Real Estate 2014 Housing Outlook Wells Fargo

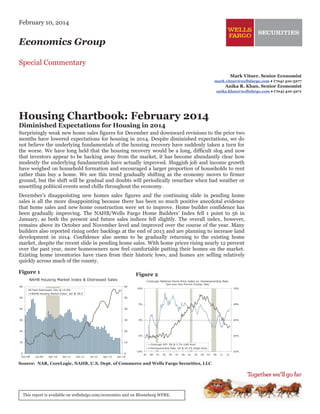

- 1. February 10, 2014 Economics Group Special Commentary Mark Vitner, Senior Economist mark.vitner@wellsfargo.com ● (704) 410-3277 Anika R. Khan, Senior Economist anika.khan@wellsfargo.com ● (704) 410-3271 Housing Chartbook: February 2014 Diminished Expectations for Housing in 2014 Surprisingly weak new home sales figures for December and downward revisions to the prior two months have lowered expectations for housing in 2014. Despite diminished expectations, we do not believe the underlying fundamentals of the housing recovery have suddenly taken a turn for the worse. We have long held that the housing recovery would be a long, difficult slog and now that investors appear to be backing away from the market, it has become abundantly clear how modestly the underlying fundamentals have actually improved. Sluggish job and income growth have weighed on household formation and encouraged a larger proportion of households to rent rather than buy a home. We see this trend gradually shifting as the economy moves to firmer ground, but the shift will be gradual and doubts will periodically resurface when bad weather or unsettling political events send chills throughout the economy. December’s disappointing new homes sales figures and the continuing slide in pending home sales is all the more disappointing because there has been so much positive anecdotal evidence that home sales and new home construction were set to improve. Home builder confidence has been gradually improving. The NAHB/Wells Fargo Home Builders’ Index fell 1 point to 56 in January, as both the present and future sales indices fell slightly. The overall index, however, remains above its October and November level and improved over the course of the year. Many builders also reported rising order backlogs at the end of 2013 and are planning to increase land development in 2014. Confidence also seems to be gradually returning to the existing home market, despite the recent slide in pending home sales. With home prices rising nearly 12 percent over the past year, more homeowners now feel comfortable putting their homes on the market. Existing home inventories have risen from their historic lows, and homes are selling relatively quickly across much of the county. Figure 1 Figure 2 NAHB Housing Market Index & Distressed Sales 60 CoreLogic National Home Price Index vs. Homeownership Rate 60 Year-over-Year Percent Change, Rate 10% 70% 5% 68% 0% 66% -5% Total Distressed: Dec @ 14.0% 64% NAHB Housing Market Index: Jan @ 56.0 50 50 40 40 30 30 20 20 10 10 CoreLogic HPI: Q4 @ 2.7% (Left Axis) Homeownership Rate: Q4 @ 65.2% (Right Axis) 0 Oct-08 Jul-09 Apr-10 Jan-11 Oct-11 Jul-12 Apr-13 0 Jan-14 -10% 62% 87 89 91 93 95 97 99 01 03 05 07 Source: NAR, CoreLogic, NAHB, U.S. Dept. of Commerce and Wells Fargo Securities, LLC This report is available on wellsfargo.com/economics and on Bloomberg WFRE. 09 11 13

- 2. Housing Chartbook: February 2014 February 10, 2014 WELLS FARGO SECURITIES, LLC ECONOMICS GROUP Sluggish Household Formations Continue to Weigh on Housing Demand The most recent data on residential vacancies and homeownership are reflective of the diminished expectations for housing in 2014. The total number occupied housing units increased by an incredibly modest 265,000 in 2013. Once again, all of the growth occurred in rental households, which grew by 315,000. The number of owner occupied homes fell by just under 50,000 during the year. The sluggish pace of household formations is likely due to the shaky recovery in employment and income. Nonfarm payrolls grew by an average of 182,000 jobs a month in 2013 and many of those jobs were in relatively low-paying industries, which weighed on wage and salary growth. We expect hiring to improve in 2014 and are currently looking for job gains to average around 195,000 per month this year. We also expect the quality of jobs to improve, with a larger proportion of new jobs created in higher paying industries. The rental vacancy rate fell 0.5 percentage points over the past year and ended 2013 at 8.2 percent. The homeowner vacancy rate rose 0.2 percentage points over the past year to 2.1 percent, however, with the number of vacant homes for sale rising by 92,000 units. The drop in the rental vacancy rate reflects tightening rental markets across much of the country, with the biggest declines coming in the Northeast and Midwest. The West remains the tightest market, however, with a rental vacancy rate at just 6.3 percent. The drop in residential vacancy rates has lifted rents across the country and made homeownership relatively more attractive. There is mounting evidence that the 9 year slide in the homeownership rate is nearing an end. There is mounting evidence that the nine-year slide in the homeownership rate is nearing an end. The homeownership rate was unchanged in the fourth quarter at 65.1 percent on a seasonallyadjusted basis, which is where it has been for the past three quarters. The rate had peaked at 69.0 percent back in the fourth quarter of 2004. We have slightly lowered our forecast for 2014 and 2015 to reflect the lower yearend home sales and new home construction figures. Sales of new homes are expected to rise 19.4 percent to 510,000 units in 2014, while sales of existing home rise 4.5 percent to 5.3 million units. With sales improving, new single-family starts should rise 19 percent in 2014 and by nearly 25 percent the following year. Overall housing starts are expected to rise nearly 16 percent to 1.07 million units in 2014 and another 14 percent to 1.22 million units the following year. The gradual ramp up in new home construction will keep new home inventories relatively lean, which means new home prices will likely once again post gains well above their historic norm. We look for the median price of a new home to rise 4.6 percent in 2014 and look for median price of existing homes to rise 4.0 percent. In addition to tight inventories, new home prices are also being bolstered by rising construction costs and higher lot prices. Home price measures from Case-Shiller and CoreLogic will likely post somewhat larger gains but the pace of home price appreciation is expected to moderate in all measures, as more new and existing homes come on the market. Figure 4 Figure 3 U.S. Homeowners vs. Renters Housing Starts Annual Change in Occupied Units, In Thousands 2,500 Renters: 2013 @ 525.5 Thousand Homeowners: 2013 @ -76.5 Thousand 2,000 2,000 2.4 2.1 2.4 Multifamily Starts Multifamily Forecast Single-family Starts Single-family Forecast 2.1 1,500 1,500 1.8 1,000 1,000 1.5 1.5 500 1.2 1.2 0 0.9 0.9 -500 0.6 0.6 -1,000 0.3 0.3 -1,500 0.0 500 0 Series Break 1981 -500 -1,000 -1,500 66 70 74 78 82 86 90 94 98 02 06 10 Forecast 0.0 80 82 84 86 88 90 92 94 96 98 00 02 04 06 08 10 12 14 16 18 Source: U.S. Department of Commerce and Wells Fargo Securities, LLC 2 1.8 Thousands Millions of Units 2,500

- 3. 3.25 3.26 5.04 4.71 216.7 -6.6 172.5 -12.9 -5.6 -12.9 374.0 4,340.0 3,870.0 464.0 553.9 445.0 108.9 -2.8 -4.4 9.3 2009 3.25 3.22 4.69 3.79 221.8 2.4 172.9 0.2 -3.0 2.1 321.0 4,190.0 3,708.0 474.0 586.9 471.1 115.8 2.5 -0.7 9.6 2010 3.25 2.78 4.46 3.03 227.2 2.4 166.1 -3.9 -4.1 -3.5 305.0 4,260.0 3,787.0 477.0 608.8 430.5 178.3 1.8 1.2 8.9 2011 3.25 1.80 3.66 2.69 245.2 7.9 176.6 6.3 3.4 0.3 369.0 4,650.0 4,127.0 528.0 780.6 535.3 245.3 2.8 1.7 8.1 2012 Source: Federal Reserve Board, FHFA, MBA, NAR, S&P, U.S. Department of C ommerce, U.S. Department of Labor and Wells Fargo Securities, LLC Forecast as of: February 10, 2014 4.88 3.66 6.04 5.18 232.1 -6.4 198.1 -9.5 -7.8 -16.7 Home Prices Median New Home, $ Thousands Percent Change Median Existing Home, $ Thousands Percent Change FHFA (OFHEO) Home Price Index (Purch Only), Pct Chg Case-Shiller C-10 Home Price Index, Percent Change Interest Rates - Annual Averages Prime Rate Ten-Year Treasury Note Conventional 30-Year Fixed Rate, Commitment Rate One-Year ARM, Effective Rate, Commitment Rate 485.0 4,110.0 3,660.0 450.0 905.5 622.0 283.5 Home Construction Total Housing Starts, in thousands Single-Family Starts, in thousands Multifamily Starts, in thousands Home Sales New Home Sales, Single-Family, in thousands Total Existing Home Sales, in thousands Existing Single-Family Home Sales, in thousands Existing Condominium & Townhouse Sales, in thousands -0.3 -0.6 5.8 Real GDP, percent change Nonfarm Employment, percent change Unemployment Rate 2008 National Housing Outlook 3.25 2.35 3.98 2.61 265.8 8.4 198.1 12.2 7.8 12.2 427.0 5,073.0 4,470.0 603.0 923.4 617.9 305.5 1.9 1.6 7.4 2013 3.25 3.10 4.80 2.70 272.5 2.5 205.0 3.5 3.8 8.1 520.0 5,300.0 4,670.0 630.0 1,100.0 750.0 340.0 2.6 1.6 6.7 Forecast 2014 3.44 3.46 5.05 2.90 279.5 2.6 210.0 2.4 2.7 3.3 630.0 5,500.0 4,850.0 650.0 1,250.0 880.0 370.0 2.9 1.7 6.3 2015 Housing Chartbook: February 2014 February 10, 2014 WELLS FARGO SECURITIES, LLC ECONOMICS GROUP 3

- 4. Housing Chartbook: February 2014 February 10, 2014 WELLS FARGO SECURITIES, LLC ECONOMICS GROUP New Home Sales vs. 30-Year Mortgage Rate Mortgages § § § Thousands; SAARFHLMC Conventional Fixed Rate Mortgage 1,600 Following a spike in mortgage rates, applications for mortgages to purchase a home fell 18.5 percent from their summer peak before rebounding over the past few weeks. The recent improvement provides a hint that the recent soft housing data may be due to unseasonably cold weather. The gain in purchase applications foreshadows a modest rebound in home sales. Rising mortgage rates over the balance of this year should not significantly impede affordability but will shift the mix of home sales toward smaller and less expensive homes. Refinance applications have also been weak in recent months and are down more than 70 percent from their mid-2012 peak. 3.0% 1,400 4.0% 1,200 5.0% 1,000 6.0% 800 7.0% 600 8.0% 400 9.0% 200 10.0% New Home Sales: Dec @ 414,000 (Left Axis) 30-Year Fixed Mortg. Rate: Feb @ 4.2% (Inverted Right Axis) 11.0% 0 90 92 94 96 98 00 02 04 06 08 10 12 14 Conventional Mortgage to 10-Year Treasury Spread Basis Points 300 300 Mortgage Spread: Feb @ 159 bps Mortgage Applications for Purchase 275 275 250 250 225 225 200 200 175 175 150 150 125 Seasonally Adjusted Index, 1990=100 500 125 500 400 400 300 300 200 200 Weekly Figure: Jan-31 @ 180.5 100 100 Down From 187.6 on Jan-24 8-Week Average Down 9.1% From Same Period Last Year 100 2005 100 2006 2007 2008 2009 2010 2011 2012 2013 2014 Mort. Appl.: 8-Week Average: Jan 31 @ 179.1 0 0 92 94 96 98 00 02 04 06 08 10 12 14 Residential Loan Standards and Demand Prime Mortgages, Net Percent of Banks Reporting Change 80% 60% Mortgage Applications for Refinancing 80% 60% 40% 40% 20% 20% 4-Week Moving Average, Seasonally Adjusted 12,000 12,000 Weekly Figure: Jan-31 @ 1,693 Up from 1,645 on Jan-24 4-Week Average: Jan-31 @ 1,558 4-Week Average Down 63.3% from Same Period Last Year 10,000 10,000 0% 8,000 0% 8,000 -20% 6,000 6,000 4,000 2,000 -40% -40% 4,000 2,000 -20% -60% 0 0 94 4 96 98 00 02 04 06 08 10 12 14 Tightening Standards: Q4 @ -8.7% -60% Reporting Stronger Demand: Q4 @ -7.2% -80% Apr 07 -80% Apr 08 Apr 09 Apr 10 Apr 11 Apr 12 Apr 13 Source: Mortgage Bankers Association, FHLMC, U.S. Department of Commerce, Federal Reserve and Wells Fargo Securities, LLC

- 5. Housing Chartbook: February 2014 February 10, 2014 WELLS FARGO SECURITIES, LLC ECONOMICS GROUP Existing & New Single-Family Home Sales Single-Family Construction In Millions, Seasonally Adjusted Annual Rate 7.0 1.2 6.0 1.0 5.0 0.8 4.0 0.6 3.0 0.4 2.0 The more forward-looking single-family permits data have also been disappointing. Single-family permits were down 4.8 percent in December and have risen just 4.5 percent over last year. § 1.4 We suspect the dip in starts is weather-related, which suggests construction activity may remain soft through January and February. § 8.0 Following two straight monthly gains, singlefamily starts dropped 7 percent in December. Although swings in the monthly data are expected during the seasonally slow winter months, non-seasonally adjusted figures plummeted more than 17 percent in December. § 1.6 0.2 1.0 New Home Sales: Dec @ 414 Thousand (Left Axis) Existing Home Sales: Dec @ 4.3 Million (Right Axis) 0.0 0.0 94 96 98 00 02 04 06 08 10 12 14 Single-Family Housing Starts SAAR, In Millions, 3-Month Moving Average 1.8 Single-Family Building Permits 2.0 1.8 1.8 1.6 1.6 1.4 1.4 1.2 1.2 1.0 1.0 0.8 0.8 0.6 0.6 Thousands SAAR, In Millions, 3-Month Moving Average 2.0 2.0 1.8 1.6 1.6 1.4 1.4 1.2 1.2 1.0 1.0 0.8 0.8 0.6 0.6 0.4 Thousands 2.0 0.4 Single-family Housing Starts: Dec @ 661K 0.2 0.2 90 0.4 92 94 96 98 00 02 04 06 08 10 12 14 0.4 Single-family Building Permits: Dec @ 624K 0.2 0.2 90 92 94 96 98 00 02 04 06 08 10 12 Expected Single-Family Home Sales 14 Percent, NAHB Housing Market Index 100% Single-Family Housing Completions 100% 90% 90% Seasonally Adjusted Annual Rate, In Millions 2.0 2.0 80% 80% 1.8 1.8 70% 70% 1.6 1.6 60% 60% 50% 50% 40% 40% 30% 30% 20% 20% 1.4 1.4 1.2 1.2 1.0 1.0 0.8 0.8 0.6 0.6 0.4 0.4 10% 10% In the Next 6 Months: Jan @ 60.0% 0% 0% 87 89 91 93 95 97 99 01 03 05 07 09 11 13 Single-family Housing Completions: Dec @ 550K 0.2 0.2 87 89 91 93 95 97 99 01 03 05 07 09 11 13 Source: U.S. Dept. of Commerce, National Association of Realtors, NAHB and Wells Fargo Securities, LLC 5

- 6. Housing Chartbook: February 2014 February 10, 2014 WELLS FARGO SECURITIES, LLC ECONOMICS GROUP Multifamily Housing Starts Multifamily Construction § § SAAR, In Thousands, 3-Month Moving Average 450 450 Despite summer slowdown, multifamily starts are running nearly 25 percent ahead of last year’s pace, reaching the highest level in seven years in 2013. Multifamily construction accounts for a third of total housing starts and is expected to continue to grow this year, albeit at a more modest pace. 400 400 350 350 300 300 250 250 200 200 Multifamily starts are expected to rise only modestly in coming years as the supply of newly completed units begins to run ahead of demand and sluggish income gains limit rent growth. Even with the dynamics shifting, the apartment market appears set for several years of gains. 150 150 100 100 50 50 Multifamily Housing Starts: Dec @ 340K 0 0 90 92 94 96 98 00 02 04 06 08 10 12 14 Multifamily Building Permits SAAR, In Thousands, 3-Month Moving Average 600 600 500 500 400 400 300 300 200 200 100 100 Private Multifamily Construction Spending Percent 120% 120% 100% 100% 80% 80% 60% 60% 40% 40% 20% 20% 0% 0% -20% -20% -40% -40% Multifamily Building Permits: Dec @ 390K 0 90 3-Month Annual Rate: Dec @ 23.3% -60% 0 92 94 96 98 00 02 04 06 08 10 12 14 -60% Year-over-Year Percent Change: Dec @ 27.3% -80% -80% 94 96 98 00 02 04 06 08 10 12 Apartment Supply & Demand 14 Percent, Thousands of Units 9% 8% Quarter-over-Quarter Percent Change 75 7% Apartment Effective Rent Growth 100 50 6% 25 1.6% 1.6% 1.2% 1.2% 0.8% 0.8% 0.4% 0.4% 5% 0 0.0% 0.0% 4% -25 -0.4% -0.4% -0.8% -0.8% -1.2% -1.2% Apartment Net Completions: Q4 @ 41,651 Units (Right Axis) Apartment Net Absorption: Q4 @ 50,627 Units (Right Axis) Apartment Vacancy Rate: Q4 @ 4.1% (Left Axis) 3% -50 2% -75 2005 2006 2007 2008 2009 2010 2011 2012 Apartment Effective Rent Growth: Q4 @ 0.8% -1.6% -1.6% 2006 6 2007 2008 2009 2010 2011 2012 2013 Source: U.S. Dept. of Commerce, REIS Inc. and Wells Fargo Securities, LLC 2013

- 7. Housing Chartbook: February 2014 February 10, 2014 WELLS FARGO SECURITIES, LLC ECONOMICS GROUP Housing Affordability, NAR-Home Sales Buying Conditions Base = 100 220 220 Housing Affordability Index: Nov @ 170.3 § With the Fed winding down its unprecedented asset purchase program, many are concerned that rising long-term rates could derail the housing recovery. With the summer spike in mortgage rates and rise in home prices, housing affordability has edged lower over the past year. First-time home buyers, which now account for an exceptionally small portion of sales, are particularly sensitive to rising mortgage rates. § Tight lending conditions and investors paying all-cash for properties have played the largest role in keeping first-time home buyers on the sidelines. According to the latest Senior Loan Officer Survey, few banks reported any change in lending standards or demand. 6-Month Moving Average: Nov @ 164.9 200 200 180 180 160 160 140 140 120 120 100 100 80 80 92 94 96 98 00 02 04 06 08 10 12 14 U.S. Real Home Prices Index, Jan. 2000=100, Not Seasonally Adjusted 190 190 U.S. Real Home Prices: Nov @ 118.2 Trough Trend Net Percent of Banks Tightening Standards Nontraditional Mortgages 170 100% Nontraditional Mortgages: Q1 @ 8.6% 90% 90% 170 * CoreLogic HPI Deflated with CPI Less Shelter 100% 60% 50% 40% 30% 30% 20% 10% 110 20% 10% 110 50% 40% 130 70% 60% 150 80% 70% 150 130 80% 90 90 70 70 50 50 76 78 80 82 84 86 88 90 92 94 96 98 00 02 04 06 08 10 12 14 0% -10% Apr 07 0% Apr 08 Apr 09 Apr 10 Apr 11 Apr 12 Apr 13 -10% Apr 14 S&P Case-Shiller Home Price Index P/E Ratio January 1987=100 2.0 2.0 S&P Case-Shiller P/E Ratio: Nov @ 1.28 Occupied Housing Units Year-over-Year Percent Change S&P Case-Shiller C-10 Home Price Index Divided by CPI Owners' Equivalent Rent 1.8 5% 1.8 5% Owner Occupied: Q3 @ -0.2% Renter Occupied: Q3 @ 1.4% 3% 1.6 1.4 1.2 4% 1.6 1.4 4% 1.2 1.0 1.0 3% 2% 2% 1% 1% 0% 0% -1% -1% -2% -2% 0.8 0.8 87 -3% -3% 85 88 91 94 97 00 03 06 09 12 89 91 93 95 97 99 01 03 05 07 09 11 13 Source: CoreLogic, S&P, Federal Reserve, NAR, U.S. Dept. of Labor, U.S. Dept. of Commerce and Wells Fargo Securities, LLC 7

- 8. Housing Chartbook: February 2014 February 10, 2014 WELLS FARGO SECURITIES, LLC ECONOMICS GROUP Inventory of New Homes for Sale New Home Sales § § § New Homes for Sale at End of Month, In Thousands 600 600 Reflecting unseasonably cold weather, newhome sales dropped more than expected in December to a 414,000-unit pace and sales for the previous three months were revised lower. The weaker new home sales data are at odds with improving builder sentiment. 550 550 500 500 450 450 400 400 350 350 Although inventories remain exceptionally tight, they are 15 percent higher than one year ago. Completions may have been slowed by unseasonably wet weather. Units “not started” and “under construction” have seen a meaningful increase over the past year. 300 300 250 250 200 200 150 150 New Homes for Sale: Dec @ 171,000 100 100 97 Sales of new homes below $150,000 rose in December, but activity in this segment has been a weak spot during the past year. 99 01 03 05 07 09 11 13 Months' Supply of New Homes Seasonally Adjusted 14 14 12 12 10 10 New Home Sales Seasonally Adjusted Annual Rate, In Thousands 1,500 1,500 1,300 1,300 1,100 1,100 8 8 6 6 4 4 900 900 700 700 500 500 Months' Supply: Dec @ 5.0 2 300 300 New Home Sales: Dec @ 414,000 2 90 92 94 96 3-Month Moving Average: Dec @ 440,667 100 91 93 95 97 99 01 03 05 07 09 11 00 02 04 06 08 10 12 14 New Home Sales 100 89 98 New Homes Sold During Month, 2002=100 13 180 160 160 140 140 120 Median New & Existing Home Sale Prices 180 120 100 100 In Thousands, Single-Family $300 $300 Median New Sales Price: Dec @ $270,200 Median Existing Sales Price: Dec @ $197,900 $250 $250 80 60 $200 80 60 $200 40 South: Dec @ 62.7 40 Midwest: Dec @ 33.5 20 $150 West: Dec @ 43.2 20 Northeast: Dec @ 43.3 $150 0 0 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 $100 $100 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 8 Source: U.S. Department of Commerce, National Association of Realtors and Wells Fargo Securities, LLC

- 9. Housing Chartbook: February 2014 February 10, 2014 WELLS FARGO SECURITIES, LLC ECONOMICS GROUP Existing Home Resales Seasonally Adjusted Annual Rate - In Millions Existing Home Sales § 7.5 Existing home sales rebounded in December to a 4.87 million-unit pace. Over the last year, allcash transactions have played a large role in overall sales activity. Although this activity has helped fuel the housing recovery by clearing up foreclosures and short sales, the spike in prices for lower priced homes has pushed many potential first-time home buyers to the sidelines. Investor purchases have shown signs of pulling back more recently, however. § Listed inventories fell to 1.86 million units, but we are in the seasonally slow period of the year. We will get a better idea of the pace of activity this spring, when the bulk of for-sale inventory tends to come on the market. 7.5 7.0 7.0 6.5 6.5 6.0 6.0 5.5 5.5 5.0 5.0 4.5 4.5 4.0 4.0 3.5 3.5 Existing Home Sales: Dec @ 4.87 Million 3.0 3.0 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 Existing Single-Family Home Resales Seasonally Adjusted Annual Rate - In Millions 7.0 7.0 6.0 6.0 5.0 5.0 4.0 4.0 3.0 3.0 Existing Single-Family Home Supply In Months, Seasonally Adjusted 12 12 Home Supply: Dec @ 4.6 6-Month Moving Average: Dec @ 4.9 11 11 10 10 9 9 8 8 7 7 6 6 5 5 Existing Home Sales: Dec @ 4.3 Million 2.0 4 4 3 2.0 86 3 00 01 02 03 04 05 06 07 08 09 10 11 12 13 88 90 92 94 96 98 00 02 04 06 08 10 12 14 Percent Change in Existing-Home Sales 14 Year-over-Year Percent Change, By Price Range 20% 15% Millions of Units 4.5 15% 10% Single-Family Home Inventory 20% 10% 4.5 New Homes: Dec @ 0.17M Existing Homes: Dec @ 1.64M 4.0 4.0 5% 5% 0% 0% 2.5 -5% -5% 2.0 2.0 -10% 1.5 1.5 1.0 1.0 0.5 0.5 3.5 3.5 3.0 3.0 2.5 0.0 0.0 92 94 96 98 00 02 04 06 08 10 12 -10% -15% -15% $0-100K $100-250K $250-500K $500-750K $750-1M $1M+ Source: National Association of Realtors, U.S. Department of Commerce, CoreLogic and Wells Fargo Securities, LLC 9

- 10. Housing Chartbook: February 2014 February 10, 2014 WELLS FARGO SECURITIES, LLC ECONOMICS GROUP FHFA Purchase-Only Index, NSA Home Prices Bars = Q/Q % Change Line = Yr/Yr % Change Home price appreciation has begun to moderate due to stronger year-over-year comparison as well as some softening in investor demand. An influx of investors concentrated in the parts of the housing market where prices overshot the most, further exaggerated the turnaround in prices and give the impression that the housing recovery is stronger than it actually is. The underlying fundamentals, such as job growth, income growth and household formations, have improved much more modestly. § 5.0% 12.5% § 15.0% 4.0% 10.0% 3.0% 7.5% 2.0% 5.0% 1.0% 2.5% 0.0% 0.0% -1.0% -2.5% -2.0% -5.0% -3.0% -4.0% -7.5% Purchase-Only Index: Q3 @ 2.1% (Right Axis) -10.0% -5.0% Purchase-Only Index: Q3 @ 8.5% (Left Axis) -6.0% -12.5% 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 With investors pulling back and monetary policy set to become progressively less supportive of housing, we expect price appreciation to decelerate to the mid- to low-single digit range. S&P Case-Shiller National Home Price Index, NSA Bars = Q/Q % Change Line = Yr/Yr % Change 24% 18% 6% 12% Home Prices Year-over-Year Percentage Change 24% 8% 4% 6% 2% 24% 16% 16% 8% 8% 0% 0% 0% 0% -6% -2% -8% -8% -12% -4% -18% National Home Price Index: Q3 @ 11.2% (Left Axis) -24% Median Sale Price: Dec @ $197,900 Median Sales Price 3-M Mov. Avg.: Dec @ 10.1% FHFA (OFHEO) Purchase Only Index: Nov @ 7.6% S&P Case-Shiller Composite 10: Nov @ 13.8% -24% -8% 88 -24% -32% -32% 96 98 00 02 04 06 08 -6% National Home Price Index: Q3 @ 3.2% (Right Axis) -16% -16% 10 12 90 92 94 96 98 00 02 04 06 08 10 12 Median Single-Family Existing Home Price 14 Year-over-Year Percentage Change 20% 15% First-Time Home Buyers Share of Existing-Home Sales 36% 36% Share of Total Existing-Home Sales: Dec @ 27% 20% 15% 10% 10% 34% 32% 32% 30% 30% 5% 5% 0% 34% 0% -5% -5% -10% -10% Median Price Change: Dec @ 9.8% -15% 28% 28% Median Sale Price: Dec @ $197,900 -20% -20% 97 26% Jan-12 10 -15% 6-Month Moving Average: Dec @ 11.2% 99 01 03 05 07 09 11 13 26% May-12 Sep-12 Jan-13 May-13 Sep-13 Source: CoreLogic, NAR, S&P, FHFA, U.S. Department of Commerce and Wells Fargo Securities, LLC

- 11. Housing Chartbook: February 2014 February 10, 2014 WELLS FARGO SECURITIES, LLC ECONOMICS GROUP Residential Investment Renovation and Remodeling Year-over-Year Percent Change 40% 40% Improvements: Q4 @ 7.7% § The share of owner-occupied homes built more than four decades ago now represent more than 40 percent of total housing stock. Older housing units could bode well for remodeling activity and new construction in the years ahead. Spending on residential improvements accounted for nearly 40 percent of total residential outlays in 2012. Part of the increase reflects investors upgrading formerly distressed properties. § Rising home prices has also helped fuel spending on improvements, as homeowners benefitted from rising home equity. The NAHB Remodeling Market Index recently hit its highest level since early 2004. 30% 30% Res. Investment Ex. Improvements: Q4 @ 16.2% 20% 20% 10% 10% 0% 0% -10% -10% -20% -20% -30% -30% -40% -40% -50% 1996 1998 2000 2002 2004 2006 2008 2010 2012 -50% 2014 NAHB Remoldeling Market Index Index, Seasonally Adjusted 65 Residential Investment 65 60 60 $900 55 55 $800 50 50 $700 $700 45 45 $600 $600 40 40 $500 $500 35 35 30 30 $400 $400 $300 $300 Billions of Dollars $900 $800 Other: Q4 @ $6.6 Billion Brokers' Commissions: Q4 @ $127.1 Billion Improvements: Q4 @ $177.0 Billion New Building: Q4 @ $209.5 Billion 25 25 Overall Index: Q4 @ 57.0 Future Expectations: Q4 @ 58.0 Backlog of Remodeling Jobs: Q4 @ 59.0 20 $200 $200 $100 $100 $0 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 $0 15 15 01 02 03 04 05 06 07 08 09 10 11 12 13 Share of Owner-Occupied Housing Year Structure Built - 2011 Leading Indicator of Remodeling Activity 1990 to 1999 14% In Billions, 4-Q Moving Total, Harvard Joint Center for Housing Studies $160 20 2000 to 2009 15% $160 JCHS Forecast $150 $150 $140 $140 $130 $130 $120 $120 $110 1980 to 1989 13% $110 $100 $100 2009 2010 2011 2012 2013 2014 1970 to 1979 17% 1969 or earlier 41% Source: Joint Center for Housing Studies, U.S. Department of Commerce, NAHB and Wells Fargo Securities, LLC 11

- 12. Wells Fargo Securities, LLC Economics Group Diane Schumaker-Krieg Global Head of Research, Economics & Strategy (704) 410-1801 (212) 214-5070 diane.schumaker@wellsfargo.com John E. Silvia, Ph.D. Chief Economist (704) 410-3275 john.silvia@wellsfargo.com Mark Vitner Senior Economist (704) 410-3277 mark.vitner@wellsfargo.com Jay H. Bryson, Ph.D. Global Economist (704) 410-3274 jay.bryson@wellsfargo.com Sam Bullard Senior Economist (704) 410-3280 sam.bullard@wellsfargo.com Nick Bennenbroek Currency Strategist (212) 214-5636 nicholas.bennenbroek@wellsfargo.com Eugenio J. Alemán, Ph.D. Senior Economist (704) 410-3273 eugenio.j.aleman@wellsfargo.com Anika R. Khan Senior Economist (704) 410-3271 anika.khan@wellsfargo.com Azhar Iqbal Econometrician (704) 410-3270 azhar.iqbal@wellsfargo.com Tim Quinlan Economist (704) 410-3283 tim.quinlan@wellsfargo.com Eric Viloria, CFA Currency Strategist (212) 214-5637 eric.viloria@wellsfargo.com Michael A. Brown Economist (704) 410-3278 michael.a.brown@wellsfargo.com Sarah Watt House Economist (704) 410-3282 sarah.house@wellsfargo.com Michael T. Wolf Economist (704) 410-3286 michael.t.wolf@wellsfargo.com Zachary Griffiths Economic Analyst (704) 410-3284 zachary.griffiths@wellsfargo.com Mackenzie Miller Economic Analyst (704) 410-3358 mackenzie.miller@wellsfargo.com Blaire Zachary Economic Analyst (704) 410-3359 blaire.a.zachary@wellsfargo.com Peg Gavin Executive Assistant (704) 410-3279 peg.gavin@wellsfargo.com Cyndi Burris Senior Admin. Assistant (704) 410-3272 cyndi.burris@wellsfargo.com Wells Fargo Securities Economics Group publications are produced by Wells Fargo Securities, LLC, a U.S broker-dealer registered with the U.S. Securities and Exchange Commission, the Financial Industry Regulatory Authority, and the Securities Investor Protection Corp. Wells Fargo Securities, LLC, distributes these publications directly and through subsidiaries including, but not limited to, Wells Fargo & Company, Wells Fargo Bank N.A., Wells Fargo Advisors, LLC, Wells Fargo Securities International Limited, Wells Fargo Securities Asia Limited and Wells Fargo Securities (Japan) Co. Limited. Wells Fargo Securities, LLC. ("WFS") is registered with the Commodities Futures Trading Commission as a futures commission merchant and is a member in good standing of the National Futures Association. Wells Fargo Bank, N.A. ("WFBNA") is registered with the Commodities Futures Trading Commission as a swap dealer and is a member in good standing of the National Futures Association. WFS and WFBNA are generally engaged in the trading of futures and derivative products, any of which may be discussed within this publication. The information and opinions herein are for general information use only. Wells Fargo Securities, LLC does not guarantee their accuracy or completeness, nor does Wells Fargo Securities, LLC assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Such information and opinions are subject to change without notice, are for general information only and are not intended as an offer or solicitation with respect to the purchase or sales of any security or as personalized investment advice. Wells Fargo Securities, LLC is a separate legal entity and distinct from affiliated banks and is a wholly owned subsidiary of Wells Fargo & Company © 2014 Wells Fargo Securities, LLC. Important Information for Non-U.S. Recipients For recipients in the EEA, this report is distributed by Wells Fargo Securities International Limited ("WFSIL"). WFSIL is a U.K. incorporated investment firm authorized and regulated by the Financial Services Authority. The content of this report has been approved by WFSIL a regulated person under the Act. WFSIL does not deal with retail clients as defined in the Markets in Financial Instruments Directive 2007. The FSA rules made under the Financial Services and Markets Act 2000 for the protection of retail clients will therefore not apply, not will the Financial Services Compensation Scheme be available. This report is not intended for, and should not be relied upon by, retail clients. This document and any other materials accompanying this document (collectively, the "Materials") are provided for general informational purposes only. SECURITIES: NOT FDIC-INSURED/NOT BANK-GUARANTEED/MAY LOSE VALUE