Health Care Reform - Small Business Health Options Program (SHOP) Updates

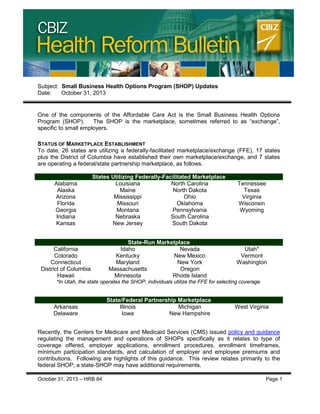

- 1. CBIZ Health Reform Bulletin Subject: Small Business Health Options Program (SHOP) Updates Date: October 31, 2013 One of the components of the Affordable Care Act is the Small Business Health Options Program (SHOP). The SHOP is the marketplace, sometimes referred to as “exchange”, specific to small employers. STATUS OF MARKETPLACE ESTABLISHMENT To date, 26 states are utilizing a federally-facilitated marketplace/exchange (FFE), 17 states plus the District of Columbia have established their own marketplace/exchange, and 7 states are operating a federal/state partnership marketplace, as follows. Alabama Alaska Arizona Florida Georgia Indiana Kansas States Utilizing Federally-Facilitated Marketplace Louisiana North Carolina Maine North Dakota Mississippi Ohio Missouri Oklahoma Montana Pennsylvania Nebraska South Carolina New Jersey South Dakota California Colorado Connecticut District of Columbia Hawaii State-Run Marketplace Idaho Nevada Kentucky New Mexico Maryland New York Massachusetts Oregon Minnesota Rhode Island Tennessee Texas Virginia Wisconsin Wyoming Utah* Vermont Washington *In Utah, the state operates the SHOP; individuals utilize the FFE for selecting coverage. Arkansas Delaware State/Federal Partnership Marketplace Illinois Michigan Iowa New Hampshire West Virginia Recently, the Centers for Medicare and Medicaid Services (CMS) issued policy and guidance regulating the management and operations of SHOPs specifically as it relates to type of coverage offered, employer applications, enrollment procedures, enrollment timeframes, minimum participation standards, and calculation of employer and employee premiums and contributions. Following are highlights of this guidance. This review relates primarily to the federal SHOP; a state-SHOP may have additional requirements. October 31, 2013 – HRB 84 Page 1

- 2. CBIZ Health Reform Bulletin COVERAGE AND ENROLLMENT An employer eligible for the SHOP must meet 3 criteria: 1. It must be ‘small employer’, defined as an employer employing between 1 and 100 employees. Employer size is determined based on the prior calendar year; both fulltime employees and full-time equivalent employees are counted. (For 2014 and 2015, a state may define small employer as one employing 1 to 50 employees. States may open their marketplaces to large employers in 2017); 2. The coverage must be offered to all full-time employees, defined as individuals working 30 or more hours per week; and 3. The employer’s principal office must be within the SHOP’s geographic area. In order to enroll in coverage through a SHOP, employers and employees are required to complete applications to determine their eligibility for coverage. The SHOP is based on an employee choice model pursuant to which the employer will select a metal tier of coverage and the employees choose any plan within that tier; in some instances, the employee may even be able to move up a tier. The metal tiers are categorized based on the level of benefit coverage, i.e., Bronze (covers 60% of total average costs of care), Silver (70%), Gold (80%) and Platinum (90%). In 2014, employers utilizing a federally-facilitated SHOP (FF-SHOP) can only choose one qualified health plan (QHP) at a single metal tier of coverage for their employees. A state can choose to make the full metal tier available, or limit it to one plan like the FF-SHOPs. Beginning in 2015, all SHOPs are required to offer all plans within a single metal tier of coverage. Once an employer enrolls through a SHOP and employees elect the employer’s offer of coverage, the SHOP then provides enrollment information to the relevant QHP issuer (insurer). INITIAL AND ANNUAL OPEN ENROLLMENT PERIODS AND COVERAGE Initial open enrollment in the FF-SHOP began October 1, 2013. The effective date of coverage is based upon the date selected by the employer as part of the application and enrollment process, as follows: Plan Selection Date 10/1/13 through 12/15/13 Between the 1st and 15th day of the month Between the 16th and last day of the month Effective Date of Coverage 1/1/14 1st day of the following month 1st day of the second following month Employer plans are issued on a 12-month basis. Open enrollment and renewal periods will occur on a rolling basis throughout the year. Employers will receive renewal notices from the FF-SHOP at least three months prior to the end of the plan year and have 30 days to respond to the renewal offer. If the employer opts to renew the coverage, then the SHOP will then notify employees about their coverage options for the subsequent year. Employees have up to 30 days to either accept or waive coverage, as well as add dependents or make changes to their QHP coverage during this open enrollment period. Both the employer’s plan offerings and employee coverage decisions must be submitted to the SHOP by the 15th of the month prior to the end of the employer’s plan year in order to be timely effective for the beginning of the following plan year. October 31, 2013 – HRB 84 Page 2

- 3. CBIZ Health Reform Bulletin Delay in On-line Enrollment Process. In late September, HHS announced a delay in the availability of electronic enrollment in a SHOP November, 2013. Updates since have moved the electronic enrollment availability to the end of November, at the earliest. According to the news release, as long as employers and employees complete the enrollment process by December 15, 2013, coverage will begin January 1, 2014. SPECIAL ENROLLMENT PERIODS A SHOP must provide for a 30-day special enrollment period during which qualified individuals may enroll in QHPs or change QHPs upon the occurrence of certain life events. These events are: Addition of a dependent as a result of marriage, birth, adoption, or placement for foster care; The covered employee or dependent loses minimum essential coverage due to job loss or loss of QHP certification; The employee moves to a new state and gains access to employer health coverage; An employee’s enrollment or non-enrollment in a plan is the result of the error, misrepresentation, or inaction by the Marketplace or by HHS; or Violation of a contract provision as proven by the covered employee. The affected employee must notify the SHOP of a life event that triggers a special enrollment period within 30 days of the event. An employee who becomes eligible or loses eligibility for Medicaid or the Children’s Health Insurance Program (CHIP) would have 60 days from the date of the event to notify the SHOP. If the employee fails to timely notify the SHOP of the event, then he/she would have to wait until their next annual enrollment period to make a change. MINIMUM PARTICIPATION RULES A SHOP can impose a 70% participation requirement unless a state requires a higher standard. States that currently require employers to meet a minimum 75% participation rate are Arkansas, Iowa, New Hampshire, New Jersey, South Dakota and Texas. For participation purposes, all employees, including full-time, part-time employees, COBRA continuees, retirees participating in the employer plan, and business owners, as well as those buying individual coverage are included in the calculation. Employees covered by another employer group health plan, or by a government program such as Medicare, Medicaid or TRICARE, need not be counted. The minimum participation rate is calculated only upon initial enrollment and renewal. Midyear fluctuations in a group’s participation rate will generally not affect eligibility for coverage. However, if a group falls below the minimum participation standard at renewal, then coverage would likely not be renewed. In this instance, an employer could re-apply for coverage at another time during the year when it could meet the minimum participation standard. PREMIUMS AND CONTRIBUTIONS For purposes of determining premium, the SHOP will offer the employer a choice between a composite rating formula, or an age-rating formula, unless a state specifies the rating methodology. Premiums for QHP coverage offered through a FF-SHOP are calculated based on the employer’s selected QHP and the number of employees who accept the offer of coverage. The total group premium is determined by adding the per-premium for each participant and beneficiary covered under the plan, adjusted by the applicable geographic rating are, based on the employer’s principal place of business. October 31, 2013 – HRB 84 Page 3

- 4. CBIZ Health Reform Bulletin Once the premiums are totaled, the amount is then divided by the number of employees electing coverage to get the average employee contribution rate. The employer would then apply the same percentage of its contribution for employee-only coverage, with the employee paying the balance, subject to any applicable tobacco surcharge. This same procedure in determining premium calculations and employer and employee contribution rates applies if the employer also selects dependent coverage and/or dental coverage, in addition to the medical coverage. Example. If the youngest employee enrolling has a premium of $100 and the oldest employee enrolling has a premium of $120, the average premium for everyone would be $110. If the employer decides to contribute 80% (or $88) towards the premium payments, each employee would pay $22. If an employee adds 2 dependents to the coverage plan, an additional premium amount will be added for the employee based on the ages of the dependents. The employer’s contribution of 80% (or $88) for its employees will remain the same. The employer’s contribution percentage toward premium cannot vary based on work status of employee, i.e., the employer contribution percentage must be the same for all of its full-time and part-time employees, and cannot vary based on employee classes. Part of the SHOP application includes an employee worksheet for estimating premiums and determining coverage. Because an employer may not know whether any of its employees or their dependents would participate in the employer’s plan selection, CMS encourages employers to collect the relevant information from its workforce prior to making application for SHOP coverage. The more accurate the information provided by the employer would likely result in a more precise estimate of premium. It is important to note that generally, coverage bought through the marketplace cannot be purchased with salary reduction dollars via IRC Section 125 (cafeteria) plan. The only exception to this is coverage purchased through the SHOP. WAITING PERIODS Beginning January 1, 2014, the ACA mandates that waiting periods can be no longer than 90 days. During the initial application process through a SHOP, an employer can select its new hire waiting period from a choice of zero days, up to 60 days. The 60-day waiting period option is the maximum selection to ensure that coverage becomes effectuated by the maximum allowable period of 90 days. NOTIFYING EMPLOYEES ABOUT SHOP COVERAGE Once the employer completes its application for coverage through the SHOP, selects the coverage, determines its contribution toward coverage and submits a roster of its employees, the SHOP will then send an e-mail to all employees identified on the roster about the availability of the employer coverage. The e-mail will include each employee’s unique access code and a link to the SHOP website for purposes of completing the employee application. Employers should ensure that the information provided in the employee roster is accurate as they are ultimately liable for ensuring their employees are notified of available health coverage through the SHOP. Presumably, this obligation is in addition to the Marketplace notice required to be provided by all employers; though, no additional guidance has been issued on this point. October 31, 2013 – HRB 84 Page 4

- 5. CBIZ Health Reform Bulletin INTERPLAY WITH SMALL BUSINESS TAX CREDIT The small business tax credit (SBTC) has been available to certain eligible employers for several years now. Beginning in 2014, only QHP coverage purchased through the SHOP is available for the SBTC, and only for a 2-consecutive year period. To be eligible, the employer must employ fewer than 25 full-time equivalent employees whose average annual wages are less than $50,000 (adjusted for inflation beginning in 2014). In addition, the small employer must cover at least 50% of the cost of single (not family) health care coverage for each employee. In addition, the employer must make a uniform contribution toward health coverage. For tax years beginning in 2014 and beyond, the maximum credit increases to 50% of premiums paid by small business employer (35% for small tax-exempt employers). Additional Information about SHOPs: SHOP Marketplace (HealthCare.gov portal) Infographic: Five Steps for Employers to Apply for Coverage in the SHOP Marketplace Background CBIZ Health Reform Bulletins relating to SHOPs: Small Business Health Options Program (6/3/13) Overview of Final Exchange Regulations (3/28/12) About the Author: Karen R. McLeese is Vice President of Employee Benefit Regulatory Affairs for CBIZ Benefits & Insurance Services, Inc., a division of CBIZ, Inc. She serves as in-house counsel, with particular emphasis on monitoring and interpreting state and federal employee benefits law. Ms. McLeese is based in the CBIZ Leawood, Kansas office. The information contained herein is not intended to be legal, accounting, or other professional advice, nor are these comments directed to specific situations. The information contained herein is provided as general guidance and may be affected by changes in law or regulation. The information contained herein is not intended to replace or substitute for accounting or other professional advice. Attorneys or tax advisors must be consulted for assistance in specific situations. This information is provided as-is, with no warranties of any kind. CBIZ shall not be liable for any damages whatsoever in connection with its use and assumes no obligation to inform the reader of any changes in laws or other factors that could affect the information contained herein. As required by U.S. Treasury rules, we inform you that, unless expressly stated otherwise, any U.S. federal tax advice contained herein is not intended or written to be used, and cannot be used, by any person for the purpose of avoiding any penalties that may be imposed by the Internal Revenue Service. October 31, 2013 – HRB 84 Page 5