Forum Journal (Winter 2014): Local Historic Preservation Tax Incentives

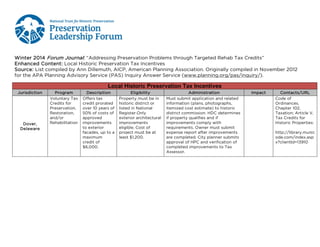

- 1. Winter 2014 Forum Journal: “Addressing Preservation Problems through Targeted Rehab Tax Credits” Enhanced Content: Local Historic Preservation Tax Incentives Source: List compiled by Ann Dillemuth, AICP, American Planning Association. Originally compiled in November 2012 for the APA Planning Advisory Service (PAS) Inquiry Answer Service (www.planning.org/pas/inquiry/). Local Historic Preservation Tax Incentives Jurisdiction Dover, Delaware Program Voluntary Tax Credits for Preservation, Restoration, and/or Rehabilitation Description Offers tax credit prorated over 10 years of 50% of costs of approved improvements to exterior facades, up to a maximum credit of $6,000. Eligibility Property must be in historic district or listed in National Register.Only exterior architectural improvements eligible. Cost of project must be at least $1,200. Administration Must submit application and related information (plans, photographs, itemized cost estimate) to historic district commission. HDC determines if property qualifies and if improvements comply with requirements. Owner must submit expense report after improvements are completed. City planner submits approval of HPC and verification of completed improvements to Tax Assessor. Impact Contacts/URL Code of Ordinances. Chapter 102, Taxation; Article V, Tax Credits for Historic Properties: http://library.munic ode.com/index.asp x?clientId=13910

- 2. Historic Residence Tax Credit Town of East Greenwich, Rhode Island Historic Properties Tax Credit Holly Springs, Georgia Provides for up to 20% reduction in property tax liability each year, equal to 4% of costs, up to a maximum of $8,000, for 5 years for property owners who incur substantial maintenance or rehab costs. Offers tax credit equal to cost of improvements for properties in historic district. Balance may be applied in following year for up to 5 years. Historic residences individually listed or contributing structures in historic districts. Any maintenance or rehab work consistent with character in accordance with Commission guidelines. Restrictive covenant preserving historic character must be granted to Town. Owner applies to Commission for tax relief on completion of work; Commission approves and makes recommendation to Town Assessor. Commission establishes guidelines; Assessor promulgates all application and certification forms. Town Code Sections 227-29 et seq.: Any property within the historic district. Certificate of appropriateness required from historic commission. Cost of work must be at least $5,000; work done by owner may be included with estimate from contractor to establish value. Owner must apply to city council with Certificate of Appropriateness (CoA), description of work done, and evidence of costs. City Code Section 70-81 et seq.: http://ecode360. com/9713273?hig hlight=tax%20cre dit#9713273 http://library.mu nicode.com/inde x.aspx?clientId=1 3156

- 3. Local Tax Abatement Ithaca, New York Local Property Tax Abatement Jackson, Mississippi State-enabled program allows 10-year window of tax relief after investment in repairs and renovations: no tax increase for 5 years, followed by 20% increase each of the next 5 years until by year 10, the property is taxed at full postimprovement value. For properties designated as landmarks or part of historic districts, owners may apply for 7year exemption from ad valorem taxes on any increase in assessment due to property improvements. Owners of locally designated historic structures who pay property tax in the city are eligible; eligible projects are those improving exteriors of buildings only; improving historic interiors open to the public; those for which 20% of total cost is attributable to exterior work or structural stability; or those returning to use a building that has been vacant for at least 2 years. Certificate of appropriateness must be obtained for improvements. Meet with contact at Dept. of Planning and Development to obtain application for abatement, schedule consultation with Tompkins County Department of Assessment. Project must be approved by Ithaca Landmarks Preservation Commission. Leslie Chatterton at Dept. of Planning and Development City tax collector must verify that improvements have been made, and historic preservation commission must verify that CoA was obtained and improvements made accordingly. Application is then submitted to city council. Historic Preservation Ordinance, Section 70-7: http://www.ci.ith aca.ny.us/boards committees/ilpc/i ndex.cfm http://www.egov link.com/public_ documents300/it haca/published_ documents/Boar ds_and_Committ ees/Ithaca_Land marks_Preservati on_Commission/ Tax_Incentives/L ocal_Historic_Pre servation_Tax_In centives.pdf http://www.jacks onms.gov/assets /planning/HISTO RIC%20PRESERV ATION%20ORDI NANCE.PDF

- 4. Mills Act Historical Property Contract Program Assesses historic property with Income Approach to Value rather than Market Approach Los Angeles, California Miami-Dade County, Florida Miami-Dade County Historic Preservation incentive Provides 10year county property tax abatement on improvements to historic buildings; program "freezes" taxable rate For qualified historic properties (locally designated or contributing property singlefamily residences with assessment of less than $1.5M and income-producing multifamily/comm ercial/ industrial properties with assessment of less than $3M) that need significant rehab whose owners pledge to rehab and maintain them for the life of the 10-year contract Improvements to historic properties Properties must apply with application provided and prepare a Historic Structure Report. 600 properties have benefitted from the program Lambert Giessinger of the Department of City Planning's Office of Historic Resources at (213) 978-1183 or lambert.giessinge r@lacity.org. http://www.pres ervation.lacity.or g/node/464 Application must be filed with Miami Beach Historic Preservation Board, processed by Miami-Dade County Office of Historic Preservation. Owner enters into 10-year maintenance/protection contract with the County Commission. Miami-Dade County Office of Historic Preservation: www.miamidade.gov/hp/ 305.375.3471 http://web.miami beachfl.gov/econ dev/scroll.aspx?i d=44910

- 5. Taxes approved historic buildings at 50% of their value. Property must be classified as historic and must meet state and local ordinance requirements for historic buildings. Owner submits historical tax deferment application to the Wake County Revenue Department. Local Tax Exemption for Substantial Rehabilitation Raleigh, North Carolina Historical Building Deferred Tax Program Freezes city property taxes at assessed value prior to rehab for 10 years OR 5 Zero / 5 Fifty program offers no city taxes for 5 years, and 50% of postrehab appraisal for the next 5 years. Subtracts rehab costs of rehabbed historic building from assessed value. For properties undergoing "substantial rehab," including improvements that extend the life of a building. Residential properties may chose either option; commercial properties get 5 Zero/ 5 Fifty program. Owner must submit Certification application for approval by Historic and Design Review Commission. After completion of construction, Verification application approved by HDRC after site visit by Office of Historic Preservation staff. OHP notifies Bexar County Appraisal District of approved exemption. For designated historic buildings undergone approved rehab within 2 years prior to application date; rehab cost are based on "qualified rehabilitation expenditures" and must equal or exceed 25% of assessed value of the improvements. Applications filed with King County Department of Assessment; Assessor transmits to Landmarks Preservation Board for Review; owner signs 10-year contract with Board. San Antonio, Texas Special Valuation of Historic Properties Seattle, Washington Raleigh Historic District Commission; applications obtained from the Wake County Revenue Department, 919856-5400. http://www.sana ntonio.gov/histor ic/incentives.aspx http://www.sana ntonio.gov/histor ic/Docs/Brochur es/Tax_incentive _brochure-82010.pdf http://www.seatt le.gov/neighborh oods/preservatio n/incentives_stat e.htm

- 6. Smithfield Historic Area Revitalization Plan (S.H.A.R.P) Smithfield, Town of (Virginia) Historic Ad Valorem Tax Exemption Program Tampa, Florida Before/after appraised tax values determined by Johnston County Tax Office; property owner "granted" back the difference between the original and new taxes paid for 5 years after project completion. State-enabled program that allows owner to apply for ad valorem tax exemption applicable to 100% of the assessed value of qualified improvements for City and County taxes for 10 years. For rehab of older buildings or infill growth with new commercial development in the Downtown historic district. Signed statement that project would not have been considered had it not been for the “S.H.A.R.P.” Johnston County, Town of Smithfield, and Downtown Smithfield Development Corporation. For locallandmarkdesignated or contributing buildings. Must receive a preconstruction or pre-rehabilitation approval and must spend at least $10,000 on improvements. Submit PreConstruction/Rehabilitation approval form to Tampa Historic Preservation and Urban Design Office for review by ARC/BLC. Hillsborough County Property Appraiser's Office performs baseline appraisal. Owner must then submit Request for Review of Completed Work, reviewed by ARC/BLC, and Appraiser's Office conducts completed improvement assessment. If approved, applicant enters into Historic Preservation Property Tax Exemption Covenant with City and County for 10 years. Contact Chris Johnson, Exec. Dir. SDDC, dsdcchris@aol.co m http://downtown smithfield.com/S HARP.pdf City of Tampa Historic Preservation and Urban Design http://www.tamp agov.net/dept_Hi storic_Preservati on/programs_an d_services/

- 7. Tax Abatement for Historic Properties Wilmington, Delaware Substantial Rehabilitation Incentives Winchester, Virginia In historic districts, exempts increased value resulting from rehabilitation of historic structures for 10 years; maintains preconstruction tax rate for 5 years for new compatible infill construction. Exempts increased value resulting from rehabilitation of historic structure for 10 years. Properties in city historic districts or National Register properties or districts are eligible. Application form from Department of Finance, Division of Revenue. Must make appointment with Department of Planning Historic Staff to discuss project; staff confirms improvements and sends approval to Division of Revenue to complete the application. Residential buildings in historic district at least 25 years old, improved to increase assessed value by 40% without increasing SF by more than 15%; commercial/indust rial buildings in historic district at least 25 years old, improved to increase assessed value by 60% without increasing SF by more than 15%. Must apply on form provided by Commissioner of the Revenue before the work is done. Property must be assessed before and after improvements. Department of Historic Preservation http://www.ci.wil mington.de.us/go vernment/preser vation http://www.ci.wil mington.de.us/do cs/25/taxabatement-forhistoricproperties.pdf A number of recently rehabbed buildings in the downtown have taken advantage of this program: http://ww w.winchest erva.gov/e con/docu ments/revi talizationmarketing. pdf City Code Section 27-28, http://www.winc hesterva.gov/doc uments/governm ent/city_code/C H27.pdf http://www.winc hesterva.gov/pla nning/documents /incentivesbrochure.pdf

- 8. Local Historic Preservation Tax Credits – Maryland Jurisdiction Program Description Eligibility Administration Historic Preservat ion Tax Credit Offers tax credit equal to 10% of amount of preservation/rehab costs of exterior improvements, up to $150,000/year. Designated City Landmarks with more than $5,000 of exterior improvements. Tax credit for historic restorati on and preservat ion Allows for 10% tax credit on property taxes on restoration / preservation of historic structures in district or designated site; 5% credit for new compatible construction adjacent to historic structure in district or designated site. Only expenses for exterior work are eligible. Work must be done in accordance with Town preservation guidelines. Submit application to Historic Preservation Commission; if approved, submit application to the Chief of Historic Preservation and submit other needed permit requests to the Director of Neighborhood and Environmental Programs. After completion, submit receipts to the Chief of HP, who along with Director of NEP notifies Director of Finance to apply approved credit. If credit exceeds tax bill, the balance may be carried forward up to 5 years. Tax credit application submitted with certificate of approval application; Historic Preservation Commission makes determination on eligibility and historic worth of structure. Approved amount forwarded to Town Finance Department. Annapolis Town of Bel Air Impact Contacts/URL City Code Section 6.04.230 http://library.munic ode.com/index.aspx ?clientId=16754 Town Code Section 50-4, http://www.ecode3 60.com/BE2811

- 9. Historic Preservat ion Tax Credit Allows for tax credit of 10% of cost of improvements to structures in historic districts or designated landmarks. Historic Property Tax Credit County property tax credit of up to 10% of the properly documented restoration and preservation expenses of structure with historical value. Calvert County Cecil County Structures of historic or architectural value located within any historic district or designated as a landmark within the County, Chesapeake Beach Town, or North Beach Town. External work, structural repair, floor repair, fireplace/chimne y repair, other items as approved. Plumbing, wiring, HVAC NOT eligible. Historic District Commission determines which structures are eligible. Receipts for expenses to be filed with Calvert County Historic District Commission on forms provided. Credit may be carried forward for 4 tax years. Credit may only be applied toward the current year's property tax; credit amount shall not exceed the amount of tax due. County may require structure to be periodically exhibited for public education. HDC must provide tax credit report to County Commiss ion each year. County Code. Chapter 136, Taxation; Article I, Historic Preservation Tax Credit, http://ecode360.co m/15523917 County Code Sections 337-6 through 337-10. http://www.ecode3 60.com/CE0748

- 10. Historic Property Tax Credit Provides 5-year tax credit based on increase in assessments for approved improvements for properties in historic districts Locally designated properties in historic districts of the City of Frederick, the Town of New Market, or those listed in the County Register. Tax credit for restorati on costs for historic landmark s; tax credit for "eligible improve ments" to historic landmark s Provides for tax credit of 10% of properly documented restoration expenses; cannot exceed $7,500; may be taken for 5 years. Ordinance also provides for eligible improvements credit equal to increase in property tax due to value of improvements. May receive credit for up to 5 years. Offers town property tax credit of 100% in 1st and 2nd year after increase in assessment of structures in historic districts Structures designated as county historic landmarks Frederick County Harford County Middletown Historic District Tax Credit For existing structures located in historic districts. County Zoning Administrator or municipal historic planner determines if property is within historic district. Supervisor of Assessments certifies amount of improvements subject to credit. Office of Board of County Commissioners computes tax credit amount, maintains file. Credit allowable for 5 years, taxpayer must apply for credit for each year. Owner must obtain certification from Historic Preservation Commission that restoration is compatible, provide necessary information to Department of Treasury. http://frederickcou ntymd.gov/index.as px?NID=4168 For City of Frederick, contact Dept. of Economic Development at 301-600-6360. Application form at http://cityoffrederic k.com/DocumentVi ew.aspx?DID=791 Owner must file with Town Office an application each taxable year. Preservation Tax Credit Commission established to review and approve applications. Town Code Section 3.12.040, http://library.munic ode.com/index.aspx ?clientId=16486 http://www.harford countymd.gov/Plan ningZoning/index.cf m?ID=55 County Code Sections 12343.5.1, 13-43.5.1, http://www.ecode3 60.com/HA0904

- 11. due to improvements; 80% in 3rd year; 60% in 4th year; 40% in 5th year. Historic Preservat ion Tax Credit Allows for tax credit of 10% of qualified expenses approved by Director for County real property taxes only. Section 9-204 Real Property Tax Credit for Restorati on and Preservat ion Allows for tax credit of 10% of cost of improvements to structures in historic districts or designated landmarks. Montgomery County St. Mary's County Property must be historic site or in historic district. Work must be subject of approved historic area work permit or ordinary maintenance expenses over $1,000. New construction/ad ditions NOT eligible. Work must be done by licensed contractor. Historic landmark designated by County or structures with historic/architec tural value in historic districts. Work must be approved in accordance with Sec. of the Interior Standards; value of owner work Submit application to Historic Preservation Commission, including receipts for qualified expenses. Director approves application and amount. Historic Preservation Tax Credit Certificate is issued. Code of Montgomery County Regulations. Chapter 52, Taxation; Article VI, Historic Preservation Tax Credit, http://www.amlegal .com/library/md/m ontgomeryco.shtml Submit application to Historic Preservation Commission; after completion, submit receipts to Commission, which submits approved amount to MDAT. Credit approved by resolution of the Commission. County Code. Chapter 267, Taxation, General; Article XXIII, Historic Preservation Tax Credit. Available at http://library.munic ode.com/index.aspx ?clientId=14466 .

- 12. not eligible, but cost of materials is; eligible expenses include architectural and other fees, replacement/rep air of structure, roof, floors, foundation, chimneys/firepla ces, exterior paint, siding and exterior features, materials.