2014 IMS Asia Pacific Insigh

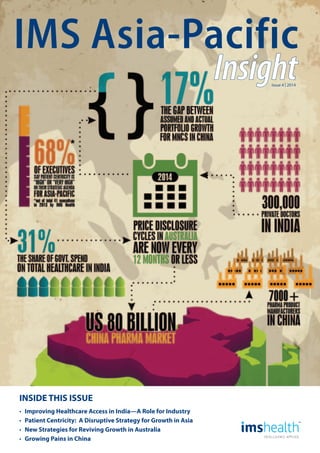

- 1. IMS Asia-Pacific INSIDE THIS ISSUE • Improving Healthcare Access in India—A Role for Industry • Patient Centricity: A Disruptive Strategy for Growth in Asia • New Strategies for Reviving Growth in Australia • Growing Pains in China InsightIssue 4 | 2014

- 2. 2 Welcome Letter.................................................................................................................................................................................3 Improving Healthcare Access in India—A Role for Industry..............................................................................5 In July 2013, the IMS Institute for Healthcare Informatics, India provided a fresh perspective on healthcare access in India – the most comprehensive of its kind since 2004.This article presents the highlights of that study, with suggestions on what the findings mean for life sciences companies already in — or planning to enter — the Indian market. Patient Centricity: A Disruptive Strategy for Growth in Asia .........................................................................11 As MNCs strive to innovate and stay competitive, understanding the patient perspective allows them to“see the world in a different way.”And in Asia, where healthcare is hampered by the“Triple-A”challenges of Affordability, Access and Awareness, understanding and empowering patients will be central to making significant advances. New Strategies for Reviving Growth in Australia ......................................................................................................17 The Australian pharmaceutical market is one of the most mature in the region; it is also one of the toughest. This article looks at the all-too-familiar challenges facing MNCs, and discusses new approaches — even radically different ones — to turn the situation around. Growing Pains in China......................................................................................................................................................23 Although at first glance China would seem to be a world of never-ending opportunities for Pharma companies, there are key variations in growth across regions, therapy areas and drug categories, each of which demands analysis, not assumption. Here, IMS Health experts discuss the variety of options MNCs have to improve their actual performance, ranging across levels of difficulty and the degree of transformation necessary. Contents

- 3. 3 Welcome letter Here in Asia Pacific, IMS Health is committed, as we are elsewhere in the world, to helping our clients anticipate the ever-changing healthcare marketplace. Many events that occurred in 2013 in our highly dynamic region — whether related to compliance in China, access and affordability of healthcare in India or tighter drug regulation in Korea and Australia — corroborate the necessity for us to provide meaningful insight to power your winning strategies. To further this effort, we’re increasing our investment in technology and services, enabling end-to-end solutions for our clients. We are also establishing stronger ties with stakeholders across the healthcare continuum, ranging from payers and providers to patients and governments.We are, in fact, in an increasingly central position to help“connect the dots”for all players in the healthcare environment, and ultimately to improve our healthcare systems. I hope you will see evidence of these broad goals and their specific supporting initiatives in the pages that follow. We’ve analyzed a wealth of data and drawn upon our best-in-class knowledge of local and regional market practices and trends to deliver insights and recommendations that offer a fresh perspective on the challenges and opportunities in this incredibly dynamic part of the world. In this issue, you’ll find: • A summary of the IMS Institute for Healthcare Informatics report on UnderstandingHealthcareAccessin India, which is the first comprehensive study on the subject in nearly a decade. • An exploration of how patient centricity could be a“game changer”for multinational companies operating in Asia. • Recommendations on strategies that multinational companies operating in Australia, one of the toughest markets in Asia-Pacific, can use to overcome such challenges as market access, payer cost containment and loss of exclusivity to spur growth. • Our views on how MNCs should be analyzing the Chinese market in order to close what for many will be a double-digit gap in top-line growth over the next three years. As we move forward in this environment, we will maintain our unrelenting focus on combining information, technology, and services in new ways to help our clients realize their potential for growth and achieve improved health outcomes across the region. Sincerely, Robert Chu President Asia Pacific & China

- 4. 4

- 5. 5 AHolisticDefinitionofAccess Traditionally, access to healthcare has been evaluated purely on the physical accessibility to, and affordability of, care. Access, however, is a much more complex issue that must be viewed holistically along four dimensions: 1. A patient's physical accessibility to healthcare facilities 2. Availability/capacity of the required resources for patient treatment 3. Quality/functionality of the resources providing care 4. Affordability of the complete treatment to the patient The most fundamental findings of the study involve the interconnectivity of these dimensions, such that: • All types of access must be met for a patient to receive appropriate healthcare treatment. • The more dimensions on which gaps exist, the lower the level of access will be. • Issues involving the first three dimensions must be addressed before efforts to improve affordability can have any significant impact. The last comprehensive study on healthcare access in India was conducted nearly a decade ago. In July 2013, the IMS Institute for Healthcare Informatics, India provided a fresh perspective in Understanding Healthcare Access in India: What is the Current State?This report summarizes the most comprehensive assessment of healthcare access since 2004 and delivers current, objective evidence on its various dimensions. The quantitative study involved an extensive nationwide survey of households and was supplemented by qualitative interviews with doctors and experts. The study highlights are presented below, with suggestions on what the findings mean for life sciences companies already in—or planning to enter—the Indian market. Ideally, the industry will use this information to adopt a common message platform in discussing how to improve healthcare access in India in the coming years. Improving Healthcare Access in India—A Role for Industry Stages of Healthcare Access FIGURE 1 Dimensions of healthcare access 1. Physical accessibility/ location 2. Availability/ Capacity 3. Quality/ Functionality Location: Rural vs Urban IP1 vs OP2 Acute vs Chronic Channels: Private vs Public Impact on Usage Components: IP vs OP Acute vs Chronic Income Levels 4. Affordability 1 IP-Inpatient 2 OP-Outpatient

- 6. 6 Study Highlights: Gaps Caused by Insufficient Infrastructure Over the past decade, the Indian government's investment in improving healthcare access has brought about remarkable improvement. Nonetheless, India still suffers from inadequacies in its healthcare infrastructure with the following effects: • Provision of healthcare services is skewed toward urban centers and the private sector. Urban residents have access to a disproportionate number of the country's hospital beds, and healthcare workers are highly concentrated in urban areas and the private sector. As a result, rural patients have to travel greater distances to access healthcare (either to other villages or to the nearest urban center), a hardship that is exacerbated by the poor connectivity of highways and the lack of public transportation. In addition, "unless drastic measures are taken to increase the number of doctors in the public facilities, other investments to improve access— either by constructing new health facilities or providing free medicines—will go to waste,”says Amardeep Udeshi, Associate Principal, IMS Health India. • Physical proximity to healthcare facilities poses a challenge in rural areas, particularly for patients with chronic ailments. As a result, treatment is often deferred or sought at a closer, more costly facility that may not bebestsuitedtothepatient'sneeds. • Gapsinthequalityandavailability ofservicesatpublichealthcare facilitiesaredrivinganincreasing percentageofpatientstoprivate facilities. Over the past 25 years, rural and urban patients alike have increased their use of private service providers due to long waiting times and a lack of diagnostic equipment at public options. Physician absenteeism is a key cause of these gaps in quality and availability within public facilities.This problem exists in both ruralandurbanareas,butistypically mostintenseinthelesseconomically developed states of India. • Patientsusingprivatefacilities faceaffordabilityhardships. The cost of treatment at private healthcare facilities is two to nine times higher than at public facilities. Each outpatient treatment for a chronic condition received at a private facility costs patients an average of 44 percent of their monthly household expenditure. • Medicine costs as a proportion of out-of-pocket (OOP) healthcare expenses remain high (at 60 percent for outpatient and 40 percent for inpatient). Low insurance penetration—and current insurance plans that do not cover drug costs—make the total cost ofmedicinesacontinuing,significant component of OOP expenses and an inconvenience for a majority of the population.The trend, however, is in the right direction. Over the last two decades, the share of OOP expenses for outpatient care devoted to medicines has decreased from 82 percent to 63 percent. In other non-reimbursed markets,itisinthe30-35percent range. StudyConclusions: ManyIssues MorePressingthanPrice IMS Institute analysts modeled and assessed the relative impact of improvements across each of the four components of healthcare access: Physical accessibility, resource Improving Healthcare Access in India—A Role for Industry Channel diversion due to lack of availability of quality healthcare resources FIGURE 2 Diversion of patients to private channels from public healthcare facilities 74% Patients Doctor Consultation Diagnostics/Medicine Government Sector Private Sector Most patients are using high cost private channel Further diversion when government doctors send patients for diagnostics to private facilities or when patients have to purchase essential medicines from private channels 26% 1 2 Patients Doctor Consultation Diversion Diagnostics/Medicine

- 7. 7 availability/capacity, quality of resources, treatment affordability. They determined: • The challenges are different in different segments of the population. Thus, interventions need to be tailored to each economic stratum and geography. • Solutions for improving healthcare access must be multi-pronged and, because the challenge is so daunting, will need to involve government entities, private enterprises and non-government organizations (NGOs). Affecting any meaningful change will take years. • Improving the quality and availability of public healthcare facilities would drive the greatest reduction in patient out-of-pocket costs. By curbing the diversion of patients to high-cost private channels, this could realize a 40-45 percent reduction in out-of-pocket expenditures for both outpatient and inpatient treatments. • Pricing is just one issue—and not even the most pressing one. Simply making drugs affordable will not fix the problem; if there are no doctors available to treat patients, and if diagnostics and medicines are in short supply, the cost of drugs is almost irrelevant. (What is more, no matter how much the price of drugs is reduced, anything short of offering them for free leaves them still out of reach for the 40 percent of the population below the poverty line). • Creating sustainable policy solutions to healthcare financing, infrastructure and human resource shortages will require recognizing the interdependencies of the issues, setting priorities, and measuring ongoing progress. ACoordinatedResponse Any company operating in India has undoubtedly experienced the dilemma that the study underscores: because the urban markets are becoming saturated, future growth will emanate from rural regions— yet it is impossible to realize that potential until the limitations in the infrastructure are addressed. And substantially improving the availability of care in the rural interior will take years and possibly decades. "The magnitude of the challenge calls for heavy investment, a systematic approach and both short- and long-term initiatives undertaken by multiple stakeholders," asserts Mr. Udeshi. "As leaders in the life sciences industry read the report, we hope they'll keep one question in mind: is there scope for our business to contribute to the solution? At IMS Health, we believe that the industry's participation can be a win-win situation, ultimately leading to market expansion and growth." Already, members of industry associations such as the Organization of Pharmaceutical Producers of India (OPPI) have recommended that the industry approach the problem in a coordinated effort, with individual companies "adopting" each of India's 27 states to form a close working relationship. By fanning out in this fashion, industry leaders could share their understanding of the issues with local authorities, identify their specific bottlenecks to progress, learn what kinds of assistance they need and then engage in a discussion of how they can help. Arun Maira, a member of the Planning Commission of India, notes, "Fixes to only parts of the system cannot produce the systemic changes required. In fact, fixing only a part, without considering their effects on other parts of the system, can backfire—as indeed some attempts are. IMS Health's study provides an objective map of the whole system, which can be used to show where the leverage points for action are and to engage stakeholders to arrive at agreements of what strategies will improve the system’s performance." Creative,butRealisticInitiatives forImprovingAccess Individual companies, working in collaboration with government organizations and NGOs, could lend their expertise and resources to help improve how healthcare services are being delivered in India. Creative solutions delivered through Public Private Partnerships (PPPs)— such as those already established to provide mobile hospital services, improve emergency response and support medical colleges—might include: • Helping to strengthen the medical supply chain, which is currently very inefficient. Shortages of supplies and medicines in public

- 8. 8 Improving Healthcare Access in India—A Role for Industry facilities are very common. The pharmaceutical industry has a very efficient distribution model and could help the government of India streamline how drugs reach remote areas. Some Indian officials have even suggested that the supply chain needs to be privatized. "This notion has some merit," agrees Amit Backliwal, General Manager, IMSHealthSouthAsia."The accountability inherent in private enterprise would help ensure efficiencies in the ongoing management of the system." • Developing and running disease management and wellness programs. This could take the form of funding and training auxiliary healthcare workers to work in remote areas of the country, increasing awareness of disease, promoting health screenings and offering education on nutrition and women's health, for example. • Sponsoring physicians in their outreach programs. Currently, many physicians take mobile units into the countryside, and MNCs could, for instance, fund such ventures. • Introducing telemedicine to connect physicians and healthcare workers with specialists and supervising physicians who can provide consultations and monitor vital signs from a distance. • Helping to create awareness about diseases and communicate the availability and benefits of existing government programs, including insurance (less than 40 percent of the population is aware of an existing government- sponsored insurance scheme). Companies might also, of their own accord, create flexible financing options for patients, such as allowing them to pay for an expensive treatment over the course of a year. Such a short-term move could help mitigate immediate concerns related to affordability. Of these possibilities, those that are financially viable and follow clearly laid out guidelines and standard operating procedures are the ones that are most likely to succeed. It will, of course, take time to build a relationship with the government and to create a climate of trust. However, having the fundamentals of healthcare access clearly understood by all parties will help private companies in initiating and managing conversations with policymakers. A clear "take away" from the IMS Institute report is that moving the needle of access calls for a multitude of approaches. "The pharmaceutical industry needs to play an integral part in contributing to this development because, ultimately, creating a strong infrastructure will lead to a more robust market with greater potential for the industry," explains Mr. Backliwal. ASpringboardtoAction Understanding Healthcare Access in India gives all stakeholders the information needed to advance the debate on next steps and to guide future investment. For the life sciences industry and the government, the study findings provide proof points for re-orienting the discussion away from measures to control prices and toward ways to improve availability of public health resources and to raise overall performance levels. "Our hope," concludes Murray Aitken, Executive Director of IMS Institute for Healthcare Informatics, "is that these findings serve as a springboard to action. With fresh insights into access barriers, the industry can contribute in meaningful ways to the solutions and in the long run, improve their own performance levels in India."

- 9. AbouttheStudy The IMS Institute's study: Understanding Healthcare Access in India was conducted in 2012 in order to: • Quantify current levels of access across the country • Identify the issues limiting access • Prioritize gaps to be addressed • Present a roadmap to guide future improvements and resource allocations Data was collected via on-the-ground research with 14,746 households across 12 representative states, urban centers, villages and rural areas across all socio-economic segments. In addition, interviews were conducted with 1,011 doctors and external experts. Funding was provided by the Organization of Pharmaceutical Producers of India (OPPI) and the Pharmaceutical Research and Manufacturers of America (PhRMA) and supported by the Indian Drug Manufacturers' Association (IDMA). The full study is available for download at www.theimsinstitute.org. To continue the conversation, please contact Amardeep Udeshi, Associate Principal, IMS Health India, at audeshi@imscg.com 9

- 10. 10

- 11. 11 According to trendwatcher.com, "No matter what market or industry you're in, if you're obsessed with catering to evolving consumer needs, desires, and expectations, you will prosper through even insane global upheavals."This is especially true in the global healthcare marketplace, and particularly in the emerging Asian market. Asia has always challenged multinational companies (MNCs) to innovate and stay competitive in a healthcare environment hampered by the "Triple-A”challenges of Affordability, Access, and Awareness. Historically, MNCs have dealt with these through commercial strategies that engage physician and payers. However, the balance of power is rapidly shifting towards the patient, who is more empowered today and who, in many Asian markets, pays for over 50% of healthcare expenditure out of pocket. In such markets, understanding the patient perspective and addressing their unmet needs along the key dimensions of treatment, services and access will be central to making significant advances. Patient Centricity: A Disruptive Strategy for Growth in Asia TheCallforPatientCentricityinAsia In addition to patients’growing importance as a key stakeholder, and their ability and willingness to pay, there are a number of other reasons why patient centricity should be a priority in Asia. • Patient centricity offers MNCs a means to differentiate from generics and local incumbents. To compete in the low price game led by generics and local players, MNCs are tasked with constantly finding new ways to compete; one way to do this is to partner with governments and other stakeholders to influence healthcare policy and shape the value chain, improving the healthcare landscape at large, while also boosting brand equity and recognition. • Patient centricity is core to tackling adherence issues, which is also a key challenge in Asia. According to a study by Capgemini, non- adherence causes USD $564 billion in lost revenue, globally1 . While a number of pharmacos operating in Asiahaveruneducationalcampaigns, launched reminder programs and offered incentives, these efforts are insufficient to tackle the root of the problem: getting patients more engaged in their treatment decisions. • Patient centricity in R&D can drive better healthcare outcomes for Asian patients. The disease profile is shifting in many Asian countries, and there is a strong trend of emerging pharma R&D models in Asia that aim to improve treatment outcomes by specifically targeting the Asian patient population. For example, Novartis’ investment in Shanghai to establish the company’s third largest R&D centre worldwide aims to tap into local scientific expertise and address China’s healthcare needs. “These challenges and opportunities are not new,”contends Anthony Morton-Small, Senior Principal, IMS Consulting Group, Asia Pacific. “Yet the relatively conservative strategies that MNCs have employed in the Asian market have not yet fully addressed them.The situation calls for disruptive approaches to improving patient disease awareness and engagement, access to treatment and affordability— approaches that are rooted in patient centricity.” 1 EstimatedAnnualPharmaceuticalRevenueLossDuetoMedicationNon-Adherence,2012,CapgeminiConsulting

- 12. 12 HowtoBecomePatientCentric Patient centricity requires pharmacos to shift from a traditional, transactional mindset to a value-oriented model across the three commercial endeavors: stakeholder engagement, offering development and value delivery. Stakeholders:Whoareweengaging? Today's model for engaging stakeholders is complex and continuously evolving, since multiple stakeholders now operate in increasingly interconnected networks (See Figure 2). All of these stakeholders directly or indirectly influence the patient experience at specific leverage touchpoints. For instance, patient forums, advocacy groups and social networks play a significant role in driving patient awareness, education and treatment experience. For pharmacos, understanding patient emotions, preferences and decision choices by tapping into these channels can provide a wealth of information on adherence, switching, outcomes and overall diagnosis and treatment rates. Similarly, access and affordability issues in Asia can be addressed through innovative programs which require partnership and co-operation with a number of stakeholders ranging from policy makers and payers to micro-financers and non-profit organizations. Engaging with policymakers provides pharmacos with the opportunity to shape emerging standards and policies in Asia, and requires cooperation with institutional providers, pharma industry associations and government/ non–government development agencies. Patient Centricity: A Disruptive Strategy for Growth in Asia Source:IMSSurvey;N=108;3%notdefined PatientCentricityDefined…andRefined The concept of patient centricity has been—and is still—evolving. As seen in Figure 1, the majority of IMS Health clients in Asia view it as a strategic approach to understanding, integrating, and pro-actively addressing patient needs throughout the healthcare value chain.While this marks a significant shift from traditional thinking, it is still not transformational. IMS Health, on the other hand, sees patient centricity helping to achieve the "Holy Grail" of personalized medicine, where pharma can be an active contributor to the patient’s wellness ecosystem by achieving seamless integration within and across the patient healthcare delivery value chain. FIGURE 1The Evolution of Patient Centricity Howwouldyoudefinepatientcentricity? -SurveytoPharmaexecutives Empowering patients with information support Information Access Value for money Proactive Tx Management Strategic Value Based Planning Personalized Medicine Optimizing price – outcome trade off demonstrating value to patients Accounting for leverage points along the patient journey to optimize patient experience of care Understanding, integrating and pro-actively addressing patient needs throughout the healthcare value chain Adopting an individualized approach to disease management by customizing medical decisions and products to the individual patient 9% 5% 16% 49% 19% Traditional Transformational

- 13. 13 Offering: What are we selling? The next pillar of patient centricity is the shift from selling products in isolation, to selling a solution that is informed by the needs, frustrations, andvalue-driversallalongthepatient journey. Many companies map the patient journey to identify the nodes of patient value. Some companies offer innovative solutions. “Only a few companies, however, have pushed this to the next level of mapping the full patient experience from the pre-symptomatic state to post-treatment stages,”observes Amkidit Afable, Engagement Manager, IMS Consulting Group, Asia Pacific.“In capturing both on- and off-treatment experiences, companies can understand patient emotions and frustrations that can impact outcomes—particularly in Asia where access to healthcare is often limited.” Value Delivery: How are we selling it? For companies to achieve true patient centricity, every function across the value chain must become patient centric (See Figure 3). Indeed, as reflected in a recent survey of top and middle managers2 , IMS Health clients in Asia believe that an integrated value chain strategy that is centered on providing solutions to patients will be a key priority in the next three to five years. There are examples of early movers such as Novo Nordisk, who adopted a holistic approach to enhancing diabetes care in China by focusing on physician training, patient education, strengthening the healthcare system, developing public awareness, setting up local production and R&D. This strategy has resulted in tremendous value creation for China and Novo 2 SurveywasconductedbyIMSHealthinNovember2013.Atotalof41responsesweregatheredfromtopexecutives,and67frommiddlemanagers.Toaccessthefullsurveyreport,pleasecontactapac.info@imshealth.com Lau nch and comm erciali zation Life cycle man agement BRAND Reg. Approval KOL KOL Physicians National payers ACADEMIA/ ACADEMICS ACADEMIA/ ACADEMICS DIAGNOSTIC LABORATORIES Productdevelopment R&D and auth orization WHS and distributors KOL Providers Regional & Local payers Marketing & commercialization Trac king, research & develo pment Legacy stakeholder model: Limited stakeholders operating in silos Lau nch and comm erciali zation Life cycle man agement Patient Reg. Approval Media Biotech companies PAGs and patient forums Caregivers & influencers Industry association Policy makers Institutional providers NGOs Micro- financing bodies KOL KOL Physicians National payers Productdevelopment R&D and auth orization WHS and distributors KOL Providers Regional & Local payers Marketing & commercialization Trac king, research & develo pment Emerging stakeholder model: Multiple, interconnected stakeholders FIGURE 2 A New Model of Interconnected Stakeholders Traditionalstakeholders/influencers Emergingstakeholders/influencers

- 14. 14 Nordisk and resulted in Novo Nordisk achieving 63% market share (2012) in the world’s second largest insulin market. Broadly, this can take the form of: • Using patient perspectives in R&D to develop potential claims and better inform outcomes. With new sources of real-world evidence (RWE) and new technologies available (such as the ability to mine social media), it is easier than ever to understand the patient’s perspective and identify unmet needs. While still nascent in Asia, such strategies are already being employed in developed economies, with companies such as Merck, UCB and Novartis partnering with PatientsLikeMe, a patient organization, to gather patient views on psoriasis, epilepsy and organ transplant respectively to better inform outcomes. • Responding to the local patient population’s preferences in how products are manufactured, supplied and distributed—perhaps through local partnerships. “There are nuances to patient behavior and preferences in every market,” notes Mr. Afable.“And an understanding of these must filter all the way back through the organization.”Some manufacturers such as Sanofi have committed to developing a local manufacturing strategy in their priority Asian markets such as Vietnam. Its recent 75 million U.S. dollars investment in a new plant in Vietnam3 is aimed at bringing medicines within the reach of a broader population beyond top tier cities. • Leveraging Real-World Evidence (RWE) to improve market access. There are numerous examples of affordability and access programs in Asia aimed at reducing patient out of pocket spend and increasing access to middle and bottom of the pyramid patients. However, as Asian governments are beginning to leverage RWE to support their reimbursement processes, developing capabilities around gathering, analysing and applying patient based real-world outcomes and "pay for performance" type of access will become critical. In Thailand, RWE is used to facilitate the selection of products for the national essential list of medicines, while in Japan and South Korea it serves to supplement Randomized Controlled Trials (RCT) data for reimbursement listing. Patient Centricity: A Disruptive Strategy for Growth in Asia R&D and portfolio Supply Chain & Distribution Pricing and Access Sales and Marketing Life Cycle Management Manufacturing Examples of patient centricity (non exhaustive) • Patient research - patient oriented outcomes • Personalized medicine – molecular analysis • Localprocurement- increase affordability • Partnerships on delivery systems & infrastructure • Multichannel stakeholder engagement • Patient experience mapping • Co-ordinate value chain solutions • SKU variations- patient tiering • Local manufacturing flexibility & response • Price volume plays – expanding the pyramid • Payforperformance and patient outcomes • Patient insights for line extensions (social media) • Loyalty programs FIGURE 3 Patient centricity across the value chain 3 http://news.xinhuanet.com/english/business/2013-03/30/c_132272285.htm

- 15. ConcludingThoughts When implemented correctly, patient centricity can have a significant impact on the bottom line—particularly in Asia where solutions to affordability, access and adherence issues all involve the patient. First movers who can integrate and embed patient centricity into their overarching strategic direction stand to gain competitive differentiation in the marketplace. This will entail recognizing how multiple stakeholders influence the patient experience, mapping the full patient journey (beginning pre-diagnosis), and using strong leadership practices to keep everyone in the organization focused on the same goals. Ideally, the entire organization will be aligned along the same market construct, aiming for the same goals with the same strategy. MeasuringandBenchmarking PatientCentricity Implementing patient centricity consistently—and with impact— requires organizations to diagnose how patient centric they currently are and to identify areas for improvement. This can be done by assessing their level of patient centricity as an organization or as a function, across financial, process, talent and customer metrics as illustrated in Figure 4. By doing so, gaps in organizational structure, capabilities and resources versus best practice targets and benchmarks can be identified and addressed. Measure Sample questions (not exhaustive; to be tailored by company) Score 1.To what extent are patient centric activities (e.g. awareness campaigns, patient assistance programs) rooted in economic goals? Financial 2. To what extent are we achieving cost synergies (cross brand, cross function) in our patient centric activities? 3. To what extent are we investing intelligently in patient-related activities in a systematic and sustainable manner? 4. To what extent is our organizational structure supportive of providing patients with seamless solutions? Internal Business Processes 5. To what extent are we equipped with capabilities (e.g. MCM, social media, healthcare apps) to interact with our patients? 6. To what extent is our mindset patient centric? (e.g. inclusion of patient centric goals or business priorities in brand / franchise plans) 7. To what extent can we map all our patient influencers? (including their role, decision flows, nodes of influence) Customer 8. To what extent can we capture and use insights from all our customers? 9. Is patient satisfaction used in evaluating the performance of a brand? 10.To what extent do we equip our employees to be more patient centric? Learning and Growth 11.To what extent does our employee performance management (incentives, KPIs) address patient centricity? 12. To what extent has our organization prioritized patient centricity in terms of resourcing? FIGURE 4 Illustrative Scorecard for Measuring Patient Centricity StructurebasedonKaplan&Norton’sBalancedScorecard:TranslatingStrategyintoAction, To continue the conversation, or to request our longer white paper on this topic, please contact Anthony Morton-Small, Senior Principal, IMS Consulting Group, Asia Pacific, at amortonsmall@imscg.com 15 Aroundindustryaveragewithaddressable gapsacrosskeymetrics Outperformsindustryaveragewithembedded bestpracticeinpatientcentricity Belowtheindustryaveragewithsignificantgaps acrosskeymetrics

- 16. 16

- 17. 17 The Australian pharmaceutical market is one of the most mature in the region; it is also one of the toughest. Growth rates have been declining since mid 2010, and the market actually began to shrink in the latter half of 2013.The reasons are all too familiar to multinational companies (MNCs): market access challenges, payer cost containment practices, loss of exclusivity, and generic penetration. Fortunately, when it comes to developing strategies to overcome these environmental pressures, Australian affiliates need not be pioneers.They can "stand on the shoulders" of their counterparts in other mature markets who, over the past few years, have begun to pursue successful strategies to sustain growth. The first critical step is to acknowledge that the "tried and true" methods of the past 50 years will no longer suffice and that new approaches—even radically different ones— may be required to turn the situation around.While there is no turnkey solution, there are options. However, one of them is not to wait and see; change is no longer optional. New Strategies for Reviving Growth in Australia A Familiar Refrain Not so long ago (in 2010), the Australian pharmaceutical market enjoyed growth rates approaching 10 percent (See Figure 1). Since then, the growth rate has declined gradually until late in 2013, when it dropped more sharply and the market actually began to contract. IMS Health forecasts the decline to continue through 2014 before a slight recovery in 2015-2017. This is primarily due to a more challenging regulatory and commercial environment—both for new and mature products. In general, the issues are similar to those in other developed markets: • Gaining market access is difficult due to reimbursement hurdles. • Government cost containment measures are eroding market value. • Patent expirations are opening the market to generic penetration and creating revenue gaps for R&D companies. Although the worst of the patent cliff occurred in 2012, products that lost market exclusivity in Australia suffered higher sales erosion than had historically been the case. And, more patent expirations are coming in the next five years. But, beneath these general features of a mature market are some conditions specific to Australia: • The Government's funding issues mean that only drugs that can demonstrate cost effectiveness or MAT Growth of the Australian Pharmaceutical Market since 2010. MATgrowth(%) -4 -2,4% Audits - Total market Audits - Prescription products only MATApr10 MATMay10 MATJun10 MATJul10 MATAug10 MATSep10 MATOct10 MATNov10 MATDec10 MATJan11 MATFeb11 MATMar11 MATApr11 MATMay11 MATJun11 MATJul11 MATAug11 MATSep11 MATOct11 MATNov11 MATDec11 MATJan12 MATFeb12 MATMar12 MATApr12 MATMay12 MATJun12 MATJul12 MATAug12 MATSep12 MATOct12 MATNov12 MATDec12 MATJan13 MATFeb13 MATMar13 MATApr13 MATMay13 MATJun13 MATJul13 MATAug13 MATSep13 MATOct13 MATNov13 -1,3% 4 0 8 -2 6 2 10 Source: IMS Health Australia, National Sales Audits FIGURE 1

- 18. 18 cost minimization, that are first to market in a class, or that address a critical need, will be approved for reimbursement. • A number of products seeking to be included in the Pharmaceutical Benefits Scheme (PBS) have been delayed due to insufficient evidence or variation to defined comparitor. The Pharmaceutical Benefits Advisory Committee (which recommends products for listing on the PBS) has made it clear that it is seeking clinical data with patient relevant outcomes and an economic evaluation that tracks the clinical data from manufacturers to justify price claims for a precise target population with a clear therapeutic indication. • The mandatory price disclosure system has been expanded and accelerated. The price at which the PBS reimburses drugs with generics is now recalculated, based on actual ex-manufacturer price, every 12 months instead of 18. IMS Health estimates this shift will cost the industry over $600 million in value in 2014. Together, the Australian government's cost-containment measures have caused a decline in value for products on the PBS of approximately $1 billion over the 12 months from December 2012 to November 2013 alone. AndtheBeatGoesOn Given this environment—and the fact that it is not going to improve dramatically on its own— the industry’s performance will continue to slip unless companies operating in Australia take action. The government will continue to pursue cost containment and efficiencies in healthcare provision and coverage. Physicians' prescribing power will continue to decline as other stakeholders (e.g., patients, patient groups, PBAC, PBS, and pharmacists) exert more influence on treatment choice. And branded products will continue to lose share to generics upon loss of exclusivity. The combination of conditions in this complex landscape makes a compelling case for approaching the market in new ways. Unfortunately, there is no panacea that will cure all, and perhaps even no easy answers. However, there are a variety of steps that companies can take to make a difference. Especially when undertaken as part of a very broad and coordinated response, they have the potential to increase both top and bottom lines. Already, we have seen that the strategies suggested below have had an impact in other mature markets, including the US where the industry and health insurers are partnering with IMS Health to consolidate and evaluate large data sets to define treatment outcomes in the real life environment.We've also seen that in Europe, Key Account Management and improved stakeholdercommunication is enabling industry to move closer to strategic partnerships with health providers. UseReal-WorldEvidence toMaximizetheProduct The Australian government's focus on cost containment elevates the importance of developing value propositions that withstand economic evaluation. In fact, the PBAC is encouraging the industry to provide Real-World Evidence (RWE)—validated measures of how marketed products are used, including their effect on patient health and disease-related costs—to support its reimbursement decisions. RWE could be supplied from other markets (if the populations are comparable) where the product is already marketed. Or, companies could pledge to provide RWE from Australia at a later date, in an effort to either sustain or improve a product’s initial reimbursement status. "At this point, due to competing agendas, there is a misalignment between the PBAC and the industry in Australia," ventures Caroline Beasley, Country Principal, IMS Health Australia. "There's a sense that much of the information provided to the committee in recent years has been biased or insufficient to support companies' claims. Providing RWE with submissions for PBS listing would go a long way toward restoring that sense of trust and will undoubtedly speed the time to approval." Beasley continues,“To define the value of their products—not merely at launch but over the course of a product’s lifetime—companies will need to develop comprehensive strategies, processes and capabilities New Strategies for Reviving Growth in Australia

- 19. 19 in gathering and providing unbiased evidence of what their health technology achieves in the real world. Fortunately, this information is becoming readily available.” At one time, RWE was expensive to obtain via third parties and involved a retrospective analysis. Today, it is available from a multitude of settings and sources, including data on dispensed prescriptions tracked over time for anonymous patients, claims data from private health insurers, and government databases. This information can be supplemented with demographic and epidemiological data from public sources as well as with a company’s own data. AdoptaNewCommercialModel In Australia, as in other mature markets, the stakeholder landscape is growing ever more complex, and the direct influence that prescribers have on the treatment decision is in decline. At the same time, with the loss of exclusivity of so many blockbuster products, much of the market is becoming commoditized. These conditions are rendering traditional commercial models (those based on share of voice with prescribers) increasingly inefficient from a cost-benefit perspective. With the end goal of optimizing their promotional resources, companies need to create a more flexible commercial organization that can cope with variations in stakeholders and apply different sales and marketing strategies as needed. This involves: • Determining the relative importance of each stakeholder group and allocating resources accordingly.This may mean adopting an account-based sales structure, employing virtual sales reps or exploring other alternatives to in-person sales calls. • Engaging all stakeholders and working continuously to provide value to all customer types. This includes government authorities, private insurers and patients. With respect to government and private payers, manufacturers must come to understand their mindset and find ways to deliver what they need. And, by developing stronger relationships with patients, companies can earn their loyalty to sustain usage upon entry of either a generic or a new competitor. (For more on how to understand, integrate, and pro-actively address patient needs, please see“Patient Centricity: A Disruptive Strategy for Growth in Asia”on page 11.) • Employing new marketing technologies, such as closed-loop marketing, enterprise-wide relationship management, and customer relationship management. The goal is to adopt customer-centric approaches that provide more differentiated messaging matched to the needs of each segment. TakingRWEbeyondHEOR Real-world evidence, collected from various points in the patient’s health journey, can be used to support product value stories, provide insight for clinical and operational decisions, and as a tool for engagement. RWE isn’t limited to HEOR RWEhasvaluethroughoutanorganization Descriptive Epidemiology Outcomes of Care Patterns of Care Relative Safety Comparative Effectiveness Patients - Population Management Payers – Quality Benchmarking Providers - Quality Intervention Payers/Providers – Key Account Management Payers/PROVIDERS – Pay For Performance Trial Optimization Supporting product value stories Providing insight to internal organization As tool for engagement Pricing & Market Access Product Development Commercial Spend Effectiveness Launch Management A B C

- 20. SUMMARY With increasing environmental pressures, it is time for pharmacos to start with a clean slate and redesign their approach to the market in Australia. In general, companies should envision what the market will look like in five years and work backward from that to formulate their strategies. The good news is that there remain ample opportunities to overcome market access hurdles and win customer loyalty. To continue the conversation, please contact Caroline Beasley, Principal, IMS Health Australia, at cbeasley@au.imshealth.com • Interacting with stakeholders at multiple levels. Rather than maintaining communication with a single contact within customer organizations, expand the number and level of relationships such that peers are communicating with peers. For example a manufacturer’s CEO might develop a relationship with the chairman of a hospital’s board, or a company’s finance director might interact with the financial controller in a government agency. “When it comes to refining their commercial model, companies in Australia have a great advantage,” suggests Frederic Lefebvre, engagement manager, IMS Health Australia.“They can examine what their counterparts have done in other countries and leapfrog over their learnings, eliminating a lot of trial and error.” MovefromBrand-Focused toCustomerCentric Particularly in the primary care market, pharmaceutical companies must transition from selling chemicals packaged into tablets to selling integrated health concepts that add value for patients and intermediaries by improving diagnosis, presentation, adherence and persistence. An example of this “whole product approach”would be offering a comprehensive patient- centered program that includes the drug, diagnosis, patient counseling, family support, diet and exercise, mood monitoring and Internet support. This approach achieves value pricing through a wholehearted commitment and investment. Fortunately, manufacturers already have much of the needed elements, including an understanding of disease treatment, existing relationships with providers and insights into patient usage through anonymous, patient-level data. The basic categories of value-creation tactics include: • Stakeholder solutions that range from customized patient education, e-tools, and social networking materials to dashboards and value-based focus groups • Stakeholder resources as varied as trial offers to healthy outcomes programs and health calculators • Offering extensions made possible through value-chain aggregation and a movement toward services or non-prescription offerings. • Partnerships with the government, healthcare organizations, disease awareness groups, and payers and employers that focus on health outcomes. New Strategies for Reviving Growth in Australia 20

- 21. 21 Customer targeting is essential in a world of limited resources, and companies should understand the relative value of their customers and allocate resources accordingly. IMS Health’s Sales Force Effectiveness (SFE) services empower your sales force to deliver efficiently and profitably. With our extensive experience across the entire SFE continuum, tested methodologies and tools, local competitive industry intelligence and access to granular data that’s not available to the market, we can help you profile, segment and target the right customers With IMS Health, your sales force will hit the right targets! Ever feel that you are not hitting the right targets? IMS Health’s Consumer Health team can address your biggest business issues around: Real-World Evidence & HEOR Payer Management Access, Pricing & Reimbursement Strategy & Portfolio Planning Sales Effectiveness Business Information Management Brand & Marketing Effectiveness

- 22. 22

- 23. 23 At first glance, China would seem to be a world of never-ending opportunities for pharmaceutical companies. Indeed, the country’s pharmaceutical market is the third largest in the world, estimated at USD 80 billion at the end of 20121 . However, this growth is not the result of unilateral escalation; there are variations in opportunity and growth across regions, therapy areas and drug categories, combined with influences from a maze of regulations and government policies. Each of these significant forces demands analysis, not assumption. Pharma companies—especially multinational companies (MNCs)—that disregard such granular trends when projecting their growth will likely be overly optimistic.To improve their actual performance, companies have a variety of options, ranging across levels of difficulty and the degree of transformation necessary. And while there is no "one-size- fits-all" solution, action is critical to successfully adapting and thriving in China. Growing Pains in China China's new pharma reality, and the necessity of an informed strategy in bridging the gap between assumed and realized growth ALoomingGapfortheAverage MNCPortfolio To what extent is the typical MNC player operating in China facing top-line revenue growth pressure? To answer this, IMS Health teams reviewed the average business mix of the top ten MNC pharmacos in China (based on the IMS China Hospital Pharmaceutical Audit). After pooling their performances into one“hypothetical company,”they applied a series of top-line growth assumptions, including, first, an overall market CAGR of 15%, and then more segment-specific growth rates. This analysis revealed a 17% gap between where companies assume their portfolio will end up in 2015 (based on the 15% growth projection) and their actual portfolio performance based on the behaviors of individual segments (see Figure 1).The off- patent-originator group (OPO) turned out to be the biggest source of risk, with a forecasted growth of -2%. “We are assuming the government’s pricing pressures on OPOs will continue, thus reducing prices,” explains Matthew Guagenty, VP IMS Consulting Group, APAC & China, “but we’re also going to see volume increases as a result. This inverse relationship will eventually result in modest declines for this segment." And so MNCs are faced with both upward and downward pressures, and a need to more proactively manage the different segments of their portfolio, and their environment. 1 IMSMarketPrognosis,2012 Figure 1 Potential gap between assumed and actual portfolio growth -4 +13 2015 - Future view 2012 - Currentstate 100pts 152pts in PRx Portfolio in OPO Portfolio in GX & OTC Portfolio Generic (Gx) & OTC Patented Rx (PRx) OPO GAP 24 +26 26 4 53 69 +29 73 (17%) 15% 3-year CAGR

- 24. 24 AComplicatedEnvironment In order to close this gap successfully, companies must understand the geographic, sociological and governmental dimensions of a very challenging market environment in China. GreatGeographicandDemographicDiversity China is home to 1.4 billion people, spread across 9.5 million square kilometers and 34 provinces/regions2 . With its myriad cultures, customs and income levels, the country might best be regarded as a multitude of sub-countries. For pharmacos, this demands a more proactive—and a more innovative— growth plan than what is required anywhere else in the world. Building market share here requires both breadth and depth. And portfolio diversity, resource allocation and growth strategies across the value chain must address a wide range of market conditions, infrastructure challenges and even personal attitudes toward healthcare. MultipleAccessHurdles For pharma companies, especially MNCs, navigating China’s complex reimbursement system is the key to securing widespread market access. At the center of the system is the Essential Drug List (EDL), which outlines those medicines that receive relatively high levels of government reimbursement. Inclusion in this list opens the door to the full spectrum of China’s pharmaceutical market, but also leads to a volume-driven model for growth based on generics- level pricing. In addition, there are several other layers of listing, tendering and bidding involved in gaining access. These include a National Reimbursement Drug List (NRDL) and the Provincial Reimbursed Drug Lists (PRDL), as well as unique listing processes in individual hospitals. With this multi-tiered system— perhaps the most complex in the world—comes exposure to significant price pressures. At the national level, there have been therapeutic- level price cuts annually over the past decade. At the provincial level, heterogeneous tendering systems place direct price pressure on the most common molecules, leaving competitors to outbid one another. AChangingRevenueModelforHospitals Until recently, Chinese hospitals have relied on markups from drugs that are both prescribed and filled onsite as a major source of revenue. Therefore, the government’s recently stated objective to separate prescribing and fulfilling signifies a fundamental shift in how the provider market will operate in the future.“This shift implies a completely different approach to provider-side economics, and subsequently a new business model altogether,”explains Mr. Guagenty. Doctors, however, will continue to be an important—if not the most important—stakeholder in the prescribing process. StrategiesforSuccess MNCs in China face a complicated reality: growth is mandatory, but is only possible by addressing the market’s complexities and contradictions. It also means not falling victim to the common China assumption that growing bigger means growing stronger. Ultimately, companies' chosen strategies should reflect the degree to which they are willing to invest in difficult and/or transformative processes. The options below are neither mutually exclusive nor collectively exhaustive, but are all worth considering: • Option #1: Embrace Generics Today China boasts over 7,000 local, regional or national pharmaceutical product manufacturers, most of whom play in the ultra-competitive generics market. Branded generics, especially, are poised for growth, given the demand for low-cost alternatives to off-patent brands. However, pricing pressures from the government will likely precipitate a decline in unit prices for these drugs. “Me-too-plus”versions of generics offer a slightly more sustainable Growing Pains in China Any strategic plan needs to ensure that it doesn’t fall victim to the common China assumption that growing bigger means growing stronger. 2 NationalBureauofStatisticsofChina2012

- 25. 25 outlook, though they require first- mover advantage in addressing a particular market/disease need. It is important to note here that national agencies aim to curtail the practice of affording favored bidding and tendering status to firms with me-too-plus generics. MNCs could fold any new generic products into existing portfolios and take advantage of synergies in the supply chain. However, actually bringing a new generic to market could take several years. And local competitors will compete heavily on price, pushing down market prices in the longer term. • Option #2: Develop Strategic Alliances & Partnerships Many MNCs are exploring various ventures with domestic Chinese companies to diversify their portfolios and leverage the market expertise and local supply chains of leading domestic manufacturers. This, coupled with the financial might and portfolios of the MNCs, could mean significantly deeper market penetration for both parties. Yet, this option is certainly more difficult to implement than a pure generics strategy, given that: • Finding a partner who can complement existing portfolios and capabilities is a challenge. • Workforce integration can be difficult, as can ensuring that the production standards of any acquired/partnered company meet those of the MNC. • There is threat of further regulation. • The number of attractive, suitable partners is dwindling. • Option #3: Branch into New Fields of Play With Chinese technology and research moving at such an astounding pace, MNCs are beginning to develop alternative strategies to keep ahead of the game. Of course, innovative ideas, while offering huge potential rewards, are the most difficult to implement. They invariably entail significant internal transformations, often with an over-reliance on partnering firms that can supplement expertise. And, there are fewer and fewer attractive, applicable spaces not occupied by competitors. The options presented here are certainly not“Band-Aids®”for a short-term growth issue, but they can be medium- to longer-term planks on which companies can build sustainable growth. Mobile technology -Taking healthcare into the future With over 1.1 billion mobile phones currently in use in China, and over 300 million 3G users, the potential for mobile health (mHealth) applications is clear.The opportunities range from better understanding patient behaviors, to improving preventative medicine initiatives and increasing compliance through third-party patient management or medicine reminders3 . Diagnostics – Creating synergies across portfolios As China continues to make preventative treatments a priority in its reform initiatives, diagnostic services are poised to be a significant factor in the expansion of both More MoreLess Difficulty Transformation necessary Generics Strategy Strategic Alliances New Fields of Play FIGURE 2 3 ChinaWirelessNews,Jan3,2013.(www.chinawirelessnews.com/2013/01/03/11699-china-had-over-1-1-billion-mobile-phone-users-by-november-2012) TechAsia.com-(www.techinasia.com/china-now-has-over-300-million-people-using-3g//14C43AE4-F02B-4698-A7E8-D609AE56BFF6)

- 26. market access and new product opportunities. For larger MNCs, diagnostics offer an intriguing opportunity for portfolio synergy and to develop a presence across a broader piece of the patient journey. For example, in a complex disease such as breast cancer, diagnostic capabilities allow for earlier patient interactions and then more targeted, appropriate treatments later in the disease cycle. Creating your own demand – Solving the affordability gap Although China is experiencing a phenomenal expansion of its middle class, many drugs remain prohibitively expensive. Cancer drugs, for example, can cost up to 10 times the average Chinese possessive worker's annual income and, as premium medications, are not included on any reimbursed drug list. The answer, for those companies with the capability and appetite for expanding into wholly new business models, could be the development of partnerships such as the one Roche struck with Swiss Re. Through this deal, Swiss Re, a provider of reinsurance, will benefit from Roche’s understanding of cancer treatment and prevalence rates. Roche, in turn, will leverage Swiss Re’s knowledge of insurance to supplement public insurance and cover more expensive drugs such as Herceptin®. Again, though any of these may be attractive, based on a company’s appetite for, and ability to, change, there is a sweet spot, as Mr. Guagenty points out:“The best investments will be those that satisfy the unmet needs of the population and align with the government agenda.”Investment outside this intersection can be riskier and have a longer pay-off period. InSummary When viewed through the lens of growth, China is one of the healthiest pharmaceutical markets in the world. However, this growth is by no means uniform. Surviving and thriving in this market going forward means proactively addressing those dynamics that make China truly unique. For MNCs, the imperatives are clear: • Change is coming, and MNCs have the opportunity to use momentum, coupled with real market intelligence, to shift their business forward • Successful strategies will recognize the upward and downward pressures on the Chinese pharma market and not rely on macroscopic growth projections • A spectrum of strategies, from core bolt-ons to new fields of play, are real options for MNCs that want to be proactive in managing pharma’s“growing pains”in China Growing Pains in China 26 To continue the conversation, or to request our longer white paper on this topic, please contact Matthew Guagenty, Vice President Consulting, Asia Pacific and China, at mguagenty@imscg.com

- 27. Asia Pacific is leading the world in terms of over-the-counter drug sales and showing growth rates that indicate enormous potential for MNCs as well as local and regional players. But the consumer’s path to purchase is not just complex – it is different across Asia Pacific’s diverse markets. So to build relevant, powerful marketing strategies, pharmaceutical companies need to understand how – and why – consumers behave at the point of sale (POS). • When do consumers decide on a brand to buy? • What is the influence of the pharmacist and POS materials in driving purchases? To address this need IMS Health has developed unique Shopper Studies for Korea, China and the Philippines, revealing critical insights into purchase drivers for each culture. IMS Health Shopper Studies: These primary market research reports are a critical tool for companies who want to be more proactive in addressing the needs of their target audience. Sample insights include: • The interaction between consumer and pharmacist in the Philippines is mainly transactional, whereas in China and Korea, recommendations by pharmacists are a key purchase driver • 97% of Filipino consumers have a brand in mind before entering the store vs. 30-40% in China and Korea • In China, posters/ads in drugstores appeal more to higher-income, well-educated shoppers Winning the sale inside the store means knowing which levers to pull. IMS Health Shopper Studies have helped many businesses understand consumers at the point of sale and influence them to choose their brand. Is your company next? Call us to learn more about our Shopper Studies today. Illuminating the consumer healthcare industry, one bright insight at a time Real-World Evidence & HEOR Payer Management Access, Pricing & Reimbursement Strategy & Portfolio Planning Sales Effectiveness Business Information Management Brand & Marketing Effectiveness IMS Health’s Consumer Health team can address your biggest business issues around:

- 28. IMS HEALTH® IMS Health Asia Pacific 8 Cross Street #21-01/02/03 PWC Building Singapore 048424 Tel: +65 6227 3006 Fax: +65 6227 5448/9 IMS Health is a leading worldwide provider of information, technology and services dedicated to making healthcare perform better. With a global technology infrastructure and unique combination of real-world evidence, advanced analytics and proprietary software platforms, IMS Health connects knowledge across all aspects of healthcare to help clients improve patient outcomes and operate more efficiently. The company’s expert resources draw on data from nearly 100,000 suppliers, and on insights from more than 40 billion healthcare transactions processed annually, to serve more than 5,000 healthcare clients globally. Customers include pharmaceutical, medical device and consumer health manufacturers and distributors, providers, payers, government agencies, policymakers, researchers and the financial community. Additional information is available at www.imshealth.com. IMS Health is present in over 100 markets. For our office locations, visit: www.imshealth.com/locations About IMS HEALTH