China’s Annual Political Gathering 2016

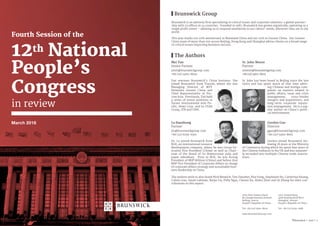

- 1. ©Brunswick | 2016 | 32 | 2016 | ©Brunswick The Authors Fourth Session of the 12th National People’s Congress in review March 2016 Brunswick Group Brunswick is an advisory firm specializing in critical issues and corporate relations: a global partner- ship with 23 offices in 14 countries. Founded in 1987, Brunswick has grown organically, operating as a single profit center – allowing us to respond seamlessly to our clients’ needs, wherever they are in the world. This year marks our 10th anniversary in Mainland China and our 12th in Greater China. Our Greater China team of more than 100 across Beijing, Hong Kong and Shanghai advise clients on a broad range of critical issues impacting business success. The authors wish to also thank Nick Beswick, Tim Danaher, Rita Fung, Stephanie Hu, Catherine Huang, Calvin Liao, Sarah Lubman, Baijia Liu, Polly Ngai, Chenni Xu, Helen Zhao and Qi Zhang for their con- tributions to this report. Mei Yan Senior Partner ymei@brunswickgroup.com +86 (10) 5960-8650 Yan oversees Brunswick’s China business. She joined Brunswick from Viacom, where she was Managing Director of MTV Networks Greater China and Chief Representative of Via- com Asia. Previously, Yan held a series of senior positions at Turner International Asia Pa- cific, News Corp. and its STAR Group, ITN and CNN. St. John Moore Partner smoore@brunswickgroup.com +86 (10) 5960-8603 St. John has been based in Beijing since the late 1990s and has spent much of that time advis- ing Chinese and foreign com- panies on matters related to public affairs, issue and crisis management, cross-border mergers and acquisitions, and long-term corporate reputa- tion management. He is a reg- ular author on China’s politi- cal environment. Lu Jianzhong Partner jlu@brunswickgroup.com +86 (21) 6039-6301 Dr. Lu joined Brunswick from RGE, an international resource development company, where he was Group Ex- ecutive Vice President (China) as well as Chair- man of the Board of its downstream pulp and paper subsidiary. Prior to RGE, he was Acting President of BHP Billiton (China) and before that BHP Vice President of Corporate Affairs in charge of corporate affairs strategy and sustainable busi- ness leadership in China. Gordon Guo Director gguo@brunswickgroup.com +86 (10) 5960-8661 Gordon joined Brunswick fol- lowing 18 years at the Ministry of Commerce during which he spent four years at the Chinese Embassy in the UK and was separate- ly seconded into multiple Chinese trade associa- tions. 2605 Twin Towers (East) B12 Jianguomenwai Avenue Beijing, 100022 People’s Republic of China Tel: +86 (10) 5960-8600 www.BrunswickGroup.com 2907 United Plaza, 1468 Nanjing Road West Shanghai, 200040 People’s Republic of China Tel: +86 (21) 6039-6388

- 2. ©Brunswick | 2016 | 54 | 2016 | ©Brunswick A rocky road to the China Dream For any business operating in China, whether Chinese or foreign, the annual meetings of the National People’s Congress (NPC) and the Chinese People’s Political Consultative Congress (CPPCC) are a crucial moment to understand the direction China is heading and how to operate in this ever complex market. These two meetings, held in March and collectively known as the lianghui, are among the most important events in the Chinese political calendar. This year’s meetings built on the foundation set by President Xi Jinping and Premier Li Keqiang over the last three years. While there were no significant changes in policy direction, the most important outcome was the release of the 13th Five-Year Plan for Economic and Social Develop- ment (2016-2020). The meetings, which spanned 12 days, focused on how to maintain growth while continuing with the reform agenda. With the release of its first Five-Year Plan this leadership team has shown its vision of how the country should develop in order to realize the “China Dream” Xi Jinping has advocated since he came into office. Yet the path towards that Dream will be challenging. The authorities spelled out a desire to achieve growth and reform—including drastically reducing overcapacity—while ensuring stability and en- during minimal pain. Achieving this holy trinity of growth, reform and stability simultaneously is unlikely. Reform is at once critical to ensuring long-term growth while also most likely to suffer as the government tries to balance its three goals. Reform inevitably brings pain and volatility. If there is none, the reform agenda is not working. There are no groundbreaking new policy directives in the 13th Five-Year Plan. Instead this latest Plan builds on previous Plans while incorporating the policies and directives put forward by Xi Jinping and the leadership team over the last three years, such as supply-side reform, the Four Comprehensives*, institutional reform, and the role of market forces. The Plan targets challeng- es facing the country such as the economy, innovation, overcapacity, pollution, urbanization, and poverty. The measures and goals laid out seek to move the needle on each of these issues while building a “moderately prosperous society” that realizes the “Chinese Dream” and avoids falling into the middle-income trap. The Chinese authorities’ determination to move ahead with structural changes, the operating en- vironment for business, whether foreign or local, will continue to be complex. There are a mix of positive signals and challenges at play. We remain cautiously optimistic about the long-term benefits of the policies laid out in the 13th Five-Year Plan, but realistic about the challenges that lie ahead for China as well as for any foreign business operating in the country. The Four Comprehensives is a political theory unveiled in early 2015 by Xi Jinping that includes: (1) comprehensively building a moderately prosperous society; (2) comprehensively deepening reform; (3) comprehensively governing the nation according to law; and (4) comprehensively strictly governing the Party. *

- 3. ©Brunswick | 2016 | 76 | 2016 | ©Brunswick Slower but steady growth The state of the economy was one of the most critical issues discussed this year. The government introduced a growth range for this year of 6.5% to 7% and a floor of 6.5% per annum through the 13th Five-Year Plan. Achieving the targets will be difficult. Commitment and focus For all the challenges, the new leadership is consistent in its assessment of and the ap- proaches to the issues that China faces. The 13th Five-Year Plan demonstrates a strong sense of urgency to execute structural re- forms—from SOE reform and increasing the role of market forces to shifting the growth drivers away from infrastructure investment and manufacturing. Balance reform, growth and stability Achieving the trinity of reform, growth and stability simultaneously with minimal pain will be tough. At the conclusion of the lianghui during a meeting with the media, Premier Li noted “there will be small and short-term volatility down the road. Restoring confidence Through the lianghui (and the China Devel- opment Forum that followed) the authorities tried to restore confidence in their ability to manage the economy after the financial tur- moil of last year. As part of the confidence rebuilding, ahead of the lianghui the head of the China Securities Regulatory Commission was replaced. Five guiding principles To achieve balanced growth the government is promoting “innovative, coordinated, green, open, and shared development”. These prin- ciples underpin many of the policy initiatives laid out in the latest Plan. Companies op- erating in China, regardless of background, must consider their operations in relation to the principles and ensure they articulate how they contribute to China’s development ob- jectives. The power of Xi Unlike previous lianghui that serve as the platform for the premier, this year’s lianghui diverged from proto- col to include significant focus on President Xi Jinping and his own statements. This is not just a signal of Xi’s position at the helm of the Party, but importantly the increasingly visible role of the Party in the government process. Anti-corruption The anti-corruption drive will con- tinue. This stopped being a cam- paign long ago and is now part of the broader new normal envi- ronment. Past behavior that was regarded as the status quo is no longer tolerated, regardless of po- sition or background. Urbanization At the end of last year 56% of citizens were living in urban areas. By the end of the next Five-Year Plan this is projected to increase to more than 60%. Urbanization is where China “will find the greatest potential for domes- tic demand and the most powerful force for sustaining economic development” stated Premier Li at the lianghui. Yet the scale of ur- banization is daunting with some 100 million people expected to move to cities in the next five-years producing strains on cities and on the communities the newly urbanized have left. Poverty alleviation The authorities vowed to move the remain- ing 60 million citizens currently in poverty to above the official poverty line by 2020. Tack- ling these vast discrepancies in economic development is a priority. Senior provincial officials will now be evaluated and held ac- countable for poverty alleviation under newly issued performance measures. Key takeaways from this year’s lianghui Domestic priorities Domestic objectives continue to trump for- eign investors’ interests and as a result the leadership team will remain strong advocates of domestic industry interests and protect- ing national security interests. This may lead them to support policies that weaken overar- ching reform goals.

- 4. ©Brunswick | 2016 | 98 | 2016 | ©Brunswick Ever since the opening up and reform policies at the end of the 1970s, China has developed pol- icy via experimentation that is akin to “crossing the river by feeling the stones”. At the Third Plenum in November 2013 the leadership noted that the country must be prepared to pass through an area of deep water – a period that will challenge the tested method of crossing areas of water by feeling the stones. The transition the country is going through is critical. It is important for the global economy that China makes the journey to the other side because in this interconnected global environment a failure to get there will have broader implications. Foreign companies operating in China will not be immune from the changes. If the country suc- ceeds in growing at 6.5% per annum through the 13th Five-Year Plan period this will add more than the current economy of Germany to the global stage. Opportunities remain. Yet challenges are very real. Past success will not guarantee future success. There is no special manual or ‘one size fits all’ strategy that companies can adopt that will ensure success over the next five years. Beyond ensuring that there is a viable customer base, there are some general principles to consider. • Pay close attention to the real intent of the leadership team’s policies and the changing environment and be ready to adapt. • Ensure that your business in China is working ‘with the grain’ of the Chinese political en- vironment and that your business is thoughfully aligned with China’s objectives. • Be clear what your business is contributing to China—and have a plan to communicate that contribution. • Proactive engagement with key stakeholders and influencers in China should be in place. Companies must pay close attention to the intent of the leadership team’s policies and the chang- ing environment and adapt accordingly. This note aims to set out in more detail what the outcome of the lianghui means for businesses operating here. Overcapacity The steel and coal sectors will be the first to be tackled. Zombie enterprises will be shut or restructured. Observers’ estimate as many as five or six million workers will be impacted as overcapacity is cut. While far less than the 28 million impacted in restructurings in the late 1990s, redeploying these workers into new industries will not be simple. Supply-side reform The latest economic principle of supply-side reform calls for the scaling back the role of government in business to allow market forces to flourish. But, the concept remains vague. Lianghui delegates referenced a varie- ty of activities they felt delivered on Xi’s new economic model. There is a risk that without clarification local authorities will continue to drive investment in the name of supply-side reform. Managing inequality The development of China over the last 30 years has left significant social and economic disparities. Ultimately the Party cannot sus- tain the popular mandate if the majority has failed to benefit from the reform agenda. As a result language used by Xi Jinping focuses on poverty reduction and addressing the masses. Mounting debt The authorities have avoided the significant stimulus used during the 2008 financial cri- sis, but to meet growth targets in the current climate may still require some level of stim- ulus. This risks more wasteful projects and rising debt. At the corporate level, People’s Bank of China governor Zhou Xiaochuan not- ed over the weekend that corporate lending as a ratio to GDP had become too high with some estimating it now stands at 160% of GDP. Devolve power to local authorities As the central authorities reduce red tape more powers are being passed to local au- thorities. The success of the reform agenda will require uniform execution down to the local levels. History has shown a risk that lo- cal authorities do not execute with uniform conviction when times get tough. Vision to reality Real action needs to be taken before the authorities can really make a change to the course of China’s development. More than 70 policies have been promulgated since the Third Plenary of the Party’s Central Com- mittee in 2013, and more will follow with the 13th Five-Year Plan on reform programs in specific areas. In addition to the political will, there needs to be a mechanism to make sure that words on the paper are faithfully implemented. Issues to be addressed during the 13th Five-Year Plan

- 5. ©Brunswick | 2016 | 1110 | 2016 | ©Brunswick The 13th Five-Year Plan: Achieving the 2020 vision In 2012 at the 18th Party Congress, the authorities unveiled a vision that by 2020 China will have become a “moderately prosperous society in all respects” and doubled 2010 GDP and per capita income. The recently approved 13th Five-Year Plan is intended to get us to the 2020 vision and is • centered on “finishing building a moderately prosperous society in all respects” • “designed to address serious issues such as unbalanced, uncoordinated, and unsustainable development” • structured “to promote innovative, coordinated, green, open, and shared development”. The 13th Five-Year Plan (2016-2020) was approved on March 16th, 2016 with 2,778 delegates voting in favor, 53 against, and 25 abstentions (by coincidence 2,778 vot- ed in favor of the 12th Five-Year Plan). The full text of the plan is now available in Chinese. The Five-Year Plan system defines China’s social and economic development ob- jectives and is a core pillar of the state planning system that has guided the coun- try’s development since the first Five-Year Plan in 1953. In the 12 months leading up to the issue of each plan a significant amount of behind the scene work is un- dertaken across the Party and government at central and local levels. Ahead of the submission of the 13th Five-Year Plan, Premier Li stressed that this latest Plan should provide “reasonable targets and feasible implementation meth- ods” while highlighting the need to promote “innovative, coordinated, green, open, and shared development” as well as structural reforms. The goals Some of the key goals for the next five-years outlined in the plan include: Economy: Grow the economy at an average annual rate of at least 6.5%. By 2020, the coun- try’s GDP will exceed RMB 90 trillion doubling the 2010 GDP and per capita income. Innovation: Innovation-driven development is highlighted as a priority and investment in R&D will increase from a targeted 2.2% in the 12th Five-Year Plan to 2.5% over the next five-years (the achieved increase during the 12th Five-Year Plan was 2.1%). The contribution of sci- entific and technological ad- vances toward economic growth should reach 60%. Role of the Market: The mar- ket must play a decisive role in resource allocation, while the government will play a bet- ter role to facilitate the market and to be prepared to intervene when there is a potential crisis. Employment: Create 50 million new urban jobs. Urbanization: By 2020 around 60% of China’s citizens should be living in urban areas and 45% of citizens should be registered as permanent urban residents. To support this, urban residen- cy should be granted to around 100 million people with rural household registration living in urban areas. Poverty: Move all citizens out of poverty (approx. 60 million) hav- ing reduced the number of rural residents living in poverty over the last five-years by 100 mil- lion. Highlighting the diversity of challenges facing the country, over the last five-years over 300 million rural residents gained ac- cess to safe drinking water. Health: Build a “healthy China” and increase average life expec- tancy by one-year from 75.8 in 2015. Infrastructure: Increase the length of high-speed railways in service to 30,000 kilome- ters and link more than 80% of large cities in China with high- speed railways. Build or up- grade around 30,000 kilometers of expressways, and achieve full broadband coverage in both ur- ban and rural areas. Environment: Prevent and con- trol air, water, and soil pollution while intensifying ecological conservation and restoration. The air quality of cities at and above the prefectural level should be good or excellent for 80% of the year and the days with severe pollution should re- duce by 25%. Energy consump- tion, CO2 emissions, and water consumption per unit of GDP should reduce by 15%, 18% and 23%, respectively. Li Keqiang stated all must work to build “a Beautiful China where the sky is blue, the land is green, and the water runs clear”.

- 6. ©Brunswick | 2016 | 1312 | 2016 | ©Brunswick The role of market forces The 13th Five-Year Plan contin- ues to build on the role of the market in furthering econom- ic transformation. Li Keqiang stressed that “development re- lies on reform and opening up” and that “it should be ensured that the market plays the de- cisive role and the government improves its role in the mar- ket”. The premier noted at the start of the meetings that business start-ups had increased signifi- cantly and that last year approx- imately 12,000 new businesses were started each day—repre- senting a 21.6% year-on-year increase—driving employment and innovation. He highlighted that last year the government cut the number of items which require government approval for new business registration by 85%. Li also stressed the impor- tance of empowering graduates to create their own businesses. In another sign of the role of market forces—this year the premier noted the importance of the role of remuneration to improve the performance of key sectors. He stressed the need to “deepen the reform of the en- terprise personnel management system and explore the possi- bility of establishing remuner- ation systems for senior rank- ing personnel and corporate executives that are compatible with competitive selection and recruitment”. This was drawn out later in the Premier’s Work Report when he noted that they “will establish human resource and remuneration systems suit- ed to the medical sector to mo- tivate medical practitioners and protect their enthusiasm”. To boost innovation greater au- tonomy will be given to univer- sities and research institutes and red tape will be cut in the management of research pro- jects—thus allowing the market to play a stronger role in influ- encing the direction of innova- tion. In parallel, new policies will be put in place to financially reward innovators by allowing them to benefit from the com- mercial success of their innova- tions. SOE reform and the role of private business SOEs a cornerstone of the economy China’s state owned enterprises (SOEs) employ approximately 37 million citizens and the 156,000 SOEs (106 at central level) ac- count for roughly 40% of Chi- na’s gross domestic product. Reform of SOEs remains impor- tant. Yet the role of the public sector will continue to be crit- ical and there is no step back from the position that the ba- sic economic system depends on public ownership as a cor- nerstone of its long-term suc- cess. As such, the language Li Keqiang used to describe the reform drive was cautious and focused on the need “to pro- mote [SOEs’] development”, “upgrade” them and “improve their performance”. Li noted that in the year ahead the government will encourage SOEs—especially those at the central level—to make struc- tural adjustments so that some will be developed through inno- vation, others will be reorgan- ized or merged, and others will exit the market. To improve the caliber of staff they will make recruitment competitive, seek professional managers, adopt mixed ownership, and introduce employee equity. In addition, to improve the competitive capabilities of the SOEs the authorities will move to quickly relieve them of their obligations to operate social programs and enable them to become leaner and more com- petitive. China’s State Council an- nounced in September last year that by 2020 it will implement a new SOE environment that will allow foreign companies to own minority stakes in government- Achieving reform and growth The current administration enters the 13th Five Year Plan period knowing that the years between now and 2020 will be pivotal for the future of China’s economy and its development. But, as ever in China, they are faced with juxtaposed impera- tives: maintaining an acceptably high level of growth and contin- uing to reform an imbalanced economic model while main- taining stability and minimizing any pain. A key question observers were asking leading into this year’s lianghui was whether critical re- forms would be delayed as the government sought to reinvig- orate the economy. One of the most watched data points is the economic growth target. This year they broke with tradition. This has his- torically been a rough target— for example the 12th Five-Year Plan targeted “about 7%”. For the 13th Five-Year Plan a floor has been introduced with a tar- geted annual growth rate of “at least 6.5%” during the five-year period. For the coming year a growth range of 6.5% to 7% has been set. The new floor—6.5%—is the lowest target for 25 years and marks the second consecutive Five-Year Plan in which China has lowered its target by half a percentage point. In addition, the decision to provide a range— even if it is an extremely narrow range—for this year’s national growth has been interpreted as a signal to local governments not to focus on top-line growth at the expense of other key pri- orities—e.g. restructuring or the environment. Ontheotherhand,scepticsargue that growth of anywhere north of 6.5% implies foot-dragging on crucial reforms or, worse, an entrenchment of structural is- sues such as rampant indebted- ness and inefficient use of cap- ital. The fact that Beijing has set itself such a target shows it doesn’t have the stomach for genuine reform, they claim. A more balanced view is that the government, while committed to (economic) reform in the long run, is wary of the impact too sharp a slowdown could have on unemployment—currently at what is considered an accept- able level—and on the ability of business and local governments to finance their operations. For that reason, while radical mon- etary policy such as that which ultimately loaded the system with debt post-2008 is out of the question, Beijing will allow itself a certain degree of fiscal flexibility. Nonetheless, the obstacles lying in the way of fundamental eco- nomic transformation are still there. China’s highly indebted local governments will contin- ue to find it hard to generate cash and growth— even at more modest levels—without rely- ing disproportionality on land and property sales. SOEs, many (although not all) of which are highly inefficient and actively stifle economic progress, will remain largely untouched (and may be asked to absorb unem- ployed workers from declining sectors of the economy). Levels of government and corporate debt will likely get worse before they get better. Still, when steady growth in ser- vices, consumption and high- end manufacturing are taken into account, the Five-Year Plan growth target seems achievable and a hard landing seems un- likely if the words in the plan can be faithfully translated into actions. Beijing will continue to give the economy an addition- al fiscal or monetary kick when needed, and the overall reform trend should continue. Sooner or later, though, there needs to be a sign that the toughest ele- ments of reform are being tack- led. This could start during this Five-Year Plan but it may not be able to complete before 2020. The question is whether Chi- na can keep the wheels straight long enough to step on the ac- celerator. Much has been written about China’s slowing growth. The authorities are cognizant of the concern and have pointed out that “every percentage point of GDP growth today is equivalent to 1.5% of growth five-years ago or 2.5% growth 10 years ago” and that “the larger the econo- my grows, the greater the diffi- culty of achieving growth”. Growth in the slowing economy Some observers have spo- ken with alarm at the slow- ing growth of China—yet this has been a long planned and anticipated trajecto- ry. In the mid-2000s when talking with officials, many would lament at the chal- lenge of shifting the econ- omy to a new growth mod- el that had more diversity and was equipped for the eventuality that the coun- try would not need as much infrastructure investment. Impact to the global economy Much has been written about China’s slowing growth. The authorities are cognizant of the concern and have pointed out that “every percentage point of GDP growth today is equivalent to 1.5% of growth five-years ago or 2.5% growth 10 years ago” and that “the larger the economy grows, the greater the diffi- culty of achieving growth”. If China achieves its goal of growing at least 6.5% per annum over the next five-years it will add more than the total 2014 GDP of Germany, the world’s fourth largest economy, to the global economy.

- 7. ©Brunswick | 2016 | 1514 | 2016 | ©Brunswick owned companies, classify SOEs into two separate baskets—one for-profit entities and the other focused on public welfare, and that supervision over State- owned assets will be improved. Although SOEs will now be open for more foreign and domestic equity investments under the reform, their impact on gov- ernance will be limited since the Chinese government will retain at least 51% ownership. When Xi Jinping came to office many opined he would intro- duce an aggressive SOE reform drive while promoting the role of private business. In the years since some have expressed dis- appointment at the speed of the reform drive. However, there is no single action that will re- form the system, and as this year’s meetings showed, we are witnessing reform via multiple strategic (even if sometimes small) steps. The slow progress is due large- ly to political entrenchment. Overcoming vested local inter- ests who rely on SOEs for the majority of their income, tax revenues, and local employ- ment is often a step the central government finds it difficult to make. A deep seated belief that any loss of control over the economy could introduce eco- nomic or political unpredicta- bility is resulting in SOE reform inertia. Supporting private business During the lianghui, the author- ities reaffirmed the importance of the private sector. Xi Jinping joined a group discussion on March 4th with CPPCC delegates where he stressed that the pri- vate sector and the state sector both have an integral role. He noted in a lengthy speech the importance of protecting private property rights and that gov- ernment maintains a “close” and “clean” relationship with business. He also criticized of- ficials who do not address the needs of private business for fear of being considered corrupt, and at the same time, urged pri- vate businessmen not to engage in illegal activities for its near- term benefits. He also admitted difficulties that the private sector has been suffering because of the insuf- ficient and inconsistent imple- mentation of policies. In an unusual move that reit- erates the critical importance of resetting the role of private business, the full script of his speech was released on official media the next day. In the following days Li Keqiang also emphasized that the gov- ernment would protect property rights regardless of the origin of the ownership. In his working report, he also called for severe punishment to activities that infringe the legitimate rights of private companies and private businessmen so as to establish a fair, just, transparent and sta- ble legal environment in which companies of any ownership will be able to develop. Though the authorities have al- ways claimed that the private sector is an indispensable part of China’s economic environment, it is rare for the top leadership to have given a speech dedicat- ed to reassure the private sector businesses of their rights. 12th Five-Year Plan: How did China do? As we focus on the next five-years, it is worth reflecting on how the country feels it did with the goals set out in the 12th Five-Year Plan. The goals in each Five-Year Plan typically build on the goals of the past—in many ways building on the foundation of the past. Perhaps not surprisingly, officials gave themselves a pat on the back in relation to achieving the goals laid out in the 12th Five-Year Plan. At the start of March the State Council noted that most goals set at the beginning of 2011 had been accomplished with many accomplished ahead of schedule and exceeding their targets. Regardless of whether one believes the measurement of each accomplishment, it is clear that the system focuses extremely diligently on achieving the overarching goals laid out in the Plan. Some of the big goals over the last five years included: • To grow the economy over the 12th Five-Year Plan by about 7% (down from about 7.5% dur- ing the 11th Five-Year Plan). The official position—the country grew 7.8% over the Five-Year Plan period. • To increase the proportion of the service sector as a proportion of GDP to 47%. At the start of this year’s meeting Li Keqiang noted the service sector now represented 50.5% of the econo- my. • To increase urbanization from 47.5% to 51.5%. At the end of last year 56.1% of citizens were living in urban areas. • To increase investment in R&D to 2.2% of GDP. The final increase was 2.1%. • To expand healthcare access and expand basic medical insurance to cover all urban and rural residents. Basic health insurance has now been expanded to achieve complete coverage. • To increase the proportion of non-fossil fuels in primary energy consumption to 11.4% while reducing energy consumption and CO2 emissions per unit of GDP by 16% and 17%, respective- ly. At the end of last year non-fossil fuels represented 12% while energy consumption and CO2 emissions per unit of GDP were reduced by 19.7% and 18.2%. • To create 45 million new urban jobs. In the end 64.3 million new jobs were created. • To increase the per capita disposable income of urban residents and the per capita net income of rural residents by an annual average of over 7% in real terms. Urban residents’ income increased 7.7% while those in rural communities increased 9.6%. • And, to continue the commitment to make “institutional changes to end the excessive con- centration of power and lack of checks on power, and resolutely prevent and punish corrup- tion”.

- 8. ©Brunswick | 2016 | 1716 | 2016 | ©Brunswick What topics dominated public discussion? To find out what topics mattered most to the public our Brunswick Insights team reviewed news re- ports, social media conversations on China-specific channels such as Weibo and international social networks Twitter and Facebook, and news websites and blogs. In total more than 330,000 reports, conversations, and blogs were reviewed that were published or posted between February 22nd and March 16th. Perhaps not surprisingly, the most significant topic in China and internationally was the state of the Chi- nese economy. Beyond economics, international media focused on foreign policy while Chinese media promoted topics related to social wellbeing. On Chinese social media, which is more indicative of general public opinion, wellbeing and social issues were discussed almost as much as the economy. Within this, education was the topic of almost half of all discussion. The environment and corruption were among the topics that featured more in social media discussion than in official Chinese news coverage.

- 9. ©Brunswick | 2016 | 1918 | 2016 | ©Brunswick The context: drivers influencing the 13th Five-Year Plan Provincial diversity A country the size of China is home to many markets—and as a result differing levels of growth. Each province has already dis- closed its own growth targets for the 13th Five-Year Plan. Six provinces followed the national model and chose to adopt a range in their own 13th Five-Year Plan growth targets. Only three prov- inces (Heilongjiang and Liaon- ing in the northeast and Shanxi in north China chose to target growth below the new nation- al goal with the vast majority of provinces still targeting growth at 7% or higher. China’s changing demographics Declining birth rates, a peaking of the working population last year, and an aging population are critical demographic challenges facing China that risk it getting old before it gets rich. The relaxation in the one-child policy over the last few years has been designed to tackle the de- clining birth rate which dropped from 2.5 children in 1990 to 1.7 in 2010. Even with the relaxa- tion of the policy, forecasts show that it will have little impact on demographic structure, as fertil- ity rates are more fundamentally shaped by economic and cultur- al factors (EIU, 2014). According to the forecast, the lifting of all birth restrictions would increase the total population by only around 25 million against the base forecasts by 2030. Many of the goals laid out in the 13th Five-Year Plan attempt to tackle the middle income trap challenge—a situation where a country loses its competitive manufacturing ability due to ris- ing costs (e.g. wages) before it has transitioned to a developed market economic model. China’s working age (15-65 years old) population is expected to shrink from 2015, after peaking at approximately one billion. In the meantime, the population of those aged 65 years or older will expand rapidly, more than doubling in size to 257 million in 2030, from 119 million in 2010. Li Keqiang emphasized the im- portance of raising basic pension benefits for retirees and launch- ing pilot comprehensive reform of the elderly care service indus- try. There are also plans to delay the retirement age, from 60 for men and 55 for women to 65 for both. Moreover as rural-to-urban migration continues in China the urban population is fore- cast to reach nearly 940 million by 2030. This bodes well for the government’s plan to rebalance the economy towards private

- 10. ©Brunswick | 2016 | 2120 | 2016 | ©Brunswick consumption but is tempered by the need for training for millions of migrant workers moving into the service sector and jobs oppor- tunities for the 7.65 million new university graduates each year, not to mention the environmen- tal impact on urban centers. Seeking job opportunities China has shifted from a pre- dominantly agrarian society to a manufacturing powerhouse in the last three decades. As the country moves forward with its latest transformation and “in- dustrial upgrading” there is an important shift to the service sector along with a drive towards “intelligent manufacturing”. Li Keqiang’s Work Report acknowl- edged the “painful adjustment” process of replacing old drivers of growth with new ones, which requires relevant and adequate training opportunities and jobs. The structural transformation the country is going through combined with the changing de- mographics of the country pres- ent significant challenges. Over the next five-years the government aims to create 50 million urban jobs—roughly the population of South Korea. The creation of new employment opportunities is critical to ab- sorbing the approximately seven million new university graduates who enter the job market each year and the increasing numbers of citizens moving into urban ar- eas. At the same time the authori- ties are grappling with a slowing economy and overcapacity that must be reduced. In this envi- ronment a significant number of people will lose their jobs. Some will have the right skills to find new employment, while a large number of others will need sup- port and training. Yin Weimin, Minister for Human Resources and Social Security, said Chi- na expects to lay off 1.8 million workers in the coal and steel in- dustries, sectors that have been earmarked as the first sectors that must address overcapacity. Third party estimates are as high as five or six million, and RMB 100 billion has been set aside for restructuring costs. Meanwhile, in September last year Xi Jinping announced that 300,000 military personnel will be demobilized by the end of 2017. In a reflec- tion of the contradictions in the reform agenda, the government announced at the end of Decem- ber that state-owned companies must help absorb soldiers laid off due to military reforms. Changing behavior - part of the new normal The authorities’ efforts to tackle corruption continue—last year more than 54,000 officials were investigated for bribery, dere- liction of duty or other related crimes and investigations were conducted into 90 central gov- ernment officials with 42 trans- ferred to the judiciary for crimi- nal investigations. Throughout the meetings of- ficials continued to stress that there will be no let-up in the work being taken to reduce, if not eliminate, corruption. The crackdown on graft is part of the ‘new normal’ and in the case of anti-corruption has been too sustained and wide-ranging to be considered a fleeting campaign or purge. It is aimed at improving the system of governance and weakening the power of vest- ed interests that are blocking or changing the course of reform— and addressing a genuine public grievance. However, some criti- cal decision-making in govern- ment has been slowed as officials seek to ensure consensus and as the anti-corruption drive has an impact on the bureaucracy. New self-discipline rules intro- duced last year, which apply to everyone from government of- ficials to SOE managers and uni- versity chancellors, include pro- visions for disciplinary penalties, while the Central Commission for Discipline and Inspection now publishes the names of senior offenders on a monthly basis (in February 3,180 officials, includ- ing three at provincial and min- isterial level, were disciplined for violating thrift and integri- ty rules). The result has been a gradual realization among cadres that graft is an increasingly risky thing to indulge in. Beyond the moral case, the ad- ministration’s stance on corrup- tion serves two very pragmatic purposes. First, Beijing under- stands that graft is perhaps the biggest potential source of public discontent and therefore under- mining the Party’s rule. Second, as the central authorities see it, collective and individual disci- pline within the Party are funda- mental to the long-term success of reforms. The authorities are being une- quivocal that behaviors that were once tolerated will no longer. Both foreign and domestic com- panies operating in China must consider this the new norm and take it as a clear directive from the authorities regarding what is expected of companies and indi- viduals.

- 11. ©Brunswick | 2016 | 2322 | 2016 | ©Brunswick Cleaning up the environment Environmental issues have shot up the agenda under the Xi ad- ministration, driven by growing public discontent at the state of the nation’s air, water and food supplies and by a recognition that environmental degradation is a serious threat to long-term economic development. After a year in which China sur- prised the world by promising a peak in carbon emissions by 2030, air pollution was front and center in the 13th Five Year Plan’s environmental pledges. Calling for air quality in large cities to be “good or excellent for 80% of the year,” Premier Li set the aim of reducing water consumption, energy consump- tion, and carbon dioxide emis- sions per unit of GDP by 23%, 15%, and 18%, respectively over the next five years. Other prom- ises included further reductions in the density of harmful fine particulate matter and an out- right ban on commercial logging in natural forests. Perhaps one of the more nota- ble shifts in tone in Premier Li’s speech was a relative emphasis on personal and collective re- sponsibility. Having talked of the need to “encourage green ways of working and living,” Li made a direct call to the public with his statement that “Every one of us has an obligation to protect the environment-we call on every member of soci- ety to act and contribute to the building of a Beautiful China.” As a resonance to the premier’s call, the Supreme Procuratorate will support public interest ac- tions against violation of envi- ronmental laws. While growing environmental consciousness within both gov- ernment and society is encour- aging, China’s plethora of en- vironmental challenges will be tough to solve within the next several decades, let alone during this Five-Year Plan. Residents of first- and second-tier cities can hope to see improvements in air quality and noise pollution, but it is difficult to see how less de- veloped areas (which also tend to be less well-governed) can reconcile better environmental stewardship with growth. The geo- political environment

- 12. ©Brunswick | 2016 | 2524 | 2016 | ©Brunswick While China’s position on major regional issues makes big news abroad, as ever it featured some way down the list of priorities at this year’s meeting. At its routine press conference, the Ministry of For- eign Affairs delivered its stand- ard lines on peaceful develop- ment, while Li Keqiang work report strayed just briefly from domestic and economic con- cerns to stress China’s com- mitment to “participating con- structively in solving global and sensitive issues”. Beyond the platitudes, though, the current administration be- gins 2016 facing an increasing- ly complex array of geopolitical issues. Relations with the U.S. and regional neighbors over is- sues such as the South China Sea and Korean Peninsula secu- rity remain strained. And while others question China’s com- mitment to free trade and pre- venting commercial espionage, Beijing remains convinced that Washington and its allies are more concerned with contain- ing China than building genuine trust. Despite this rather fraught backdrop, trade and invest- ment will remain a key tool for improving ties with other na- tions. Forums like the Asian In- frastructure Investment Bank, which got off to a flying start last year, should facilitate genu- ine collaboration. And Beijing’s resolve to use its Belt and Road Initiative (see map above) as a means of growing both its eco- nomic and diplomatic influence should not be underestimated. In his keynote speech, Premier Li emphasized continued im- portance of trade and invest- ment, identifying services and manufacturing as areas where FDI restrictions will be further “relaxed,” while pledging sup- port for Chinese companies seeking to export goods and ser- vices. Such talk alone is unlike- ly to convince those who have complained that China’s com- mitment to openness has not been matched by genuine mar- ket access. But while the years of generous tax policies and eye-watering margins are gone, there is good money to be made for companies whose expertise can make a telling contribution in priority sectors. Hong Kong, Macau & Taiwan Mainland China’s image in Hong Kong has been strained in the past couple of years. While the protests against Beijing’s perceived interference in the autonomous region’s political affairs have subsided for now, tensions continue to bubble un- der the surface. Relations with Taiwan, which recently elected the traditionally pro-independ- ence Democratic Progressive Party (DPP), could also conceiv- ably come under strain. For its part, the Chinese govern- mentisstickingtoitslongstand- ing position. In his work report, Li Keqiang reiterated Beijing’s commitment to implementing, “to the letter and in spirit,” the ‘one country, two systems’ principle vis-a-vis Hong Kong and Macau. And when asked about the relationship during Li Keqiang’s press conference on March 16th he opined that Hong Kong will maintain long-term stability and prosperity before opining that “the Hong Kong SAR government has the abil- ity and Hong Kong people have the wisdom to properly han- dle the complex issues in Hong Kong”. He concluded by saying that “the central government will give full support to any pro- posal from the SAR government that helps maintain Hong Kong long-term stability and pros- perity and contributes to the well-being of people in Hong Kong”. Regarding the outlook for cross-Taiwan Strait relations, Li emphasized at his press con- ference that so long as the new government in Taiwan adhered to the “one China” policy there would be no issues. The trend towards increasing reliance of other regions on mainland China, economically, if not politically, is unlikely to change in the near term. But Beijing is acutely aware of the potentially destabilizing effect of dissatisfaction in Hong Kong, and will be watching carefully when the DPP’s Tsai Ing-wen assumes office in May.

- 13. ©Brunswick | 2016 | 2726 | 2016 | ©Brunswick Sectors in focus Healthcare Reform of the public hospi- tal system and roll-out of basic medical insurance was promi- nent during the 12th Five-Year Plan as the authorities sought to “deepen reform of the phar- maceutical and healthcare sys- tems”. From no national insur- ance five ago, all citizens now have access to basic health in- surance. Creating a healthy China was raised at multiple points in the lianghui and Li Keqiang noted that health is at the root of hap- piness. To support a healthy China, the focus on access contin- ues. To alleviate pressure on large hospitals, resources at smaller healthcare facilities in urban and rural areas are to be increased. An initial batch of large hospitals will adopt a modern online appointment reservation systems. The de- velopment of private hospi- tals (including those with for- eign investment) will continue. The premier also stressed the importance of improving the skills of general practitioners and pediatricians with more training and creating a human resource and remuneration sys- tem to motivate and attract the best medical professionals. Ensuring affordability has been added to the agenda. In 2011 the authorities stressed the need to “genuinely cut drug prices”. Which sectors will prosper? As China transitions its economic growth model from one built on infrastructure, manufacturing and export to one that leverages services, consumer spending and more advanced manufacturing, companies that did well in the past have no guarantee of the same opportunities in the new phase. Equally, in the new environment there are some sectors that can expect significant growth opportuni- ties. In his meeting with the press on March 16th Premier Li noted that he’d read a foreign report saying that a “visit to a heavy industry left the impression of depression, while the next stop to a technology park left the impression that the economy is growing at a double-digit rate”, going on to note that “hope and challenges coexist”. It is clear from the 13th Five-Year Plan that low end products in such heavy industry as iron and steel, coal mining, aluminum, glass panel and cement will suffer from the initiatives to cut excess overcapac- ity and changing demand. The Plan has outlined an “innovation-driven development strategy” with a desire that “industries must be propelled toward medium-high end”. By the end of the Plan “advances should be made in core technologies such as information communication, new energy, new materials, aviation, biological medicine and intelligent manufacturing”. While achieving this, protecting the en- vironment remains critical. Beyond understanding the direction of the economy and what sectors are being prioritized, it is also important to note that opportunities over the next five-years will differ regionally within China as well due to the vast differences in economic development that prevail across the country. Some of the sectors that will see opportunities range from film, entertainment and leisure, healthcare, and education to services, environmental, and R&D based industries. Below we look at a few key sectors.

- 14. ©Brunswick | 2016 | 2928 | 2016 | ©Brunswick troduced to the stock market, but maintained that the regu- lator would step in “decisive- ly” in the event of further mar- ket turmoil. He also cautioned that while a registration sys- tem to remove barriers to pub- lic listings was in the works, it would take time to design a fully-fledged regulatory frame- work to support the launch of a registration-based IPO regime. Central Bank Governor Zhou Xiaochuan played down con- cerns over capital flight, stress- ing the value of the yuan was re- turning to “normalcy,” and said the government would continue to look at ways to ensure regu- lation “solves problems” and “increases efficiency” in the capital markets. There is a sense that China’s leaders are gradually getting to grips with the role finance needs to play in the Chinese econo- my, but we are some way from foreign players being allowed anything like a prominent role in the sector. While improving access to capital for corporates and allowing a greater role for private financial institutions— notably in Internet finance—are priorities, creating opportuni- ties for foreign firms to increase their exposure to China is not. And Premier Li sent a strong signal in his work report with his twice-repeated assertion that “the job of financial insti- tutions is to provide better ser- vices to the real economy”. In the long term, we should see less volatility in the markets and greater sophistication from regulators, but it won’t be an easy journey. Technology Innovation is the primary driv- ing force for development and must occupy a central place in China’s development strategy, stated Premier Li at the start of this year’s lianghui. He noted that it was critical the country adopt a strategy of “innova- tion-driven development” to promote “new growth engines” across areas such as telecom, clean energy, medical tech- nology, new energy, industrial equipment, new material and biotechnology. In parallel, the Internet Plus strategy that was introduced last year continues to feature as a means to trans- form and reinvigorate tradi- tional industries as well as even government services. Speaking at the China Develop- ment Forum following the end of this year’s lianghui, Xu Sha- oshi, chairman of the National Development and Reform Com- mission, promised foreign com- panies equal treatment with lo- cal companies. Yet many parts of the technology sector contin- ue to be challenging for foreign investors. The current innovation initia- tives are in many ways an evo- lution from the indigenous in- novation policies that caused concern among investors roughly ten years ago. While the phrase indigenous innova- tion has largely disappeared, the broad intent remains—a strong desire to build domestic technology capabilities. In the technology space, Chi- nese officials’ national security concerns have led to a signifi- cant tightening of regulations. This ranges from the location of data to the origin of hardware. Those providing traditional and social media services as well as those in the Internet Content Provider arena are also facing an increasingly controlled envi- ronment. This tightening is not expected to loosen in the cur- rent climate. Yet only last year did pricing return to the agenda at the li- anghui with a call to “stop the practice of charging more for medicines to make up for low prices for medical services” and to “lower extortionate prices on medicines”. This year there is a renewed focus on “medical ser- vice pricing reform and reform in medicine distribution”. Ma Xiaowei, vice-minister of Na- tional Health and Family Plan- ning Commission, noted that if current pilot price negotiations are successful then those drugs may be included on the national reimbursement list thereby in- creasing patient access to previ- ously high-priced medicines. In addition to the measures mentioned already—this year Li Keqiang stressed the need to speed up the development of a safety monitoring system for food and pharmaceuticals thereby “reinforcing every line of defense from the farm to the dining table, and from the labo- ratory to the hospital”. Energy In its last Five-Year Plan the government vowed to revolu- tionize the structure of China’s energy sector, moving away from an overreliance on coal to include a higher proportion of renewables and cleaner fossil fuels in the energy mix. In the plan’s 13th iteration, this trend is set to continue. Nonetheless, there remains a tension between the need for structural change and the need to fuel development in inland areas. While it has now put a brake on coal development in the eastern part of the country, the government is following a less strict policy in the interior, recognizing the geographic im- balance in clean energy infra- structure and levels of economic development. In upstream oil and gas, there are (optimistic) hopes that SOE reform will allow market forc- es to clean up so-called “zom- bie enterprises” and create a more efficient value chain in which private Chinese and for- eign players can have a great- er—although still limited— role. Meanwhile, a government pledge last year to liberalize pricing of oil, natural gas, and electricity will hopefully create better value for consumers and downstream players. Financial services After last year’s financial mar- ket turmoil, China’s leaders were keen to use the lianghui to convince the market that les- sons had been learned. Premier Li promised further liberaliza- tion of interest rates, a more “market-based” mechanism to define the value of the yuan, and steps to allow commercial banks greater room to invest in small businesses. Following mur- murings that the much vaunt- ed Hong Kong-Shanghai Stock Connect had been a disappoint- ment, the government promised that an equivalent mechanism connecting the autonomous re- gion with the Shenzhen Bourse would be in place by the end of 2016—theoretically offering overseas investors another ave- nue into the mainland. Newly appointed China Secu- rities Regulatory Commission head Liu Shiyu told the press that the widely derided circuit breaker mechanism—the fail- ure of which cost his predeces- sor his job—would not be rein-

- 15. ©Brunswick | 2016 | 3130 | 2016 | ©Brunswick What next Rising stars, potential contenders At the end of next year Xi Jinping will conclude his first five-year term as head of the Commu- nist Party of China (CPC). The months ahead should begin to give an early indication of rising stars that may be contenders to be elevated into more senior positions at the 19th Party Con- gress which is expected to be held around October or Novem- ber 2017. Some of those who rise at the 19th Party Congress can be expected to be in the sen- ior leadership team for the 20th and 21st Party Congress periods (2022-2032). At the 19th Party Congress (2017-2022), we anticipate that 11 to 14 officials in the 25-per- son Politburo and five members of the seven-person Standing Committee will retire. Only Xi Jinping and Li Keqiang are ex- pected to remain in the Standing Committee. Based on current rules and recent past precedent, the General Secretary / Presi- dent (Xi Jinping) and Premier (Li Keqiang) are expected to serve two five-year terms before re- tiring from office at the end of the 19th Party Congress in 2022. Predicting whose political influ- ence is rising or falling is chal- lenging at the best of times. In this current climate it is even more challenging and there is much speculation over who may be contenders. The most obvious candidates to fill the vacant Standing Com- mittee seats will be members of the Politburo who do not retire. Assuming the process remains unchanged, of the current Po- litburo members only two are able based on age to serve in the leadership team for two terms beyond the 19th Party Congress (2022-2032)—Hu Chunhua and Sun Zhengcai. It remains far too early to predict with certainty the future of Hu or Sun. Yet, it is possible that the seats in the Standing Committee could be filled by one or more officials who are not currently in the Politburo—similar to the rise of Xi Jinping. Xi was a mem- ber of the 16th Central Commit- tee of the CPC (2002-2007), but not a member of the Politburo. He was elevated into the Stand- ing Committee at the 17th Par- ty Congress (2007-2012) before taking the helm at the 18th Party Congress in 2012. Xi’s rise into the Standing Committee caught many observers off-guard. The successor in waiting to Xi Jinping will most likely be a member of the Politburo in the 19th Party Congress and even more likely a member of the Standing Committee. Based on the last two transitions (Jiang Zemin to Hu Jintao and Hu Jintao to Xi Jinping) the future General Secretary / President and Pre- mier has shadowed the current leadership team for at least one five-year Party Congress cycle. This phased transition is a crit- ical approach to ensuring conti- nuity and consistency in leader- ship. So—who are the contenders? In the coming months we ex- pect some provincial and min- isterial positions to be rotated. These appointments will give early clues. Another question on observers’ minds looking at the future contenders—what type of leader will Xi be after he leaves his official positions? Will he step away quickly and hand the reins completely to a new leader as Xi’s predecessor, Hu Jintao, did? Or will he take a more hands-on role and contin- ue to exert influence?

- 16. ©Brunswick | 2016 | 3332 | 2016 | ©Brunswick What is the lianghui? Lianghui (两会两会) means “two meetings” and is the informal reference to the annual gathering of the National People’s Congress (全国人民代表大会全国人民代表 大会) and the Chinese People’s Political Consul- tative Conference (中国人民政治协商会议中国人民政治协商会议) which is typically held during the first two weeks in March. What is the NPC? The National People’s Congress (NPC) is the highest legislative body in China and has sole responsibility for enacting legislation in the country. The NPC meets once a year in March and enacts and amends basic laws relating to the Constitution, criminal offences, civil affairs, state organs and other relevant matters. When the NPC is not in session each March, the Stand- ing Committee of the NPC is tasked with enact- ing and amending laws, with the exception of basic laws that must be enacted by the NPC. The NPC is also responsible for electing and ap- pointing members to central state organs—in- cluding the Standing Committee of the NPC, the President of the People’s Republic of China (cur- rently Xi Jinping) and the Premier of the State Council (currently Li Keqiang). Based on nom- inations by the Premier, the NPC is also respon- sible for appointing China’s Vice Premiers, State Councilors, and Ministers. This is the Fourth Session of 12th NPC. The 12th NPC was formed in March 2013 and will serve a five year term. This year’s session was held from March 5th to 16th with 2,943 delegates (2,986 were elected in March 2013). What is the CPPCC? The Chinese People’s Political Consultative Conference (CPPCC) is a political advisory body that consists of representatives from a range of political organization, academia, business lead- ers, celebrities, and other experts. The Nation- al Committee of the Chinese People’s Political Consultative Conference (中国人民政治协商会议全 国委员会会) meets on an annual basis at the same time as the NPC. This is the Fourth Session of 12th CPPCC. This year’s session was held from March 3rd to 14th with 2,214 delegates (2,237 were elected in March 2013). What is the Five-Year Plan? A relic of the planned economy, China’s Five- Year Plan model provides a blueprint for eco- nomic development in a mixture of overarching goals and specific targets (such as GDP growth). While market forces play an increasingly deci- sive role in the Chinese economy, Five-Year Plan targets are still an important yardstick by which the government measures its own economic performance. The latest Five-Year Plan, run- ning from 2016 to 2020, is the thirteenth since the Communist Party took power in 1949. Political Backgrounder