Real Return Strategies: A Closer Look

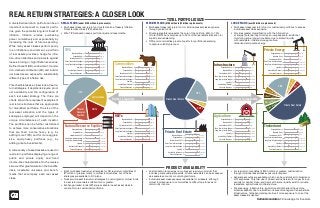

- 1. TOTAL PORTFOLIO SIZE A diversified real return portfolio can be an important component to investor portfo- lios, given the potential long-term threat of inflation. Inflation erodes purchasing power cumulatively and exponentially by increasing the cost of future spending. While many asset classes perform poorly in an inflationary environment, a portfolio of real assets provides a hedge for infla- tion-driven liabilities and protects against losses in rising or high inflation scenarios. Defined benefit (DB), endowment, founda- tion, defined contribution (DC) and individ- ual investors are exposed to substantially different types of inflation risk. This charticle takes a closer look at real re- turn strategies. It depicts risk levels, prod- uct availability and the configuration of each real asset strategy. The three pie charts shown here represent examples of real return structures that are appropriate for diversified portfolios. The size of the real asset allocation and the types of strategies employed will depend on the unique circumstances of each investor. The portfolios can be further customized to achieve more conservative allocations that are fixed income heavy (e.g., by adding more TIPS) and for more aggres- sive, equity-heavy portfolios (e.g., by adding private investments). A wide variety of asset classes are used in real return portfolios displaying a range of public and private equity and fixed income-like characteristics. On the reverse side we offer greater detail on the benefits, risks, investable universes and bench- marks that accompany each real asset class. Real RetuRn StRategieS: a CloSeR look Customization required as no multi-asset real return product that includes private real estate exists. Private real estate can be accessed via separate accounts or commingled funds. Individual asset class exposure is available for all assets, although mutual fund exposure to commodities is difficult due to taxes on commodity income. Eight multi-asset real return strategies for DB real return mandates of $1 million or greater, mostly in mutual fund vehicles. Six of these strategies are available to DC plans. Twelve multi-asset real return strategies in commingled or mutual funds for real return mandates of $5 million or greater. Exchange-traded funds (ETFs) are available in each asset class to construct more customized portfolios. For real return mandates of $500 million or greater; customization through individual asset class exposure is required. Separate accounts are available, which can be customized to broaden or limit exposures. Potential use of closed-end vehicles with longer lock-up periods for capital. Open-end funds with some liquidity exist for private real estate, agriculture and infrastructure. Private energy, infrastructure, agriculture and timberland have more limited availability due to a smaller universe of managers. Can substitute infrastructure, timberland and agriculture if more exposure to one of the asset classes is desired. Callan Associates • Knowledge for Investors MEDIUM PLANS ($100 million to $3 billion in plan assets) • Multi-asset class real return fund or individual asset class exposure through pooled funds. • Private real estate represents the core of the portfolio, 65% to 75% of total. REITs can comprise up to 20% of the real estate allocation for liquidity and rebalancing. • TIPS and commodities provide liquidity for portfolio rebalancing to capture volatility premium. SMALL PLANS (under $100 million in plan assets) • Multi-asset class real return fund or stand-alone Treasury Inflation- Protected Securities (TIPS) allocation. • 50% TIPS allocation keeps portfolio liquid and less volatile. LARGE PLANS (over $3 billion in plan assets) • Multi-asset class real return fund or customized portfolios to access individual asset class exposure. • Provides greater diversification with the introduction of a larger potential opportunity set—requires scale, additional monitoring and a longer time frame due to limited liquidity with real estate, infrastructure, agriculture, timberland and private energy. Expected Return Expected Risk Correlation with CPI Short-Term Inflation Hedge Long-Term Inflation Hedge Liquidity Availability of Product Fees and Expenses cash equity cash equity low high poor excellent poor excellent low high poor excellent poor excellent Private Real Estate Expected Return Expected Risk Correlation with CPI Short-Term Inflation Hedge Long-Term Inflation Hedge Liquidity Availability of Product Fees and Expenses cash equity cash equity low high poor excellent poor excellent low high poor excellent poor excellent Commodities Expected Return Expected Risk Correlation with CPI Short-Term Inflation Hedge Long-Term Inflation Hedge Liquidity Availability of Product Fees and Expenses cash equity cash equity low high poor excellent poor excellent low high poor excellent poor excellent TIPS Expected Return Expected Risk Correlation with CPI Short-Term Inflation Hedge Long-Term Inflation Hedge Liquidity Availability of Product Fees and Expenses cash equity cash equity low high poor excellent poor excellent low high poor excellent poor excellent Timberland Expected Return Expected Risk Correlation with CPI Short-Term Inflation Hedge Long-Term Inflation Hedge Liquidity Availability of Product Fees and Expenses cash equity cash equity low high poor excellent poor excellent low high poor excellent poor excellent Agriculture Expected Return Expected Risk Correlation with CPI Short-Term Inflation Hedge Long-Term Inflation Hedge Liquidity Availability of Product Fees and Expenses cash equity cash equity low high poor excellent poor excellent low high poor excellent poor excellent Infrastructure Expected Return Expected Risk Correlation with CPI Short-Term Inflation Hedge Long-Term Inflation Hedge Liquidity Availability of Product Fees and Expenses cash equity cash equity low high poor excellent poor excellent low high poor excellent poor excellent Private Energy Expected Return Expected Risk Correlation with CPI Short-Term Inflation Hedge Long-Term Inflation Hedge Liquidity Availability of Product Fees and Expenses cash equity cash equity low high poor excellent poor excellent low high poor excellent poor excellent REITs Expected Return Expected Risk Correlation with CPI Short-Term Inflation Hedge Long-Term Inflation Hedge Liquidity Availability of Product Fees and Expenses cash equity cash equity low high poor excellent poor excellent low high poor excellent poor excellent Natural Resource Equities REITs Timberland Agriculture Infrastructure Private Energy Commodities Private Real Estate Private Real Estate Commodities Higher Liquidity Higher Complexity TIPS TIPS TIPS Commodities Natural Resource Equities REITs REITs PRODUCT AVAILABILITY

- 2. Further Reading About Callan Beyond U.S. Timberland (2010) Publicly Traded Privately Traded For further reading, Callan recommends the following research pieces: Founded in 1973, Callan Associates Inc. is one of the largest independently owned investment consulting firms in the country. Headquartered in San Francisco, Calif., the firm provides research, education, decision support and advice to a broad array of institutional investors. www.callan.com © 2011 Callan Associates Inc. Published January 2011 Is it Time to Add TIPS to Your DC Plan? (2010) Global Real Estate Securities: An Introduction for the Institutional Investor (2007) Real RetuRn StRategieS: a CloSeR look Callan Associates • Knowledge for Investors Timberland is a compelling real asset strategy that is attracting investment due to its income generation potential and diversification benefits. Historically, the majority of institutional investors have focused on U.S. timberland, which represents the largest share of the global marketplace. International timberland investment opportunities are increasingly becoming available. International timberland presents unique opportunities and challenges. Investing abroad diversifies domestic exposure and provides access to an emerging opportunity set and attractive pricing. However, investors face country and environmental risks, scanty return data for benchmarking, implementation challenges and a limited manager universe with little quantifiable performance history. In this paper Callan explores global timberland investments, which offer opportunities for investors looking beyond the more mature U.S. timberland market. *"! $ ! Investors seeking inflation protection and portfolio diversification are shifting focus to real asset strategies and due diligence is increasingly trained on investments that represent finite resources. Timberland is a compelling investment strategy due to a variety of unique character- istics, including its biological growth component, income generation potential and diversification benefits. The majority of institutional investment in timberland has been within the U.S., which represents the largest share of the global timberland marketplace. However, the investment industry has begun to explore opportunities in the vast timberland areas outside of the U.S. In this paper we explore global timberland investments, including the investment manager uni- verse, opportunity set and the fundamental benefits and risks of looking beyond the U.S. We describe common challenges in benchmarking and obtaining historical performance, and exam- ine implementation options. !&$" ' & "! Callan Associates • Knowledge for Investors Is it Time to Add TIPS to Your DC Plan? Due to 2008 and 2009 monetary and fiscal stimulation, the possibility of higher inflation in the future has motivated some plan sponsors to pursue offsetting diversification options, such as Treasury Inflation-Protected Securities (TIPS). TIPS may be a good fit for defined contribution (DC) plans seeking additional fixed income inflation-protection options. Plan sponsors adding TIPS to their DC fund lineup must be willing to assume the challenge of communicating this investment thoroughly and appropriately to plan participants. This paper addresses how to offer TIPS in a DC plan—as part of a core fixed income fund, within target date funds, as an available option in a self-directed brokerage account or as a stand-alone fixed income fund—for optimal participant utilization. As the market and economy show signs of recovery, plan sponsors are taking a closer look at their defined contribution plan fund lineup. They are asking questions like: Does it allow for sound diversification? Does it meet the demographic needs of plan partici- pants? Can it weather the next storm—whatever that might be? In particular, Treasury Inflation-Protected Securities (TIPS) is an asset class that bears closer scrutiny, both for its diversification potential and for its inflation-protection properties. -77-9 >>:/5-?1> G %BCK@98;9 :CF #BJ9GHCFG -0#"- &"- 45"5& &$63*5*&4 $ ($ & .<9 G<=:H HCK5F8G 5 Q;@C65@R F95@ 9GH5H9 G97IF=H=9G 5DDFC57< 6M =BGH=HIH=CB5@ =BJ9GHCFG <5G 699B 5 F9@5H=J9@M B9K 6IH F5D=8@M ;FCK=B; HF9B8 1<5H <5G GDIFF98 H<=G <9=;<H9B98 @9J9@ C: =BJ9GHCF =BH9F9GH 5B8 57H=J=HM #B H<=G D5D9F K9 9L5A=B9 H<9 <=GHCFM 5B8 9JC@IH=CB C: H<9 ;@C65@ F95@ 9GH5H9 G97IF=H=9G A5F?9H 5B8 9J5@I5H9 H<9 =AD57H 5 8=J9FG=:=98 ;@C65@ F95@ 9GH5H9 G97IF=H=9G DCFH:C@=C A5M <5J9 CB 5 HMD=75@ =BGH=HIH=CB5@ =BJ9GHA9BH DFC;F5A 19 <=;<@=;<H 7CAACB A9H<C8G C: =AD@9A9BH5H=CB 5B8 8C7IA9BH H<9 F979BH J=;CFCIG ;FCKH< =B H<9 IB=J9FG9 C: A5B5;9FG K<C GD97=5@=N9 =B ;@C65@ F95@ 9GH5H9 G97IF=H=9G =B5@@M K9 8=G7IGG H<9 J5F=CIG =B89L 5@H9FB5H=J9G :CF 69B7<A5F?=B; H<9 F9HIFB 5B8 F=G? C: 5 ;@C65@ F95@ 9GH5H9 G97IF=H=9G DCFH:C@=C .<9 ;@C65@=N5H=CB C: / - =BGH=HIH=CB5@ F95@ 9GH5H9 DCFH:C@=CG =G 5 F9@5H=J9@M B9K 6IH F5D=8@M ;FCK=B; HF9B8 /G=B; 5@@5BSG A5B5;9F G95F7< 57H=J=HM 5G 5 65FCA9H9F CIF 7@=9BHG :=FGH 69;5B D9F:CFA=B; G95F7<9G :CF ;@C65@ 5B8 =BH9FB5H=CB5@ , #. A5B5;9FG =B H<9 A=88@9 C: -=B79 H<5H H=A9 , #. G95F7<9G <5J9 8CA=B5H98 5@@5BSG F95@ 9GH5H9 A5B5;9F G95F7< 57H=J=HM 1<5H <5G GDIFF98 H<=G <9=;<H9B98 @9J9@ C: =BJ9GHCF =BH9F9GH 5B8 57H=J=HM #B H<9 :C@@CK=B; D5;9G K9 9L5A=B9 H<9 <=GHCFM 5B8 9JC@IH=CB C: H<9 ;@C65@ F95@ 9GH5H9 G97IF=H=9G A5F?9H 5B8 9J5@I5H9 H<9 =AD57H 5 8=J9FG=:=98 ;@C65@ F95@ 9GH5H9 G97IF=H=9G DCFH:C@=C A5M <5J9 CB 5 HMD=75@ =BGH=HIH=CB5@ =BJ9GH A9BH DFC;F5A 19 5@GC @CC? 5H H<9 IB=J9FG9 C: A5B5;9FG K<C GD97=5@=N9 =B H<=G 5F95 =B5@@M K9 8=G7IGG H<9 69B7<A5F? CDH=CBG H<5H 5F9 5J5=@56@9 :CF ;5I;=B; H<9 F9@5H=J9 D9F:CFA5B79 C: 5 ;@C65@ DCFH:C@=C /530%6$5*0/ Callan Associates • Knowledge for Investors Contact Information For more information please contact your Callan consultant. San Francisco 415.974.5060 Atlanta 770.618.2140 Chicago 312.346.3536 Denver 303.861.1900 New Jersey 973.593.8050 Agriculture Agriculture investments are in properties that are leased to farmers and used to grow crops. Sources of return include a high income component from leasing fees. Agriculture provides an indirect inflation hedge from two sources: an inflation- sensitive income stream and exposure to the underlying spot prices of commodities. Benefits • Solid long-term inflation hedge; capital appreciation from income producing investments. • High current income, low observed volatility. Should outperform stocks and will trump bonds in periods of rapidly rising or high inflation. Risks • Long-term, illiquid investment with very thin supply of institutional-quality products. • High transaction costs and valuation and monitoring challenges; can suffer from imbalances in supply and demand. • Unique operational risks (e.g., commodity prices, pests, disease, regulation). Investable Universe • $900 million (investable U.S. agriculture), representing 1% of total U.S. agriculture. Often difficult to find farms of a large enough value for institutional investments. Less than 20 institutional managers accessed via separate accounts or commingled funds. Benchmark: NCREIF Farmland Index (investable U.S. universe) Commodities The commodities market trades 96 different commodities. Institutional investors typically invest in futures contracts because of the difficulties of owning physical commodities. For futures, the sources of return include spot prices, roll returns and the interest on underlying collateral. Commodities provide a direct hedge to inflation since spot commodity prices can be a major driver of inflation. Benefits • Good potential candidate for active management. • Strong complement to TIPS exposure in a real return portfolio; low to negative correlation to stocks and bonds. • Rise in price with inflation providing a natural hedge against equity and debt losses. Risks • Highly volatile with a steep downside and should be actively rebalanced with uncorrelated assets. Investable Universe • $300 trillion (commodities derivatives market); 50 active and passive institutional commodities strategies, accessed publicly. Benchmarks: Goldman Sachs Commodity Index; Dow Jones-UBS Commodity Index Infrastructure Investments in infrastructure are in facilities that provide essential public services (e.g., transport, utilities, communications, social services). Infrastructure’s main source of return is income generated from toll payments or underlying fees (e.g., leases). Inflation protection stems from the inflation-sensitive income stream and the replacement costs of the underlying physical asset. Benefits • Stable income stream providing a long-term inflation hedge. • Provides high current income and low observed volatility. May outperform stocks and bonds in periods of rapidly rising or sustained high inflation. Risks • Returns are bond like—impacted by interest rates and credit market conditions. • Long-term, illiquid investment with thin supply of institutional-quality products. Political and regulatory risks as well as public controversies over privatization. • Fees based on committed, not invested, capital therefore performance and fee calculations are usually estimates. Investable Universe • $1 trillion (global universe) with 120 managers worldwide; U.S. and Europe comprise 40% of the total. MLP markets are small but growing. Benchmarks: S&P Global Infrastructure Index; Alerian MLP Index (MLP) Natural Resource Equities Natural resource equities are the equity securities of commodity producers, generating returns from two sources: dividend income and capital appreciation. Commodity producers have an indirect hedge to inflation from exposure to the underlying spot commodities. Benefits • Solid correlation with inflation while having equity-like risk/reward characteristics. • Highly liquid compared to non-exchange traded real return strategies. • Eliminates the negative “roll return” often faced by commodity futures. Risks • More correlated at times with equity markets than direct commodity exposure. Investable Universe • Large universe through energy sector equities whose earnings are linked to commodity prices, ETFs and hedge funds (e.g., CTAs, global macro). Benchmarks: MSCI All Country World Commodity Producers Index; S&P Global Natural Resources Index Private Energy Private energy investments are through acquisitions or equity stakes in energy companies, or through direct ownership of properties or energy projects. Private energy's inflation-sensitive income stream provides an indirect inflation hedge from the sale of resources at market rates and from valuation changes as the resource price fluctuates. Benefits • Income is often linked to inflation, providing a solid long-term inflation hedge, particularly from rising commodity prices. • Outperforms stocks and bonds in periods of rapidly rising or sustained high inflation. • Less volatile than commodities, adds value over the long term, provides diversification. Risks • Long-term, illiquid investment with thin supply of institutional-quality products. • Potential for periods of underperformance relative to stocks and bonds, given long commodity cycles. Investable Universe • Limited universe of approximately 40 managers, employing energy sector investment strategies including oil and gas, power and alternative energy (e.g., wind, solar, geothermal, etc.). Benchmarks: Dow Jones Energy Sector Index; S&P 500 Energy Index Private Real Estate Private real estate is a direct approach to owning commercial real estate properties. Sources of return for core private real estate include rental income and capital appreciation. Similar to infrastructure, real estate can have an inflation-sensitive income stream, as well as inflation protection via replacements costs of the underlying physical asset. Benefits • Solid long-term inflation hedge, with a high level of short-term correlation to inflation. • Core strategies provide high current income, a relatively high rate of return and low observed volatility. Should outperform stocks, and will certainly trump bonds, in periods of rapidly rising or high inflation. Risks • Illiquid; significant declines in early 1990s and 2009 not related to inflation. Investable Universe • $6 trillion (institutional private investment). 36% of the commercial market is located in the U.S. and 35% in Europe. Benchmark: NCREIF Property Index REITs REITs are publicly traded real estate securities that provide liquidity not found in private real estate. Similar to natural resource equities, returns stem from dividend income and capital appreciation. Inflation-sensitivity is derived from the characteristics of the underlying private real estate assets. Benefits • Provide access to diversified real estate assets not found in other vehicles. • Solid long-term inflation hedge; outperform bonds in periods of rapidly rising or sustained high inflation. • Liquidity enables REITs to replace private real estate in smaller portfolios. REITs complement private real estate in larger portfolios with liquidity and exposure to specific market segments, such as regional malls and CBD offices. Risks • Sensitive to interest rates and management. • Highly correlated to small and mid cap equities; highly volatile. Investable Universe • 192 institutional-quality global real estate securities, totaling $555 billion; 126 institutional-quality U.S. real estate securities, totaling $359 billion, as well as a limited number of out-of-benchmark securities. Benchmarks: FTSE NAREIT Equity Index (domestic institutional-quality); FTSE EPRA/NAREIT Developed REITs Index (global institutional-quality) Timberland Timberland displays characteristics of more than one asset class with attributes of real estate, fixed income and commodities. It derives its revenue from its biological growth value, land prices and the price of timber. It is difficult to implement in a DC framework because of the daily valuation requirement. Benefits • Solid long-term inflation hedge, stemming from biological growth and income generated by harvesting a commodity. • High current income, low correlation with other assets, a relatively high rate of return and low observed volatility. Should outperform stocks and will trump bonds in periods of rapidly rising or high inflation. Risks • Limited transaction activity and history. • Long-term, illiquid investment with thin supply of institutional-quality products. • Unique operational risks (e.g., fire, pests, water shortage, disease, regulation). Investable Universe • $300 billion est. (total global timber), with the majority in the U.S. ($212 billion), representing 1.5 billion hectares. About 25 institutional-quality investment managers globally accessed via direct separate accounts or closed-end commingled funds. Benchmark: NCREIF Timberland Index (limited availability of data) TIPS TIPS are notes and bonds issued by the U.S. Treasury as “inflation-linked” debt. Inflation-indexed bonds are quoted in terms of a real yield. TIPS are considered the purest hedge against CPI inflation as their principal and interest are adjusted for actual or realized inflation. Benefits • Positive risk-free real return—if the embedded “real yield” is positive at purchase, positive real return will result at maturity. Risks • Impacted by supply and demand pricing factors because of limited supply and issuance. Can produce negative real returns over short periods. • Low yields—many investment programs need a higher real return to meet return assumptions. Investable Universe • $1.5 trillion (global inflation-linked bond market), of which $500 billion is outstanding U.S. TIPS. 70 institutional U.S. TIPS strategies accessible to institutional investors and over 20 global inflation-linked bond strategies. Benchmarks: BC U.S. TIPS Index; BC Global Inflation-Linked Index