Understanding the Sales Process

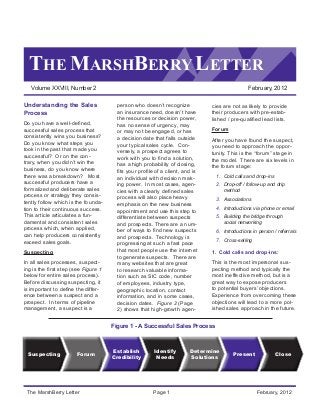

- 1. THE MARSHBERRY LETTER Volume XXVIII, Number 2 February, 2012 The MarshBerry Letter Page 1 February, 2012 Understanding the Sales Process Do you have a well-defined, successful sales process that consistently wins you business? Do you know what steps you took in the past that made you successful? Or on the con- trary, when you didn’t win the business, do you know where there was a breakdown? Most successful producers have a formalized and deliberate sales process or strategy they consis- tently follow which is the founda- tion to their continuous success. This article articulates a fun- damental and consistent sales process which, when applied, can help producers consistently exceed sales goals. Suspecting In all sales processes, suspect- ing is the first step (see Figure 1 below for entire sales process). Before discussing suspecting, it is important to define the differ- ence between a suspect and a prospect. In terms of pipeline management, a suspect is a person who doesn’t recognize an insurance need, doesn’t have the resources or decision power, has no sense of urgency, may or may not be engaged, or has a decision date that falls outside your typical sales cycle. Con- versely, a prospect agrees to work with you to find a solution, has a high probability of closing, fits your profile of a client, and is an individual with decision mak- ing power. In most cases, agen- cies with a clearly defined sales process will also place heavy emphasis on the new business appointment and use this step to differentiate between suspects and prospects. There are a num- ber of ways to find new suspects and prospects. Technology is progressing at such a fast pace that most people use the internet to generate suspects. There are many websites that are great to research valuable informa- tion such as SIC code, number of employees, industry type, geographic location, contact information, and in some cases, decision dates. Figure 2 (Page 2) shows that high-growth agen- cies are not as likely to provide their producers with pre-estab- lished / pre-qualified lead lists. Forum After you have found the suspect, you need to approach the oppor- tunity. This is the “forum” stage in the model. There are six levels in the forum stage: 1. Cold calls and drop-ins 2. Drop-off / follow-up and drip method 3. Associations 4. Introductions via phone or email 5. Building the bridge through social networking 6. Introductions in person / referrals 7. Cross-selling 1. Cold calls and drop-ins: This is the most impersonal sus- pecting method and typically the most ineffective method, but is a great way to expose producers to potential buyers’ objections. Experience from overcoming these objections will lead to a more pol- ished sales approach in the future. Determine Solutions Identify Needs Present Close Establish Credibility ForumSuspecting Figure 1 - A Successful Sales Process

- 2. 5. Social Networking: Some popular social media channels used today are Linke- dIn, Facebook, Google Places, Twitter and Meetup.com. LinkedIn is probably the most business-to-business oriented social media networking used today. These channels allow for warm introduction through brand building. Social media also makes it easy for people to iden- tify what associations potential clients are actively involved in. 6. Introductions in Person: As opposed to level three of introductions via phone or email, your introduction source accom- panies you on the meeting to your potential client. The intro- duction is commonly a lunch or dinner. This goes much deeper than a simple referral. 7. Cross-Selling: This is a form of introduc- tion where another producer introduces you to the prospect through the relationship already built. The credibility stage in the sales process is easier to pass through since your colleague has already built the rapport with the client. We refer to cross-selling as “sofa money.” The money in the sofas is there for the taking, but people don’t seem to care. Similarly, we find there are a lot of cross-selling opportunities that have yet to be exposed. The usual excuse for producers not selling an all-encompassing insurance solution to their client is because of their limited knowl- edge outside their core product expertise. Another common breakdown to successful cross- selling is the insecurity of hurting The MarshBerry Letter Page 2 February, 2012 2. Drop-off / follow-up and drip method: The drop-off/follow up, drip method and associations, involves dropping off an item for the decision maker and fol- lowing up at a later date. The item can be anything to start a conversation such as a book to read or an article from a magazine. The drip method is a technique used to establish underlying dialogue before actually calling or meeting someone. A common example is emailing a suspect a monthly newsletter or articles you find in newspapers. It is much easier to get a suspect engaged if they perceive you as an expert. 3. Associations: Joining an association is a low cost, easy and effective suspecting forum. Get active in local associations to meet suspects and become known within your community. Joining an association helps build the relation- ship through common interests. Just be sure to only join associations that truly have members that are potential opportunities. 4. Introductions Via Phone or Email: Potential clients usually decide early in the sales process whether or not they will ever buy from you. With a strong introduction, suspects do not make an objective evaluation, but rather look to validate what your introduction source said about you. Figure 2 Percentage of Agencies that provide producers with a pre-established / pre-qualified list of leads or prospects Average Agencies High-Growth Agencies Figure 3 Percentage of Agencies that have established internal cross-sell / referral goals between production lines of business Average Agencies High-Growth Agencies 30% 25% 20% 15% 10% 5% 0% 27% 17% 40% 25% 20% 15% 10% 5% 0% 30% 37% 35% 30%

- 3. The MarshBerry Letter Page 3 February, 2012 existing producer-client relation- ships by bringing in an organi- zational counterpart. However, cross-selling remains a successful technique (see Figure 3, Page 2) when an effective communication and education process is involved. Establishing Credibility The next step in our sales process is establishing credibility, which we see as the most difficult of the sales steps to overcome. It takes time to build credibility, yet seconds to destroy it. The potential client will quickly dismiss you if you have not gained their trust or positioned yourself as an industry expert. Branding yourself through public speaking and published industry news is one of the most common ways to get your name in front of a large number of opportunities. A relatively easy and successful tech- nique is writing a monthly newslet- ter specific to the industry being targeted. It can be sent out via mass email or hard copies. Your target audience should be able to relate to your subject matter in the article. Become a trusted advisor through building credibility from actively participating in your chosen associations or other networking groups. The most effective way to establish credibility is to leverage a referral with an existing relation- ship. As mentioned previously, a personal introduction to an oppor- tunity is much more valuable than someone just giving you a name. Identify Needs Once you have established cred- ibility with the decision maker, they should be more forthright with their organizational needs. Infer- ring needs from prior clients in the same industry is a successful tactic to probe their needs. Also, finding obvious pains is a proven tactic for getting prospects to divulge what they expect out of their trusted advisor. Asking ques- tions like “So if your current bro- ker is a 10 out of 10, they must be providing you with a customer perceived value-added service timeline. How often does your broker sit down and review the timeline with you?” Always ask open ended questions and let the customer answer. “What do you really like about your current program or what do you dislike about your current program?” Remember to look beyond price. You need to be competitive, but for now you want additional value to be realized by the prospect. Don’t just be a quoting machine. Always be conscious of the deci- sion maker. A CEO or owner will be concerned about increasing company value, reducing costs, increasing profits and improving processes of the organization. CFOs are typically concerned with lower unit costs, cash flow, increasing profit or coverage liability. The HR department tends to focus on service, reli- ability and supporting his or her team. Figure 4 shows a simpli- fied breakdown of the various decision maker concerns. Determine Solutions After finding out the prospect’s needs, the next step in the sales model is to find solutions to those needs. If there is a market for the risk, communicate the next steps for providing the solution and ask the prospect to confirm that you are solving their needs. This is a very effective tactic used by successful sales people. Whether it be consolidating all their insurance needs under one roof, offering preferred pricing and coverage by having market control with premium carriers, or that your firm employs a full- time safety advisor that allows for more consistent renewal for your clients, always relate your solutions back to the “So what?” mentality. “So what if your agency is local?” “So what if you have been around for 150 years?” How is that a solution to your client’s needs? A few examples of how your agency can provide solutions to build client’s perceived value are: ♦♦ Risk assessment questionnaires and preliminary inspections to evaluate the company’s risks and possible gaps in coverage, if the incumbent doesn’t already do this. ♦♦ Insurance coverage analysis and benchmarking study to compare the client to other companies in their industry. This is a great benefit for the client to know if he is attracting top talent in his industry. Figure 4 Decision Maker Concerns CEO / Owner Increased Company Value Reduced Cost More Profit CFO Lower Unit Cost Cash Flow More Profit Coverage Liability HR Department Service Reliability Time Saving

- 4. ♦♦ An agency offered comprehensive inspection followed by an accident prevention seminar to reduce accidents, as moving carriers no longer impacts consistent risk management. ♦♦ A professional claims management staff that turns claims around two-times faster, allowing the client to re-open for business faster. ♦♦ Continuous risk monitoring during coverage to reduce claim exposure, thus providing for a more consistent renewal. Presentation to Prospect It is now time to deliver what has been agreed to and what has been promised to the prospect. We recommend holding the meet- ing at your offices so you can introduce your team and their rel- ative functions on that prospect’s account. When presenting, show your prospects how your solutions will help them achieve their key The MarshBerry Letter © 2012 Marsh, Berry & Company, Inc. (440) 354-3230 / (800) 426-2774 4420 Sherwin Road / Willoughby, OH 44094 MarshBerry@MarshBerry.com www.MarshBerry.com business goals. It is effective to recap the prospect’s business issues and how your plan solves those concerns. Speak the cus- tomer’s language. If you confuse them with insurance jargon they aren’t familiar with, it may over- whelm them and they will lose interest. Convince your prospect that you are a trusted advisor and ensure that their particular emotional requirements are met. Closing The close occurs when the prospect agrees to buy. If you do not close sales, you are just a professional visitor. Get commitment with regard to your solutions and realize when the potential customer is ready to buy. Do not be afraid to ask for the business at this point. If they do not agree to buy, you have not uncovered all of their needs. Position yourself as a trusted advisor which comes with a long-term and mutually beneficial relationship. Remember that the Don’t Forget to Participate in the Insurance Agency Compensation Survey Compensation typically represents the largest expense of an agency. Thus, it is no surprise that compensa- tion questions are among the most frequently asked questions to the MarshBerry staff. While compensation structures vary from agency to agency, we can identify trends and changes in compensation over time. MarshBerry is currently conducting the 2012 Insurance Agency Compensation Survey, which was included with your January, 2012 issue of The MarshBerry Letter. Your participation is greatly appreciated. The more responses we get, the better the information will be for all of us to use in evaluating current compensation programs. Please go to www.MarshBerry.com for the links to download or complete the survey directly at www.SurveyMonkey.com/s/9ZVKRCW. If you have any questions, please call 440-392-6553 or email Megan@MarshBerry.com. The submission deadline is February 29, 2012. The results of the Compensation Survey will be published in the April 2012 issue of The MarshBerry Letter. Thank you in advance for your help with this very important endeavor. close is the penultimate event; the final event is actually deliver- ing the products and services that will make them successful. If you ever feel like the potential sale is steering the wrong way, it probably is. Maintain control of your sales process by getting back on course. If the prospect tells you just to give them a quote, then you evidently haven’t established credibility and they do not see your value. You need to jump back to the credibility stage and differentiate why you are not just a quoting machine. Control your sales process and you will become a more consis- tent, successful sales person. Justin Berry is Vice President of Sales Management at MarshBerry and can be contacted at 440-220-5431 or Justin.Berry@MarshBerry.com. Jim Wochele is a Sales Management Analyst at MarshBerry and can be contacted at 440-392-6559 or Jim.Wochele@MarshBerry.com.