Top MI Decision Errors: 1st Quarter 2012 (Article)

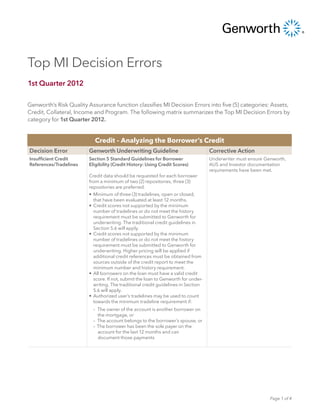

- 1. Top MI Decision Errors 1st Quarter 2012 Genworth’s Risk Quality Assurance function classifies MI Decision Errors into five (5) categories: Assets, Credit, Collateral, Income and Program. The following matrix summarizes the Top MI Decision Errors by category for 1st Quarter 2012. Credit – Analyzing the Borrower’s Credit Decision Error Genworth Underwriting Guideline Corrective Action Insufficient Credit Section 5 Standard Guidelines for Borrower Underwriter must ensure Genworth, References/Tradelines Eligibility (Credit History: Using Credit Scores) AUS and Investor documentation requirements have been met. Credit data should be requested for each borrower from a minimum of two (2) repositories, three (3) repositories are preferred. • Minimum of three (3) tradelines, open or closed, that have been evaluated at least 12 months. • Credit scores not supported by the minimum number of tradelines or do not meet the history requirement must be submitted to Genworth for underwriting. The traditional credit guidelines in Section 5.6 will apply. • Credit scores not supported by the minimum number of tradelines or do not meet the history requirement must be submitted to Genworth for underwriting. Higher pricing will be applied if additional credit references must be obtained from sources outside of the credit report to meet the minimum number and history requirement. • All borrowers on the loan must have a valid credit score. If not, submit the loan to Genworth for under- writing. The traditional credit guidelines in Section 5.6 will apply. • Authorized user’s tradelines may be used to count towards the minimum tradeline requirement if: – The owner of the account is another borrower on the mortgage, or – The account belongs to the borrower’s spouse, or – The borrower has been the sole payer on the account for the last 12 months and can document those payments Page 1 of 4

- 2. Assets – Analyzing the Borrower’s Assets Decision Error Genworth Underwriting Guideline Corrective Action Less Than Required Reserve Requirements Underwriter must ensure Genworth, Reserves After Closing AUS and Investor documentation Primary Purchase requirements have been met for • Two (2) months verification and documentation • 1 unit with > $417,000: Six (6) months of assets. AUS assumes any assets Insufficient Assets to Primary Rate/Term Refinance required will be verified and Close and/or Pay Off • DU & LP: determined by AUS documented in file. Required Obligations • 1 unit with > $417,000: Six (6) months Example 1: The bank printouts Primary Cash-out Refinance provided as documentation of assets • DU & LP: determined by AUS did not contain the bank name and were not signed or dated by a bank Primary Residence – 2 units official. Rental Income used to qualify – Six (6) months Example 2: Borrower is short cash Rental Income is not used to qualify to close and 2 months of required • Purchase: Two (2) months reserves. Per the HUD-1 • Refinance: determined by AUS Settlement Statement, borrower Second Homes needed $17,502.75 in funds to close • Two (2) months the transaction and $1,867.80 for 2 months reserves. Verified funds in Reserve Requirements – Primary Residence file are for $15,361.39. Borrower is Conversion short $4,009.16 in cash to close and Current Primary Pending Sale reserves. • 6 months for both properties Example 3: Missing documentation • Reserves may be reduced to 2 months for both to evidence source of a large deposit properties if there is a minimum 30% documented in the amount of $2,000.00. equity in the existing property The underwriter must investigate any Primary Conversion to Second Home indications of borrowed funds. This • DU & LP: determined by AUS but no less than includes recently opened accounts, 2 months recent large deposits, or account • For all other loans: Six (6) months reserves for balances that are considerably larger each property than the average balance over the • Reserves may be reduced to 2 months for both previous few months. The underwriter properties if there is a minimum 30% documented must obtain a written explanation of equity in the existing property the source of funds from the borrower, and must verify the source Primary Conversion to Investment Property of funds. • 6 months for both properties Assets Not Documented Section 1.6 Approved Automated Underwriting as Required by Program Systems or AUS Guidelines • Genworth will insure most loans that are processed through Fannie Mae’s Desktop Underwriter (DU) and Freddie Mac’s Loan Prospector (LP) automated Source of Funds Not underwriting systems (Agency AUS). Our approval Adequately or Properly is conditional on the loan being documented Documented for Large according to the standards in the Agency AUS Deposits finding or feedback. (Refer to Section 1.6.1 for DU & LP requirements and Genworth Guideline overlays) Section 3 Documentation Requirements Genworth generally accepts the documentation set from DU and LP with a few overlays. Our policy for manually underwritten loans is to: • Follow Fannie’s guidelines when Fannie is the investor or the Fannie Selling Guide is your standard guideline set. • Follow Freddie’s guidelines when Freddie is the investor or the Freddie Sellers Guide is your standard guideline set. • Follow the more conservative of the agencies’ guidelines for all other situations, unless a specific agency’s guideline is noted to follow for all others. (Also, refer to Section 5 for additional details on Page 2 of 4 Asset documentation)

- 3. Collateral – Appraisal and Property Analysis Decision Error Genworth Underwriting Guideline Corrective Action Appraisal Form Not Section 1 Introduction Underwriter must ensure that Obtained in Accordance Genworth follows Agency Appraisal Standards and AUS, Genworth and Investor with Program or AUS Uniform Standards of Professional Appraisal Practice documentation requirements Requirements (USPAP) guidelines. When Genworth’s underwriting have been met. manual is “silent” and does not address a guideline, • If the appraisal is incomplete, the the lender must follow Agency Standard guidelines. underwriter should request the If you typically adhere to Fannie guidelines for under- missing documentation and review writing, follow Fannie’s Selling Guide when we are prior to issuing loan approval. silent. Likewise, follow Freddie’s Sellers Guide guide- • The lender has ultimate lines if you typically adhere to Freddie guidelines. For responsibility of ensuring there are all other situations, follow the more conservative of the adequate processes in place to agencies guidelines. determine the accuracy and • Interior/Exterior review (URAR) or 2055 Exterior completeness of the appraisal Only, per guidelines below. report. • The appraisal form and applicable addenda, such as • The appraisal should fully analyze 1004MC/Form 71, must meet Agency requirements the neighborhood, site, physical • A Field Review (Form 2000/Form 1032) is required characteristics, and condition of the for loan amounts > $625,500. property. • Use of automated valuation models (AVMs), PIWs, • All adjustments must be fully PIAs and desk reviews to obtain property values are supported with detailed analysis ineligible. from the appraiser. • All property evaluations must be completed by a • Sales agreements must be licensed or certified appraiser. reviewed thoroughly to determine • Appraisals may be 180 days, for newly constructed if consistent with appraisal: homes, however, a re-certification of value must be - Parties to transaction provided if the appraisal is more than 120 days. If the - Closing costs value has declined, a new, full appraisal is required. - Personal property • HARP-Eligible Refinance (Same Servicer): appraisal may be 180 days. Effective 5/2/11 • Form 2055 Exterior Only may be obtained if permitted by DU or LP for the loan transaction • A 2055 may not be used if the property is currently in foreclosure or is an investor/institution/bank- owned REO; a full URAR is required. The appraisal must be upgraded to a full URAR by the lender, or the upgrade may be requested by Genworth, if any of the following conditions exist: • Inspection of exterior of dwelling is reported to be or appears to be in less than average condition • Any 2055 ratings or narrative indicate adverse conditions • The contract or home inspection (if included) indicate repairs are needed Acreage Guidelines Section 6 Standard Guidelines for Property Not Met and Appraisals • We require properties with more than 10 acres of land to be submitted to Genworth for underwriting consideration. Page 3 of 4

- 4. Collateral – Appraisal and Property Analysis Decision Error Genworth Underwriting Guideline Corrective Action Verbal VOE Missing, Section 3 Documentation Requirements Underwriter must ensure that Incomplete or Incorrect For DU & LP Loans AUS, Genworth and Investor • Follow the Agency AUS requirements. documentation requirements • Use of a verbal VOE, when determined by an have been met. Agency AUS, as the sole method of documenting employment and income is not permitted. For Manually Underwritten Loans Verbal VOE is required as follows: • Salaried borrowers: dated within 10 days of note date • Self-employed borrowers: dated within 30 days of note date (Also, refer to Section 5 for additional details on Income and Employment Documentation) For More Information Contact us at action.center@genworth.com or 800 444.5664 for questions or to give us feedback. Loan Prospector® is a registered trademark of Freddie Mac. Desktop Underwriter® is a registered trademark of Fannie Mae. 6161144.0412 ©2012 Genworth Financial, Inc. All rights reserved. Page 4 of 4