Emerging Economy Copycats

- 1. 2011 Luo, Sun, and Wang 37 A R T I C L E S Emerging Economy Copycats: Capability, Environment, and Strategy by Yadong Luo, Jinyun Sun, and Stephanie Lu Wang Executive Overview Emerging economy enterprises nowadays relentlessly scale the value chain in a quest to compete on the world stage in part by copying the products of others. They develop new products and services that are dramatically less expensive than their Western equivalents. In this article we discuss what these copycats are and how they have grown in their unique trajectory. We emphasize their unique capabilities and weaknesses, internal and external conditions that foster growth, and strategies and paths that transform them along a continuum from duplicative imitators to creative imitators and ultimately to novel innova- tors. To this end, we present the CHAIN Framework (combinative, hardship-surviving, absorptive, intelligence, and networking) capabilities to showcase the copycats’ capabilities and discuss STORM conditions (social, technological, organizational, regulatory, and market) that spur their growth. Finally, we present four case studies of copycats and discuss future research on this issue. I n the past two decades, the economic and man- In this paper we examine the strategy of such firms agement arena has witnessed the emergence, and lay out a research agenda for us to further growth, and dominance of a growing number of understand such businesses. firms from emerging economies. However, our un- To illustrate the strategy, consider these well- derstanding of such emerging market competitors known companies. Samsung leapfrogged from be- remains limited. As a result, there is growing rec- ing a mere assembler of discrete devices to a major ognition that we need a better model for business, player in dynamic random-access memory one that reaches out further temporally, geograph- (DRAM) chips in only a decade. Once India’s ically, and ideologically (Cappelli, Singh, Singh, largest pharmaceutical company, Ranbaxy (now & Useem, 2010; Chen & Miller, 2010). A key owned by Daiichi Sankyo), followed a similar feature defining most emerging economy enter- trajectory from duplicative imitation to creative prises is that they begin with imitation and later imitation, enabling them to move up the value progress toward innovation. We refer to these chain of pharmaceutical R&D. Brazil’s Embraer is companies as emerging economy copycats (EECs). today the third largest global aircraft company; it reached this position after a long period of cre- The authors would like to thank Professor Garry Bruton and several anonymous reviewers for their valuable comments and suggestions. ative imitation through global partnerships. Rus- * Yadong Luo (yadong@miami.edu) is Professor of Management and Emery M. Findley Jr. Distinguished Chair, Department of Manage- ment, School of Business Administration, University of Miami. He is also a distinguished honorary professor of Sun Yat-Sen Business School, Sun Yat-Sen University, China. Jinyun Sun (jysun@fudan.edu.cn) is a doctoral student at the School of Management, Fudan University, Shanghai, China, and a visiting scholar at the School of Business Administration, University of Miami. Stephanie Lu Wang (slu@exchange.sba.miami.edu) is a doctoral student in the Department of Management, School of Business Administration, University of Miami. Copyright by the Academy of Management; all rights reserved. Contents may not be copied, e-mailed, posted to a listserv, or otherwise transmitted without the copyright holder’s express written permission. Users may print, download, or e-mail articles for individual use only.

- 2. 38 Academy of Management Perspectives May sian conglomerates Metal Loinvest, Suek, and intervention to Internet censorship, an increasing Rusal quickly evolved from imitators to listed pow- gap between the wealthy and poor to rampant erhouses by challenging major Western multination- corruption, these countries are at the forefront of als and gaining market share in low-end and mid- rapidly rising emerging markets, and we believe range markets. All of these companies masterfully they will play a definitive role in leading the way compete locally, regionally, and globally producing, out of the current global recession as the momen- selling, and exporting cost-effective products. tum of emerging economies continues to grow. A recent study and report by the Economist (2010) suggested that emerging economies are Defining Emerging Economy Copycats E becoming hotbeds of business innovation in much merging economy copycats are enterprises the same way Japan was in the 1950s. Not only are based in emerging economies that significantly they creating novel products broadly equivalent to mimic a market leader or pioneer’s products. the products of Western companies, but they are EECs often imitate existing technologies, designs, doing so at a fraction of the cost. By reinventing and functions. This definition does not necessarily production and distribution systems and experi- entail a negative connotation, and does not nec- menting with the way they use available resources essarily refer to the imitators that illicitly and and networks, EECs are creating entirely new illegitimately infringe a pioneer’s intellectual and business models. Thus, emerging economy firms industrial property rights, such as brand, trade- offer a unique mix of copying and innovating that mark, and patent. Korea’s rapid industrialization offers a major challenge to existing business. stemmed largely from imitation, which does not So are these entirely new business models? What necessarily imply illegal counterfeits or clones of are the unique capabilities and strengths of these foreign goods; it can also be legal, involving nei- copycats that enable them to maintain unique com- ther patent infringement nor pirating proprietary petitive advantages over Western counterparts? know-how (Kim, 1997). Those companies that Why are emerging economy copycats that were until cause billions of dollars in losses for innovative recently discounted as merely sources of cheap labor global businesses by manufacturing and marketing now becoming such powerful global competitors? counterfeits are referred to as “business pirates” What are the driving forces behind their revolution- and are not included in our study. ary strategies and business models? Probing these The distinction between the two groups, how- understudied questions will help us better under- ever, is not always easy to delineate. It can be stand firms that are challenging and overturning the difficult to appraise the legality and legitimacy of prevailing Western paradigms (Bruton, Ahlstrom, EECs’ imitation as imitation itself is not black and & Obloj, 2008; Cappelli et al., 2010; Chen & white but instead falls within a “zone of accep- Miller, 2010; Guillen & Garcia-Canal, 2009; Im- tance” (Deephouse & Suchman, 2008). Steven melt, Govindarajan, & Trimble, 2009; Prahalad Schnaars (1994) categorized several distinct imi- & Mashelkar, 2010). This is particularly critical tations: counterfeits (or pirate products), knock- since existing theories on innovation based offs (or clones), design copies, creative adapta- mainly on Western companies do not fully apply tions, technological leapfrogging, and adaptation to ever-evolving firms in emerging economies. to another industry. Pirate firms are excluded from We set out to explore these issues, providing an our definition of copycatting. Smaller and newer analytical framework for EECs’ environment, ca- copycats often remain in the pure imitation phase pability, and strategy. To do so we examine four (knockoff or design imitation), while more estab- companies: two from China, one from Brazil, and lished copycats evolve to become innovative one from India, each representing a different type imitators (creative adaptation) or even novel inno- of copycat. Among leading emerging economies, vators leapfrogging technology and adapting tech- China, India, and Brazil furnish a rich research nology to other industries. Some EECs imitate a field of EECs. Although plagued with controver- pioneer’s product designs and appearance; others sial debates ranging from foreign exchange rate mimic product performance and technology, brand

- 3. 2011 Luo, Sun, and Wang 39 names, images, and even slogans. EECs tend to treat seize new opportunities in blue-ocean or uncon- imitation as an early-stage stepping-stone to survey tested markets (Kim & Mauborgne, 2005). a targeted market before expanding toward inno- Fourth, successful EECs are characterized by vation. In the majority of cases, products are imi- speed of design, production, and marketing and their tated through reverse engineering, patent purchase ability to quickly adapt to mass markets. China’s through licensing, the purchase of key components Haier, Mexico’s Mabe, and Turkey’s Arcelik are in open markets, and joint development through successful copycats, characterized by rapid learning, partnerships. To further explicate what EECs are, we innovative imitation, and mass production in the now turn to common characteristics of EECs. early stage of international expansion (Bonaglia, First, EECs tend to remain in either a pure/ Goldstein, & Mathews, 2007). In less than a decade, duplicative imitation stage (early phase) or in a Tianyu, China’s third largest cell phone maker, has creative/innovative imitation stage (later phase). engineered a design process significantly faster than The products offered imitate a successful incum- those of globally recognized leaders Nokia and bent’s existing products and services. EECs often Motorola. Tianyu produces mobile phones in less begin with reverse engineering and imitation, than one third of the time of these mobile tele- without proprietary core technology, know-how, communications giants. Today, the company brands, and reputation, but quickly evolve from launches more than 100 new cell phone models duplicative imitation to creative or innovative each year. EECs like Tianyu develop products imitation (improvement included) and finally with easy-to-use functions at extremely affordable produce innovative products of their own (often prices for masses of price-sensitive consumers. focusing on new designs, functions, and speed). Last, EECs are heterogeneous: They differ in both Once an EEC surpasses duplicative and innova- their evolutionary stage and in their imitative traits. tive imitation stages, it is no longer considered a MyTrip.com, India’s leading travel agency Web copycat. Two former copycats, China’s Huawei, a site—listed on the NASDAQ in 2010 —adopted a leading global telecommunications solutions pro- business model and management process system very vider, and India’s Arcelor Mittal, a leader in the similar to that of Expedia.com. Sany, China’s largest global steel market, have evolved to become novel concrete machine manufacturer, took a different ap- innovators with enormous investments in R&D. proach. For Sany, reverse engineering was a vital Second, most EECs are privately owned enter- early step that accelerated its creative imitation. The prises (POEs). Unlike state-owned enterprises company identified and analyzed every possible area (SOEs), POEs lack government protection and crit- that could be imitated, learned, and assimilated to ical access to government-controlled resources. achieve its current status as a market leader. Today, They, however, maintain high levels of opera- Sany operates both a national research center and a tional flexibility, market knowledge, and aggres- postdoctorate research station in China, as well as sive opportunity-seeking ambition. This entrepre- research and manufacturing bases in Germany, the neurial spirit enables them to adopt prompt, United States, and India. This notable former copy- novel, and realistic tactics without running afoul cat now owns 536 patents and hundreds more know- of government policies and legal provisions. how technologies. Third, EECs are evolutionary. Equipped with Through extensive field studies and interviews, the learning advantage of newness, many EECs we observed that EECs possess three competitive participate in fierce competition with domestic advantages: cost, channel, and speed. These advan- and global firms early in their life cycles and have tages mutually reinforce one another. EECs have an inherent learning advantages over late entrants edge in “cost innovation” (Zeng & Williamson, because they possess fewer deeply embedded rou- 2007) by delivering suitable technology at a low cost tines (Autio, Sapienza, & Almeida, 2000). More- by leveraging inexpensive R&D resources, betting over, they face fewer structural constraints, such as on low-cost alternative technologies, and using the organizational inertia, corporate politics, and in- rise of open architecture to dismantle competitors’ ternal bureaucracies, resulting in the ability to high-margin proprietary systems. These companies

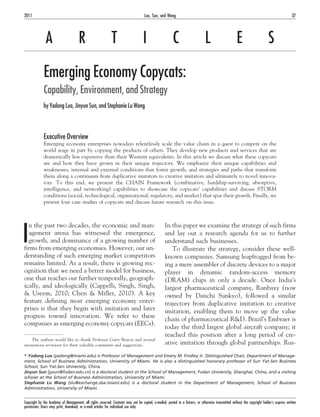

- 4. 40 Academy of Management Perspectives May Figure 1 Typology of Emerging Economy Copycats 1st Generation 2nd Generation 3rd Generation Large II IV Duplicating Adaptive World-stage Wildcat: Junglecat: Innovator: MARKET SHARE (Li Ning) (Tianyu) (Destination) I III Mocking Emulating Novel Kitten: Housecat: Specialist: (Video (Dr. Reddy’s) (Destination) Brinquedo) Small Duplicative Innovative Novel Imitation Imitation Innovation IMITATIVENESS offer customers substantial variety at mass-market ness in proprietary innovation and lack of in-house prices by focusing on process innovation and recom- R&D. Improved inbound and outbound logistics bination of existing technologies. EECs apply scale- services also fortify their channel advantage. Many based technology to specialty products and thus EECs in consumer products industries remove de- transform businesses by dramatically reducing costs sign and component manufacturing to specialized and prices, hence increasing volume. The sheer size outsiders through inshore outsourcing after build- of the EECs’ home market makes this possible. ing their own supply channels and necessary net- Channel advantage is the EECs’ unique strength works. This not only bolsters their cost advantage in identifying, developing, and utilizing all channel but also increases their ability to get products to networks needed for both primary and support ac- market quickly. tivities. These channels include market information EECs possess a speed advantage. Their entrepre- channels, government channels, supply chain chan- neurial orientation, combined with their learning nels, distribution and marketing channels, interme- advantage, channel advantage, and improved open diary production or services channels, and outsourc- markets in specialized services and important re- ing channels. To leverage their learning advantages sources, increases their ability to quickly identify of newness while dispelling the liabilities of lateness, market opportunities, respond to market needs, and many EECs develop a unique ability to identify introduce and deliver products to the market. Hard where to secure critical resources, raw materials, key work propels speed too. Lax labor laws permit components, government support, important em- around-the-clock production, and it is not uncom- ployees, and distribution networks. As a result, they mon to see 24-hour design and manufacturing oper- quickly create new businesses or introduce new prod- ations in EECs. In fact, this pressure has pushed their ucts. Although often EECs do not own original or speed advantage to a higher level in recent years. To core technologies, their ability to license, purchase, market leaders, fast imitation by followers undercuts or outsource standard technologies, key compo- the durability of their first-mover advantages (Lee, nents, and specialized service providers in an open Smith, Grimm, & Schomburg, 2000). market makes it possible to circumvent their weak- Figure 1 offers a typology of EECs in three distinct

- 5. 2011 Luo, Sun, and Wang 41 Figure 2 Emerging Economy Copycat’s Capabilities: The CHAIN Framework CombinaƟve Intelligence Copycat’s CompeƟƟve Capability Capability Advantage • Cost Advantage • Channel Advantage Hardship-Surviving • Speed Advantage Networking Capability Capability AbsorpƟve Capability phases: duplicative (or pure) imitation, innovative Yet another risk is brand image. Consumers per- (or creative) imitation, and novel innovation. An- sistently perceive copycats as low-end, low-qual- other dimension used in this typology is a copycat’s ity, cheap product manufacturers. Thus, changing market share or its market influence. This 2ϫ3 ma- the image from copycat to innovator after the firm trix produces six cells or identities, which will be begins developing its own proprietary technology further illustrated in our case study section. The and independent innovation has proven difficult. three phases are often linked to the developmental Altering this view can be formidable, time-con- phases of the respective national economies. In the suming, and expensive. 1970s and 1980s, weak intellectual property rights (IPR) protection in India facilitated duplicative Copycat Capabilities: CHAIN Framework H imitation. Conversely, countries with strong IPR ow have EECs built the above advantages? legal regimes must take a more novel or indepen- Our answer rests in the capabilities of the dent approach. Duplicative imitation may be an CHAIN Framework (see Figure 2). EECs’ astute strategy in the early industrialization of a cost advantage, channel advantage, and speed low-wage country as duplicative imitation of ma- advantage are a function of the manner in ture technology is relatively easy to undertake which the company possesses, leverages, and (Kim, 1997). Many EECs’ imitative acts are tech- upgrades the five CHAIN capabilities: combi- nically and legally ambiguous, eroding a target native, hardship-surviving, absorptive, intelli- pioneer’s market share and profitability. Lack of a gence, and networking. well-established and well-enforced legal system to protect IPR can make counteracting EECs’ imita- Combinative Capability tive acts difficult and costly. Combinative capability is an EEC’s distinctive Relatedly, copycatting itself involves many ability to combine outside technologies, key com- risks, one of the most common of which is legal ponents, and specialized services available from ambiguity. Because their products reach consum- open markets with its own resources, designs, ers in many nations, including developed coun- and/or production to offer better performance fea- tries where legal systems and IPR safeguards are tures, lower cost, and/or other improved attri- much more established, navigating legal issues can butes. EECs are often inferior in creating a novel be challenging. More often than not, market lead- set of product offerings (idea, design, function, ers do not allow EECs to easily enter and compete technology, brand, etc.) but superior in combin- in these markets, and they tactically position ing and integrating outside technologies with themselves to outmaneuver copycatting behavior. their own resource base. This capability is the

- 6. 42 Academy of Management Perspectives May main source of cost advantage and speed advan- have added to existing institutional hardship in tage. Savvy EECs, skillful in combinative capa- many emerging economies. bility, can deliver products even at an early While hardship increases a firm’s transaction stage of their life cycle. The availability of open costs and even destroys some firms, established markets in key components, technology, design, copycats often survive under economically and assembly facilitates the development of fragmented and institutionally harsh conditions combinative capability. (Cuervo-Cazurra & Genc, 2008; Luo & Rui, Careful consideration of the target market and 2009). Private ownership, organizational resil- culture is imperative to success when imitating or ience, learning advantage, and lower innovation copying a product from a developed country. Fur- investment costs allow copycats to learn and adapt ther, imitation requires a considerable degree of faster than others in responding to institutional combinative capability in terms of adaptation austerity. When seeking out new opportunities in (Yoon, 1998). This explains in part why many new geographic regions (domestic and inter- EECs competent in combinative capability can national), EECs can leverage their institutional successfully evolve from duplicative to creative arbitrage advantages (Boisot & Meyer, 2008; imitation. Emerging modularization for many Cuervo-Cazurra & Genc, 2008). EECs tend to be products (e.g., household appliances and telecom- more successful in investing and marketing in munication products) has also simplified the pro- developing countries than in developed ones. cess of imitation and utilizing combinative capa- bility (Pil & Cohen, 2006). Since MediaTek, a Absorptive Capability leading semiconductor company based in Taiwan now investing in mainland China, offered a total This capability demonstrates an EEC’s distinctive solution and technology package combining mo- ability to value, assimilate, and apply new knowl- bile chips and software, hundreds of Chinese edge. It involves a broad set of skills needed to copycats have been using this package, delivering deal with the tacit component of transferred cell phones with more product choices and per- knowledge and the need to modify the knowledge formance features than even Nokia and Motorola imported (Cohen & Levinthal, 1989, 1990; provide. Mowery & Oxley, 1995). Speed is made possible through an EEC’s absorptive capability: Followers invest in absorptive capacity to facilitate learning Hardship-Surviving Capability from others and accelerate implementation. Fol- This capability represents an EEC’s distinctive lowers with strong absorptive capacity delay com- ability to both operate and survive in an institu- mitment and collect better information without tionally austere environment and to deal with compromising their ability to respond. Absorp- demanding business stakeholders (e.g., govern- tive capacity extends the window for effective mental institutions) that impose significant con- action, reducing the risk that the firm will straints on business activities. In major emerging imitate too early or too late, and allows for economies, political, economic, and administra- improved decision-making processes (Lieber- tive decentralization, originally aimed at unclog- man & Asaba, 2006). Many successful EECs ging blockages in the central bureaucracy, has led equipped with sharpened skills assimilate and to a more fragmented economy, redundant pro- use technological skills and process the knowl- duction capacity, and heightened formal and in- edge of market leaders. In fact, a large propor- formal barriers to domestic trade (Boisot & Meyer, tion of EECs are led by those with science 2008). Such unintended consequences, together degrees and industrial experience in research with long-standing challenges in the institu- and development (Hu & Mathews, 2008). In tional environment, including regulatory hin- addition, their superior background in reverse drance, policy uncertainty, weak legal protection, engineering enhances a solid foundation for fur- ubiquitous corruption, and poor public services, ther developing their absorptive capability.

- 7. 2011 Luo, Sun, and Wang 43 Intelligence Capability ability to do so has been identified as a powerful Intelligence capability is an EEC’s distinctive abil- tool in helping it maintain a competitive ad- ity to identify, collect, analyze, and interpret busi- vantage and achieve superior performance. Eco- ness information pertaining to market, technol- nomic fragmentation and institutional obsta- ogy, competition, standards, and regulations cles, combined with cumbersome government needed for its duplicative or innovative imita- control over critical resources and market entry, tions. Among the three competitive advantages put copycats at a disadvantage compared with mentioned above, speed and channel advantages established state-owned rivals that are largely particularly benefit from this ability. Intelligence protected by the central or local governments. gathering helps an EEC gain the requisite insights This in turn prompts copycats to rely more to gain a competitive advantage (cost, speed, or heavily on formal and informal networks. Even channel) associated with duplicative or innova- for mature copycats that have passed the dupli- tive imitation and increase the quality of its cative imitation stage and progressed to inno- strategic decisions. Further, it helps the firm vative imitation and even novel innovation formulate imitative and innovative plans and in- phases, networking capability remains key to vestment priorities. Intelligence capability makes firm growth, domestically and internationally. it possible for EECs to know what to do, while other capabilities in Figure 2 show them how. For Copycat Growth: STORM Conditions C example, intelligence capability has advanced the apability endowment, as explained above, is a ability of many Indian pharmaceutical firms to necessary but not sufficient condition for EEC better predict global demand for generic drugs, growth. As Figure 3 shows, five conditions, analyze critical markets, choose target firms to termed here as STORM (social, technological, acquire, and secure inbound and outbound net- organizational, regulatory, and market) condi- works vital to success in foreign markets. tions, facilitate EEC development. Social Conditions Networking Capability Many emerging economies rely on imitative re- This is an EEC’s distinctive ability to obtain the search of foreign inventions to maintain indus- necessary resources from outside institutions (e.g., trial competitiveness (Kim, 1997). Emerging government, suppliers, buyers, partners, competi- economy societies tend to be apathetic to intel- tors, or vendors) through both formal and infor- lectual property rights protection, thus allowing mal networks. Networking is one of the major social acceptance of imitation (and even counter- strategies pursued by emerging market enterprises feits to some degree). Fragmentation and disparity to gain access to resources and cope with environ- in economic development, real income, social jus- mental uncertainty and impediments to their op- tice, public service, and infrastructure conditions erations (Hoskisson, Eden, Lau, & Wright, 2000). are common characteristics of large emerging When organizations are linked by stronger net- economy countries. Such fragmentation and dis- work ties, they are more likely to have detailed parity foster the popularity of wild imitation and information about each other, which facilitates even counterfeits in underdeveloped regions and imitation (Gulati, Nohria, & Zaheer, 2000). Im- for low-income populations. Further, nationalism itation tends to be socially beneficial and poten- encourages indigenous companies to imitate, pro- tially profitable in situations where imitators com- duce, and deliver products to replace those origi- plement each other, which often arise in nally developed by well-known foreign multination- environments with network externalities or ag- als. Import substitution, a government-enacted glomeration economies (Lieberman & Asaba, policy adopted in many developing countries for 2006). decades, fuels growth for localized imitation in Social networking helps EECs draw on con- these countries. nections in business relationships, and a firm’s During economic and social transformation,

- 8. 44 Academy of Management Perspectives May Figure 3 Conditions Fostering Copycat Growth: The STORM Framework Social CondiƟons • Apathy to intellectual property rights protecƟon • Tolerance for counterfeiting • Asymmetric informaƟon fostering fake goods • Blind naƟonalism encouraging knockoffs • Herding effect enlarging all condiƟons above Emerging Economy Copycats MoƟvaƟon of Copycats Technological Seeking mass-market opportunity for low-end and Market CondiƟons CondiƟons mid-range consumers Seeking high volume with low margin • Presence of mass market • StandardizaƟon and Behavior of Copycats for copycat products modularizaƟon ImitaƟon of product offering • Social acceptance of • Availability of open market EvoluƟon from complete to creaƟve imitaƟon copycat products in many for key technology, countries components, and design • Increasing sensiƟvity to • Rise of specialized OrganizaƟonal CondiƟons price-value raƟo intermediaries • Improved logisƟcs, • Convergence of technical channels, and networks • Flat organizaƟonal structure norms • Low entry barriers or low • Entrepreneurial orientaƟon startup/exit costs • Performance-based culture and incenƟves • Learning advantage of newness Regulatory and Legal CondiƟons • Lack of a clear disƟncƟon between legal and illegal copycat products • Ambiguous IPR systems • Weak enforcement of IPR protecƟon and weak punishment for IPR infringement • Inadequate puniƟve regulaƟons for counterfeits these societies also tend to become increasingly modernization encouraged a decline in traditional demoralized, often allowing copycatting and even social controls based on family and communal some immoral business practices to prevail. Moral relationships, a resultant weakening of norms, degradation—the process of a society’s progressive and, in turn, increased deviance. Moral degrada- loss or weakening of morality and ethics—socially tion provides fertile soil for the growth of the and culturally upholds imitation. This view is anomic pressures associated with market arrange- consistent with the premise of institutional ano- ments. In an anomic organizational context, pres- mie theory (e.g., Messner & Rosenfeld, 1997), sure exists to take any path necessary to achieve which suggests that cultural and social drivers performance goals. result in conditions in which pressures for goal achievement through any means—legitimate or Technological Conditions not— displace normative control mechanisms. In- International supply chains are increasingly mod- stitutional and cultural changes associated with ular, many activities are now outsourced, and

- 9. 2011 Luo, Sun, and Wang 45 global markets for capital, knowledge, and acqui- Organizational Conditions sitions are more open, reducing the entry barriers Success of EECs is augmented by a series of orga- faced by EECs (Zeng & Williamson, 2007). Mod- nizational catalysts, such as flat organizational ularity—the degree to which a supply chain structure, entrepreneurial orientation, task-ori- system’s components may be separated and recom- ented corporate culture, and learning advantage of bined—is positively related to the speed of prod- newness. Due to private ownership and entrepre- uct design imitation, which allows EECs to exploit neurial propensity, copycats respond easily to out- technological opportunities and to react to evolv- side opportunities. In doing so, they maintain a ing market opportunities through recombination, flat, nonhierarchical structure. This gives employ- modular innovation, and outsourcing (Pil & Co- ees incentives to perform a wide range of tasks and hen, 2006; Thomke & Reinertsen, 1998). Increas- initiatives with greater autonomy and flexibility. ingly, open global markets for key components Entrepreneurial orientation, often comprising in- and technologies facilitate an EEC’s ability to novativeness, risk taking, competitive aggressive- imitate, thus reducing the burden to invest heav- ness, and a proactive approach (Lumpkin & Dess, ily in R&D. This enables mass manufacturing 1996; Miller, 1983), is a critical trait allowing with standardized technology and offsets techno- EECs to interact with institutional legacies and logical weaknesses. Austin, Texas-based Silicon the competitive environment of emerging econo- Laboratories supplies semiconductor chips for cel- mies. Corporate executives at EECs must skillfully lular phones and computer modems to several maneuver strategic choices, seeking out ways to large EECs including China’s TCL and Brazil’s garner the political support that allows the free- Embratel Participacoes. In the personal computer dom and support to pursue appropriate growth (PC) market, the latest technologies developed strategies. Successful EECs are often led by exec- in Silicon Valley can reach China within a utives with sharp vision and a pragmatic approach month or so. This swift transfer of technology to tap into new markets first through duplicative allows Dongguan, a small city in the Guangdong imitation and subsequently through innovative province with the world’s highest concentration imitation. Moreover, EECs are often managed by of component manufacturers, to provide Chi- a task-oriented corporate culture that uses out- nese PC markets with a ready supply of world- come- or performance-based incentives to evalu- class technology. ate and reward employees. This approach directly Today, well-established open global markets supports EECs’ hardship-surviving capability and in applied technology, advanced machinery and generates high productivity. Last, the learning ad- equipment, latest instruments, and sophisticated vantage of newness fuels EEC growth. These firms materials and components make EECs much more have fewer deeply embedded routines and face less cognitive complexity and structural rigidity, path independent. In addition, convergence and which allows them to easily recognize and respond standardization of technical norms, pushed in to new opportunities. part by international organizations such as the International Organization for Standardization (ISO), encourages EECs to distribute products Regulatory Conditions in multiple markets and countries. The Internet Undoubtedly, lax regulatory and legal conditions, helps EECs access critical information and especially in protecting IPR, help EECs imitate. strengthen their ability to identify market op- Legal protection of legitimate business activities portunities. Finally, the willingness of advanced and IPR is weak in emerging economies. Al- market multinationals to sell (e.g., via licens- though legislative and governmental bodies in ing) or share (e.g., via a joint venture) technol- emerging economies have begun to enact more ogy, brands, or other assets provides EECs with commercial laws and regulations, they are gener- an additional channel to purchase or acquire ally not strictly enforced for a variety of political, critical resources they need. socio-cultural, institutional, and historical rea-

- 10. 46 Academy of Management Perspectives May sons. This enforcement uncertainty and variabil- key) countries, the Gini index (a measure of the ity can be partly ascribed to long traditions of inequality of a country’s wealth distribution) untrustworthy legal and governmental systems, over the past several years ranged from 37 (In- lack of independent law enforcement, deficiency dia) to 57 (Brazil), with other countries falling of supervision mechanisms, and frequent unjusti- somewhere in between. From 1992 to 2007, the fied law changes. These weak systems cause enor- richest 10% held 28.4% of the nation’s total mous “appropriability hazards” (a term in transac- income in Russia, 43% in Brazil, and over 30% tion cost economics that indicates possible losses in India and China. These statistics show that from uncompensated knowledge leakages or prop- most inhabitants in these countries remain at erty right infringements by others) for original the bottom of the wealth pyramid, earning low innovators. salaries and facing social injustice. Since copy- With weak legal protection, a victim of IPR cat products are more affordable for these in- infringement has very little legal recourse. Un- habitants, who are indifferent to brands but der ambiguous IPR systems in emerging markets, highly sensitive to prices, EECs’ products and “legitimacy” of imitation is better viewed not as services are well-suited to their needs. While a binary concept but rather as a “zone of accept- EECs’ cost advantage gives them leadership in ability” within which copycats vary in the de- serving this large number of low-end consumers, gree of imitation (Deephouse & Suchman, their channel advantage facilitates economies 2008; Zuckerman, 1999). Most copycats operate of scale in distributing products to geographi- somewhere within this zone. Meanwhile, loose cally dispersed consumers. enforcement of IPR protection and weak pun- ishment over IPR infringement lessen the fear Copycats’ Strategies and Transformation of piracy. EECs’ compliance costs are far greater in countries where IPR legal protection is EEC Strategies A strictly enforced. Shuanghuan, the Chinese au- lthough this article was not designed to con- tomotive maker, copied three famous car de- cretely discuss EECs’ strategies, it is worth signs but won a lawsuit in China’s local court, in noting several strategic behaviors unique to part due to legal ambiguity in IPR and lack of EECs. At the corporate level, most successful IPR knowledge by local judges. EECs use a single or dominant strategy instead of a diversified one. A vast local market and enor- Market Conditions mous export potentials are the premise of their Despite considerable differences within this single/dominant strategy. China’s Galanz pro- group, emerging markets are economic territo- duces only microwave ovens and holds approxi- ries in national economies that grow rapidly; mately 50% of the global market share. Many their industries structurally change, the markets EECs that diversified into different businesses are promising but volatile, regulatory regimes have failed (e.g., the failure of China’s Delong is favor economic liberalization and adoption of a primarily a result of overdiversification). In the free-market system, and governments reduce early stages of development, EECs use greenfield bureaucratic and administrative control over investment and networks or alliances rather than business activities (Luo, 2002). Despite their joint ventures (due to the necessity for control) or vast size and strong demand, these markets re- M&As (due to their small size and lack of finan- main extremely fragmented and segmented, cial resources). As they mature and evolve into marred by disparity of real income and purchas- creative imitation and novel innovation phases, ing power and marked by diversity of consump- EECs progressively diversify product categories tion preference and behaviors of consumers. and product offerings. In these stages EECs often According to World Bank statistics (World proactively engage in mergers and acquisitions to Bank, 2009), in BRIC (Brazil, Russia, India, and diversify and embark on outward foreign direct China) and MIT (Mexico, Indonesia, and Tur- investment (FDI).

- 11. 2011 Luo, Sun, and Wang 47 At the business level, many successful EECs and the ability to launch worldwide operations establish competitive advantages (cost, speed, and from the manufacturing center. Home country channel) in several ways. markets remain the primary focus of operations, First, these companies begin by seeking out but international venturing generates lucrative promising massive low-cost markets where they opportunities for growth. The long-term success accumulate experience in operations and market- and viability of EECs lies in their ability to simul- ing and build market share by focusing on limited taneously leverage core competencies at home and product lines. explore new opportunities abroad. In particular, Second, they diligently research the right mar- EECs use international venturing to cash in on ket to target for imitation. Targets often include their competitive advantage in additional emerg- mass-produced products, standardized technology ing and developing markets. Mass production ca- (not advanced), and easy-to-reverse-engineer or pabilities, experience, and low-cost advantages cash-cow market leaders. To accomplish the mis- drive the manufacture of technologically stan- sion these companies often hire former employees dardized products in new emerging and develop- from a market leader, search for low-cost substi- ing markets where great demand exists. This low- tutes for main components or technology, cut cost position allows them to offer local consumers costs through economies of scale, and build net- very attractive prices. It then results in market works with specialized providers offering standard- share gains over companies from advanced and ized or modular components or services. Next, industrialized countries operating in the same they begin to build their own small-scale R&D market. To upgrade imitated products, EECs often capabilities as they progress from duplicative to employ technology newly acquired through inter- innovative imitation. national expansion to both improve domestic Third, successful EECs maintain an accelerated manufacturing and develop new products for in- pace in closing the gap with market leaders. As ternational markets. EECs mature, they aggressively leverage and inte- During international expansion, EECs leverage grate their established capabilities: using combi- both inward internationalization and institutional native capability to sharpen creative imitation arbitrages. EECs actively conduct inward interna- and develop new designs, using intelligence capa- bility to identify new opportunities, using network tionalization in numerous ways, such as interna- capability to benefit from comparative competi- tional licensing, original equipment manufactur- tive advantages contributed by a multitude of spe- ing, cooperative alliances, equity joint ventures, cialized service providers, and using absorptive brand purchasing, and relationship building with capability to assimilate new technologies and cre- foreign firms. As they develop their knowledge ate new designs and performance features. base, these firms become competitors of compa- Finally, EECs excel in managing value chain nies from advanced economies (Mudambi, 2008). systems, from which they benefit and further re- Inward internationalization provides both oppor- inforce their cost, speed, and channel advantages. tunities to learn and exposure to foreign business In conducting support activities such as human practices and markets. resource management, EECs empower employees Many EECs embark on outward FDI as part of and offer more incentives than their rivals. their growth strategy after gaining adequate inter- Through networks, EECs subcontract and out- national experience through inward cooperation source activities in which they do not have a with their foreign partners. Finally, EECs leverage competitive edge. Through combinative and in- their institutional arbitrage, the term capturing a telligence capabilities, copycats quickly deliver fi- firm’s pursuit of efficient institutions outside its nal products with new designs and performance home country. The disadvantages previously suf- features appealing to mass consumers. fered at home can be overcome by investing and On an international level, EECs recognize that operating in other developing countries because success depends on their domestic performance they are experienced in operating in “difficult”

- 12. 48 Academy of Management Perspectives May governance conditions (Boisot & Meyer 2008; frogging are generic forms of innovative imitation. Cuervo-Cazurra & Genc, 2008). Still, all forms of innovative imitation begin with reverse engineering, which involves purposive EEC Transformation searching of relevant information, effective co- As Figure 1 illustrates, EECs transform along several operation among technical members of project paths. Along with the shift from duplicative (or teams and with marketing and production depart- pure) imitation to innovative (or creative) imitation ments, strong and effective relationships with sup- and ultimately to novel innovation, EECs can opt pliers and customers, and trial and error in devel- for several road maps to grow and evolve: (1) im- oping a satisfactory result (Kale & Little, 2007). prove creation and innovation (a horizontal path), Samsung’s catch-up with Sony may be a lesson to (2) increase market share (a vertical path), and (3) EECs seeking to move forward from creative imita- strengthen both innovation and market share (a tion to novel innovation: In the mid-1990s Samsung diagonal path). As a latecomer approaches the tech- caught up with Sony in number of patents, and since nological frontier, its strategies have to shift from then has gone beyond simply imitating and applying imitation to innovation (Kim, 1997). This has been Sony’s technology (Chang, 2008). Interestingly, the case for many Asian Tigers: First were those from Samsung caught up with Sony in terms of corpo- Japan (e.g., Hitachi, Sharp, and Toshiba), followed rate value and brand value only after the 2000s, by those from South Korea (e.g., Samsung and LG), suggesting that technological catch-up precedes then Taiwan and Singapore, and now leading corporate value- and brand value-based catch-up. emerging economies. Many Korean firms began du- In the process to improve innovative imitation, plicative imitation during the 1960s and 1970s and EECs leverage low-cost R&D into mass markets evolved to innovative imitation in the 1980s and and bet on low-cost and disruptive technologies 1990s as the economy became more industrialized (Zeng & Williamson, 2007). Cost-cutting initia- (Kim, 1997). Numerous Indian pharmaceutical tives, simplified operations, and lower labor costs companies share a similar trajectory, starting with underpin these enterprises’ survival and success in duplicative imitation and progressing to innovative massive, fast-growing markets. Built on such low- imitation and today to novel innovation (Chittoor, cost advantages, EECs continue exploiting high Sarkar, Ray, & Aulakh, 2009; Kale & Little, 2007). technology in low-cost novel ways established While most new copycats begin in the pure global competitors have yet to envision or find imitation stage, more established EECs have re- difficult to conduct. As a result, EECs offer prod- cently advanced to the innovative imitation ucts with incremental innovations in ever-shorter phase. A handful, including India’s Ranbaxy and product life cycles—typically at prices global rivals China’s Huawei, have even propelled themselves find hard to match. to the novel innovation stage. Today, most EECs Dawning, a high-performing Chinese computer strive to collect returns from creative and innova- manufacturer, succeeded in selling high-end prod- tive imitation. Often, they incorporate high tech- ucts to middle and low-end markets with higher nology in low-cost products, offer more product volume and lower prices than competitors. BYD, a choices, and even turn high-end specialty prod- Chinese battery manufacturer, holds more than 30% ucts into low-cost, high-volume items (Zeng & of the global battery market share and produces Williamson, 2007). Creative or innovative imita- batteries at 20% of the cost of its Japanese rivals. tion is aimed at generating facsimile products but These EECs are experts in tailoring products to the with new performance features. It involves not needs and budgets of local consumers. They are also only activities like benchmarking but also notable good at driving innovations from one market to learning through substantial investment in R&D another. For example, Shinco gained its market po- activities to create imitative products, which may sition in China’s video compact disc (VCD) market have significantly better performance features by creating a superior error correction ability that than the original (Kim, 1997; Shenkar, 2010). enables consumers to play all kinds of discs— even Creative adaptations and technological leap- pirated ones. Later, the company successfully ex-

- 13. 2011 Luo, Sun, and Wang 49 panded into the digital versatile disk (DVD) market cording to a report by the World Intellectual throughout the world. Property Organization in 2009). But not all copycats thrive; in fact, many EECs terminate operations, liquidate assets, and end up Mocking Kitten: Video Brinquedo filing for bankruptcy. Failure to evolve and trans- form in ever-changing markets tops the list of Founded in 1994, Video Brinquedo is an anima- reasons for failure. Many EECs learn not only from tion video company based in Sao Paulo, Brazil. ˜ market pioneers but from their own failures and Predominantly owned (90%) by a British offshore successes. Despite the apparent weaknesses and company called RXSG Media Group Ltd., the handicaps EECs face, few experts doubt that their company is led by Silvana Aparecida da Silva, growth will accelerate. who holds the remaining 10%. Video Brinquedo’s absorptive and intelligence capabilities appear to play a critical role in fostering the firm’s growth. Case Studies The recent availability of computer-generated E ach of the four cases here represents a different imagery (CGI) software and increased computer type of EEC. Two cases are from China (Li speed has made it possible for individual artists Ning and Tianyu), one is from India (Dr. Red- and small companies to produce professional- dy’s), and one is from Brazil (Video Brinquedo). level films and games from their home comput- We chose these companies after extensive field ers. The company produced low-cost films by studies and desk research. Since 2005 we have adeptly imitating established international ri- been conducting nationwide field studies and vals such as Disney-Pixar and DreamWorks. By interviews in China to collect the needed in- taking advantage of Brazil’s state-of-the-art 3-D formation for the two Chinese cases. The infor- rendering and booming CGI animation tech- mation for Dr. Reddy’s and Video Brinquedo nology, Video Brinquedo was able to quickly an- was obtained through thorough desk research, alyze and reproduce new releases by established including identifying and cross-checking rele- international rivals and then distribute Video vant information from dozens of online sources. Brinquedo’s version almost simultaneously with We finally opted for these four cases because the original movie’s release (judging from the they met our selection criteria: (1) they vary in dates of the New York Times reviews). For exam- size and age, (2) they vary in market share and ple, as noted on the Web site of Brazil’s Ministry scale of operations, (3) they belong to different of Culture, Ratatoing, the cartoon film by Video types of copycats proposed in this study, (4) Brinquedo, which was distributed in North Amer- their imitation is not illegal, and (5) they offer ica by Branscome International, was recognized as sufficient insight into critical practices relative being very similar to the famous 2007 Pixar film to imitation and its evolution. Table 1 high- Ratatouille. Likewise, The Little Cars series by lights the profile of these four cases. Video Brinquedo closely resembles the Pixar film China, India, and Brazil are among the fastest Cars, Heavy Weight Panda resembled Kung Fu growing emerging economies, with an average real Panda, and Gladiformers resembled Transformers. gross domestic product (GDP) growth rate of Armed with advantages in both cost and speed, 10%, 8%, and 5% respectively from 2006 to 2008 Video Brinquedo adopted a well-matched niche (World Bank, 2009). While the number of inter- distribution strategy, namely direct to video, un- national patents owned by Chinese firms is far der which films were released to the public on smaller than those owned by firms in G7 countries home video formats before or without being re- (Canada, France, Germany, Italy, Japan, the leased in movie theaters or on broadcast televi- United States, and the United Kingdom), many sion. These direct-to-video releases are well-suited EECs in these three countries exhibit steady to Video Brinquedo’s niche in lower technical or growth in filing patents and registering trademarks poorer artistic quality and fewer content restric- (annual growth of over 20% in such filings, ac- tions. In this way, Video Brinquedo managed to

- 14. 50 Academy of Management Perspectives May Table 1 Case Summary Company Video Brinquedo Li Ning Dr. Reddy’s Tianyu Year founded 1994 1990 1984 2002 Home country Brazil China India China Ownership Private Publicly listed Publicly listed Private Size n/a 6,200 retail stores 10,000 employees 1,100 employees Revenue (USD) n/a 635 million (2008) 854.6 million (2008) 1,150 million (2008) Sales growth n/a 37.7% 26.05% 45.5% (05–09) Major business Animation Sporting goods Pharmaceuticals Mobile phones Domestic market n/a 11.1% (2008) 2% (2008) 14% (2008) share CHAIN Framework Combinative ● Imitated multiple targets ● Identified and imitated ● Quickly reverse-engineered ● Excelled in utilization outside capability separately (e.g., Disney- competitors’ brand generic drugs core technologies (e.g., the Pixar, DreamWorks) management and marketing ● Delivered high-quality drug turnkey model invention) strategies offerings ● Was skillful in delivering a ● Hunted talents from ● Achieved successful variety of products sophisticated MNEs integration via sequential M&As Hardship-surviving ● Survived in underdeveloped ● Survived as a latecomer in an ● Survived under hyper- ● Survived under hyper- capability domestic market by industry occupied by well- competition in local generic competition in domestic competing with known foreign brands drug market mobile market sophisticated international competitors Absorptive ● Developed analogous but ● Adopted new forms of ● Had a distinctive ability to ● Quickly and continuously capability different key elements marketing and channel (e.g., develop new generic drugs launched newly designed (e.g., character design, the ambush marketing with public patent models with improved animation, scenery, and strategy of the 2008 Olympics) information features voice acting) ● Established research centers in India, the U.S., and the U.K. Intelligence ● Aware of opportunistic ● Prioritized marketing and shoe ● Could foresee and respond ● Catered to rapidly changing capability potential of new releases by design research to local IPR policy changes consumer preferences established international ● Used timely celebrity ● Had first-mover ● Had first-mover advantage rivals marketing advantages resulting from of related license and ● Built online sales channels the Waxman-Hatch Act in channel partnership the U.S. Networking ● Focused on direct-to-video ● Undertook collaborative R&D ● Had good connections with ● Had close connection with capability channel projects with universities and local and global venture distributors and retailers ● Built online sales channel MNEs capitalists and other ● Maintained partnerships or ● Maintained close affiliation investors sales agents in several with related authorities ● Maintained excellent countries through sponsorship programs collaborative R&D with other research-focused firms

- 15. 2011 Luo, Sun, and Wang 51 satisfy the needs of price-sensitive customers un- Yelena Isinbayeva, and several high-profile NBA concerned with brand affiliation. players, including Shaquille O’Neal, Baron Davis, Not surprisingly, with an excessive focus on Chuck Hayes, and Damon Jones, to compete with imitation, Video Brinquedo’s films are plagued rivals Nike, Adidas, and Reebok. Like Nike, Li with a less than stellar reputation. For instance, Ning hosted college basketball games in 2005, over 70,000 negative comments have been posted building brand familiarity with more than 10,000 for the trailer of Video Brinquedo’s Ratatoing and students from 120 different universities. over 50,000 for Heavy Weight Panda on YouTube. On the management side, founder Li Ning has Nevertheless, aside from largely imitated central tapped talent from sophisticated multinational concepts and characters, Brinquedo managed to companies. The firm’s chief financial officer hails deliver a certain style of its own (e.g., online from Reuters Group, the chief marketing officer ordering of the combination of DVDs and char- brings his expertise from Coca-Cola, its public acter toys) and contributed to Brazil’s CGI indus- relations director came from DuPont, and one of try by helping bolster the country’s animation and its vice presidents transferred from Procter and entertainment production. In order to survive and Gamble. The company continues to evolve, striv- thrive in the movie industry this mocking kitten ing to rise along the imitation-innovation curve. needs to work hard to shed its gloomy reputation It has also increased its R&D and innovation for plagiarism and innovate by incorporating more capabilities. In 1998, the company set up its first original content and creating a signature style. R&D center. In 2004, the company collaborated with Hong Kong Chinese University to build a Duplicating Wildcat: Li Ning research database for footwear style and design. Li Ning is an outstanding Chinese “gym prince” The company purchases core technologies and who won six gold medals in the sixth World patents for style design and color application and Gymnastics Championships in 1982. His com- keeps costs down by outsourcing its manufacturing pany, Li Ning, is now recognized as the largest operations. To capture growth from direct-to-con- Chinese sporting goods company, rivaling the sumer channels, it expanded online sales by U.S.’s Nike and Germany’s Adidas in China. Es- launching a Web site in 2009. Meanwhile, the tablished in 1990 after Li Ning’s retirement, the company opened its first overseas flagship store in company operates more than 6,200 retail stores in Singapore and is projected to open 70 to 100 China, 1,012 of which opened in 2008. To ensure overseas outlets for badminton and related equip- successful marketing strategies, the company fol- ment. Li Ning’s main challenges include its per- lowed an approach similar to that of sophisticated ception as a copycat brand and competition from competitors such as Nike and Adidas. It closely established international brands. Nevertheless, Li mimicked the famous Adidas slogan “Impossible is Ning is successfully emerging from its status as nothing” when crafting its own slogan “Anything duplicative copycat and showing strong signs of is possible,” and its logo closely resembles Nike’s becoming an adaptive and creative copycat, hold- famous swoosh. ing a substantial market share in China. The company has demonstrated a remarkable ability to actively and creatively follow and ex- Emulation Housecat: Dr. Reddy’s tend marketing strategies from established coun- Founded in 1984, Dr. Reddy’s has evolved from a terparts. For example, it sponsored four Chinese small private firm to a leading Indian pharmaceu- national teams (table tennis, diving, gymnastics, tical company with global impact. Among the first and shooting), as well as the Spanish, Swedish, Asian pharmaceutical companies listed on the and Argentinean national basketball teams. In New York Stock Exchange (NYSE), Dr. Reddy’s doing so the brand expanded into international has enjoyed a soaring growth rate in both sales markets in Russia, Southeast Asia, and Spain. Li revenue and profit (26% and 78% respectively) in Ning signed a variety of celebrities such as profes- the last five years, according to Dr. Reddy’s finan- sional tennis player Ivan Ljubicic, pole-vaulter cial statements reported to the NYSE. After India

- 16. 52 Academy of Management Perspectives May abrogated laws respecting international pharma- Southeast Asia, and Latin America. With accu- ceutical patents through its Patents Act in 1970 mulated rich cash reserves, the company later (this act removed composition patents from food expanded domestically and internationally and drugs), the pharmaceutical industry became through a series of mergers and acquisitions to hypercompetitive, with 20,000 or so local firms strengthen its manufacturing capacity, foreign competing in the domestic market, which is the sales channels, and most important, patents and world’s second largest pharmaceutical market to- technology. Dr. Reddy’s acquired Benzex Labora- day by volume. By 1990, Dr. Reddy’s survived by tories in India, Trigenesis and American Reme- boasting a wide range of imitative drugs in its dies in the United States, BMS Laboratories and portfolio and by buttressing its strong reverse- Meridian Healthcare in the United Kingdom, be- engineering and hardship-surviving capabilities. tapharm Arzneimittel GmbH in Germany, and With its high intelligence capability, Dr. Red- Roche’s API plant in Mexico. It has nine Food dy’s carefully scrutinized the U.S. market—the and Drug Administration-approved plants (six in world’s largest pharmaceutical market, accounting India and one each in the U.K., U.S., and Mex- for half of global sales. It aggressively copied ico), five research centers (two in India, one in blockbuster drugs and searched for potential the U.K., and two in the U.S.), and seven strate- anomalies or loopholes in the patents by hiring a gic business units. team of experienced and specialized lawyers. Be- tween 2002 and 2004, Dr. Reddy’s was involved in Adaptive Junglecat: Tianyu at least seven lawsuits for drug patent violation, Founded in April 2002 as a mobile phone sales two of which involved patented drugs with ex- agent, Tianyu performed well compared with its pected sales of more than US$700 million, ac- peers, selling approximately 50% of Samsung’s cording to various news reports. In 2002 Dr. Red- mobile phones in China. The turnkey model in- dy’s succeeded in defeating Pfizer in a New Jersey vention by MediaTek, a leading Taiwanese chip courtroom and was allowed to produce and sell the design company, made low-cost integration of patented drug Norvasc, with annual sales of multiple chip functions possible in 2006. This US$3.7 billion. This success helped Dr. Reddy’s activity spurred low-cost mobile phone produc- reposition itself and get a foothold in the lucrative tion. Since then hundreds of Chinese knockoff “branded generic” segment of the massive U.S. (shanzhai in Mandarin) phone manufacturers have pharmaceutical market. emerged. Approximately 50% of Chinese consum- While Dr. Reddy’s began by copying existing ers favor shanzhai phones because they include top-selling drugs, technological advances triggered larger screens and more features at a price signif- its ability to develop new molecules and apply for icantly lower than high-priced brands from Nokia, its own patents. In 2001, when the Waxman- Motorola, and Sony. By the end of 2003, Chinese Hatch Act took effect, allowing generics compa- knockoffs accounted for 60% of the market. nies to undertake preparatory actions to file In 2006 Tianyu became further entrenched in registration applications before the patents of the mobile phone manufacturing market, quickly originators expire, Dr. Reddy’s appeared as the transforming its operations from pure imitation to “first to file” and quickly moved to the U.S. mar- innovative imitation. Given fierce competition in ket with its well-prepared abbreviated new drug the mobile phone market, the company quickly applications. One example of these successes is its realized that pure imitation would not be sustain- US$56 million profit from producing and selling able and that profit margins arising from pure Eli Lilly’s off-patent drug Prozac. imitation would constantly drop due to increasing Dr. Reddy’s successfully expanded internation- modularization and standardization. Thus, the ally by following a strategy that focused on merg- company emphasized its strength in creative imi- ers and acquisitions as well as R&D (a combina- tation, increasing creative components in its prod- tive capability). Dr. Reddy’s first expanded to uct design and also taking a creative approach to other developing countries in Eastern Europe, market distribution and customization. It aban-

- 17. 2011 Luo, Sun, and Wang 53 doned its colossal hierarchical distribution net- shows, EECs differ from their Japanese and Korean work model and instead willingly shared almost predecessors in several traits and strategies. half of its profit margin with its direct sales agents. By presenting conceptual models and four case Tianyu focused on the design, appearance, and studies, we hope to shed light on why and how performance of its products rather than original, EECs have experienced rapid growth in recent basic research. Under a strong, consolidated, and years. We contribute to the growing stream of rigorous management, Tianyu now introduces research on emerging economy copycats by delin- more than 100 new products to market each year. eating these firms’ capabilities, competitive ad- It takes merely 45 days on average from an idea to vantages, internal and external conditions that production at Tianyu, compared to at least six facilitate growth and progression, and correspond- months at its global rivals such as Motorola and ing strategies underlying their imitation-innovation Nokia. Tianyu boasts a strong applied research curve. We suggest that EECs’ unique capabilities and development workforce (more than 600 (combinative capability, hardship-surviving capabil- employees in this area), 40% of them holding ity, absorptive capability, intelligence capability, and graduate degrees. Innovative imitation and its fur- networking capability) and distinctive competitive ther push into novel innovation have propelled advantages (cost, speed, and channel) are what set Tianyu into the limelight at record speed, with them apart from their rivals in other countries. This US$1.15 billion in revenues in 2009 and 75.4% is made possible by a new set of social, technological, average growth rate. organizational, regulatory and legal, and market con- ditions they face. This study may also provide insight and impli- Future Research and Conclusion cations for practitioners. It may be useful for ex- T he developing world is rapidly surpassing the ecutives to rethink conventional innovation. developed world in terms of economic size, Many firms in developed countries equate inno- with EECs playing a major role in this trans- vation with technological breakthroughs, embod- formation. These enterprises are latecomers to the ied in revolutionary new products designed for world stage, having started rather unceremoni- mid-range to high-end consumers. Lessons from ously. Yet following a considerable period of de- EECs suggest that innovations also consist of in- velopment, EECs are now beginning to challenge cremental improvements to products and pro- global industry leadership positions. The breadth cesses aimed at the middle or bottom of the in- and impact of EECs is quickly intensifying, and come pyramid. In the economic downturn, such some rank among the leaders in their respective lessons become particularly critical. It is true that fields. many EECs have failed, and many more will fail This study seeks to deliver an overarching due to their inherent weaknesses. But from a framework to better understand EECs’ patterns, learning perspective, cost advantage, speed advan- types, behaviors, strategies, and evolution. Al- tage, and channel advantage are important not though most have not yet reached global status, only to EECs but to Western companies that many have fashioned unconventional business intend to successfully cope with today’s economic models and brought an innovative approach to and market conditions. developing products, marketing, engaging custom- Furthermore, EECs’ innovative imitation in- ers, and growing market share. Many elements of volves rethinking entire production processes and modern business, from supply chain management business models. To this end, many successful to recruitment and retention, are being retooled EECs actively use specialized vendors and subcon- in one emerging market or another. EECs’ growth tractors for modularized or standardized compo- along the continuum from pure imitation to cre- nents, design, or services; use existing technology ative imitation and finally to novel innovation in imaginative new ways; and apply mass-produc- parallels the growth of many Japanese and Korean tion techniques to serve the masses on the bottom firms three to four decades ago. Still, as this study of the income pyramid. Emerging economy entre-

- 18. 54 Academy of Management Perspectives May preneurs may find a developmental path under the the end but as a process-based means by which to guidance of the framework presented above and ultimately establish their own competitive edge. learn important lessons from pioneering copycats. Only when transcending is ultimately achieved Entrepreneurs must also realize that future success will EECs thrive, but this transformation requires depends on the continuous improvement of cre- a full set of organizational architecture (e.g., cul- ative imitation and ongoing transformation from ture, reward system, routines, and ethics) that imitation to innovation. Without continuous im- incubates and supports continuous learning and provement, today’s entrepreneurs can lose their improvement. This process is a critical lacuna position and shares to next-generation copycats warranting future inquiry. from countries with even less expensive producers Conditioning factors that facilitate creative (e.g., Vietnam). imitation and further transition to novel innova- tion must be examined as well. These factors may Research Agenda explain and predict why copycatting behaviors This study has aided in setting the groundwork for vary across countries, industries, and organiza- further research. It represents an important step tions. Research should look at such factors from a that analyzes unique strengths, strategies, prac- multilevel (micro, meso, macro, and meta) lens. tices, and environments for firms in emerging This article renders a parsimonious framework on economies. A logical extension of our research some of these forces yet does not go as far as would be to verify this framework empirically. It is articulating specific ways in which they affect the also important to follow up on EECs’ evolution process and consequence of imitation and its and transformation as they continue to grow do- transformation. Two fascinating paths for future mestically and internationally. Our four cases are research are (1) to theorize and verify under what rather limited and thus not representative of di- circumstances copycatting flourishes in the face of verse EECs from a large number of emerging econ- competition and globalization and (2) to investi- omies. Even among BRIC countries, EECs are gate how it contributes to the financial return of quite different in their capabilities, strategies, the firm and the well-being of the society. and performance (Ramamurti & Singh, 2009). When applied to emerging economy enter- To address this bias, new research examining and contrasting EECs from different emerging prises, resource-based, knowledge-based, and dy- economies is warranted. Also, the lines demar- namic-capability theories may be enriched by in- cating the typology of EECs are constantly shift- corporating the tacit and inimitable knowledge of ing, and some companies may move from one developing innovative imitation and upgrading category to another. from imitation to novel innovation. Good imita- Imitation is an intelligent search for cause and tion is difficult and requires intelligence and imag- effect, rather than mindless repetition (Shenkar, ination (Shenkar, 2010). Another worthy avenue 2010). Research needs to address imitation from a for future research is to explore what creative rational, deliberate, and process perspective. It is imitation-related competencies can produce a sus- particularly interesting to unpack the black box of tained competitive advantage for EECs. We doc- how creative imitation is initiated, continued, ex- ument that much of copycats’ success has to do ecuted, and succeeded. For instance, EECs’ intel- with unique processes associated with intelligent ligence-gathering capability may foster their iden- search, target aiming, cost reduction, product of- tification of where, what, when, and how to copy, fering, business networking, and marketing strat- while other unique capabilities we discussed here egies. These processes are difficult to substitute may stimulate their speedy implementation of in- and mimic and are often achieved by proprietary novative imitation. Important too, transforma- learning. To unveil such processes, one could in- tional process from imitation to innovation merits tegrate entrepreneurial, learning, and ambidex- scholarly attention because successful copycats in trous insights into capability possession, deploy- every industry and market view imitation not as ment, and upgrading needed to attain sustained

- 19. 2011 Luo, Sun, and Wang 55 competencies in creative imitation and innova- Chittoor, R., Sarkar, M. B., Ray, S., & Aulakh, P. (2009). tive transformation over time. Third-world copycats to emerging multinationals: Insti- tutional changes and organizational transformation in Another fruitful avenue for future research lies the Indian pharmaceutical industry. Organization Science, in conceptualization of imitation itself. As noted, 20(1), 187–205. this concept is a spectrum, varying in magnitude Cohen, W. M., & Levinthal, D. A. (1989). Innovation and (degree of imitativeness vs. creativeness), scope learning: The two faces of R&D. Economic Journal, 99, 569 –596. (breadth of copying vs. new features), and domain Cohen, W. M., & Levinthal, D. A. (1990). Absorptive (area of imitation, such as technology, design, capacity: A new perspective on learning and innovation. process, brands, or marketing). This feature entails Administrative Science Quarterly, 35, 128 –152. methodological and empirical repercussions as Cuervo-Cazurra, A., & Genc, M. (2008). Transforming disadvantages into advantages: Developing country it determines research design and measurement MNEs in the least developed countries. Journal of Inter- concerning imitation and innovation. Re- national Business Studies, 39(6), 957–979. searchers should be inspired to use several prox- Deephouse, D. L., & Suchman, M. (2008). Legitimacy in ies or variables to define the multiplicity and organizational institutionalism. In R. Greenwood, C. Oliver, R. Suddaby, & K. Sahlin-Andersson (Eds.), The multidimensionality of copycatting acts. Like- Sage handbook of organizational institutionalism (pp. 49 – wise, consequences of such acts are multilevel 77). London: Sage Publications Ltd. and multifaceted, meriting a well-rounded de- Economist (2010). The world turned upside down: A special sign that can derive profitability, stability, and report on innovation in emerging markets. April 17, pp. 1–14. sustainability as well as legitimacy, credibility, Guillen, M. F., & Garcia-Canal, E. (2009). The American and reputation. model of the multinational firm and the “new” multina- In sum, our understanding of emerging market tionals from emerging economies. Academy of Manage- copycats is far from complete, and further assess- ment Perspectives, 23(2), 23–36. Gulati, R., Nohria, N., & Zaheer, A. (2000). Strategic ments are warranted. We humbly hope this article networks. Strategic Management Journal, 21(3), 203–215. will serve as a starting point for additional re- Hoskisson, R. E., Eden, L., Lau, C. M., & Wright, M. search, for imitation is rich in research possibili- (2000). Strategy in emerging economies. Academy of ties and implications. Management Journal, 43(3), 249 –267. Hu, M. C., & Mathews, J. A. (2008). China’s national innovative capacity. Research Policy, 37(9), 1465–1479. References Immelt, J. R., Govindarajan, V., & Trimble, C. (2009). Autio, E., Sapienza, H. J., & Almeida, J. G. (2000). Effects How GE is disrupting itself. Harvard Business Review, of age at entry, knowledge intensity, and imitability on October, 56 – 65. international growth. Academy of Management Journal, Kale, D., & Little, S. (2007). From imitation to innovation: 43(5), 909 –924. The evolution of R&D capabilities and learning pro- Boisot, M., & Meyer, M. W. (2008). Which way through cesses in the Indian pharmaceutical industry. Technology the open door? Reflections on the internationalization of Analysis & Strategic Management, 19(5), 589 – 609. Chinese firms. Management and Organization Review, Kim, L. (1997). Imitation to innovation: The dynamics of 4(3), 349 –366. Korea’s technological learning. Boston: Harvard Business Bonaglia, F., Goldstein, A., & Mathews, J. A. (2007). Ac- School Press. celerated internationalization by emerging markets’ Kim, W. C., & Mauborgne, R. (2005). Blue ocean strategy. multinationals: The case of the white goods sector. Jour- Boston: Harvard Business School Press. nal of World Business, 42(4), 369 –383. Lee, J., Smith, K. G., Grimm, C. M., & Schomburg, A. Bruton, G. D., Ahlstrom, D., & Obloj, K. (2008). Entrepre- (2000). Timing, order and durability of new product neurship in emerging economies: Where are we today advantages with imitation. Strategic Management Journal, and where should the research go in the future. Entre- 21(1), 23–30. preneurship Theory and Practice, 32(1), 1–15. Lieberman, M. B., & Asaba, S. (2006). Why do firms Cappelli, P., Singh, H., Singh, J., & Useem, M. (2010). The imitate each other? Academy of Management Review, India way: Lessons for the U.S. Academy of Management 31(2), 366 –385. Perspectives, 24(2), 6 –24. Lumpkin, G. T., & Dess, G. G. (1996). Clarifying the Chang, S. J. (2008). Sony vs. Samsung: The inside story of the entrepreneurial orientation construct and linking it to electronics giants’ battle for global supremacy. New York: performance. Academy of Management Review, 21(1), Wiley. 135–172. Chen, M-J., & Miller, D. (2010). West meets East: Toward Luo, Y. (2002). Multinational enterprises in emerging markets. an ambicultural approach to management. Academy of Copenhagen: Copenhagen Business School Press. Management Perspectives, 24(4), 17–24. Luo, Y., & Rui, H. (2009). An ambidexterity perspective