5th Global Forum on Investing in Distressed Debt

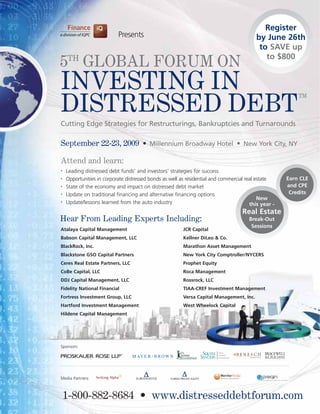

- 1. Register Presents by June 26th to SAVE up to $800 5TH GLOBAL FORUM ON INVESTING IN DISTRESSED DEBT TM Cutting Edge Strategies for Restructurings, Bankruptcies and Turnarounds September 22-23, 2009 • Millennium Broadway Hotel • New York City, NY Attend and learn: • Leading distressed debt funds’ and investors’ strategies for success • Opportunities in corporate distressed bonds as well as residential and commercial real estate Earn CLE • State of the economy and impact on distressed debt market and CPE • Update on traditional financing and alternative financing options Credits New • Update/lessons learned from the auto industry this year - Real Estate Hear From Leading Experts Including: Break-Out Sessions Atalaya Capital Management JCR Capital Babson Capital Management, LLC Kellner DiLeo & Co. BlackRock, Inc. Marathon Asset Management Blackstone GSO Capital Partners New York City Comptroller/NYCERS Ceres Real Estate Partners, LLC Prophet Equity CoBe Capital, LLC Roca Management DDJ Capital Management, LLC Rossrock, LLC Fidelity National Financial TIAA-CREF Investment Management Fortress Investment Group, LLC Versa Capital Management, Inc. Hartford Investment Management West Wheelock Capital Hildene Capital Management Sponsors: Media Partners: 1-800-882-8684 • www.distresseddebtforum.com

- 2. 5TH GLOBAL FORUM ON INVESTING IN DISTRESSED DEBT TM Dear Colleague, Who should attend IQPC’s 5th Global Timing is everything, particularly in to maximizing your ROI. At IQPC’s distressed debt investing. Knowing when to invest is crucial Forum on Investing in 5th Global Forum on Investing leading funds and investors in distr essed debt will discuss the state of in Distressed Debt, the Distressed Debt: cutting-edge strategies for successfu the market as well as the lly taking advantage of current cond • Distressed Debt Funds itions. Is now the time the buy? Will there • Hedge Funds be deepening discounts? What will one year from now? Attendees of the market look like • Private Equity Funds IQPC’s 5th Global Forum on Inves benefit from the wealth of informati ting in Distressed Debt will on shared over two full days of educ • Limited Partner Investors (Pensions, networking. ational sessions and Endowments, Foundations, HNW/Family Offices, etc.) Through panel discussions, formal presentations and interactive audi attendees will gain valuable insights ence participation, • Legal, Tax & Accounting Firms into: • The State of the Market: Where We Are and • Third-Party Marketers • Governme Where We’re Heading nt Programs Update • Overseas • Rating Agencies Investing • Turnarou Lenders/Alternative Finance Providers nd Strategies for the Whole Busin • • Opportun ess ities in Distressed Structured Products • Consultants, Turnaround Firms and • Legal & Tax Aspects of Workouts, Defaults & Bank Portfolio Advisors • Alter nativ ruptcy e Financing Options - Hedge Fund • Residentia s’ and Private Equity’s Role • Data Providers and Trading Firms l and Commercial Real Estate Distr • Lessons from essed Debt Recent Filings in the Automobile Indu • Anyone wishing to gain an edge in this • Up and Com stry ing Asset Classes highly competitive market! Don’t miss this unequalled opp ortunity; reserve your space now Forum on Investing in Distressed Debt for IQPC’s 5th Global ! Best Regards, Finance IQ – A Global Leader in Financial Conferences Lisa Ringlen Among the Senior Conference Director world’s most Finance IQ, a division of IQPC cutting edge www.distresseddebtforum.com financial conference organizers, Finance IQ provides strategic events across the US, Europe, Asia and the Middle East every year, educating almost 5,000 high-level executives 5th Global Forum on Investing in Distressed Debt annually. Our comprehensive events provide an unbiased, specialist Advisory Board: forum where you can discuss the Chair: Members: issues most important to you and Peter Antoszyk Thomas Kiriakos Thomas Salerno Stephen Lerner network with industry leaders. Partner Partner Partner & Co-Chair International Partner and Chair of the Bankruptcy Finance IQ is a division of the PROSKAUER ROSE LLP MAYER BROWN Insolvency Practice, SQUIRE, and Restructuring Group, SQUIRE, International Quality and Productivity SANDERS & DEMPSEY LLP SANDERS & DEMPSEY LLP Center (www.iqpc.com), a global conference company with offices across six continents. 2 Register Today: Call 1-800-882-8684 or visit www.distresseddebtforum.com

- 3. Main Conference Day One TUESDAY, SEPTEMBER 22, 2009 8:00 Registration & Coffee • Discussion on past performance vs. views of the future • Hedge funds and private equity’s role 8:45 Opening Remarks from IQPC and Chairperson • Acquisition strategies by private equity funds to acquire special opportunities in a distressed market through debt acquisition Forum Co-Chair: • Raising capital: How are you finding investors? Which types of Peter Antoszyk investors are you targeting? Are you using third-party marketers? Partner • Restructuring strategies: Workout war stories PROSKAUER ROSE LLP • Overseas investing: New developments in the European market; Are there still deals in Asia? 9:00 The State of the Market: Current Overview and • Sponsor debt buy backs: New stimulus plan tax break may make Future Outlook this a more attractive option, but is it worth it? The economy, where we are and where we’re heading • Current outlook for distressed debt: Will there be more large- Moderator: scale deals in the coming months? Thomas S. Kiriakos • Examining the pricing trajectory for the near-term: Where will we Partner be in the next six months? MAYER BROWN LLP • How much worse can it get? Panelists: • Consolidation of financial institutions and funds; impact on the Marti P. Murray market Managing Director & Portfolio Manager • Update on residential and commercial property distressed debt BABSON CAPITAL MANAGEMENT LLC opportunities • Corporate bonds forecast: Which sectors are ripe for distress? David J. Breazzano President, Chief Investment Officer Moderator: DDJ CAPITAL MANAGEMENT, LLC Peter Antoszyk Partner Kate Kutasi PROSKAUER ROSE LLP Principal/Portfolio Manager, KDC Distressed & High Income Securities Panelists: KELLNER DILEO & CO. Ivan Zinn Founding Partner & Chief Investment Officer John Buck ATALAYA CAPITAL MANAGEMENT Vice President VERSA CAPITAL MANAGEMENT, INC. Curtis Arledge Co-Head Of US Fixed Income 12:30 Networking Luncheon BLACKROCK INC. Jason New 1:30 Distressed Debt Investing: Recent Developments Senior Managing Director Impact of workouts, defaults & bankruptcy on distressed debt BLACKSTONE GSO CAPITAL PARTNERS funds • Workouts from the fund perspective 10:00 Government Programs Update • Bankruptcy law update • Cram-ups/cram-downs: What works and what doesn't? Current administration’s initiatives including TARP, PPIP, TALF and • 363 Sales: Recent trends and structures their impact on distressed debt • PPIP / Legacy Loan Program, Legacy Securities Program Presenter: • Good bank/bad bank outlook Steven Ellis • PPIP impact on CMBS market Partner • FDIC PROSKAUER ROSE LLP • TARP - asset and portfolio acquisition opportunities • Government’s involvement in the bankruptcy process: What are 2:30 Operational Turnaround: A Case Study the longer term impacts of such heavy government involvement • Going beyond the debt structure in what used to be dealt with by the courts? • What’s the upside and when is it worth it? • The role of government and government-related entities and • Driving working capital improvement claims in restructurings • Cash gap analysis Panelists to be announced – check Presenters: www.distresseddebtforum.com for updates. Jeff Jones Chief Executive Officer 11:00 Morning Networking Break JC JONES & ASSOCIATES, LLC 11:30 Fund Sponsors’ Strategy Roundtable Terry Newcomb • Status of you current deals? Partner • Which new markets are you considering? JC JONES & ASSOCIATES, LLC • What are your investment criteria? • Leveraged loans: Good returns so far this year for the largest 3:30 Afternoon Networking Break names; will it continue? 3 Sponsors:

- 4. Main Conference Day One Continued CONCURRENT SESSIONS BEGIN – Please choose Track A or B Track A: CORPORATE Track B: REAL ESTATE 4:00 Outlook for and Opportunities in Distressed Commercial Real Estate Distressed Debt Structured Products • Pricing, supply of product or lack thereof, trends in the market • Outlook for distressed CDOs, CLOs, ABS • Lessons from recent retail filings • Implications of CLO debt on the CLO and the industry: Are there • Will large scale commercial RE defaults result in large commercial RE thresholds and who’s making the decisions? distress or are most deals being "worked out" through extensions, low • Secondary market: Trading structured products rates etc? • Securities: Pricing, any deals on horizon to securitize distressed debt Panelists: • Assets (REO): Valuing, exit (sell, auction, rent) Brett Jefferson • The rush to single loan and whole loan portfolio market: Is it President overcrowded with inexperience? HILDENE CAPITAL MANAGEMENT Panelists: Manish Kapoor Brian Newman Managing Principal Managing Principal, WEST WHEELOCK CAPITAL CERES REAL ESTATE PARTNERS, LLC Joel Holsinger William P. Bowman Managing Director Senior Vice President, Investment Management FORTRESS INVESTMENT GROUP LLC HARTFORD INVESTMENT MANAGEMENT James H. Ross, Managing Member ROSSROCK LLC 5:00 DIP Financing: Recent Trends and Structures Residential Real Estate Distressed Debt • Current pricing, fees and interest rates • From individual homes to MBS and the effect of the PPIP program, etc. • With the increasing number of workouts and insolvencies, will we see • Investing in RE single family distressed mortgages: What are the pitfalls? more DIP loans? • Residential Loans: What is trading (pricing, servicing, exit strategies)? • Roll ups of old loans with the new lending Moderator: • Understanding what is necessary to obtain priming liens Jay Rollins Presenter: Principal Brian Trust JCR CAPITAL Partner Panelists: MAYER BROWN LLP Rudy Orman Vice President MARATHON ASSET MANAGEMENT Ricardo Koenigsberger Managing Partner ROCA MANAGEMENT 6:00 Networking Cocktail Hour 7:00 Day One Concludes 4 Register Today: Call 1-800-882-8684 or visit www.distresseddebtforum.com

- 5. Main Conference Day Two WEDNESDAY, SEPTEMBER 23, 2009 8:30 Opening Remarks Joe Farricielli Senior Vice President 8:45 Deal Structuring: Legal & Tax Issues in Distressed Debt FIDELITY NATIONAL FINANCIAL Investing Ross Gatlin • Examining the legal aspects of workouts, restructurings, defaults & Chief Executive Officer & Managing Partner bankruptcy PROPHET EQUITY • Mark to market rules and other accounting issues: Impact on future investing 12:15 Lessons from the Chrysler and General Motors Chapter • Tax strategies 11 Cases • Intercreditor agreement update & avoiding intercreditor litigation • Section 363 Sale of “good” assets -- legal or just expeditious? • Have the Courts re-written the priority scheme of the Bankruptcy Code? Panelists: • The need for speed -- is it real or imagined? Thomas Salerno • Role of the US Government Partner & Co-Chair International Insolvency Practice • Unintended consequences SQUIRE, SANDERS & DEMPSEY LLP • Who is next? Elizabeth McGinley Presenter: Partner Stephen Lerner BRACEWELL & GIULIANI LLP Partner and Chair of the Bankruptcy and Restructuring Group SQUIRE, SANDERS & DEMPSEY LLP 9:45 Institutional Investors’ Roundtable Pension plan sponsors, sovereign wealth funds, endowments & 1:15 Networking Luncheon foundations, HNWs and family offices: Who is investing in distressed debt? What are the returns? Are you increasing allocations to this market? 2:15 Finance Providers’ Roundtable • Alternative financing options: New innovative strategies Panelists: • Who are the finance providers now? Eric Edidin • Is there any traditional financing available? Managing Partner • Lender liability/re-characterization/equitable subordination: Lots of smoke, ARCHER CAPITAL MANAGEMENT any fires? Sheryl Schwartz • Liquidity without CLO's: Who will fill the gap? The next wave Managing Director, Alternative Investments • Mezzanine financing: What are Mezz lenders doing when they don't have TIAA-CREF the capital to "take out" the senior debt in a borrower maturity default? • Reconsidering the intercreditor agreement: Lessons from the trenches Joseph J. Haslip Assistant Comptroller for Pensions Moderator: NEW YORK CITY COMPTROLLER/NYCERS Stephen Boyko Partner 10:45 Morning Networking Break PROSKAUER ROSE LLP Panelists: 11:15 Acquiring Controlling Stakes In Distressed Companies Jay Rollins • Turnaround strategies for the whole business, not just the debt Principal • Managing the ‘control’ part: Dealing with stakeholders, appointing JCR CAPITAL managers, defining new strategy Joel Holsinger • Acquiring a company through a 363 transaction Managing Director Moderator: FORTRESS INVESTMENT GROUP LLC William I. Kohn Peter J. Ulmer Attorney at Law Senior Director BENESCH, FRIEDLANDER, COPLAN & ARONOFF LLP WELLS FARGO RETAIL FINANCE, INC. Panelists: Ken McMillen 3:15 IQPC’s 5th Global Forum on Investing in Distressed Debt Managing Director Main Conference Concludes COBE CAPITAL LLC Followed by Post-Conference Workshop EARN CLE CREDITS: IQPC will seek CLE accreditation in those EARN CPE CREDITS: Penton Learning Systems d.b.a International Quality and states requested by registrants (post conference) which have Productivity Center is registered with the National Association of State Boards continuing education requirements. This is subject to the rules, of Accountancy (NASBA), as a sponsor of continuing professional education on regulations and restrictions dictated by each individual state the National Registry of CPE Sponsors. State boards of accountancy have final authority organization. Application for accreditation of this course or on the acceptance of individual courses for CPE credit. Complaints regarding registered program in all CLE approved states is currently pending. For sponsors may be addressed to the National Registry of CPE Sponsors, 150 Fourth Avenue Financial Aid Policy information and to request CLE credits, North, Suite 700, Nashville, TN 37219-2417. Website: www.nasba.org please indicate so when calling to register: 1-800-882-8684, This program stands as BASIC as there are no prerequisites or advanced preparation or on the online registration form. requirements to attend our conferences. “Group Live” delivery method. 5 Sponsors:

- 6. Post Conference Workshop WEDNESDAY, SEPTEMBER 23, 2009 3:30 pm – 5:30 pm Registration at 3:15 pm Distressed Assets and Joint Venture Equity in the New Era Joint Venture Equity Overview • Bankruptcy issues: The basics that you must know • Sponsor equity • Loan defaults: What are the options? • Joint venture equity • Note sales: Understanding the process and the opportunities • Equity investments analysis: Deep dive into IRR’s, waterfalls, and profit multiples • Foreclosures: Things you must know • Comparing mezzanine financing and equity financing • REO: How banks view it and how to profit from it • Opportunistic funds vs. standalone joint venture transactions • Negotiating workouts with banks Distressed Assets 101 Your Workshop Leader: •Distressed assets overview Jay Rollins, Principal, JCR CAPITAL About our Sponsors Chair Sponsor: unparalleled in the turnaround industry. The firm has a wide reach geographically and Proskauer Rose is one of the diverse industry experience. In recent years, JC Jones has won two national nation's leading law firms. Founded in 1875 and headquartered in Turnaround-of-the-Year awards, a Transaction-of-the-Year award, and an Ethics award. Website: www.jcjones.com New York City, the firm also has offices in Boston, Los Angeles, Washington, Paris, Boca Raton, Newark, and New Orleans. We Squire, Sanders & Dempsey L.L.P. One of the five most global US- have over 700 attorneys who provide a broad spectrum of legal based law firms, has more than 850 lawyers in 30 offices and 14 services to major corporations, financial institutions and other countries around the world. With one of the strongest integrated global platforms clients worldwide. Our Distressed Debt Group is a dedicated team and a longstanding one-firm philosophy, Squire Sanders provides sophisticated of multidisciplinary attorneys that focus on representing funds in seamless legal counsel worldwide. Website: www.ssd.com distressed situations throughout the world. Website: www.proskauer.com Benesch is a business law firm with multiple offices in Cleveland, Columbus, Wilmington, Philadelphia and Shanghai. Sponsor: Our Business Reorganization Practice Group represents a diverse range of corporations Mayer Brown: The lawyers in Mayer Brown’s in workouts and as debtors-in-possession, as well as creditor interests, committees Restructuring, Bankruptcy and Insolvency practice have and lenders, and has extensive experience in all major professional capacities of broad international experience representing creditors and investors in every aspect of public, corporate and large private entity chapter 11 practice, creditor compositions a troubled situation. We represent a wide array of institutional clients, including many and other methods of restructuring debt. The Business Reorganization Practice Group Fortune 500 companies, in M&A activity in distressed situations and in structuring is devoted to matters concerning bankruptcy and restructuring and has a growing out-of-court workouts and restructurings, including DIP and exit financings . Mayer team of attorneys whose practice is exclusively dedicated to matters concerning Brown is a leading global law firm with 1,800 lawyers in 21 key business centers bankruptcy and enforcement of creditors’ rights. Website: www.beneschlaw.com across the Americas, Asia and Europe. Website: www.mayerbrown.com Bracewell & Giuliani LLP is an international law firm with more than The JC Jones & Associates Business Turnaround Practice provides 450 lawyers in Texas, New York, Washington, D.C., Connecticut, Dubai, operational and financial turnaround, crisis management and Kazakhstan and London. We serve major financial institutions, leading private restructuring, bankruptcy, liquidation and trustee services. The practice regularly drives investment funds, Fortune 500 companies, governmental entities and individuals both top and bottom line business performance, delivering real EBITDA improvement. concentrated in the energy and financial services sectors worldwide. The firm achieves significant improvements in cash flow and working capital by Bracewell provides guidance on business law, finance, litigation, government relations identifying and resolving core operational issues that cause distress - people, process, and regulatory policy. As a full services firm, Bracewell has considerable bench and technology – as well as issues related to capital structure. All JC Jones strength in all requisite practice areas including government relations, strategic Performance Improvement and Turnaround professionals are senior level executives communications, tax, trial, labor and employment law, intellectual property, real with broad operational backgrounds across all business cycles and experience that is estate, government contracting and school and public law. Website: www.bracewellgiuliani.com Sponsorship and Exhibition Opportunities Sponsorships and exhibits are excellent opportunities for your company to showcase its products and services to high-level, targeted decision-makers attending the 5th Global Forum on Investing in Distressed Debt. IQPC and Finance IQ help companies like yours achieve important sales, marketing and branding objectives by setting aside a limited number of event sponsorships and exhibit spaces – all of which are tailored to assist your organization in creating a platform to maximize its exposure at the event. For more information on sponsoring or exhibiting at the 5th Global Forum on Investing in Distressed Debt, please contact Mario Matulich at (212) 885-2719 or sponsorship@iqpc.com. 6 Register Today: Call 1-800-882-8684 or visit www.distresseddebtforum.com

- 7. Registration Information Qualified Investors Register by 6/26/09 Register by 7/10/09 Register by 7/24/09 Register by 8/21/09 Standard Price Conference Only (Save $800) $699 (Save $600) $899 (Save $400) $1,099 (Save $200) $1,299 $1,499 Workshop $250 $250 $250 $250 $250 All Others Register by 7/24/09 Register by 8/21/09 Standard Price Conference Only (Save $600) $1,899 (Save $300) $2,199 $2,499 Workshop $250 $250 $250 Visit www.distresseddebtforum.com for explanation of Details for making payment via VENUE & ACCOMMODATIONS: Qualified Investors and All Others. EFT or wire transfer: Millennium Broadway Hotel JPMorgan Chase - Penton Learning 145 West 44th Street, New York - USA 10036-4012 Please note multiple discounts cannot be combined. Systems LLC dba IQPC: 957-097239 Phone: (212) 768-4400 A $99 processing charge will be assessed to all registrations ABA/Routing #: 021000021 Website: www.millenniumhotels.com not accompanied by credit card payment at the time of Reference: Please include the name registration. of the attendee(s) and the event IQPC has secured a special group rate for participants at Millennium number: 11705.003 Broadway Hotel New York of $379 + tax (single occupancy). To make MAKE CHECKS PAYABLE IN U.S. DOLLARS TO: IQPC reservations, please contact the hotel directly at (212) 768-4400. * CT residents or people employed in the state of CT must PAYMENT POLICY: Payment is due Reservations must be booked before September 9, 2009. Rate is also valid add 6% sales tax. in full at the time of registration and 3 days pre and post event, subject to availability. Please identify you are includes lunches, refreshment and part of Distressed Debt - IQPC to ensure the group rate. TEAM DISCOUNTS: For information on team discounts, detailed conference materials. Your please contact IQPC Customer Service at 1-800-882-8684. registration will not be confirmed Only one discount may be applied per registrant. until payment is received and may be SPECIAL DIETARY NEEDS: If you have a dietary restriction, please contact SPECIAL DISCOUNTS AVAILABLE: A limited number of subject to cancellation. Customer Service at 1-800-882-8684 to discuss your specific needs. discounts are available for the non-profit sector, For IQPC’s Cancellation, ©2009 IQPC. All Rights Reserved. The format, design, content and government organizations and academia. For more Postponement and Substitution arrangement of this brochure constitute a trademark of IQPC. information, please contact customer service at Policy, please visit Unauthorized reproduction will be actionable under the Lanham Act and 1-800-882-8684. www.iqpc.com/cancellation common law principles. 5TH GLOBAL FORUM ON REGISTRATION CARD INVESTING IN DISTRESSED DEBT TM YES! Please register me for ❑ Main Conference ❑ Workshop Name _________________________________________________________________________________________________________ Job Title _________________________________________________ Organization_________________________________________ Approving Manager_____________________________ _______________________________________________________________ Address _______________________________________________________________________________________________________ City________________________________________State__________________________________________Zip_________________ Phone______________________________________E-mail_____________________________________________________________ ❑ Please keep me informed via email about this and other related events. ❑ Check enclosed for $_________ (Payable to IQPC) ❑ Charge my ❑ Amex ❑ Visa ❑Mastercard ❑ Diners Club Card #__________________________Exp. Date______/_____ ❑ I cannot attend, but please keep me informed of all future events. 7 Sponsors: