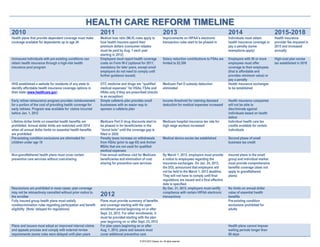

Health care reform_timeline_chart_1-28-13

- 1. HEALTH CARE REFORM TIMELINE 2010 2011 2013 2014 2015-2018 Health plans that provide dependent coverage must make Medical loss ratio (MLR) rules apply to Improvements on HIPAA’s electronic Individuals must obtain Health insurance coverage available for dependents up to age 26 how health insurers spend their transaction rules start to be phased in health insurance coverage or provider fee imposed in premium dollars (consumer rebates pay a penalty (some 2015 and increased must be paid by Aug. 1 each year exemptions apply) annually starting in 2012) Uninsured individuals with pre-existing conditions can Employers must report health coverage Salary reduction contributions to FSAs are Employers with 50 or more High-cost plan excise obtain health insurance through a high-risk health costs on Form W-2 (optional for 2011; limited to $2,500 employees must offer tax established in 2018 insurance pool program mandatory for later years, except small coverage to their employees employers do not need to comply until (that is affordable and further guidance issued) provides minimum value) or pay a penalty HHS established a website for residents of any state to OTC medicine and drugs are “qualified Medicare Part D subsidy deduction Health insurance exchanges identify affordable health insurance coverage options in medical expenses” for HSAs, FSAs and eliminated to be established their state (www.healthcare.gov) HRAs only if they are prescribed (insulin is an exception) Early retiree reinsurance program provides reimbursement Simple cafeteria plan provides small Income threshold for claiming itemized Health insurance companies for a portion of the cost of providing health coverage for businesses with an easier way to deduction for medical expenses increased will not be able to early retirees. Program was available for claims incurred sponsor a cafeteria plan discriminate against before Jan. 1, 2012 individuals based on health status Lifetime dollar limits on essential health benefits are Medicare Part D drug discounts start to Medicare hospital insurance tax rate for Individual health care tax prohibited. Annual dollar limits are restricted until 2014 be phased in for beneficiaries in the high wage workers increased credits available for certain when all annual dollar limits on essential health benefits “donut hole” until the coverage gap is individuals are prohibited filled in 2020 Pre-existing condition exclusions are eliminated for Penalty taxes increase on withdrawals Medical device excise tax established Second phase of small children under age 19 from HSAs (prior to age 65) and Archer business tax credit MSAs that are not used for qualified medical expenses Non-grandfathered health plans must cover certain Free annual wellness visit for Medicare By March 1, 2013, employers must provide Insured plans in the small preventive care services without cost-sharing beneficiaries and elimination of cost a notice to employees regarding the group and individual market sharing for preventive care services insurance exchanges. On Jan. 24, 2013, must provide comprehensive the DOL announced that employers will benefits coverage (does not not be held to the March 1, 2013 deadline. apply to grandfathered They will not have to comply until final plans) regulations are issued and a final effective date is specified. Rescissions are prohibited in most cases; plan coverage By Dec. 31, 2013, employers must certify No limits on annual dollar may not be retroactively cancelled without prior notice to compliance with certain HIPAA electronic value of essential health the enrollee 2012 transactions benefits Fully insured group health plans must satisfy Plans must provide summary of benefits Pre-existing condition nondiscrimination rules regarding participation and benefit and coverage starting with the open exclusions prohibited for eligibility (Note: delayed for regulations) enrollment period beginning on or after adults Sept. 23, 2012. For other enrollments, it must be provided starting with the plan year beginning on or after Sept. 23, 2012 Plans and issuers must adopt an improved internal claims For plan years beginning on or after Health plans cannot impose and appeals process and comply with external review Aug. 1, 2012, plans and issuers must waiting periods longer than requirements (some rules were delayed until plan years cover additional preventive care 90 days © 2010-2012 Zywave, Inc. All rights reserved.

- 2. beginning on or after Jan. 1, 2012) services for women without cost- sharing. Exceptions to contraceptive coverage apply to religious employers First phase of the small business health care tax credit For plan years ending on or after Oct. 1, Reforms related to the 2012, issuers and self-insured health allocation of insurance risk plans must pay comparative through reinsurance, risk effectiveness research fees. corridors and risk adjustment become effective Rebates for the Medicare Part D “donut hole” Non-grandfathered health sent to eligible enrollees plans will be subject to cost- sharing limits © 2010-2012 Zywave, Inc. All rights reserved.