Insider Trading_Code Of Conduct

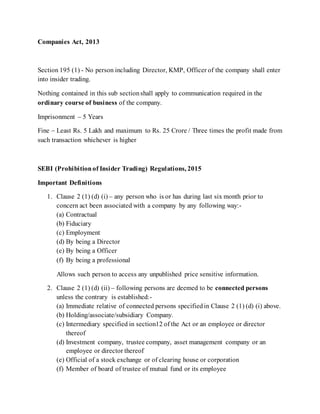

- 1. Companies Act, 2013 Section 195 (1) - No person including Director, KMP, Officer of the company shall enter into insider trading. Nothing contained in this sub sectionshall apply to communication required in the ordinary course of business of the company. Imprisonment – 5 Years Fine – Least Rs. 5 Lakh and maximum to Rs. 25 Crore / Three times the profit made from such transaction whichever is higher SEBI (Prohibitionof Insider Trading) Regulations, 2015 Important Definitions 1. Clause 2 (1) (d) (i) – any person who is or has during last six month prior to concern act been associated with a company by any following way:- (a) Contractual (b) Fiduciary (c) Employment (d) By being a Director (e) By being a Officer (f) By being a professional Allows such person to access any unpublished price sensitive information. 2. Clause 2 (1) (d) (ii) – following persons are deemed to be connected persons unless the contrary is established:- (a) Immediate relative of connected persons specifiedin Clause 2 (1) (d) (i) above. (b) Holding/associate/subsidiary Company. (c) Intermediary specified in section12 of the Act or an employee or director thereof (d) Investment company, trustee company, asset management company or an employee or director thereof (e) Official of a stock exchange or of clearing house or corporation (f) Member of board of trustee of mutual fund or its employee

- 2. (g) Member or director of public financial institution (h) Banker (i) Concern trust, HUF, firm, company etc where the director/immediate relative of director, banker have more than 10% holding. 3. Clause 2 (1) (e) – “generally available information” means information that is accessible to the public on a non-discriminatory basis. 4. Clause 2(1) (n) – “unpublished price sensitive information” means any information which is not generally available which upon becoming generally available, may affect the prices of the securities such as:- (a) Financial results (b) Dividends (c) Change in capital structure (d) Mergers, de-mergers, acquisitions, de-listings, disposals and expansion of business and such other transactions (e) Changes in key managerial personnel (f) Material events in accordance with the listing agreement. Restrictionon communication and Trading by Insiders 5. Clause 3 (1) - No insider shall communicate any unpublished price sensitive information, relating to a listed or proposed to be listed company except such communication is in furtherance of legitimate purposes, performance of duties or discharge of legal obligation. 6. Clause 3 (2) – No person shall procure any price sensitive information from any insider except in furtherance of legitimate purposes, performance of duties or discharge of legal obligations. 7. Clause 3 (3) - Notwithstanding anything contained in these regulations UPSI can be communicated if :- (a) It entails an obligation to make an open offer under the takeover regulations (b) Does not entails obligation of open offer but BOD thinks that proposed transaction is in the best interests of the company, then this information is made generally available least 2 days prior to the proposed transactions. Trading when in possessionof unpublished price sensitive information 8. Clause 4 (1) – No insider shall trade in securities while in possessionof unpublished price sensitive information Except cases where he can prove that:-

- 3. (a) Transaction is off-market transfer between promoters who have same unpublished price sensitive information without being in breach of regulation 3. (b) In case of non-individual insiders:- The individuals taking trading decisions are different from the individuals in possession of price sensitive information and such persons making trading decision were not in possessionof price sensitive information. Appropriate measures/arrangements were in place to insure that these regulations were not breached Trades were according to the trading plan formulated as per regulation 5. Trading Plan 9. Clause 5 (1) – A Trading plan should be formulated by the insider, which should be duly approved by the compliance officer and put forward for public disclosure 10.Clause 5 (2) :- (a) trading should not start within 6 months from the date of disclosure of trading plan (Clause 5 (2) (i) (b) Insider is not allowed to trade between 20th day before 31st March of every year till 2nd day of disclosure of financial results for such financial year. Clause 5 (2) (ii) (c) trading plan be for period of not less than 12 months Clause 5 (2) (iii) (d) One trading plan should not overlap an existing trading plan 5 (2) (iv) (e) Trading plan should state value of trades to be affected or the number of securities to be traded and their intervals or dates on which such trades shall be affected. (f) If the trading is done my manipulating the time of release of price sensitive information to make the trading lucrative. Such act will initiate proceeding for alleged breach of SEBI Insider trading regulations. 11.Clause 5 (4) - Once the trading plan is approved it has to be mandatorily fulfilled without any deviation from the plan or trading outside the scope of the plan. Provided that if the unpublished price sensitive information is not made public then above regulation is not applicable and the compliance officer shall confirm that the commencement of trading plan is ought to be deferred. 12.Clause 5 (5) – Approved trading plan would be notified by the compliance officer to the stock exchange where the securities are listed.

- 4. Disclosure ofTrading By Insider 13.Clause 6 (2) – Disclosure under these rules are not to be made only by person concerned but also for its relatives for whom the person concerned takes trading decisions. 14.Clause 6 (3) – Trading in securities include trading in derivative of the securities, the traded value of the derivative shall be taken into account for purpose of this chapter. 15.Clause 6 (4) - Disclosure made under this chapter shall be maintained for a minimum period of 5 years. Initial Disclosure 16.Clause 7 (1) (a) – Every promoter, KMP, Director of a listed company shall disclose his shareholding to the company as on the date of these regulations taking place. 17.Clause 7 (1) (b) – Every person appointed as KMP, Director or being becoming a promoter shall disclose its holding to the company within 7 days of its appointment or becoming promoter. Continual Disclosure 18.Clause 7 (2) (a) – Every promoter, employee, director of every company shall disclose to the company about securities acquired or disposed in a quarter of calendar if the aggregate of trade is in excess of 10 Lac within 2 working day. 19.Clause 7 (2) (b) – Within 2 days of receiving of such disclosure as per Clause 7 (2) (a) by the company, company shall notify the particular of such trading to the stock exchange. 20.Clause 7 (3) – Company may require such disclosure as per Clause 7 (2) (a) by any other connected person in order to monitor compliance with these regulations Disclosure On Website 21.Clause 8 (1) – Board of every listed company on its website shall disclose a code of practices and procedures for fair disclosure of Unpublished price sensitive information 22.Clause 8 (1) – Every such code of practices and procedure as per Clause 8 (1) any amendment thereto shall be intimated to the stock exchange where the securities are listed.