resume chintan

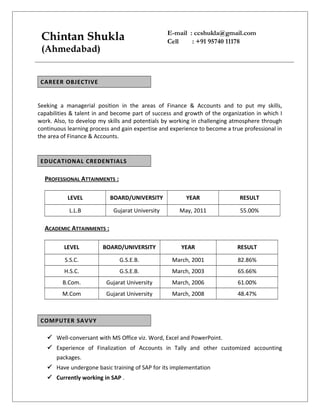

- 1. Chintan Shukla (Ahmedabad) E-mail : ccshukla@gmail.com Cell : +91 95740 11178 CAREER OBJECTIVE Seeking a managerial position in the areas of Finance & Accounts and to put my skills, capabilities & talent in and become part of success and growth of the organization in which I work. Also, to develop my skills and potentials by working in challenging atmosphere through continuous learning process and gain expertise and experience to become a true professional in the area of Finance & Accounts. EDUCATIONAL CREDENTIALS PROFESSIONAL ATTAINMENTS : LEVEL BOARD/UNIVERSITY YEAR RESULT L.L.B Gujarat University May, 2011 55.00% ACADEMIC ATTAINMENTS : LEVEL BOARD/UNIVERSITY YEAR RESULT S.S.C. G.S.E.B. March, 2001 82.86% H.S.C. G.S.E.B. March, 2003 65.66% B.Com. Gujarat University March, 2006 61.00% M.Com Gujarat University March, 2008 48.47% COMPUTER SAVVY Well-conversant with MS Office viz. Word, Excel and PowerPoint. Experience of Finalization of Accounts in Tally and other customized accounting packages. Have undergone basic training of SAP for its implementation Currently working in SAP .

- 2. WORK EXPERIENCE – MORE THAN 8 YRS. Account Executive in Dishman Pharmaceuticals and Chemicals Ltd (MFG. Pharma. API) I am working with the co. since last 1.5 Years. Brief work profile is follows; • Accounts: To check all Purchase / Stores / Labour / Exps. Bills with PO, WO, GRN and SRN and due to authorization Purchase Accounting Creditors Reconciliation Preparing Monthly Creditors Aging Reports and Provision Vendor Bill Passing Preparation and Monitoring monthly statements like Outstanding Doing all entries in ‘SAP’ , and working in SAP Environment Ready To work Independently • Taxation: CST: As per our 100% Export Oriented Unit, we are getting benefit of SEZ of reimbursement of CST which we have paid to parties. Preparing of CST reimbursement Return on quarterly basis. • Excise & Export : Reconciliation of RG-1,RG 23A & 23C – Part I & II of Monthly Basis • Audit: Coordinating with the audit authorities for conducting audits with a view to ensure that accounts are prepared and maintained as per the pre-set accounting standards. Maintain compliance with legal and organizational policies. Participate in Internal Audit, Statutory, Vat Audit Tax Audit and resolve its query Ensure Statutory Tax Compliances on monthly basis, viz .payment of TDS, Excise, Vat and Service Tax on due dates and arranging funds for the same. Independent handling of annual statutory audit and tax audit of the company. Account Executive in Sakar Healthcare Pvt Ltd (MFG. Pharmaceutical Formulation) I am working with the co. since last 1.6 Years. Brief work profile is follows; • Accounts: To ensure timely completion of all accounting functions including: Checking and feeding of all Bank, Cash, Purchase, Sales in Books and editing thereof. To check all Purchase / Stores / Labour / Exps. Bills with PO, WO, GRN and SRN and due to authorization

- 3. handle independently Accounts Receivable (also follow-up with customer for collection) Purchase / Sales Accounting Debtors & Creditors Reconciliation Preparing Monthly Debtors Aging Reports and Provision Vendor Bill Passing Preparation and Monitoring monthly statements like Outstanding Doing all entries in ‘ERP’ , and working in ERP Environment Ready To work Independently • Finance: Cheque Preparation Bill Discounting & Settlement advice Entries. Bank Payment / Receipt, Bank Transfer Accounting Preparation of Stock Statement. Field work of banking Transactions also. Day to Day BANK RECONCILIATIONS with entire Banking Transactions and Term Loan Transactions Preparation Documents of Bank LC Open and arrange for its payment for the same. • Taxation: TDS: Monthly TDS Liability Calculation & E-TDS Payment and E- TDS Quarterly Return , To Issue Form 16 & 16A (TDS Certificate), To Filing also revised return if error. Service Tax : Service Tax Liability Calculation , Payment and Help Halfly Return Filling. To handle Service Tax, recovery from customer CST: As per our 100% Export Oriented Unit, we are getting benefit of SEZ of reimbursement of CST which we have paid to parties. Preparing of CST reimbursement Return on quarterly basis. Sales Tax: (1). Monthly Vat and CST Liability Calculation and Payment (2).To Filling Returns for Vat & CST (3) Application and Issue of Sales Tax Forms (4) Follow-up with Customer for ‘C’ & ‘H’ Form (5) Yearly Audit Report & Yearly Form 205 (6) Online Upload Form 402 & 403 Independent Handling of Vat, TDS Assessment • Excise & Export : Reconciliation of RG-1,RG 23A & 23C – Part I & II Preparation of ARE-1 , ARE-2 Prepare Document of Rebate Claim Prepare Performa Invoice, Commercial Invoice, Packing Invoice for Export Party Follow up with bank in terms of Foreign Remittance and prepare documents against remittance received Prepare Document of Sample/ working standard for outside country • Stock: Preparing Consumption & Production Report on Monthly Basis To check all Raw Material Consumption & Finished goods Production as per Suffix Batch size if any query then communicate with Production Dept • MIS:

- 4. Raw Material Consumption & Cost Report Invoice wise Expenses Details Country wise Export Details • Audit: Coordinating with the audit authorities for conducting audits with a view to ensure that accounts are prepared and maintained as per the pre-set accounting standards. Maintain compliance with legal and organizational policies. Participate in Internal Audit, Statutory, Vat Audit Tax Audit and resolve its query Ensure Statutory Tax Compliances on monthly basis, viz .payment of TDS, Excise, Vat and Service Tax on due dates and arranging funds for the same. Independent handling of annual statutory audit and tax audit of the company. • Awareness about Mutual Funds: Conducted a survey to know the age group in which people invest in Mutual Funds. Was actively involved in the Selling of Mutual Funds of various companies. Drew Recommendations on the various aspects on which the Mutual Fund companies should work in order to increase the customer base. Account Executive in Concord Biotech Ltd (MFG. Pharmaceutical API) I am worked with the co. since last 2 Years. Brief work profile is follows; • Taxation: TDS: See Proper Deduction on Contractor Payment, Commission, Professional Charges, Consulting Charge, Rent, Technical Services, Brokerage. Prepare Monthly Data for TDS & Quarterly Data for TDS, Handling Form 16A for Creditors, Filing also revised return if error. Service Tax – Preparing Form ST 3 Return, Taken Credit on Half year Basic, Taking Credit of Service as an Input service Distributor and preparing service tax computation of GTA and making ST-3 return and TR-6 Challan. To handle Service Tax, recovery from customer CST: As per our 100% Export Oriented Unit, we are getting benefit of SEZ of reimbursement of CST which we have paid to parties. Preparing of CST reimbursement Return on quarterly basis. Sales Tax: Prepare Monthly Data (201A, 201B, Annexure I, Annexure II) ,Monthly Return File, Statutory Payment, Prepare Yearly Audit Report & Yearly Form 205, Handling ‘C’ & ‘H’ form Collection from Debtors. • Audit: Coordinating with the audit authorities for conducting audits with a view to ensure that accounts are prepared and maintained as per the pre-set accounting standards. Maintain compliance with legal and organizational policies. Participate in Internal Audit, Statutory, Vat Audit Tax Audit and resolve its query Ensure Statutory Tax Compliances on monthly basis, viz .payment of TDS, Excise, Vat and Service Tax on due dates and arranging funds for the same.

- 5. • Excise & Export : Reconciliation of RG-1,RG 23A & 23C – Part I & II Preparation ARE-1, ARE-2 Prepare Document of Rebate Claim Prepare Performa Invoice, Commercial Invoice, Packing Invoice for Export Party Follow up with bank in terms of Foreign Remittance and prepare documents against remittance received Accounts: To ensure timely completion of all accounting functions including: Checking and feeding of all Bank, Cash, Purchase, Sales in Books and editing thereof. To check all Purchase / Stores / Labour / Exps. Bills with PO, WO, GRN and SRN and due to authorization handle independently Accounts Receivable (also follow-up with customer for collection) Purchase / Sales Accounting Debtors & Creditors Reconciliation Preparation and Monitoring monthly statements like Outstanding Doing all entries in ‘ SAP’ , and working in SAP Environment • Finance: Cheque Preparation Bill Discounting & Settlement advice Entries. Bank Payment / Receipt, Bank Transfer Accounting Preparation of Stock Statement. Field work of banking Transactions also. Day to Day BANK RECONCILIATIONS with entire Banking Transactions and Term Loan Transactions Account Executive in Rajiv Petrochemicals Pvt Ltd (MFG Plastic Woven Sack Ind.) I am worked with the co. since last 2.5 Years. Brief work profile is follows; • Taxation: TDS: See Proper Deduction on Contractor Payment, Commission, Professional Charges, Consulting Charge, Rent, Technical Services, Brokerage. Prepare Monthly Data for TDS & Quarterly Data for TDS, Handling Form 16A for Creditors, Filiing also revised return if error. Service Tax – Preparing Form ST 3 Return, Taken Credit on Half year Basic, Taking Credit of Service as an Input service Distributor and preparing service tax computation of GTA and making ST-3 return and TR-6 Challan. To handle Service Tax, recovery from customer CST: As per our 100% Export Oriented Unit, we are getting benefit of SEZ of reimbursement of CST which we have paid to parties. Preparing of CST reimbursement Return on quarterly basis. Sales Tax: Prepare Monthly Data (201A, 201B, Annexture I, Annexture II) ,Monthly Return File, Statutory Payment, Prepare Yearly Audit Report & Yearly Form 205, Handling ‘C’ & ‘H’ form Collection from Debtors.

- 6. • Audit: Coordinating with the audit authorities for conducting audits with a view to ensure that accounts are prepared and maintained as per the pre-set accounting standards. Maintain compliance with legal and organizational policies. Participate in Internal Audit, Statutory, Vat Audit Tax Audit and resolve its query Ensure Statutory Tax Compliances on monthly basis, viz .payment of TDS, Excise, Vat and Service Tax on due dates and arranging funds for the same. • Excise & Export : Reconciliation of RG-1,RG 23A & 23C – Part I & II Preparation ARE-1, ARE-2 Prepare Document of Rebate Claim Prepare Performa Invoice, Commercial Invoice, Packing Invoice for Export Party Follow up with bank in terms of Foreign Remittance and prepare documents against remittance received Accounts: To ensure timely completion of all accounting functions including: Checking and feeding of all Bank, Cash, Purchase, Sales in Books and editing thereof. To check all Purchase / Stores / Labour / Exps. Bills with PO, WO, GRN and SRN and due to authorization handle independently Accounts Receivable (also follow-up with customer for collection) Purchase / Sales Accounting Debtors & Creditors Reconciliation Preparation and Monitoring monthly statements like Outstanding Doing all entries in ‘ ERP’ , and working in ERP Environment • Finance: Cheque Preparation Bill Discounting & Settlement advice Entries. Bank Payment / Receipt, Bank Transfer Accounting Preparation of Stock Statement. Field work of banking Transactions also. Day to Day BANK RECONCILIATIONS with entire Banking Transactions and Term Loan Transactions Account Executive in Alpha Science Academy Pvt Ltd I am worked with the co. since last 1.5 Years. Brief work profile is follows; • Finance: Cheque Preparation Bill Discounting & Settlement advice Entries. Bank Payment / Receipt, Bank Transfer Accounting Field work of banking Transactions also. Day to Day BANK RECONCILIATIONS with entire Banking Transactions and Term Loan Transactions

- 7. HOBBIES Watching movies Appreciate Music Reading books STRENGTHS Determined to succeed, Dedicated to work Enthusiastic and Self Motivator Passionate about Work Curiosity and eagerness to learn. Ability to adopt changes PERSONAL PROFILE Address of Correspondence A/4,Ravi Apartment, B/H, Balaji Complex, Vastrapur, Ahmedabad-382443 Gujarat, India Contact Number Mobile: +91- 95740 11178 Date of Birth 9th August, 1986 Gender Male Marital Status Not Married Nationality Indian E-mail ccshukla@gmail.com Language Proficiency English, Gujarati & Hindi Hobbies Playing Cricket, Listening Music Date Of Availability 1 Month DECLARATION

- 8. I, Here with declare that above furnished all the details are true And authentic, as per best of my understanding. Date: 05/04/2016 Yours truly, Place: Ahmedabad (Chintan Shukla)