Neostem Research Report by JMP Securites

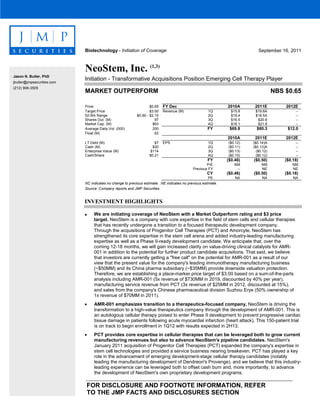

- 1. FOR DISCLOSURE AND FOOTNOTE INFORMATION, REFER TO THE JMP FACTS AND DISCLOSURES SECTION INVESTMENT HIGHLIGHTS • We are initiating coverage of NeoStem with a Market Outperform rating and $3 price target. NeoStem is a company with core expertise in the field of stem cells and cellular therapies that has recently undergone a transition to a focused therapeutic development company. Through the acquisitions of Progenitor Cell Therapies (PCT) and Amorcyte, NeoStem has strengthened its core expertise in the stem cell arena and added industry-leading manufacturing expertise as well as a Phase II-ready development candidate. We anticipate that, over the coming 12-18 months, we will gain increased clarity on value-driving clinical catalysts for AMR- 001 in addition to the potential for further product candidate acquisitions. That said, we believe that investors are currently getting a "free call" on the potential for AMR-001 as a result of our view that the present value for the company's leading immunotherapy manufacturing business (~$50MM) and its China pharma subsidiary (~$35MM) provide downside valuation protection. Therefore, we are establishing a place-marker price target of $3.00 based on a sum-of-the-parts analysis including AMR-001 (5x revenue of $730MM in 2019, discounted by 40% per year), manufacturing service revenue from PCT (3x revenue of $25MM in 2012, discounted at 15%), and sales from the company's Chinese pharmaceutical division Suzhou Erye (50% ownership of 1x revenue of $70MM in 2011). • AMR-001 emphasizes transition to a therapeutics-focused company. NeoStem is driving the transformation to a high-value therapeutics company through the development of AMR-001. This is an autologous cellular therapy poised to enter Phase II development to prevent progressive cardiac tissue damage in patients following acute myocardial infarction (heart attack). This 150-patient trial is on track to begin enrollment in 1Q12 with results expected in 2H13. • PCT provides core expertise in cellular therapies that can be leveraged both to grow current manufacturing revenues but also to advance NeoStem's pipeline candidates. NeoStem's January 2011 acquisition of Progenitor Cell Therapies (PCT) expanded the company's expertise in stem cell technologies and provided a service business nearing breakeven. PCT has played a key role in the advancement of emerging development-stage cellular therapy candidates (notably leading the manufacturing development of Dendreon's Provenge), and we believe that this industry- leading experience can be leveraged both to offset cash burn and, more importantly, to advance the development of NeoStem's own proprietary development programs. Biotechnology - Initiation of Coverage September 16, 2011 NeoStem, Inc. (1,3) Initiation - Transformative Acquisitions Position Emerging Cell Therapy Player MARKET OUTPERFORM NBS $0.65 Price $0.65 FY Dec 2010A 2011E 2012E Target Price $3.00 Revenue (M) 1Q $15.8 $19.6A -- 52-Wk Range $0.60 - $2.15 2Q $19.4 $18.5A -- Shares Out. (M) 97 3Q $16.5 $20.6 -- Market Cap. (M) $63 4Q $18.1 $21.6 -- Average Daily Vol. (000) 200 FY $69.8 $80.3 $12.0 Float (M) 62 2010A 2011E 2012E LT Debt (M) $7 EPS 1Q ($0.12) ($0.14)A -- Cash (M) $20 2Q ($0.11) ($0.13)A -- Enterprise Value (M) $114 3Q ($0.13) ($0.12) -- Cash/Share $0.21 4Q ($0.10) ($0.12) -- FY ($0.46) ($0.50) ($0.18) P/E NM NM NM Previous FY -- NE NE CY ($0.46) ($0.50) ($0.18) PE NA NA NA NC indicates no change to previous estimate. NE indicates no previous estimate. Source: Company reports and JMP Securities Jason N. Butler, PhD jbutler@jmpsecurities.com (212) 906-3505

- 2. 2 COMPANY DESCRIPTION NeoStem is a diversified stem cell technology company that is focusing its broad expertise and resources on the development of high-value cellular therapies aimed at impacting outcomes of serious diseases with an unmet medical need. The company expanded its core expertise in stem cell technologies into manufacturing and therapeutics through acquisitions over the past 12 months. Its lead therapeutic candidate is AMR-001, an autologous cell therapy being developed for the treatment of patients following acute myocardial infarction to prevent progressive cardiac tissue damage. Results from a 31-patient Phase I trial established preliminary evidence of safety and efficacy, and NeoStem is preparing to initiate a Phase II trial in 1Q12, intended to inform the design of a Phase III registration program. NeoStem has two further therapeutic platform technologies from which we expect to see candidates emerge into clinical development over the next 12-24 months. The company also has a profitable pharmaceutical subsidiary in China, of which it holds 51% ownership, the divestiture of which is currently being explored. FIGURE 1: NeoStem Historical Price Chart 0.6 0.8 1 1.2 1.4 1.6 1.8 2 2.2 Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug 0 4 Source: FactSet VALUATION We value NeoStem based on a sum-of-the-parts analysis including AMR-001, manufacturing service revenue from the Progenitor Cell Therapy (PCT) subsidiary, and sales from the company's Chinese pharmaceutical division, Suzhou Erye. FIGURE 2: Absolute Valuation Sales Revenue year Profit share Multiple Discount rate Current value Current value per share AMR-001 730 2019 90% 5 40% 312 $2.10 PCT CM revenue 25 2015 100% 3 15% 49 $0.33 Suzhou Erye 70 2011 51% 1 36 $0.24 Total 397 $2.67 Source: JMP Securities, LLC

- 3. 3 Our price target assumes an estimate for fully diluted shares outstanding of approximately 148 million shares. This estimate is based on approximately 96 million shares outstanding following the July equity offering, approximately 33 million warrants with an exercise price below our objective, and 19 million stock options with an average exercise price of $1.79. AMR-001 We value AMR-001 based our projections for sales in acute myocardial infarction patients at high risk of experiencing further major adverse cardiac events (MACE). We conservatively only include sales projections in the U.S. Our model assumes that AMR-001 will be approved in 2016 and will be launched by a specialized sales force assembled by NeoStem. We project peak sales in the U.S. of approximately $715MM in 2019, the third full year of commercialization, of which the company owes a 10% royalty to Amorcyte shareholders. We then derive our valuation by applying a 5x multiple to our 2019 sales projection, discounted by 40% per year to the end of 2012. In our view, this discount rate reflects higher than average clinical and regulatory risk despite the positive Phase I results and clear scientific rationale, which takes into consideration uncertainties in cellular therapies arena. There are approximately 1.25 million people who suffer from an acute myocardial infarction in the U.S. each year. Of these, approximately 40% are ST-segment elevated myocardial infarctions (STEMI), as characterized by electrocardiogram. Patients with ST elevation are experiencing ongoing cardiac tissue injury and require immediate treatment to remove any blockage and restore blood flow. It is estimated that half of STEMI patients will have a low ejection fraction (< 50%) and 60% of these patients are at high risk for adverse cardiac remodeling, which involved changes in size, shape, and function of the heart after injury that results in increased stress to the organ and a high risk for further MACE. Based on these assumptions, we view the target population for AMR-001 is at least 150,000 patients per year in the U.S. We model AMR-001 penetration into this patient population projecting that peak penetration of 9.5% will be achieved in 2019. We assume a cost of therapy of $50,000, conservatively with no annual price increases, and therefore derive a peak sales estimate of $730MM. We believe that at peak sales, NeoStem can achieve gross margins of 80%. We note that NeoStem has issued patents covering AMR- 001's composition of matter that extend through 2028. In addition, given the manufacturing and regulatory complexities in the cellular therapeutics field, we do not view generic competition as a meaningful risk at this time. FIGURE 3: AMR-001 Revenue Model US AMR-001 market 2015 2016 2017 2018 2019 2020 Acute myocardial infarction (MI) incidence 1,255,000 1,261,275 1,267,581 1,273,919 1,280,289 1,286,690 ST-elevated MI incidence 502,000 504,510 507,033 509,568 512,116 514,676 STEM with low ejection fraction 251,000 252,255 253,516 254,784 256,058 257,338 Patients at increased risk of MACE 150,600 151,353 152,110 152,870 153,635 154,403 AMR-001 penetration 0.0% 0.5% 1.5% 5.0% 9.5% 9.5% Treated patients 757 2,282 7,644 14,595 14,668 Cost of therapy ($, annual) 50,000 50,000 50,000 50,000 50,000 Sales ($MM) 38 114 382 730 733 Source: Company reports and JMP Securities, LLC

- 4. 4 PCT In 2010, PCT generated services revenue of approximately $10MM, which is approaching breakeven for this business. We project that sales can grow to $25MM in 2015 based on 1) an increasing number of clients and 2) clients progressing product candidates through to later stages of development and ultimately commercialization. We value revenue generated by PCT by applying a 3x multiple to our 2015 revenue estimate of $25MM, discounted by 15% per year to the end of 2012. We estimate that $25MM would reflect manufacturing service for clinical product to treat between 1,000 and 1,500 patients. Suzhou Erye In 2010, NeoStem reported sales of approximately $70MM from Suzhou Erye and in 1H11 sales were $34MM. We project sales for FY11 of $71MM, to which we apply a 1x multiple and attribute 51% to NeoStem based on its ownership stake. Relative Valuation We corroborate our absolute valuation methodology with a relative, comparable company analysis for which we evaluated other companies with core platform technologies that can be leveraged to develop high value therapeutic candidates. We focused also on companies with hybrid business models that generate cash flow or value appreciation through existing non-core partnerships. Companies in our comparable universe have a median enterprise value of $231 million (range of $76-447MM). This compares favorably to the current enterprise value of NeoStem of $64MM. Using this median value, we derive a 12-month price target of approximately $3 per share. FIGURE 4: Relative Valuation Company Name Ticker Price Shares Market Cap Cash Debt Enterprise Value Aastrom Biosciences Inc. ASTM $2.62 38.6 101 19 0 83 Isis Pharmaceuticals Inc. ISIS $7.17 99.7 715 395 143 462 Lexicon Pharmaceuticals Inc. LXRX $1.28 337.7 432 164 24 292 Rockwell Medical Technologies Inc. RMTI $8.73 18.1 158 21 0 137 Sangamo BioSciences Inc. SGMO $5.93 52.5 311 91 0 220 Median 311 239 Neostem NBS $2.61 96.6 252 13.4 0 239 Source: JMP Securities, LLC and FactSet KEY UPCOMING CATALYSTS 1Q12 Initiate Phase II trial for AMR-001 in AMI patients 2012 Initiate Phase I trial(s) for Athelos T reg therapeutic candidate(s) 2012 Monetize 51% ownership in Suzhou Erye KEY INVESTMENT POINTS NeoStem is positioning to become a leading player in cellular medicine. NeoStem is a biopharmaceutical company with a focus in the field of stem cell technologies, with core expertise in collection, storage, and manufacturing of stem cells globally. The company's Progenitor Cell Therapy (PCT) unit is a key player providing contract manufacture and development/regulatory consultancy to stem cell therapeutics companies. NeoStem is now leveraging their core expertise to advance emerging therapeutic programs. Through the recent acquisition of Amorcyte, NeoStem has gained rights to AMR- 001, a well characterized autologous cell therapy product candidate with an established mechanism of action and defined threshold dose. The company completed an equity financing over the summer, raising gross proceeds of $16.5MM, which we believe can further enable the transformation into a focused therapeutics development company and progress AMR-001 into Phase II development. In our view, execution on the AMR-001 development program and continued commitment to high-value therapeutic assets will further establish NeoStem as a focused development-stage biotechnology company and can provide multiple value-inflecting milestones over the next 12-18 months. In turn, we

- 5. 5 believe, investors will begin to more appropriately value the potential of the company's assets and capabilities. Cellular therapies - emerging investable opportunities. The therapeutic potential of stem cells has long been recognized as a powerful approach to treating diseases, especially in the field of regenerative medicine but beyond this in a wide array of diseases ranging from autoimmune to neurodegenerative and cardiovascular. However, there have been multiple challenges faced and, in many examples not overcome, including ethical, technical, regulatory, and commercial considerations. Just as biologic therapies (e.g., monoclonal antibodies) are considerably more complex than small molecule pharmaceuticals, cellular therapies are even more complex. However, just as the therapeutic potential of biologics was realized, we believe cellular therapies are now entering a period of development when successes can become more frequent. PCT unit provides core, industry leading expertise as well as growing contract manufacturing revenue. NeoStem acquired Progenitor Cell Therapies (PCT) in January 2011. Since its inception in 1997, PCT has become an industry-leading resource in the cellular therapy space, specifically for clinical trial products. The company has established cGMP manufacturing capabilities on the East and West coasts of the U.S. and participated in the advancement of a growing list of clinical candidates, in terms of product and process development, regulatory advice, manufacturing, and logistics. Its most notable client has been Dendreon, and PCT's expertise and experience was influential in the development of its now-approved cellular therapy product Provenge. The company intends to continue growing its CMO offerings as cellular therapies emerge as a key focus for biopharmaceutical development in coming years. In our view, the PCT business unit provides NeoStem with a high- visibility, low-risk revenue stream; as the products of PCT’s clients advance through clinical development and commercialization, and the number of clients grows (currently ~25), revenues can also grow. In 2010, PCT's revenue was approximately $10MM, and we project that revenue can grow to $25MM by 2015. Moreover, we believe this expertise can be leveraged to advance the development of NeoStem's own proprietary therapeutic programs, including AMR-001, as well as provide unique diligence insights on potential product acquisition candidates. Amorcyte acquisition brings on board Phase II-ready asset. In July, NeoStem announced the acquisition of Amorcyte for up to $18MM in NBS stock ($10MM up front, $2MM warrants, $6MM vesting upon achievement of certain clinical milestones). Amorcyte's lead development candidate is AMR-001, an autologous bone marrow-derived cellular therapeutic. This cellular product contains an enriched population of CD34+CXCR4+ cells, which are believed to better satisfy energy requirements of heart muscle following acute myocardial infarction, limiting apoptosis, promoting neoangiogenesis, and reducing post-AMI tissue damage. AMR-001 is protected by a patent including composition of matter claims through 2028. A completed Phase I trial (31 patients, 4 U.S. sites, 6 month duration) has established a threshold dose for efficacy in acute myocardial infarction patients, and a Phase II trial is expected to begin in 1Q12. The Phase I trial demonstrated positive signals of efficacy in terms in key measures of cardiac function (hypoperfusion, ejection fraction, and end systolic volume) as well as a favorable safety profile. The planned Phase II trial is expected to enroll approximately 150 patients at 30 sites in the U.S. for a treatment follow-up period of six months. The aim of this trial is to inform the design of a Phase III program that best enables regulatory success. We look to gain further clarity on enrollment timelines, but we currently believe results could be available in 2H13. Proprietary technologies provide additional clinical candidates. In addition to Amorcyte, NeoStem has two proprietary therapeutic platforms from which clinical candidates may emerge over the coming 12-24 months. The first is the company’s Athelos unit, a joint venture with Beckton Dickinson, of which Neostem owns 80%. The Athelos technology is based on T cells that are harvested from peripheral and/or cord blood and then activated and expanded. These cells are believed to have applications in therapeutics for a range of auto-immune diseases. NeoStem is on track to begin Phase I trials for therapeutic candidates from the Athelos platform in 2012 with possible indications including GvHD, solid organ transplant rejection, and other in autoimmune diseases including asthma and diabetes. NeoStem's second proprietary platform is VSEL (Very Small Embryonic Like) stem cells. VSELs have the attractive attributes of embryonic stem cells (i.e., pluripotent) but without the ethical considerations. In our view, this technology can be applicable to multiple regenerative medicine opportunities, and we look to gain increased visibility in emerging clinical candidates.

- 6. 6 Intended divesture of profitable Chinese pharmaceuticals business can further strengthen balance sheet. NeoStem is the majority (51%) stakeholder of Suzhou Erye, a Chinese pharmaceuticals business focused primarily on generic antibiotics. Since NeoStem acquired its share in Suzhou Erye, sales have more than doubled from $32MM in 2007 to $69MM in 2010. Growth in this business has been driven both by strong growth in the Chinese healthcare sector as well as by development of a new manufacturing facility built and validated with NeoStem's investment, doubling capacity. In 1H11, NeoStem reported sales from Suzhou Erye of $35MM, and we project full year sales exceeding $70MM. In line with its focus on high-value cellular therapeutic programs, NeoStem intends to divest this asset to generate further cash to fund clinical development programs and/or further potential therapeutic asset acquisitions. The company is progressing negotiations to sell Suzhou Erye, and we believe that it could generate upwards of $35MM from this transaction (51% of 1x sales). INVESTMENT RISKS Clinical risk. NeoStem's development candidates could fail to generate expected results in current or future clinical trials. Regulatory risk. The FDA, and/or other ex-U.S. regulatory agencies, could reject any of the firm's, or its partners', future regulatory filings or require additional studies prior to granting approval. Commercial risk. If successfully developed, NeoStem's products may face competition both from approved products and also potentially from new product candidates in development by biotechnology and pharmaceutical companies. Balance sheet risk. The expenses associated with drug development are high. It is possible that the company will return to the capital markets to secure additional financing to fund current or future development programs. As of June 30th, 2011, NeoStem had approximately $5MM in cash and equivalents and subsequently raised net proceeds of $15MM from an equity financing. We do not believe current funds will be sufficient to support operations through profitability. AMORCYTE NeoStem announced the acquisition of Amorcyte in July 2011 in an all-stock transaction valued at up to $18MM. The transaction included an upfront payment of $10MM in NBS stock as well as warrants for $2MM in NBS stock and up to a further $6MM in NBS vesting on the achievement of certain clinical milestones. The primary reason for the acquisition was Amorcyte's lead product candidate AMR-001, a cellular therapy being developed to reduce heart muscle damage following a heart attack. Amorcyte has completed a 31-patient, randomized, controlled Phase I trial for AMR-001 that established preliminary evidence of safety and efficacy as well as a threshold dose for progression in to Phase II development. Through this transaction, NeoStem acquired a Phase II-ready asset that we believe demonstrates solid execution on its transition to a development-stage therapeutics company. Scientific rationale and clear mechanism of action provide basis for clinical utility. AMR-001 is comprised of an enriched population of autologous bone marrow-derived stem cells, co-expressing CD34 and CXCR4 (CD34+CXCR4+). The cells are harvested from a patient following an acute myocardial infarction (AMI), are enriched, and are then infused into the infarct-related artery six to ten days post-AMI, within the timeframe required for clinical benefit. The cells do not undergo expansion during this procedure. Preclinical studies have provided insight into the mechanism of action, which, in our view, informs the potential for clinical success. Following an AMI, the body acts to rescue damaged tissue, and preclinical data have demonstrated that CD34+CXCR4+ cells play a role in this process. A distress signal, hypoxia induced factor (HIF), is released by the damaged heart muscle, which, in turn, induces synthesis of stromal cell-derived factor (SDF) and vascular endothelial growth factor (VEGF). This process mobilizes CD34+CXCR4+ cells, which travel along the SDF gradient to the area of damage, the peri-infarct zone. The cells are then involved in preventing apoptosis and effecting neoangiogenesis. Further tissue damage results from a limited natural availability of regenerative CD34+CXCR4+ cells, and AMR-001 serves to reduce this burden, reducing or preventing progressive tissue damage.

- 7. 7 AMR-001 Phase I results provide sufficient evidence of efficacy to progress development. Amorcyte completed a 31 patient Phase I trial for AMR-001, providing what we view to be encouraging preliminary evidence of safety and efficacy. The results demonstrated that patients treated in the two higher dose cohorts (10 to 15 million cells) achieved improved cardiac perfusion. In our view, results from the Phase I trial established the feasibility and reproducibility of AMR-001 treatment, including cell harvest, enrichment, and infusion, and provided a sufficient basis to progress development into a Phase II trial. Furthermore, we believe the data establish a threshold dose for AMR-001, an important concept in the development of cellular therapies. The trial demonstrated that while improved cardiac perfusion was observed in the higher dose cohorts, no therapeutic benefit was seen with the low dose cohort or the control group. Phase II well designed and powered to build on Phase I experience. NeoStem is preparing to initiate a 150-patient Phase II trial assessing AMR-001 in patients following acute myocardial infarction. The design of this trial is based on the Phase I trial while providing substantially greater statistical power. The aim of this trial is to inform the design of a Phase III program that best enables clinical and regulatory success. As with the Phase I trial, the primary efficacy measure will be preservation of cardiac function. We expect the trial to begin enrolling patients in 1Q12, based on which we believe results could be available in 2H13. Baxter experience establishes clinical evidence of effect, but candidate therapy leaves room for improvement. Baxter previously completed a randomized, placebo controlled Phase II trial using autologous CD34+ stem cells in patients with chronic myocardial ischemia. The aim of this 150 patient trial was to assess the potential for this cellular product to reduce the frequency of angina episodes. The results demonstrated that, at six months after treatment, patients treated with the cellular therapy had significantly fewer episodes of angina per week than patients treated with placebo (6.8 vs. 10.9), a difference that was maintained at one year (6.3 vs. 11.0). In addition, patients in the treatment arm of the trial were able to exercise significantly longer at six months (139 seconds vs. 69 seconds). These results were published in August in the journal Circulation Research (Circulation Research 2011;109:428-436). In contrast to AMR-001, Baxter's product is derived from G-CSF mobilized CD34+ cells. G-CSF has been demonstrated to neutralize CXCR4+ cells, therefore implying that Baxter's product would not be able to home to the peri-infarct zone, a key differentiating attribute of AMR-001. Given that Baxter's product cannot rely on a targeting mechanism, the company is pursuing a Phase III program in cardiac ischemia that employs local delivery of the therapeutic candidate using a NOGA "mapping" catheter. AMR-001 Clinical Development NeoStem is preparing to initiate a 150 patient, placebo-controlled trial to assess the safety and efficacy of AMR-001 in the preservation of cardiac function in patients following acute myocardial infarction. Enrollment is expected to begin in 1Q12, and patients will be recruited at 30 clinical sites in the U.S. The design of the trial is based on the Phase I trial but will provide greater statistical power. Patients will be randomized to receive a single administration of AMR-001 or placebo and assessed following a six month treatment period. The dose of AMR-001 is release of at least ten million cells. The primary endpoint is increased cardiac perfusion (RTSS) measured by SPECT at six months post infusion. Secondary endpoints include a composite of measures of cardiac function (preservation of LVEV, LVEF, prevention of adverse remodeling) and quality of life measures (KCQQ and SAQ). Phase I Results Amorcyte completed a 31-patient, randomized Phase I trial with AMR-001, demonstrating meaningful biological activity of the product candidate in patients following myocardial infarction as well as establishing a threshold dose. The trial was completed at four clinical sites in the U.S., and results were published earlier this year in the American Heart Journal (Quyyumi et al., Am Heart J 2011; 161: 98- 105). The aim of this study was to establish preliminary evidence of the therapy's safety; however, a composite of measures of cardiac function including perfusion (RTSS) was included. Patients were randomized into one of four treatment groups (escalating doses of AMR-001 or placebo) following an ST elevation myocardial infarction (STEMI). Eligible patients had received an intracoronary stent, implanted within three days of a myocardial infarction, and had an LVEF of less than 50%. A total of 15 patients were enrolled in the control group and 16 were enrolled to receive one of three escalating

- 8. 8 doses (5, 10, or 15 million cells) of AMR-001. Between five and eight days after stent implantation, patients in the AMR-001 group underwent bone marrow harvest following which, harvested cells were selected for CD34 and enriched to 5, 10, and 15 million cell doses. The cells were infused via the infarct-related artery 7-11 days following the STEMI. The primary efficacy measure in the trial was hypoperfusion, measured as the resting total severity score (RTSS) by single-photon emission computed tomography (SPECT). RTSS was measured at baseline and three and six months after treatment. The study results demonstrated that, in patients receiving 10 to 15 million cells, there was a significant improvement (reduction) in RTSS at six months as compared to patients receiving 5 million cells and control (p=0.11). In addition, there was a trend towards improvement in ejection fraction and infarct size with increasing cell doses. FIGURE 5: Phase I Results - Hypoperfusion Control 5mil 10mil 15mil Patient numbers 15 5 5 5 RTSS Baseline 259 714 999 584 6 mos 273 722 636 462 Change 14 8 -363 -122 % change 5.4% 1.1% -36.3% -20.9% AMR-001 Source: Company reports It is important to note that patients in the control group had a smaller baseline RTSS than patients in the treatment groups (p=0.04), implying that these patients were less sick. However, the five million cell dose cohort, which did not demonstrate an improvement in RTSS, had a more similar baseline score to the 10 and 15 million cell dose cohorts, providing a more robust comparison, in our view. We believe these data demonstrate an encouraging signal of efficacy. FIGURE 6: Phase I Results - Subgroup Analyses Below Threshold Above Threshold % change RTSS 3.3% -31.4% Ejection fraction 1.3% 9.4% End systolic volume 4.6% -6.1% Source: Company reports As shown in Figure 6, subgroup analyses, combining data for groups below the threshold dose (control group and 5 million cell dose cohort) and above threshold dose (5 and 10 million cell dose cohorts) further supports the treatment effect above this threshold, demonstrating improvements in additional measures of cardiac function.

- 9. 9 PROGENITOR CELL THERAPIES Progenitor Cell Therapies (PCT) is a cell therapy services business that provides development, manufacturing, and regulatory expertise participating in the advancement of candidate cellular therapeutics. PCT was acquired by NeoStem in January 2011 in an all-stock transaction valued at approximately $20MM. The business unit has core expertise in manufacturing cell-based products, through which it has demonstrated success facilitating the progression of product candidates through preclinical and clinical development, most notably with Dendreon's Provenge. Contract manufacturing services are provided through state of the art, cGMP-compliant facilities in Allendale, NJ, and Mountain View, CA. In 2010, PCT generated revenues of approximately $10MM, which we believe can grow substantially through further recognition of its industry-leading capabilities as well as more broadly through increased investment in the development of cellular therapies. Established expertise and execution in cellular therapies. PCT was founded in 1997 by Drs. Andrew Pecora, MD, and Robert Preti, PhD, who remain active members of NeoStem's leadership. Dr. Pecora currently serves as NeoStem's Chief Medical Officer and Dr. Preti as PCT's President and Chief Scientific Officer. In our view, the continued contribution of PCT's management team can drive further success both in the growth of the contract manufacturing business and in the progressing development of NeoStem's therapeutic candidates. To date, PCT has provided contract manufacturing services for upwards of 100 clients, assisting in more than 15,000 cell therapy procedures in over 5,000 patients. PCT has participated in more than 50 regulatory filings in the U.S. and EU PCT participates in all aspects of a candidate stem cell product's advancement from bench to patient including establishing product characterization and comparability, cell processing, manufacturing scale up, storage, and distribution and delivery logistics. Proven record of success with pivotal role in the pioneering of Provenge manufacturing. Dendreon's Provenge is an autologous stem cell therapy approved by the FDA in April 2010 for the treatment of advanced prostate cancer. PCT played a key role in the development of the Provenge, manufacturing more than 60% of clinical trial product, supporting all stages of clinical development as well as BLA submission and approval. In our view, this experience demonstrates PCT's execution and success in the development and manufacture of a commercially viable asset. Furthermore, we believe that PCT has gained valuable expertise with regulatory authorities that could be leveraged as cellular therapies emerge as investable development options. Beyond Dendreon, PCT currently has more than 25 clients with product candidates in or near clinical stage development. CM growth potential from multiple sources. We believe that revenue growth for PCT's contract manufacturing business can be driven both by advancement of product candidates into later stages of development, where larger trials require greater amounts of product, as well as increasing the number of clients, including the potential for a broadened client pool as development of cellular therapies becomes an increasingly attractive strategic investment. Approximately 50% of PCT’s current clients are conducting, or preparing to initiate, Phase I trials; another ~25% are in or preparing to commence Phase II or Phase III trials; and ~5% are preparing for commercial production. As products progress through clinical development, the size of trials increases as does the requirement for drug, which in the case of cellular therapies has a limited shelf life (vs., e.g., a small molecule). Importantly, PCT's revenue potential can continue to grow independent of the success of an individual development program. Additionally, in our view, cellular-based therapies can become a key focus for biopharmaceutical development in coming years. We draw a parallel to the emergence of monoclonal antibodies in the early 2000s that were at first viewed with investor skepticism due to manufacturing and development challenges but now represent a $20+ billion global market. Opportunity to leverage PCT expertise for proprietary programs and conduct due diligence on new opportunities. In addition to providing potential for near-term revenue growth, NeoStem is able to leverage PCT's expertise as a cellular therapy service provider to advance the development of the company's proprietary therapeutic programs, including AMR-001. Prior to being acquired by NeoStem, Amorcyte was a PCT client, and AMR-001 development to date has been facilitated by PCT's contributions. PCT's experience has the potential to maximize the cost and time efficiency of product development decisions. In addition to providing NeoStem with expertise and infrastructure to progress current development programs, we believe PCT provides the company with a unique insight into the

- 10. 10 development landscape of emerging cellular therapeutics. PCT's technical, scientific, clinical, and business capabilities can, we believe, enable NeoStem to more optimally evaluate opportunities for further strategic collaborations of asset acquisitions. PIPELINE DEVELOPMENT OPPORTUNITIES In addition to the recent Amorcyte acquisition, NeoStem is pursuing development of proprietary therapeutic candidates through two stem cell platforms, the Athelos joint venture and VSEL technology. While these programs are still early in development, we believe that they further demonstrate NeoStem's renewed focus on high-value therapeutic candidates. We expect increasing visibility from both of these platforms over the next 12-18 months but currently view these assets as upside to our valuation. Athelos Athelos is a joint venture between NeoStem and Beckton Dickinson, of which NeoStem holds 80% ownership. The joint venture was established to focus on development of cellular therapeutics for a range of autoimmune diseases. These therapeutics are based on restoring the balance between T effector cells and T regulatory (T reg) cells, an imbalance of which is thought to result in, or at least contribute to, immune-mediated and autoimmune diseases. While there is recognition that T reg cells can suppress immune responses, clinical application of this effect has been challenged by cell scarcity, activity, and lack of specificity. Athelos is pursuing an approach that is intended to enhance both T reg cell numbers and function. In this approach, T reg cells are harvested from peripheral and/or cord blood by apheresis and isolated using surface markers including CD4+, CD25+, and FoxP3+. The cells are then activated and expanded before being re-administered to the patient. There are currently several investigator-led INDs exploring T reg cells and Athelos is planning to begin Phase I trials in 2012 for the most promising candidates as determined by these ongoing studies. Target indications currently being considered include graft-vs.-host disease (GvHD), solid organ transplant rejection, and autoimmune diseases including asthma and diabetes. The intellectual property covering the Athelos product candidates was in-licensed from the University of Pennsylvania and University of Southern California, providing worldwide rights to approximately 30 issued patents and 50 pending patent applications. This broad intellectual property estate includes composition of matter and method patents. VSEL Technology VSEL (Very Small Embryonic Like) stem cell technology is NeoStem's novel, proprietary approach to cellular therapeutics. This cell population has many of the properties of embryonic stem cells (pluripotent) but can be harvested from a patient's bone marrow or peripheral or cord blood. Importantly, these cells do not undergo inducted pluripotency. Preliminary data support that significant quantities of VSEL stem cells can be harvested from peripheral blood utilizing granulocyte-colony stimulating factor (GCSF), and storage is straightforward through cryopreservation. In addition, data have been generated providing evidence that VSEL stem cells are mobilized by the body in response to injury or stress including acute myocardial infarction and stroke. The cells have also been shown to migrate to sites of injury and, importantly, then differentiate into target cell types. NeoStem licensed the VSEL technology from the University of Louisville, gaining worldwide rights to a patent estate covering cell isolation, purification, and therapeutic use. We believe this technology may have application in multiple regenerative medicine opportunities and look to gain further visibility on clinical development plans.

- 11. 11 CHINA OPERATIONS NeoStem's activities in China are focused in two areas: 1) expansion of its stem cell technologies into this geography and 2) Suzhou Erye, a pharmaceuticals division 51% owned by the company. We view the company's China operations as non-core assets and do not expect it to commit substantial capital to these efforts going forward. Furthermore, we believe that the intended divesture of Suzhou Erye will be a source of cash, strengthening NeoStem's balance sheet to fund further clinical advancement of its high-value therapeutic programs. Suzhou Erye NeoStem acquired a 51% controlling interest in Suzhou Erye in 2009, since which time it has grown revenues at a CAGR of approximately 30%. Suzhou Erye was established in the 1960s and has more than 160 approved products that it sells in China. Most products in Suzhou Erye's portfolio are antibiotics, with more than 90% of revenues being derived from products containing penicillin or cephalosporin as the key active ingredient. The Chinese pharmaceutical industry has been growing rapidly at an annual rate of over 20% for the past 10 years, reaching $184 billion in 2010, according to the Chinese State Department. Infectious diseases are an important therapeutic area in the country, and drug sales from this category contribute 24% of total hospital drug sales. Within this, antibiotics are a major drug category representing an estimated market size of $12 billion in 2009, according to the Chinese State Food and Drug Administration (SFDA). Regenerative Medicine NeoStem has expanded its stem cell technology applications to China, where the company has ongoing initiatives to advance cellular therapies in regenerative medicine. Since 2009, the company has initiated and completed construction of a stem cell research and development laboratory and processing and manufacturing facility in Beijing. In addition, it has in-licensed several cellular therapeutic development candidates and has begun to establish relationships with hospitals in China to advance these therapies, specifically, the company’s proprietary autologous mesenchymal stem cells extracted from bone marrow for use in orthopedic indications. In 2010, NeoStem formed a collaboration with Shandong Wendeng Orthopaedic Hospital to offer cellular-based orthopaedic treatments. Following this, additional collaborations were formed with Shijiazhuang Third Hospital, in the provincial capital of Hebei Province, and Tianjin Nankai Hospital, located approximately 80 miles from Beijing. MANAGEMENT Robin L. Smith, M.D., MBA Chairman & Chief Executive Officer Dr. Smith joined NeoStem in September 2005 as Chairman of its Advisory Board and in June 2006 was appointed CEO and Chairman of the Board. Prior to joining the company, from 2000 to 2003, Dr. Smith served as President and CEO of IP2M, a multi-platform media company specializing in healthcare sold to a publicly-traded company in 2003. Previously, from 1998 to 2000, she was Executive Vice President and CMO of HealthHelp, Inc., a National Radiology Management company that managed 14% of the healthcare dollars spent by large insurance companies. In addition, Dr. Smith currently serves on the Board of Trustees of the NYU Medical Center Board and is past Chairman of the Board of Directors for the New York University Hospital for Joint Diseases. She is also the President and serves on the Board of Directors of The Stem for Life Foundation. Dr. Smith received a medical degree from Yale University in 1992 and a master's degree in business administration from the Wharton School in 1997. Andrew L. Pecora, M.D., F.A.C.P. Chief Medical Officer Dr. Pecora joined NeoStem following the company's acquisition of Progenitor Cell Therapies, where he was Chairman and Chief Executive Officer. In addition, Dr. Pecora currently serves as Vice President of Cancer Services and Chief Innovations Officer of the John Theurer Cancer Center at Hackensack University Medical Center (HUMC) and Co-Managing Partner of the Northern New Jersey Cancer Center, a private physicians practice group affiliated with HUMC. He is a Professor of Medicine at the University of Medicine and Dentistry of New Jersey. He also serves as Chairman of the Board of

- 12. 12 Directors of Tetralogics, a private venture-funded biotechnology company developing small molecules for cancer therapy, and of Cancer Genetics, a private venture-funded cancer diagnostics company. Dr. Pecora received his medical degree from the University of Medicine and Dentistry of New Jersey and completed his medical education in internal medicine at New York Hospital and in hematology and oncology at Memorial Sloan-Kettering Cancer Center. He is board certified in internal medicine, hematology, and oncology. Robert A. Preti, Ph.D. President and Chief Scientific Officer, Progenitor Cell Therapy Dr. Preti joined NeoStem following the company's acquisition of Progenitor Cell Therapies where he was co-founder, President, and Chief Scientific Officer. Previously, Dr. Preti served as Scientific and Laboratory Director of Hackensack University Medical Center's stem cell processing and research laboratory and Scientific Director of the Clinical Services Division at the New York Blood Center. Dr. Preti is a founding member of the International Society for Cellular Therapies (ISCT, formerly the International Society for Hematotherapy and Graft Engineering) and also serves on professional, state, and federal regulatory committees charged with the development and refinement of regulations for the developing field of cellular therapy. Dr. Preti received his Doctor of Philosophy degree from New York University. Jason Kolbert, MBA Vice President of Strategic Business Development Jason Kolbert joined NeoStem in March 2011 as Vice President of Strategic Business Development. Prior to joining NeoStem, Mr. Kolbert spent 16 years on Wall Street as a sell side and buy side analyst focused on biotechnology companies. Most recently, he was a managing director of National Securities where he founded the firm's research effort in emerging biotechnology companies. Before his career on Wall Street, Mr. Kolbert spent several years in the pharmaceutical industry with Schering-Plough in Japan. Mr. Kolbert has an undergraduate degree in Chemistry (New Paltz) and an MBA in Finance (University of New Haven). Larry A. May Chief Financial Officer Mr. May joined NeoStem in 2003 and was appointed CFO in 2006 following the company's acquisition of NS California where he had served as CFO and then CEO. Previously, from 2000 to 2003, Mr. May served as the CFO of Saronyx, Inc., a company focused on developing productivity tools and secure communication systems for research scientists. From 1998 to 2000, Mr. May served as the Senior Vice President, Finance and Chief Financial Officer of Biosource International, Inc., a provider of biologic research reagents and assays. He is the former Treasurer of Amgen where he served in roles of increasing responsibility from 1983 to 1998, including as Corporate Controller (1983 to 1988), Vice President/Corporate Controller/Chief Accounting Officer (1988 to 1997), and Vice President/Treasurer (1997 to 1998). Mr. May received a Bachelor of Science degree in Business Administration & Accounting from the University of Missouri.

- 13. FIGURE 7: NeoStem, Inc. Income Statement ($MMs) 2008 2009 1Q10 2Q10 3Q10 4Q10 2010 1Q11 2Q11 3Q11E 4Q11E 2011E 2012E 2013E 2014E 2015E Revenue Pharmaceutical product sales 0.0 11.4 15.8 19.4 16.4 18.1 69.6 18.1 16.2 18.0 18.5 70.8 0.0 0.0 0.0 0.0 Stem cell service revenue 0.1 0.2 0.1 0.1 0.1 0.0 0.2 1.5 2.3 2.6 3.1 9.5 12.0 15.0 20.0 25.0 Total Revenue 0.1 11.6 15.8 19.4 16.5 18.1 69.8 19.6 18.5 20.6 21.6 80.3 12.0 15.0 20.0 25.0 Cost of goods sold 0.0 9.7 10.9 12.9 11.2 14.7 49.7 14.3 13.5 15.0 15.8 58.6 11.2 13.2 16.4 19.5 Gross Profit 0.1 1.9 5.0 6.5 5.2 3.4 20.2 5.3 4.9 5.6 5.8 21.7 0.8 1.8 3.6 5.5 Operating Expenses R&D 0.8 4.3 1.3 2.1 1.7 2.6 7.7 2.9 2.4 2.4 2.5 10.2 8.1 8.9 9.8 10.8 SG&A 8.5 23.4 6.3 7.9 9.3 7.9 31.3 10.4 12.6 12.8 13.1 49.0 9.8 10.8 11.8 13.0 Total Operating Expenses 9.3 27.7 7.6 10.0 11.0 10.5 39.0 13.3 15.0 15.3 15.6 59.1 17.9 19.7 21.7 23.9 Operating Income (Loss) (9.2) (25.9) (2.6) (3.5) (5.7) (7.0) (18.9) (8.0) (10.0) (9.7) (9.7) (37.4) (17.1) (17.9) (18.1) (18.4) Interest income 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.1 0.1 0.0 0.0 0.1 0.1 Interest expense (0.0) (0.0) (0.0) (0.0) (0.0) (0.5) (0.5) (0.9) (1.0) (1.0) (1.0) (3.9) 0.0 0.0 0.0 0.0 Other income (expense) 0.0 (0.0) (0.2) 0.1 0.0 0.5 0.5 (0.3) 0.6 0.0 0.0 0.3 0.0 0.0 0.0 0.0 Total other income (expense) (0.0) (0.0) (0.2) 0.1 0.0 0.0 0.0 (1.1) (0.4) (1.0) (0.9) (3.4) 0.0 0.0 0.1 0.1 Net Income Before Taxes (9.2) (25.9) (2.8) (3.4) (5.7) (7.0) (18.8) (9.1) (10.4) (10.7) (10.7) (40.9) (17.1) (17.9) (18.0) (18.3) Provision (benefit) for income taxes 0.0 0.0 0.5 0.4 0.3 (0.6) 0.6 0.6 0.1 0.0 0.0 0.7 0.0 0.0 0.0 0.0 Tax rate 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% Net Income (Loss) (9.2) (25.9) (3.3) (3.8) (6.0) (6.4) (19.4) (9.7) (10.5) (10.7) (10.7) (41.6) (17.1) (17.9) (18.0) (18.3) Attributable to non-controlling interest 0.0 0.2 1.3 1.6 1.1 (0.2) 3.9 0.5 0.1 0.2 0.2 0.9 0.0 0.0 0.0 0.0 Preferred dividends 0.0 5.6 0.1 0.1 0.0 0.1 0.2 0.2 0.2 0.2 0.2 0.8 0.8 0.8 0.8 0.8 Net Loss attributable to NBS (9.2) (31.8) (4.7) (5.4) (7.1) (6.3) (23.5) (10.4) (10.8) (11.1) (11.1) (43.3) (17.8) (18.7) (18.7) (19.0) EPS Basic ($1.53) ($2.44) ($0.12) ($0.11) ($0.13) ($0.10) ($0.46) ($0.14) ($0.13) ($0.12) ($0.12) ($0.50) ($0.18) ($0.18) ($0.17) ($0.17) Diluted ($1.53) ($2.44) ($0.12) ($0.11) ($0.13) ($0.10) ($0.46) ($0.14) ($0.13) ($0.12) ($0.12) ($0.50) ($0.18) ($0.18) ($0.17) ($0.17) Weighted shares outstanding Basic 6.1 13.0 40.0 48.8 56.8 61.0 51.6 73.7 80.6 94.5 94.7 85.8 96.6 106.5 108.6 110.8 Diluted 6.1 13.0 40.0 48.8 56.8 61.0 51.6 73.7 80.6 94.5 94.7 85.8 96.6 106.5 108.6 110.8 Cash Flow GAAP Net Income (9.2) (31.8) (4.7) (5.4) (7.1) (6.3) (23.5) (10.4) (10.8) (11.1) (11.1) (43.3) (17.8) (18.7) (18.7) (19.0) Depreciation and amortization 0.1 0.7 0.8 0.7 1.1 2.6 5.1 2.2 2.4 2.4 2.4 9.3 9.3 9.3 9.3 9.3 Stock Based Compensation 3.9 12.3 2.1 2.3 3.1 0.5 7.9 2.0 4.6 2.0 2.0 10.7 3.0 3.0 3.0 3.0 Other adjustments 0.5 10.4 (0.7) 1.6 3.3 (2.1) 2.1 (4.1) 0.7 0.0 0.0 (3.4) 0.0 0.0 0.0 0.0 Operating Burn (4.7) (8.4) (2.6) (0.9) 0.3 (5.3) (8.5) (10.2) (3.1) (6.7) (6.7) (26.6) (5.5) (6.3) (6.4) (6.7) Cash at start of period 2.3 0.4 7.2 11.4 11.0 4.1 7.2 15.6 9.4 4.9 13.4 15.6 6.7 1.3 25.0 18.6 Cash from operations (4.7) (8.4) (2.6) (0.9) 0.3 (5.3) (8.5) (10.2) (3.1) (6.7) (6.7) (26.6) (5.5) (6.3) (6.4) (6.7) Cash from investing (0.0) (2.7) (4.6) (3.4) (3.0) (6.1) (17.1) (3.1) (3.3) 0.0 0.0 (6.4) 0.0 0.0 0.0 0.0 Cash from financing 2.9 17.8 11.5 3.7 (4.2) 22.9 33.9 7.1 1.8 15.3 24.1 0.0 30.1 0.0 0.0 Shares issued 13.8 8.0 Price per share 1.2 4.0 Effect of Fx 0.0 0.0 0.0 0.1 0.0 0.1 0.2 0.0 0.1 0.0 0.1 0.0 0.0 0.0 0.0 Cash at end of period 0.4 7.2 11.4 11.0 4.1 15.6 15.6 9.4 4.9 13.4 6.7 6.7 1.3 25.0 18.6 12.0 Source: Company reports and JMP Securities, LLC 13

- 14. 14 JMP FACTS AND DISCLOSURES Analyst Certification: The research analyst(s) who prepared this report does/do hereby certify that the views presented in this report are in accordance with my/our personal views on the securities and issuers discussed in this report. As mandated by SEC Regulation AC no part of my/our compensation was, is or will be directly or indirectly related to the specific views or recommendations expressed herein. This certification is made under the obligations set forth in SEC Regulation AC. Any other person or entity may not use it for any other purpose. This certification is made based on my/our analysis on the date of this report’s publication. I/We assume no obligation to update this certification to reflect any facts, circumstances or events that may subsequently come to my/our attention. Signed Jason N. Butler, PhD Publicly Traded Companies Mentioned in This Report (as of September 15, 2011): Company Disclosures NeoStem, Inc. (1,3) JMP Securities Disclosure Definitions: (1) JMP Securities currently makes a market in this security. (2) JMP Securities has received compensation for banking or other services rendered to this company in the past 12 months. (3) JMP Securities was manager or co-manager of a public offering for this company in the past 12 months. (4) JMP Securities participated as an underwriting or selling group member of a public offering by this company in the past 12 months. (5) JMP Securities and/or its affiliates have obtained a position of at least 1% in the equity securities of this company during the ordinary course of its/their business/investments. (6) An officer of JMP Securities is a director or officer of this company. (7) The analyst covering this company (as defined in NASD Rule 2711) or a member of the analyst's household has a financial interest in this company. (8) The analyst covering this company or a member of the analyst’s household serves as an officer, director, or advisory board member of this company. (9) The analyst covering this company has had discussions of employment with the company. JMP Securities Investment Opinion Definitions: Market Outperform (MO): JMP Securities expects the stock price to outperform relevant market indices over the next 12 months. Market Perform (MP): JMP Securities expects the stock price to perform in line with relevant market indices over the next 12 months. Market Underperform (MU): JMP Securities expects the stock price to underperform relevant market indices over the next 12 months. JMP Securities Research Ratings and Investment Banking Services: (as of July 7, 2011) # Co's % # Co's % # Co's Receiving % of Co's Regulatory Under of Regulatory Under of IB Services in With This JMP Rating Equivalent Coverage Total Rating Coverage Total Past 12 Months Rating Market Outperform Buy 208 66% Buy 208 66% 54 26% Market Perform Hold 106 33% Hold 106 33% 16 15% Market Underperform Sell 3 1% Sell 3 1% 0 0% TOTAL: 317 100% 317 100% 70 22% Stock Price Chart of Rating and Target Price Changes: Note: First annotation denotes initiation of coverage or 3 years, whichever is shorter. If no target price is listed, then the target price is N/A. In accordance with NASD Rule 2711, the chart(s) below reflect(s) price range and any changes to the rating or price target as of the end of the most recent calendar quarter. The action reflected in this note is not annotated in the stock price chart. Source: Jovus and JMP Securities. JMP Disclaimer: JMP Securities LLC (the “Firm”) compensates research analysts, like other Firm employees, based on the Firm’s profitability, which includes revenues from the Firm’s institutional sales, trading, and investment banking departments as well as on the quality of the services and activities performed that are intended to benefit the Firm’s institutional clients. These data have been prepared by JMP Securities LLC for informational purposes only and are based on information available to the public from sources that we believe to be reliable, but we do not guarantee their accuracy or completeness. Any opinions and projections expressed herein reflect our judgment at this date and are subject to change without notice. These data are neither intended nor should be considered as an offer to sell or a solicitation or a basis for any contract for the purchase of any security or other financial product. JMP Securities LLC, its affiliates, JMP Group LLC, Harvest Capital Strategies LLC, and their respective partners, directors, officers, and associates may have a long or short position in, may act as a market maker for, or may purchase or sell a position in the securities mentioned herein. JMP Securities LLC or its affiliates may be performing, have performed, or seek to perform investment banking, advisory, or other services and may have acted as manager or co-manager for a public offering of securities for any company mentioned herein. The reader should assume that JMP Securities LLC will solicit business from the company covered in this report. © Copyright 2011. All rights reserved by JMP Securities LLC. JMP Securities LLC is a member of FINRA, NYSE Arca, NASDAQ, and SIPC.

- 15. JMP SECURITIES LLC 600 Montgomery Street, Suite 1100, San Francisco, CA 94111-2713, www.jmpsecurities.com Peter V. Coleman Director of Equity Research (415) 869-4455 Financial Services Capital Markets David Trone (212) 906-3525 Steven Fu, CFA (212) 906-3548 Chris Ross, CFA (212) 906-3532 Consumer & Specialty Finance, Commercial Banks John Hecht (415) 835-3912 Kyle M. Joseph (415) 835-3940 Financial Processing & Outsourcing David M. Scharf (415) 835-8942 Kevane A. Wong (415) 835-8976 Insurance Matthew J. Carletti (312) 768-1784 Christine Worley (312) 768-1786 Market Structure David M. Scharf (415) 835-8942 Kevane A. Wong (415) 835-8976 Residential & Commercial Real Estate Finance Steven C. DeLaney (404) 848-7773 Trevor Cranston, CFA (415) 869-4431 Trevor Cranston, CFA (415) 869-4431 Healthcare Biotechnology Charles C. Duncan, PhD (212) 906-3510 Jason N. Butler, PhD (212) 906-3505 Gena H. Wang, PhD (212) 906-3528 Liisa A. Bayko (312) 768-1785 Heather Behanna, PhD (312) 768-1795 Jason N. Butler, PhD (212) 906-3505 Healthcare Facilities & Services Peter L. Martin, CFA (415) 835-8904 Aaron Hecht (415) 835-3963 Healthcare Services Constantine Davides, CFA (617) 235-8502 Tim McDonough (617) 235-8504 Medical Devices J. T. Haresco, III, PhD (415) 869-4477 Real Estate Hotels & Resorts William C. Marks (415) 835-8944 Housing & Housing Supply Chain Michael G. Smith (415) 835-8965 Land Development Michael G. Smith (415) 835-8965 Real Estate & Property Services William C. Marks (415) 835-8944 Real Estate Technology Michael G. Smith (415) 835-8965 REITs: Healthcare Peter L. Martin, CFA (415) 835-8904 Aaron Hecht (415) 835-3963 REITs: Office & Industrial Mitch Germain (212) 906-3546 Technology Clean Technology Alex Gauna (415) 835-8998 Semiconductors Alex Gauna (415) 835-8998 Matt Danziger (415) 869-4454 Software Patrick Walravens (415) 835-8943 Greg McDowell (415) 835-3934 Greg McDowell (415) 835-3934 For Additional Information Mark Lehmann President, JMP Securities (415) 835-3908 Erin Seidemann Vice President, Publishing (415) 835-3970