the five European carriers in which it has invested or is seeking stakes would face thousands of job cuts and possible collapse without its involvement, hitting back at critics of its holdings. Etihad is poised to become a rescue investor in Italy’s Alitalia, while Air Berlin, Aer Lingus Group (AERL), Air Serbia and Darwin Airline would all face route closures and higher fares at best without the Abu Dhabi-based carrier’s support. The rapid expansion of Middle Eastern airlines has threatened the status of established European carriers in the competition for lucrative long-haul transfer traffic, with the Gulf big three building fleets of wide-body planes to tap the potential of hubs located on natural international crossroads. (Bloomberg) SMG postpones London IPO due to sale consideration – Dubai-based Stanford Marine Group (SMG) has postponed a planned IPO in London as majority owner Abraaj Group courts potential buyers for the Dubai-based business. SMG may now sell shares in the 1H2015 instead of 2014 and won’t issue IPO if it finds a buyer earlier. SMG is an operator of offshore supply vessels for oil and gas firms in the Middle East and Gulf of Mexico. (Bloomberg) Aldar to reduce gross debt to AED5bn by end-2015 – Aldar Properties is planning to reduce its remaining gross debt by half to AED5bn by the end of 2015, as it continues to make progress on cleaning up its balance sheet. The company has already brought down its debt from AED14.5bn at the time of its merger with fellow developer Sorouh in July 2013 to AED10bn. Aldar is targeting to diversify its portfolio of investments. (Bloomberg) Dubai plans project to build world's biggest mall – Dubai is planning to launch a project to build an entertainment and hotel district that will include the world's largest shopping mall. The plans for new project, named Mall of the World revealed 18 months ago, helping to trigger a strong rally in Dubai's real estate and stock markets. The latest version of the plans includes construction of an 8mn square foot (743,000 square meters) mall, connected to a theme park, theatres, medical tourism facilities and 100 hotels and serviced apartment buildings with 20,000 rooms. The complex would be able to host 180mn visitors annually. (Bloomberg) Shelf Drilling cancels London IPO – Dubai-based oil rig supplier Shelf Drilling has cancelled its London IPO of shares, due to challenging public market conditions despite a positive

- 7. Page 7 of 8 response from prospective investors to the company, its strategy and operations. (Reuters) ADWEC, GDF Suez sign 25-year agreement for Mirfa Project – France-based GDF Suez has entered into 25-year power and water purchase agreement for the Mirfa Independent Water and Power (IWPP) project with the Abu Dhabi Water and Electricity Company (ADWEC). GDF SUEZ holds a 20% equity interest in the project with the remaining 80% held by Abu Dhabi Water and Electricity Authority (ADWEA). Mirfa project will be built at a capital cost of approximately $1.5bn and will involve the acquisition of certain existing water and power facilities, the development, design, engineering and construction of new power and water facilities, as well as the operation of the plant. When finished, and with the existing and new facilities fully integrated, Mirfa IWPP will have a total power capacity of 1,600 megawatt and a seawater desalination capacity of 52.5mn imperial gallons per day. (GDF Suez, Reuters) Oman budget surplus hits $1.5bn in Jan-May – Oman's government budget surplus reached OMR582.9mn in January- May compared with a deficit of OMR110.4mn a year ago, provisional government data showed. Analysts polled by Reuters in April predicted that Oman would post a fiscal surplus of 1.7% of GDP in 2014. Oman, which based its 2014 budget on a projected oil price of $85 per barrel, sees an expenditure of OMR13.5bn and a deficit of OMR1.8bn this year. (Bloomberg) NCSI: Oman’s exports touch OMR3.4bn, down by 10.5% – According to the statistics by the National Centre for Statistics and Information (NCSI), the total value of Oman's exports stood at OMR3.4bn from January to the end of February 2014, showing a decline of 10.5% compared to OMR3.8bn in the corresponding period in 2013, while non-oil exports grew by 23.9% during the same period. The figure includes oil and gas, non-oil products and re-exports. The decline is attributed to the fall in oil and gas exports, generating export revenue of OMR2.2bn till the end of February 2014, compared to OMR2.4bn by the end of February 2013. During the same period, the total value of re-exports declined by 39.7%, reaching OMR479.1mn by the end of February 2014 against OMR795mn by the end of February 2013. Within the export categories, the only increase recorded was in the non-oil exports which grew by 23.9%, totaling OMR694.9mn at the end of February 2014, compared to OMR560.7mn during the same period in 2013. (GulfBase.com) ABC to raise $500mn loan, picks arrangers – Bahrain’s Arab Banking Corporation (ABC) has chosen four banks to arrange a $500mn loan of three years duration. The funds will be used for general business purposes. The facility, to be arranged by HSBC, National Bank of Abu Dhabi, Natixis and Sumitomo Mitsui Banking Corp, will pay an interest rate of 120 basis points above the London interbank offered rate (Libor). Four other banks — Deutsche Bank, Royal Bank of Scotland, Societe Generale and Standard Chartered — have committed to subscribe to the loan, while an invitation to other lenders to join was sent out by ABC. (GulfBase.com) SLRB: Real estate trading up 44% in Bahrain – According to Bahrain’s Survey and Land Registration Bureau (SLRB), Bahrain has made a major leap in real estate trading in 1H2014. The total real estate trading amounted to BHD722.6mn, an increase of 44% compared to 1H2013. The volume of trading in 2Q2014 amounted to BHD78.3mn, an increase of 23% compared to last year. Gulf real estate investors' trading, until the end of last month, amounted to 139%, while foreign investors' trading amounted to 22%. (GulfBase.com) ABC mandates banks for $500mn 3-year loan – Arab Banking Corporation (ABC) has mandated banks for $500mn three-year Loan. Term facility for general funding purposes, pays a margin of Libor+120bps. HSBC, National Bank of Abu Dhabi, Natixis and Sumitomo Mitsui Banking Corporation are acting as bookrunners and initial mandated lead arrangers. Deutsche Bank, Societe Generale, Standard Chartered Bank and The Royal Bank of Scotland pre-committed to facility before launch of general syndication as mandated lead arrangers. (Bloomberg)

- 8. Contacts Saugata Sarkar Abdullah Amin, CFA Shahan Keushgerian Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6569 Tel: (+974) 4476 6509 saugata.sarkar@qnbfs.com.qa abdullah.amin@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa Sahbi Kasraoui Ahmed Al-Khoudary QNB Financial Services SPC Manager – HNWI Head of Sales Trading – Institutional Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6544 Tel: (+974) 4476 6548 PO Box 24025 sahbi.alkasraoui@qnbfs.com.qa ahmed.alkhoudary@qnbfs.com.qa Doha, Qatar DISCLAIMER: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange; QNB is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. While this publication has been prepared with the utmost degree of care by our analysts, QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 8 of 8 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg (* Market closed on 04 July 2014) Source: Bloomberg (* Market closed on 04 July 2014) 80.0 90.0 100.0 110.0 120.0 130.0 140.0 150.0 160.0 170.0 180.0 190.0 200.0 210.0 Jul-10 Jul-11 Jul-12 Jul-13 Jul-14 QE Index S&P Pan Arab S&P GCC 0.1% (0.1%) (0.3%) (0.2%) 0.4% (0.8%) 0.2% (1.0%) (0.5%) 0.0% 0.5% Saudi Arabia Qatar Kuwait Bahrain Oman Abu Dhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D% WTD% YTD% Gold/Ounce 1,320.55 0.1 0.3 9.5 DJ Industrial* 17,068.26 0.0 1.3 3.0 Silver/Ounce 21.17 0.1 1.0 8.7 S&P 500* 1,985.44 0.0 1.2 7.4 Crude Oil (Brent)/Barrel (FM Future) 110.64 (0.3) (2.3) (0.1) NASDAQ 100* 4,485.93 0.0 2.0 7.4 Natural Gas (Henry Hub)/MMBtu * 4.29 0.0 (1.9) (1.2) STOXX 600 347.95 (0.3) 1.7 6.0 LPG Propane (Arab Gulf)/Ton* 104.00 0.0 (3.0) (17.6) DAX 10,009.08 (0.2) 2.0 4.8 LPG Butane (Arab Gulf)/Ton* 121.38 0.0 (0.3) (11.1) FTSE 100 6,866.05 0.0 1.6 1.7 Euro 1.36 (0.1) (0.4) (1.1) CAC 40 4,468.98 (0.5) 0.7 4.0 Yen 102.06 (0.1) 0.6 (3.1) Nikkei 15,437.13 0.6 2.3 (5.2) GBP 1.72 0.0 0.7 3.6 MSCI EM 1,062.40 0.0 1.6 6.0 CHF 1.12 (0.1) (0.4) (0.1) SHANGHAI SE Composite 2,059.37 (0.2) 1.1 (2.7) AUD 0.94 0.2 (0.7) 5.0 HANG SENG 23,546.36 0.1 1.4 1.0 USD Index 80.27 0.1 0.3 0.3 BSE SENSEX 25,962.06 0.5 3.4 22.6 RUB 34.47 0.6 2.2 4.9 Bovespa 54,055.90 0.3 1.7 4.9 BRL 0.45 (0.0) (0.8) 6.8 RTS 1,360.48 (2.2) (1.4) (5.7) 177.8 150.3 136.3